How To Build A Rental Portfolio

How To Build A Rental Portfolio - Want to know how to build a rental portfolio from scratch? This involves creating a real estate investment plan; In this guide, you’ll learn. If you’ve gotten this far and the thought of managing your own account feels overwhelming, a financial advisor can build and maintain a portfolio for you. It also helps reduce risk. Building a rental property portfolio is a smart move for landlords who want to increase their income and spread their investments. In this article, we’ll cover everything from choosing the right properties to managing them efficiently. Using the $1 million hypothetical investment. By the end, you’ll know how to make smart investments and see your rental. But where do you start, and what strategies work best? The basic principles will also apply if you're considering. In this article, we’ll cover everything from choosing the right properties to managing them efficiently. You need a plan to make your investments work for you. The investor who wants to know how to build a real estate portfolio should settle on goals and develop a strategy to achieve them, and a time horizon in which to do so. You could build a diverse portfolio of real estate investments across property types and geographies by investing in multiple dsts. Growing your rental property portfolio can be a smart way to build wealth. Make life easy for tenants by allowing them to pay rent online, request maintenance digitally, and build their credit via rent reporting. Keeping your home as a rental allows you to continue building property equity, while your tenant helps pay down your. Here are a few tips on how. Give careful thought to your desired markets, risk tolerance, and investing. Establishing a clear strategy and plan is essential before starting the process of growing your rental business. By the end, you’ll know how to make smart investments and see your rental. In this guide, we'll walk. Make life easy for tenants by allowing them to pay rent online, request maintenance digitally, and build their credit via rent reporting. In this. But not sure how to minimize risks, choose the right property, or find the right tenants? This involves creating a real estate investment plan; In this article, we’ll cover everything from choosing the right properties to managing them efficiently. The investor who wants to know how to build a real estate portfolio should settle on goals and develop a strategy. Establishing a clear strategy and plan is essential before starting the process of growing your rental business. The investor who wants to know how to build a real estate portfolio should settle on goals and develop a strategy to achieve them, and a time horizon in which to do so. You need a plan to make your investments work for. Keeping your home as a rental allows you to continue building property equity, while your tenant helps pay down your. You need a plan to make your investments work for you. You could build a diverse portfolio of real estate investments across property types and geographies by investing in multiple dsts. It also helps reduce risk. By the end, you’ll. This includes drafting a comprehensive real. Retain property ownership and build equity. If you’ve gotten this far and the thought of managing your own account feels overwhelming, a financial advisor can build and maintain a portfolio for you. In this article, we’ll cover everything from choosing the right properties to managing them efficiently. This strategy lets investors earn income from. You need a plan to make your investments work for you. Developing a successful rental property portfolio starts with understanding the business and adopting a strategic approach. In this article, we’ll cover everything from choosing the right properties to managing them efficiently. But not sure how to minimize risks, choose the right property, or find the right tenants? The brrrr. In this article, we’ll cover everything from choosing the right properties to managing them efficiently. Make life easy for tenants by allowing them to pay rent online, request maintenance digitally, and build their credit via rent reporting. If you’ve gotten this far and the thought of managing your own account feels overwhelming, a financial advisor can build and maintain a. This strategy lets investors earn income from several tenants at once. Establishing a clear strategy and plan is essential before starting the process of growing your rental business. It’s similar to house flipping, but you earn ongoing rental income instead of selling the property. This includes drafting a comprehensive real. This guide is designed to provide. Establishing a clear strategy and plan is essential before starting the process of growing your rental business. Give careful thought to your desired markets, risk tolerance, and investing. The investor who wants to know how to build a real estate portfolio should settle on goals and develop a strategy to achieve them, and a time horizon in which to do. In this guide, we'll walk. This strategy lets investors earn income from several tenants at once. It also helps reduce risk. You need a plan to make your investments work for you. Developing a successful rental property portfolio starts with understanding the business and adopting a strategic approach. Developing a successful rental property portfolio starts with understanding the business and adopting a strategic approach. In this article, we’ll cover everything from choosing the right properties to managing them efficiently. This guide is designed to provide. Establishing a clear strategy and plan is essential before starting the process of growing your rental business. Whether you currently own a property or are just considering your first purchase, it’s beneficial to understand how to develop a diversified real estate portfolio. Retain property ownership and build equity. But where do you start, and what strategies work best? The brrrr method allows you to quickly build a large portfolio of rental properties. You could build a diverse portfolio of real estate investments across property types and geographies by investing in multiple dsts. Want to know how to build a rental portfolio from scratch? They also offer the added benefit of. The basic principles will also apply if you're considering. To build a successful rental property portfolio, you must first learn the business and be strategic in your approach. In this guide, we'll walk. It’s not just about buying more properties. By the end, you’ll know how to make smart investments and see your rental.How To Build a High Performance Single Family Rental Portfolio (Part 2

How To Build a High Performance Single Family Rental Portfolio (Part 1

How to Build a Rental Portfolio from Scratch Azibo

How to Build a Rental Portfolio FAST Without Tons of Time or Money

How To Build A Million Dollar Rental Portfolio Invested Agents

How to build a Real Estate Portfolio Rental Property Portfolio

How To Build a 6 Figure Rental Portfolio in Less Than 3 Hours a Week

How to Build a Diversified Rental Property Portfolio

How to Build a Portfolio of 10 Rental Properties Team Massey Castle

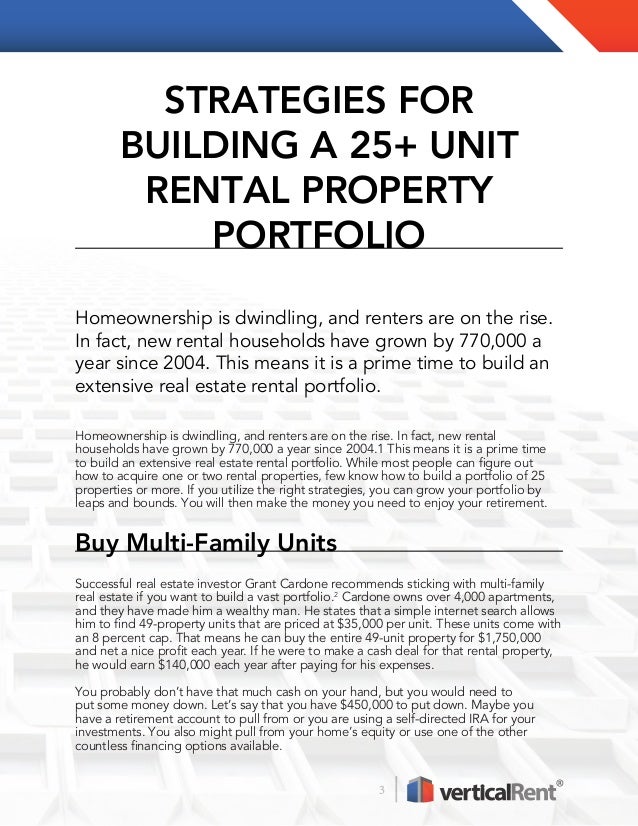

Strategies for Building a 25+ Unit Rental Property Portfolio

You Need A Plan To Make Your Investments Work For You.

This Involves Creating A Real Estate Investment Plan;

Keeping Your Home As A Rental Allows You To Continue Building Property Equity, While Your Tenant Helps Pay Down Your.

The Investor Who Wants To Know How To Build A Real Estate Portfolio Should Settle On Goals And Develop A Strategy To Achieve Them, And A Time Horizon In Which To Do So.

Related Post: