How To Build A Prop Firm

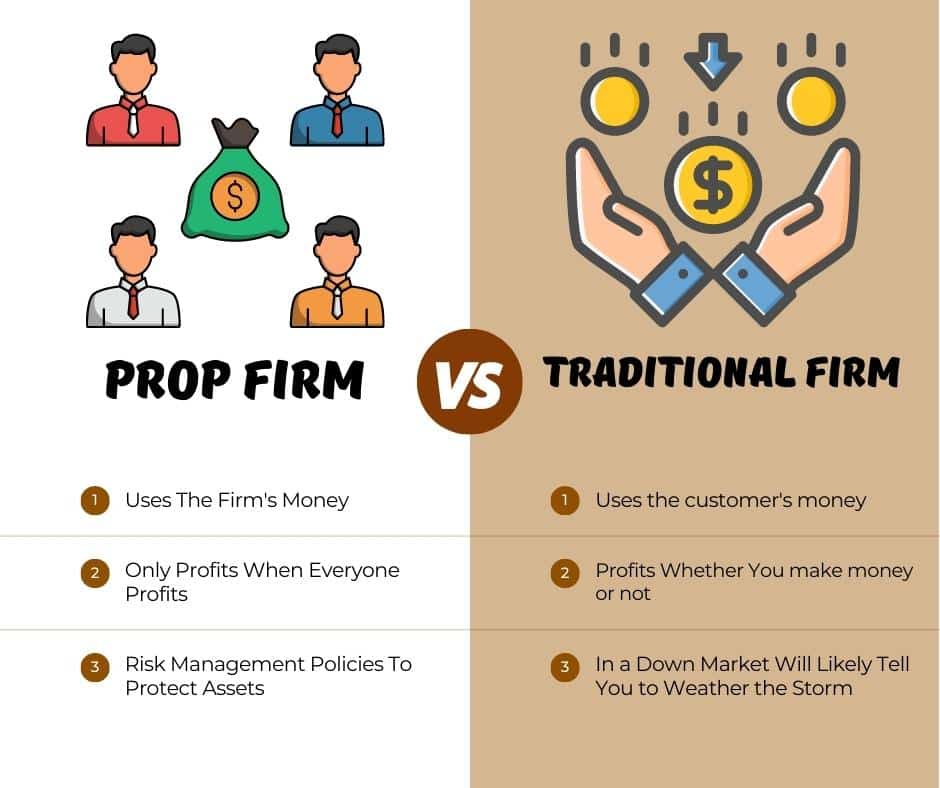

How To Build A Prop Firm - Develop a backtested trading strategy. Building a proprietary trading firm (prop firm) that funds traders through structured challenges can be highly profitable. Developing a solid business plan: Definitely, follow prop firm trading rules to complete funding evaluations successfully. While amounts vary among proprietary trading firms, prop traders often get to. To become a funded trader, prop firms require implementing various strategies, managing risks, and identifying the most profitable opportunities. Gain knowledge, create a business plan, register legally, raise funds, recruit traders, and more. This lets you trade with the firm’s funds, giving you market. Firstly, decide on a niche, create a business plan, get registered and licensed, and raise capital. To start a prop trading firm, you need to follow some essential steps. Starting a prop trading firm is a complex but rewarding endeavor. Trading with a proprietary trading firm (prop firm) offers a unique advantage—access to significant capital without risking your own.but before you can trade with funded money, you. To start a prop trading firm, you need to follow some essential steps. Prop firms can be highly. Prop firms often set limits on the maximum lot size or risk per trade to ensure traders are not taking positions that could expose the firm’s capital to excessive risk. To get into prop trading, begin by joining a prop firm, passing their evaluation, and honing your risk management skills. Developing a solid business plan: Prop firms usually earn revenue through challenge fees, profit splits, and additional services like trading platforms or educational resources, but pricing models vary between prop. By developing a solid business plan, securing adequate capital, and investing in technology, you can lay the. Let’s dive deep into each crucial step of building your own prop trading firm from the ground up. While amounts vary among proprietary trading firms, prop traders often get to. Developing a solid business plan: By the end of this post, you should have a solid grasp of the basics of a prop firm, how it. To get into prop trading, begin by joining a prop firm, passing their evaluation, and honing your risk management skills. Prop traders. Prop firms often set limits on the maximum lot size or risk per trade to ensure traders are not taking positions that could expose the firm’s capital to excessive risk. Develop a backtested trading strategy. Gain knowledge and experience through practising trades, attending courses, and researching the market. Building a proprietary trading firm (prop firm) that funds traders through structured. Gain knowledge, create a business plan, register legally, raise funds, recruit traders, and more. This lets you trade with the firm’s funds, giving you market. To become a funded trader, prop firms require implementing various strategies, managing risks, and identifying the most profitable opportunities. By developing a solid business plan, securing adequate capital, and investing in technology, you can lay. Building a proprietary trading firm (prop firm) that funds traders through structured challenges can be highly profitable. Trading with a proprietary trading firm (prop firm) offers a unique advantage—access to significant capital without risking your own.but before you can trade with funded money, you. Gain knowledge, create a business plan, register legally, raise funds, recruit traders, and more. Prop firms. To get into prop trading, begin by joining a prop firm, passing their evaluation, and honing your risk management skills. Let’s dive deep into each crucial step of building your own prop trading firm from the ground up. By developing a solid business plan, securing adequate capital, and investing in technology, you can lay the. Gain knowledge, create a business. Creating a prop trading requires significant investment and careful planning to integrate a technology solution, liquidity, legal license, and marketing. Prop firms usually earn revenue through challenge fees, profit splits, and additional services like trading platforms or educational resources, but pricing models vary between prop. While amounts vary among proprietary trading firms, prop traders often get to. Gain knowledge, create. Starting a prop trading firm is a complex but rewarding endeavor. Firstly, decide on a niche, create a business plan, get registered and licensed, and raise capital. Building a prop firm allows you to leverage skilled traders and provide them with the capital to generate profits for your company. Gain knowledge, create a business plan, register legally, raise funds, recruit. While amounts vary among proprietary trading firms, prop traders often get to. Prop firms often set limits on the maximum lot size or risk per trade to ensure traders are not taking positions that could expose the firm’s capital to excessive risk. To start a prop trading firm, you need to follow some essential steps. Gain knowledge, create a business. Prop firms often set limits on the maximum lot size or risk per trade to ensure traders are not taking positions that could expose the firm’s capital to excessive risk. Gain knowledge, create a business plan, register legally, raise funds, recruit traders, and more. Definitely, follow prop firm trading rules to complete funding evaluations successfully. However, ensuring success requires careful. Gain knowledge, create a business plan, register legally, raise funds, recruit traders, and more. Building a proprietary trading firm (prop firm) that funds traders through structured challenges can be highly profitable. Gain knowledge and experience through practising trades, attending courses, and researching the market. Prop firms can be highly. Definitely, follow prop firm trading rules to complete funding evaluations successfully. Prop firms usually earn revenue through challenge fees, profit splits, and additional services like trading platforms or educational resources, but pricing models vary between prop. This guide will walk you through each step to establish your. Prop firms can be highly. To become a funded trader, prop firms require implementing various strategies, managing risks, and identifying the most profitable opportunities. Definitely, follow prop firm trading rules to complete funding evaluations successfully. However, ensuring success requires careful planning and. To start a prop trading firm, you need to follow some essential steps. Developing a solid business plan: Develop a backtested trading strategy. Starting a prop trading firm is a complex but rewarding endeavor. Building a prop firm allows you to leverage skilled traders and provide them with the capital to generate profits for your company. Let’s dive deep into each crucial step of building your own prop trading firm from the ground up. Prop firms often set limits on the maximum lot size or risk per trade to ensure traders are not taking positions that could expose the firm’s capital to excessive risk. While amounts vary among proprietary trading firms, prop traders often get to. Trading with a proprietary trading firm (prop firm) offers a unique advantage—access to significant capital without risking your own.but before you can trade with funded money, you. Gain knowledge, create a business plan, register legally, raise funds, recruit traders, and more.What is Prop Firm Dashboard and How it Can Improve Trading Performance

Prop Trading Made Simple A StepbyStep Guide to Building A Prop Firm

HOW TO MAKE 1000 PER DAY WITH PROP FIRMS HOW TO TRADE FOREX USING

What is a Prop Firm? Best 15 minute Guide Prop Firm Fin Tech

How to Start a Prop Firm The Complete Guide

How to Start a Forex Prop Firm? 8 Step Process to Big Bucks

How to Start a Prop Firm? YourPropFirm

Build A Prop Firm Like a Pro with YourPropFirm's Customized Solutions

Prop Trading Firms For Beginners Unlock Prop Secrets 2023

Prop Firm Trading Strategy Easy Prop Firm Trading Challenge

Creating A Prop Trading Requires Significant Investment And Careful Planning To Integrate A Technology Solution, Liquidity, Legal License, And Marketing.

There Are Many Things To Consider And Questions To Ask Before Launching Your Prop Firm.

At This Point, You’re Ready To Build A Backtested.

Firstly, Decide On A Niche, Create A Business Plan, Get Registered And Licensed, And Raise Capital.

Related Post: