How To Build Credit Buying A Car

How To Build Credit Buying A Car - We can’t look under the hood, but we can help you get off to a good start. Cafcu can empower you with credit builder loans on new and used vehicles. Credit builder loans are designed for. 4 ways to build your credit before buying a car. For most people, buying a car is a big financial decision with many moving parts. The majority of dealer loans have a markup of up to 2.5% that goes. Many if not most of those in the market for a car will consider whether to buy new or used. The process of building your creditcan take anywhere from a few months to several years, depending on the factors that are driving down your score. Financing a car can help you build credit, as long as you manage the loan responsibly and the loan’s activity is reported to one of the major credit bureaus. The best choice between a new car versus a used one depends on your goals and needs. From down payments to test drives, we’ll. For example, former tpg contributor richard kerr paid for a $40,000 car with the platinum card® from american. Save for a down payment. The best choice between a new car versus a used one depends on your goals and needs. But with the right financial prep, you can set yourself up for success. Call your provider to add the new car or get a quote beforehand. You can actually build your credit with a car loan. Your credit rating plays a significant role in the interest rate you receive for a car loan. Many if not most of those in the market for a car will consider whether to buy new or used. To build credit, just get a few credit cards. Lenders will use your credit score to determine your creditworthiness, your employment status, and the. Credit builder loans are designed for. A car title shows a vehicle’s legal owner, as well as other info. The process of building your creditcan take anywhere from a few months to several years, depending on the factors that are driving down your score. It's. Use them sparingly, pay them regularly and in full, don’t miss payments, and never let a balance report more than 5 to 10%. To build credit, just get a few credit cards. Call your provider to add the new car or get a quote beforehand. When purchasing the car, compare loan interest rates, put money down, and keep the loan. Call your provider to add the new car or get a quote beforehand. Use them sparingly, pay them regularly and in full, don’t miss payments, and never let a balance report more than 5 to 10%. Determine how much you can afford. If you can hold off on buying a car, you can implement strategies to build your. To actually. In this article, we’ll look at the credit requirements to buy a car, what to expect when financing a car, and what you can do if you need to improve your score. Credit builder loans are designed for. Your credit rating plays a significant role in the interest rate you receive for a car loan. A car title shows a. Buying a car with a credit card might take some legwork. For most people, buying a car is a big financial decision with many moving parts. It involves taking certain steps to establish a positive credit history that focuses. Looking to help your credit and in the market for a car? Your credit rating plays a significant role in the. For example, former tpg contributor richard kerr paid for a $40,000 car with the platinum card® from american. Home equity loans can be a good way to borrow money for the long term. We can’t look under the hood, but we can help you get off to a good start. So the last part what do. Looking to help your. Building car credit is a gradual process that requires patience, discipline, and consistency. 4 ways to build your credit before buying a car. A car title shows a vehicle’s legal owner, as well as other info. Credit builder loans are designed for. The majority of dealer loans have a markup of up to 2.5% that goes. When purchasing the car, compare loan interest rates, put money down, and keep the loan term as short as possible. Getting approved for a car loan is just the beginning of repairing or building your poor credit history. The best choice between a new car versus a used one depends on your goals and needs. Using a home equity loan. To actually boost your credit score, you need to pay all your bills on time,. 4 ways to build your credit before buying a car. Building car credit is a gradual process that requires patience, discipline, and consistency. The majority of dealer loans have a markup of up to 2.5% that goes. A car title shows a vehicle’s legal owner,. A car title shows a vehicle’s legal owner, as well as other info. So the last part what do. The process of building your creditcan take anywhere from a few months to several years, depending on the factors that are driving down your score. The majority of dealer loans have a markup of up to 2.5% that goes. 4 ways. Home equity loans can be a good way to borrow money for the long term. Building car credit is a gradual process that requires patience, discipline, and consistency. Are you looking to buy a new car? Lenders will use your credit score to determine your creditworthiness, your employment status, and the. To actually boost your credit score, you need to pay all your bills on time,. Using a home equity loan to buy a car. To build credit, just get a few credit cards. It involves taking certain steps to establish a positive credit history that focuses. These loans often have low interest rates because they are. A complete guide to car titles. Cafcu can empower you with credit builder loans on new and used vehicles. But with the right financial prep, you can set yourself up for success. 4 ways to build your credit before buying a car. Decide what car is right for you. You might want to check your credit score first because it impacts your monthly payment and how much you can afford. On the other hand, dealers make a lot of money by getting you to finance the purchase through them.How to Buy a Car with Bad Credit in 2020 in 2020 Bad credit, Bad

How buying a car can help you build your credit Car Credit Tampa

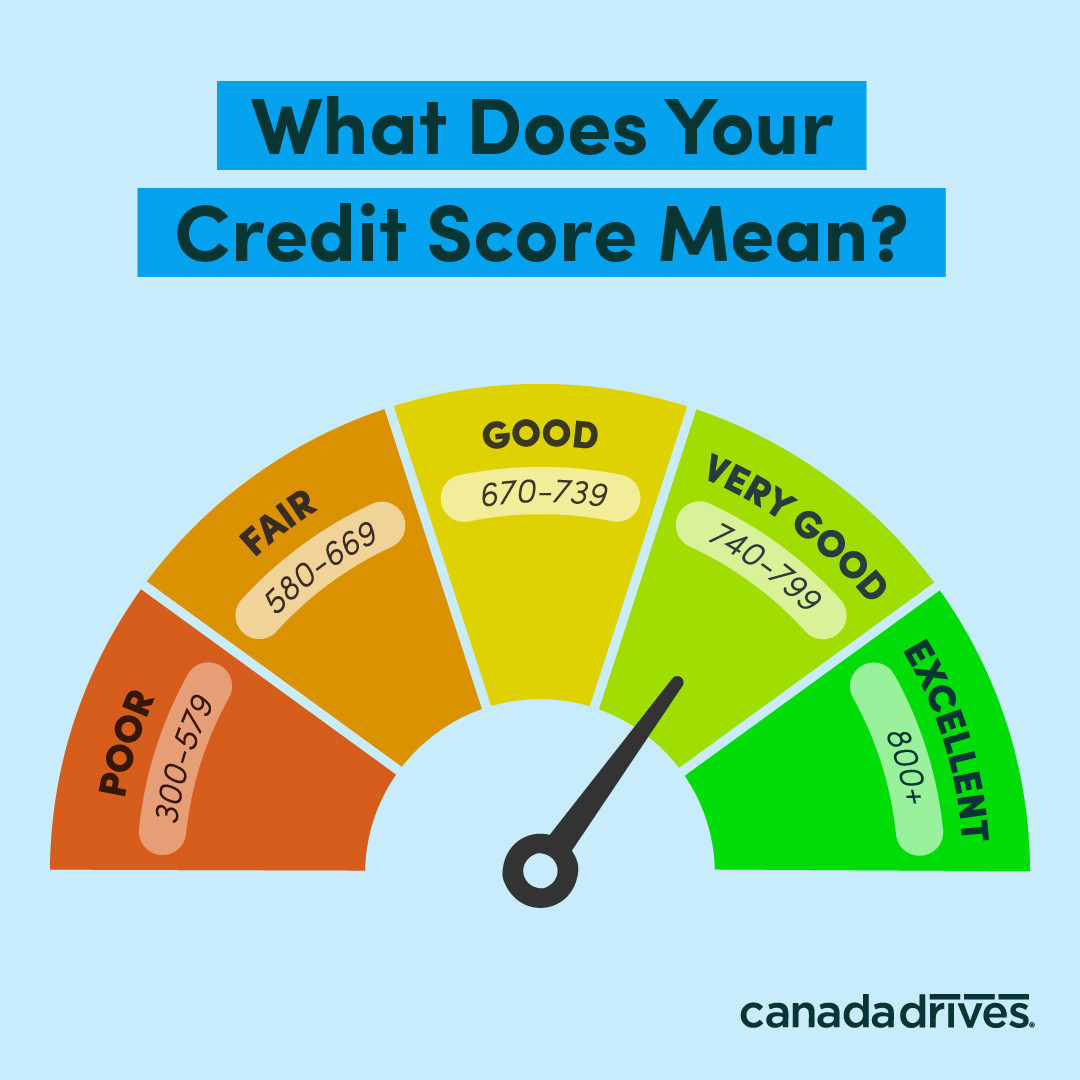

What Credit Score Do You Need to Buy a Car? Ally

How To Build Car Credit LiveWell

9 Things to Do After Buying a Used Car

How To Build Credit To Buy A Car

What Credit Score Is Used for Car Loans? Self. Credit Builder.

What Credit Score is Needed to Buy a Car

Does Leasing a Car Build Credit? Self. Credit Builder.

The Easiest Way to Buy or Sell a Car Canada Drives

Your Credit Rating Plays A Significant Role In The Interest Rate You Receive For A Car Loan.

For Example, Former Tpg Contributor Richard Kerr Paid For A $40,000 Car With The Platinum Card® From American.

In This Article, We’ll Look At The Credit Requirements To Buy A Car, What To Expect When Financing A Car, And What You Can Do If You Need To Improve Your Score.

The Majority Of Dealer Loans Have A Markup Of Up To 2.5% That Goes.

Related Post: