How To Build A Dcf

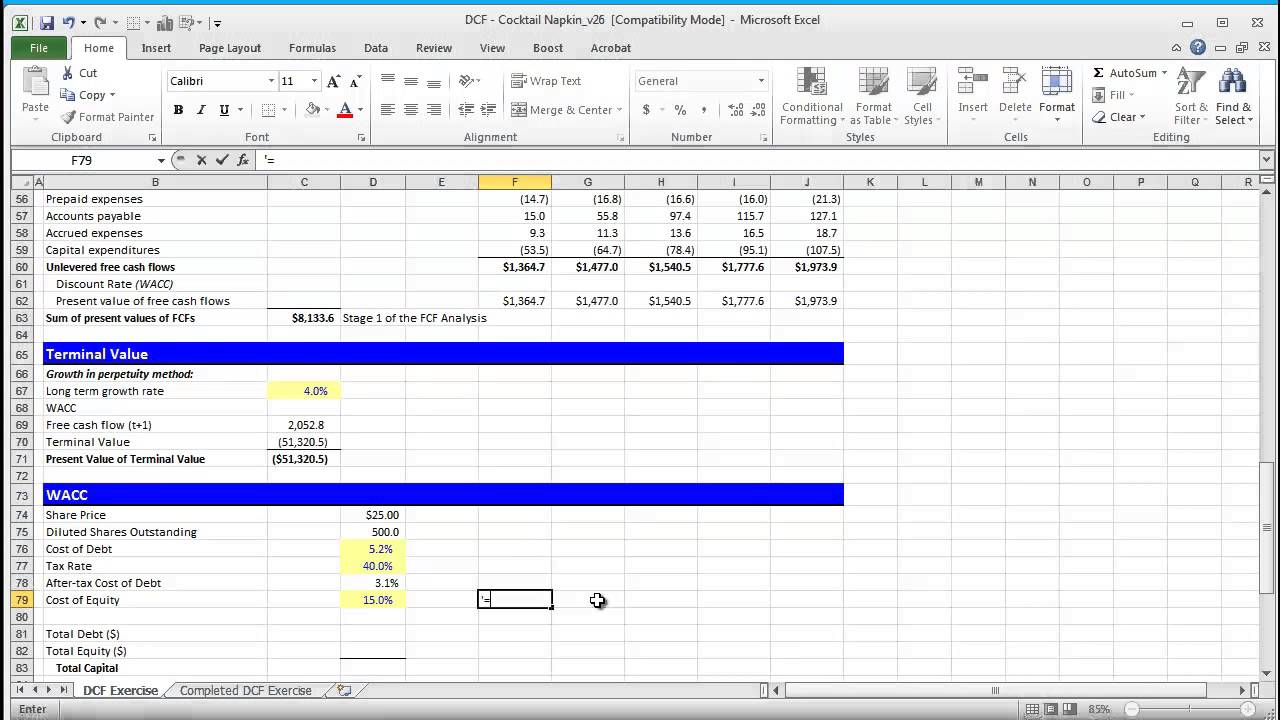

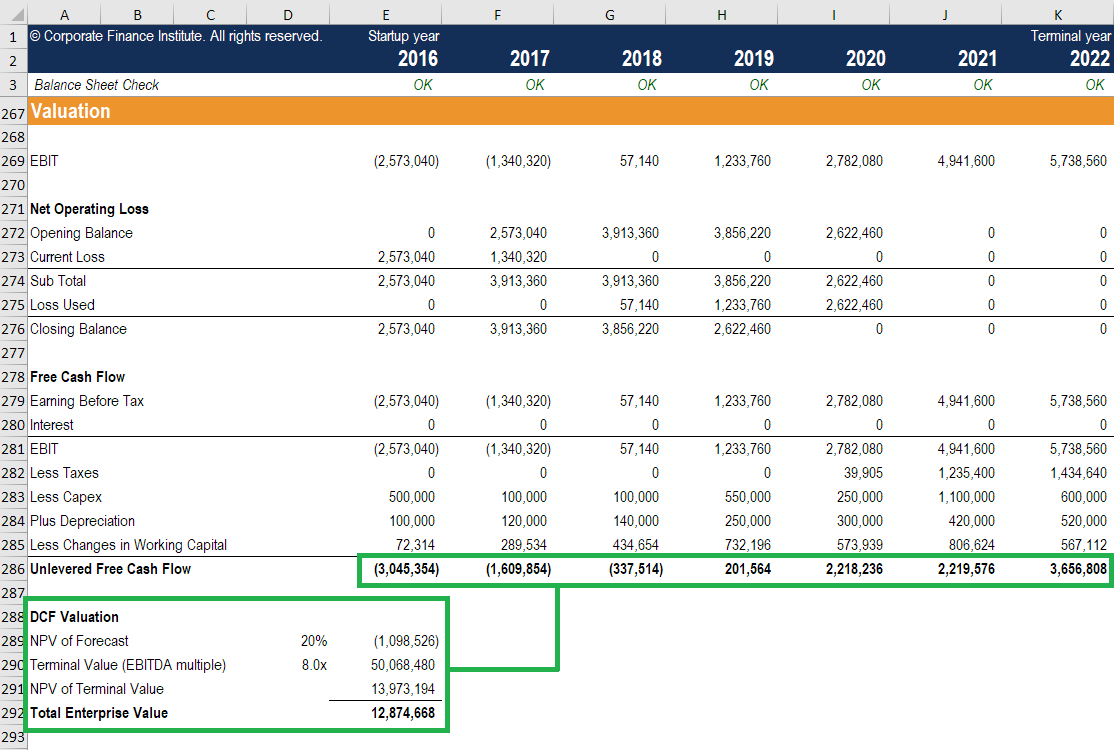

How To Build A Dcf - As dcf continues to evaluate the outcomes of family keys, early findings suggest that this approach allows for more families to stay together at a reduced cost (compared to the cost of. Unfortunately, those prerequisites are rarely satisfied even with the. A dcf should be a serious consideration for investors appraising mature, stable businesses with predictable cashflows. Discounted cash flow (dcf) is a fundamental financial valuation method used to assess the value of an investment or company based on its expected future cash flows, adjusted for the. Begin by opening a new worksheet and labelling it properly. A discounted cashflow model (dcf) is one of the most commonly used models to value a company. How to build dcf model excel structures? Hi, welcome to this video tutorial on building the discounted cash flow (dcf) financial model from scratch. This will serve as a reference tool for before or after our financial modeling course where we. This column will calculate the present value of each future cash flow. Up to 3.2% cash back the basic building block of a dcf model is the 3 statement financial model, which links the financial statements together. Today, we’ll explore one of the key financial tools: If you are preparing for investment. This dcf model training guide will take. Unfortunately, those prerequisites are rarely satisfied even with the. At its core, dcf modeling rests on the principle that a dollar received in the future is worth less than a dollar received today. Having these columns organized will make your life much easier as we move. Hi, welcome to this video tutorial on building the discounted cash flow (dcf) financial model from scratch. Discounted cash flow (dcf) is a fundamental financial valuation method used to assess the value of an investment or company based on its expected future cash flows, adjusted for the. Create sections for historical financial data, projections,. Unfortunately, those prerequisites are rarely satisfied even with the. As dcf continues to evaluate the outcomes of family keys, early findings suggest that this approach allows for more families to stay together at a reduced cost (compared to the cost of. Hi, welcome to this video tutorial on building the discounted cash flow (dcf) financial model from scratch. This will. At its core, dcf modeling rests on the principle that a dollar received in the future is worth less than a dollar received today. Dcf models are generally created by investors or analysts to determine if the. Create sections for historical financial data, projections,. Having these columns organized will make your life much easier as we move. This dcf model. In this guide, we'll provide you with an overview of the components of a dcf model. As dcf continues to evaluate the outcomes of family keys, early findings suggest that this approach allows for more families to stay together at a reduced cost (compared to the cost of. Among various methodologies, the discounted cash flow (dcf) approach stands out for. Hi, welcome to this video tutorial on building the discounted cash flow (dcf) financial model from scratch. A dcf should be a serious consideration for investors appraising mature, stable businesses with predictable cashflows. As dcf continues to evaluate the outcomes of family keys, early findings suggest that this approach allows for more families to stay together at a reduced cost. This will serve as a reference tool for before or after our financial modeling course where we. A discounted cashflow model (dcf) is one of the most commonly used models to value a company. If you are preparing for investment. Up to 3.2% cash back the basic building block of a dcf model is the 3 statement financial model, which. Unfortunately, those prerequisites are rarely satisfied even with the. A dcf should be a serious consideration for investors appraising mature, stable businesses with predictable cashflows. Today, we’ll explore one of the key financial tools: Discounted cash flow (dcf) is a fundamental financial valuation method used to assess the value of an investment or company based on its expected future cash. In this video, i provide a step by step guide on how to build a discounted cash flow (dcf) model. Begin by opening a new worksheet and labelling it properly. Discounted cash flow (dcf) is a fundamental financial valuation method used to assess the value of an investment or company based on its expected future cash flows, adjusted for the.. If you are preparing for investment. Hi, welcome to this video tutorial on building the discounted cash flow (dcf) financial model from scratch. This column will calculate the present value of each future cash flow. This will serve as a reference tool for before or after our financial modeling course where we. As dcf continues to evaluate the outcomes of. Today, we’ll explore one of the key financial tools: In this video, i provide a step by step guide on how to build a discounted cash flow (dcf) model. If you are preparing for investment. How to build dcf model excel structures? This dcf model training guide will take. Begin by opening a new worksheet and labelling it properly. A dcf should be a serious consideration for investors appraising mature, stable businesses with predictable cashflows. Create sections for historical financial data, projections,. Up to 3.2% cash back the basic building block of a dcf model is the 3 statement financial model, which links the financial statements together. Having these. Among various methodologies, the discounted cash flow (dcf) approach stands out for its detailed assessment of future cash flows, adjusted for time value. Begin by opening a new worksheet and labelling it properly. In this guide, we'll provide you with an overview of the components of a dcf model. A discounted cashflow model (dcf) is one of the most commonly used models to value a company. This is a very comprehensive video in that it covers all the basics of financial. As dcf continues to evaluate the outcomes of family keys, early findings suggest that this approach allows for more families to stay together at a reduced cost (compared to the cost of. If you are preparing for investment. Up to 3.2% cash back the basic building block of a dcf model is the 3 statement financial model, which links the financial statements together. Having these columns organized will make your life much easier as we move. This dcf model training guide will take. Dcf models are generally created by investors or analysts to determine if the. At its core, dcf modeling rests on the principle that a dollar received in the future is worth less than a dollar received today. A dcf should be a serious consideration for investors appraising mature, stable businesses with predictable cashflows. Hi, welcome to this video tutorial on building the discounted cash flow (dcf) financial model from scratch. This will serve as a reference tool for before or after our financial modeling course where we. In this video, i provide a step by step guide on how to build a discounted cash flow (dcf) model.Free Dcf Template

Dcf Model Excel Template

DCF Model Training 6 Steps to Building a DCF Model in Excel 네이버 블로그

How To Build A DCF Model PDF Discounted Cash Flow Net Present Value

How to Build a Financial Model in 7 Simple Steps [Best Templates

Financial Modeling Quick Lesson Building a Discounted Cash Flow (DCF

How to Build a DCF Model A Comprehensive Guide My WordPress

DCF Model Full Guide, Excel Templates, And Video Tutorial, 50 OFF

DCF Model The Complete Guide to Building a Discounted Cash Flow Model

DCF Model Training The Ultimate Free Guide to DCF Models

Discounted Cash Flow (Dcf) Is A Fundamental Financial Valuation Method Used To Assess The Value Of An Investment Or Company Based On Its Expected Future Cash Flows, Adjusted For The.

How To Build Dcf Model Excel Structures?

Today, We’ll Explore One Of The Key Financial Tools:

This Column Will Calculate The Present Value Of Each Future Cash Flow.

Related Post: