How To Build Credit As A Minor

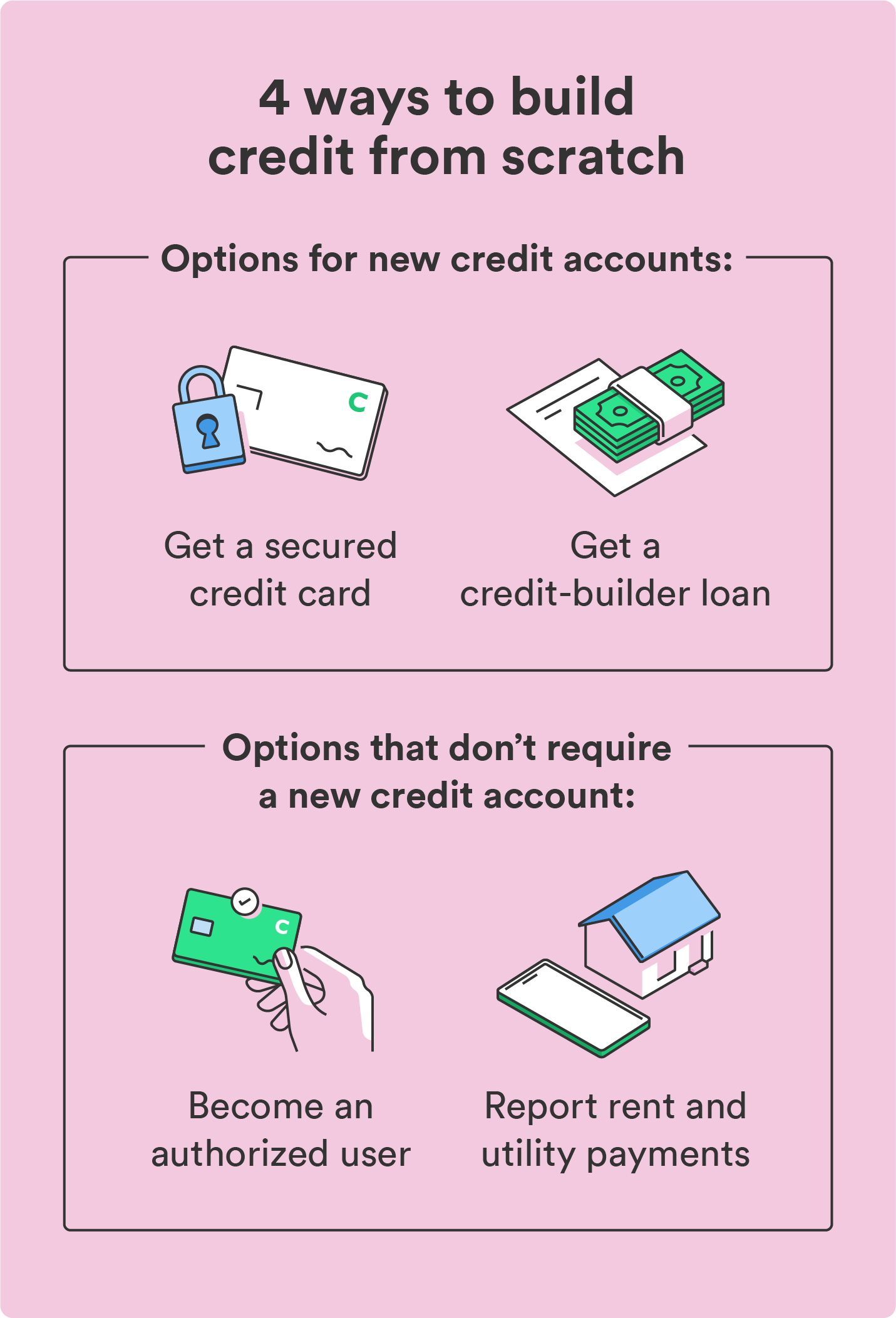

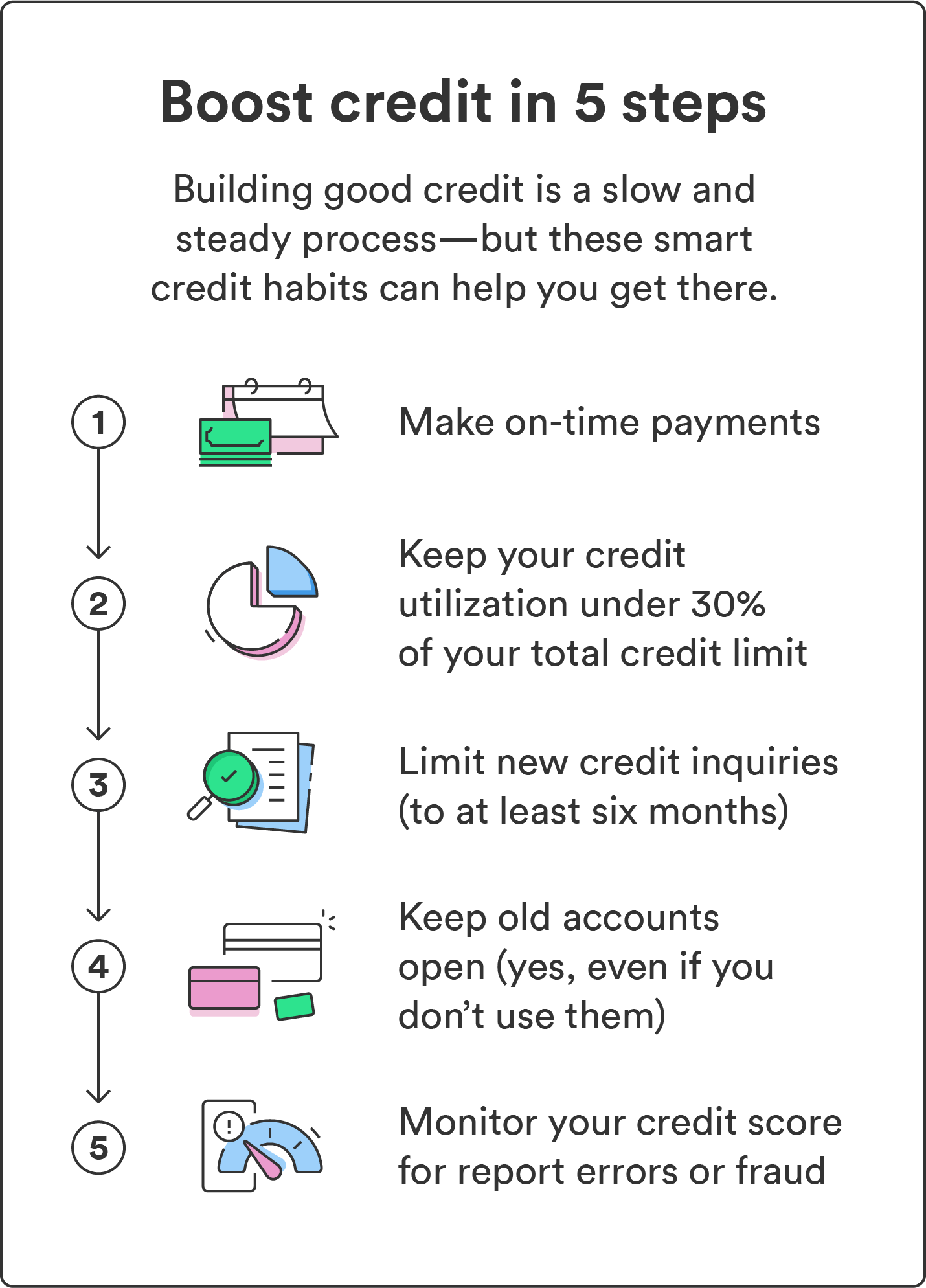

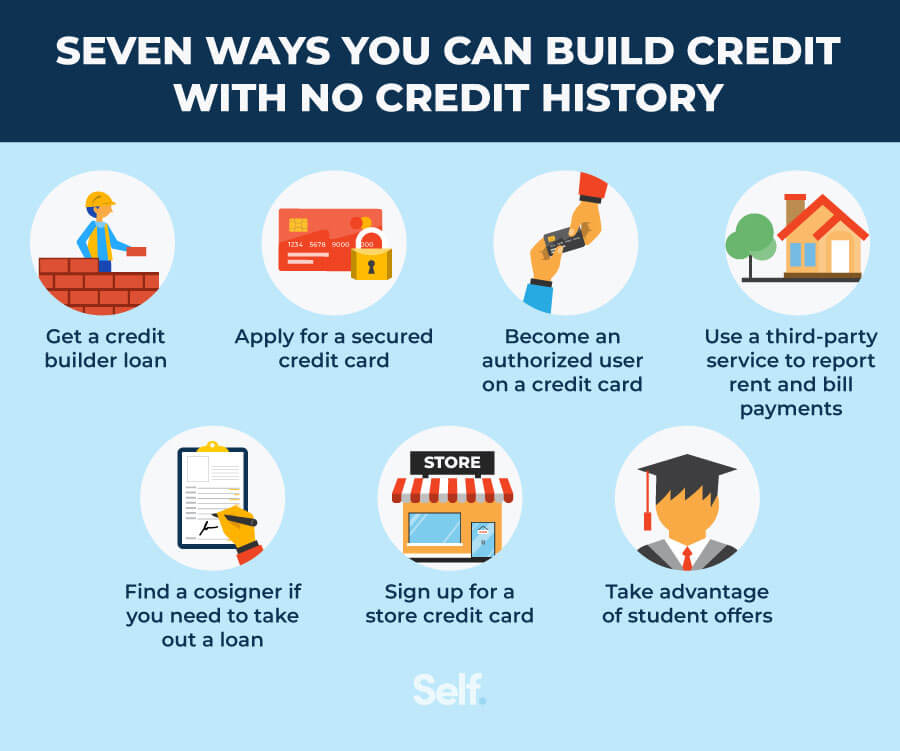

How To Build Credit As A Minor - One quick and easy way to help your child build their credit is to add them as an authorized user on your credit card. Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan. As a parent, teaching your child about credit is important. It’s also helpful to begin credit education. The best first credit cards. Sending your child off to college is a major milestone. Here are some tips on how (and when) to help your child build credit for the first time. The best way to help build your child's credit is to show them the ropes at an early age. Learn how to check your child’s credit report and establish credit for your child. Whether they're in elementary school or getting ready to leave the nest, learning these skills before adulthood can help them establish strong credit and shore up their financial future when they're ready. The best first credit cards. For minors, there are two best ways to start building credit (1) adding them as an authorized user to credit cards or (2) opening a secured credit card. You can build credit as a minor by becoming an authorized user on a friend or family member’s credit card account. A child usually needs to be between 13 and 15 years old. When you do this, your child will get their own credit card,. Learn how to check your child’s credit report and establish credit for your child. To build good credit and maintain their credit score, your child needs to learn basic financial literacy — that is, solid budgeting and money management skills. One quick and easy way to help your child build their credit is to add them as an authorized user on your credit card. You need to be at least 18. If the options feel overwhelming, check out our favorite cards for college students and building credit. Here are some tips on how (and when) to help your child build credit for the first time. Sending your child off to college is a major milestone. When you do this, your child will get their own credit card,. Find out how to build your child’s credit so they’ll have a head start when they want to get a. One quick and easy way to help your child build their credit is to add them as an authorized user on your credit card. Practical strategies for building credit responsibly help young people lay the groundwork for a stable financial future. While you're busy thinking about packing lists, course schedules, and student loans, there's another crucial topic that. When you. A child usually needs to be between 13 and 15 years old. Learn how to check your child’s credit report and establish credit for your child. If the options feel overwhelming, check out our favorite cards for college students and building credit. Whether they're in elementary school or getting ready to leave the nest, learning these skills before adulthood can. Here are some tips on how (and when) to help your child build credit for the first time. As a parent, teaching your child about credit is important. To build good credit and maintain their credit score, your child needs to learn basic financial literacy — that is, solid budgeting and money management skills. One quick and easy way to. To build good credit and maintain their credit score, your child needs to learn basic financial literacy — that is, solid budgeting and money management skills. The best first credit cards. You can build credit as a minor by becoming an authorized user on a friend or family member’s credit card account. A child usually needs to be between 13. Practical strategies for building credit responsibly help young people lay the groundwork for a stable financial future. It’s also helpful to begin credit education. For minors, there are two best ways to start building credit (1) adding them as an authorized user to credit cards or (2) opening a secured credit card. Building credit for kids can start when they’re. One quick and easy way to help your child build their credit is to add them as an authorized user on your credit card. As a parent, teaching your child about credit is important. The best first credit cards. By building a child’s credit, you can help them establish a positive credit history and develop responsible financial habits that will. For minors, there are two best ways to start building credit (1) adding them as an authorized user to credit cards or (2) opening a secured credit card. Whether they're in elementary school or getting ready to leave the nest, learning these skills before adulthood can help them establish strong credit and shore up their financial future when they're ready.. By building a child’s credit, you can help them establish a positive credit history and develop responsible financial habits that will benefit them for years to come. Learn how to check your child’s credit report and establish credit for your child. If the options feel overwhelming, check out our favorite cards for college students and building credit. To build good. Whether they're in elementary school or getting ready to leave the nest, learning these skills before adulthood can help them establish strong credit and shore up their financial future when they're ready. Learn how to check your child’s credit report and establish credit for your child. Building credit for kids can start when they’re relatively young — but there are. Building credit for kids can start when they’re relatively young — but there are still a few steps you’ll want to take before your children are old enough to use a credit card on their. Here are some tips on how (and when) to help your child build credit for the first time. A child usually needs to be between 13 and 15 years old. By building a child’s credit, you can help them establish a positive credit history and develop responsible financial habits that will benefit them for years to come. Practical strategies for building credit responsibly help young people lay the groundwork for a stable financial future. While you're busy thinking about packing lists, course schedules, and student loans, there's another crucial topic that. There are various ways to build credit for your child, like adding them as an authorized user or cosigning on a loan with them. Want to know how to build your child’s credit and at what age you can start? You can build credit as a minor by becoming an authorized user on a friend or family member’s credit card account. Whether they're in elementary school or getting ready to leave the nest, learning these skills before adulthood can help them establish strong credit and shore up their financial future when they're ready. You need to be at least 18. The best first credit cards. The best way to help build your child's credit is to show them the ropes at an early age. Sending your child off to college is a major milestone. If the options feel overwhelming, check out our favorite cards for college students and building credit. When you do this, your child will get their own credit card,.How to Build Credit The 7Step Guide Chime

How to Build Credit The 7Step Guide Chime

How to Build Credit as a Minor [Starting Before Age 18]

Help your child build a credit score before 18. (How to build credit

How to build credit in 6 easy steps Artofit

What is the best way for a minor to build credit? Leia aqui How can a

How to Build Credit in 6 Easy Steps

How can I build my minor child’s credit? Leia aqui How can I build

7 Strategies to Build Credit with No Credit History

How to Build Credit [Infographic] Credit One Bank

Learn How To Check Your Child’s Credit Report And Establish Credit For Your Child.

For Minors, There Are Two Best Ways To Start Building Credit (1) Adding Them As An Authorized User To Credit Cards Or (2) Opening A Secured Credit Card.

To Build Good Credit And Maintain Their Credit Score, Your Child Needs To Learn Basic Financial Literacy — That Is, Solid Budgeting And Money Management Skills.

It’s Also Helpful To Begin Credit Education.

Related Post:

![How to Build Credit as a Minor [Starting Before Age 18]](https://wealthup.com/wp-content/uploads/parents-helping-minor-child-build-credit.jpg)

-2.jpg)

![How to Build Credit [Infographic] Credit One Bank](https://www.creditonebank.com/content/dam/creditonebank/articles/2021/11/A_Few_Good_Ways_to_Build_Credit_Infographic.jpg)