How To Build Business Credit Llc

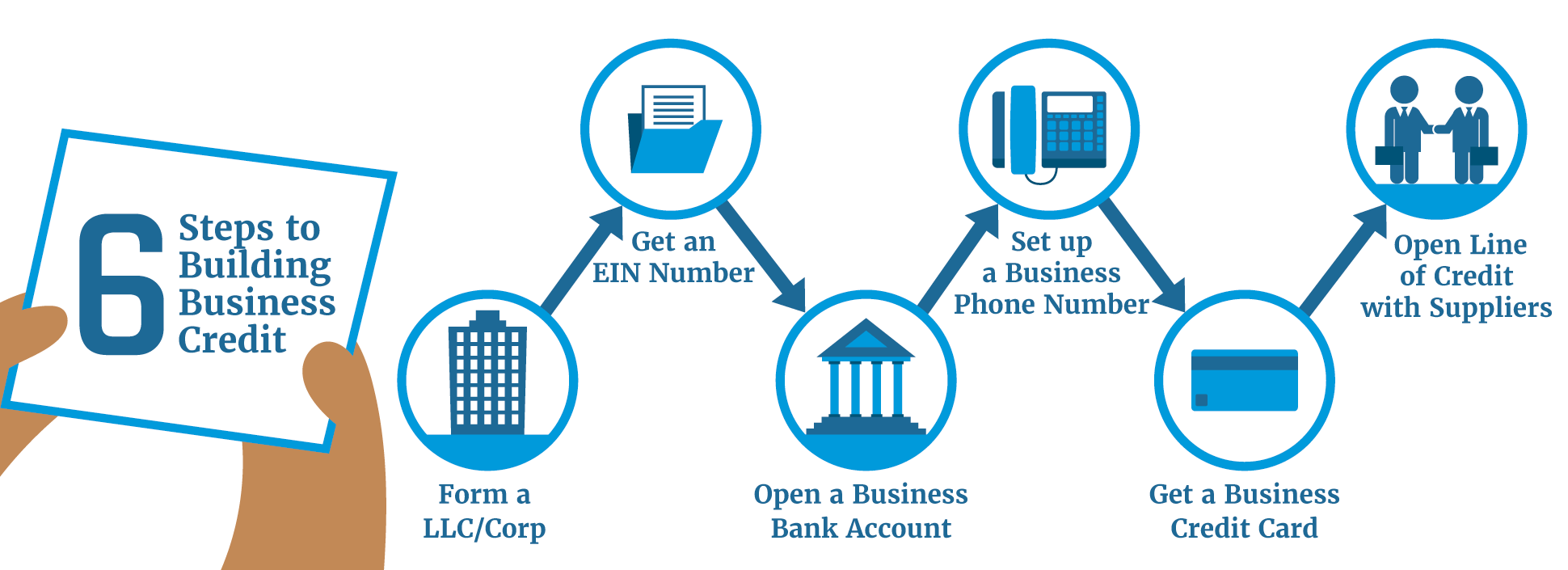

How To Build Business Credit Llc - Understand that you can use these steps and tools whether you operate as an llc,. Here’s everything you need to know. Budget for quarterly or monthly. Build your business credit early. These contain your company’s credit history. Establishing and managing business credit can help your company secure financing when you need it and with better terms. If you haven’t formed an llc yet, you’ll start. Building business credit can benefit your small business in many ways. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. It’s not just about getting a loan when you’re in a pinch. The business credit umbrella involves two terms: This information can show others how you have managed. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Started in 2003 by experienced businesswoman anita campbell, who has built. How to build business credit fast. A solid business credit profile can open doors to. Build your business credit early. Good business credit allows a company to secure loans, access better terms and interest rates from vendors, and even help. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. Our guide on how to establish business credit will take you through all the essential steps required to establish, maintain and grow your credit profile. Here are eight steps to building business credit, including registering your business, opening a business bank account and applying for trade credit. Business credit is a term that describes several tools lenders, creditors and vendors. Business credit is a term that describes several tools lenders, creditors and vendors use to measure the creditworthiness of your business. A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. Budget for quarterly or monthly. Building business credit can benefit your small business in many ways. Having. As soon as you start your llc, begin setting up your. Budget for quarterly or monthly. A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. Here are eight steps to building business credit, including registering your business, opening a business bank account and applying for trade credit.. How to build business credit fast. We’ve broken down how to build business credit into 10 steps. It may not be possible to build a strong business credit history right away, but starting early is key. Build your business credit early. Our guide on how to establish business credit will take you through all the essential steps required to establish,. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. Establishing and managing business credit can help your company secure financing when you need it and with better terms. These contain your company’s credit history. In general, good personal credit is all you need to qualify. The first four steps will help you establish your business identity. Business credit is a term that describes several tools lenders, creditors and vendors use to measure the creditworthiness of your business. It can also help you negotiate supply. It’s not just about getting a loan when you’re in a pinch. Building up your business credit works in a similar. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. Building business credit doesn’t happen overnight, but following the right steps can speed up the process. Small business trends is the online spot for small business owners and entrepreneurs. Here’s. Building business credit can benefit your small business in many ways. A solid business credit profile can open doors to. It may not be possible to build a strong business credit history right away, but starting early is key. Subscription services available for regular monitoring; The business credit umbrella involves two terms: Small business trends is the online spot for small business owners and entrepreneurs. Strong business credit can make it easier or less expensive to get certain types of financing, business. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. A solid business credit profile can. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. Building business credit doesn’t happen overnight, but following the right steps can speed up the process. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable. It can also help you negotiate supply. Unlike a traditional business loan, where the borrower receives. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Understand that you can use these steps and tools whether you operate as an llc,. It may not be possible to build a strong business credit history right away, but starting early is key. Strong business credit can make it easier or less expensive to get certain types of financing, business. Building business credit is like laying the groundwork for future success. Having good business credit is essential for any llc to succeed. Business credit is a term that describes several tools lenders, creditors and vendors use to measure the creditworthiness of your business. A solid business credit profile can open doors to. The first four steps will help you establish your business identity. A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. As soon as you start your llc, begin setting up your. Building business credit can benefit your small business in many ways. This information can show others how you have managed.30 Best Net 30 Accounts to Build Your Business Credit [Latest]

How to Build Business Credit for a Small Business

How To Build Business Credit FAST For Your LLC or Corp and EIN

How To Build Business Credit With An Llc Name Only Best Images

How to Establish Your Business Credit For LLC? How to Get Business

How to Build Business Credit (StepbyStep Guide) WealthFit

How To Build Business Credit Of 2022 8 Simple Steps

How Long Does It Take To Build Business Credit? Self. Credit Builder.

How To Build Business Credit For An LLC In 2023 (BANKS ARE COLLAPSING

How to Build Business Credit for LLC • Business Credit Builder Software

If You Haven’t Formed An Llc Yet, You’ll Start.

Here’s Everything You Need To Know.

Good Business Credit Allows A Company To Secure Loans, Access Better Terms And Interest Rates From Vendors, And Even Help.

It’s Not Just About Getting A Loan When You’re In A Pinch.

Related Post:

![30 Best Net 30 Accounts to Build Your Business Credit [Latest]](https://wisebusinessplans.com/wp-content/uploads/2023/01/strategies-to-build-business-credit-fastly-1536x864.jpg)