How To Build Credit For A Teenager

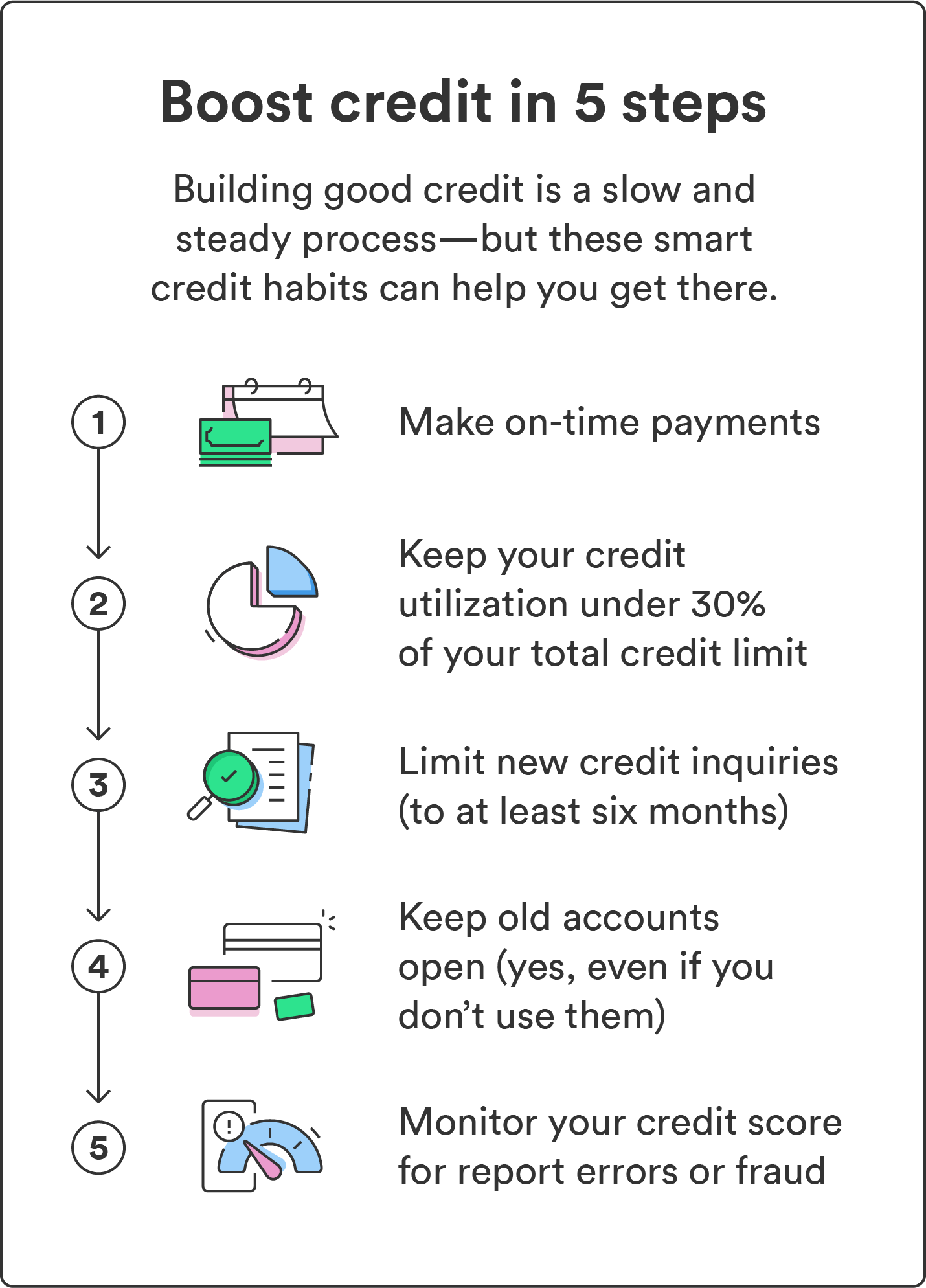

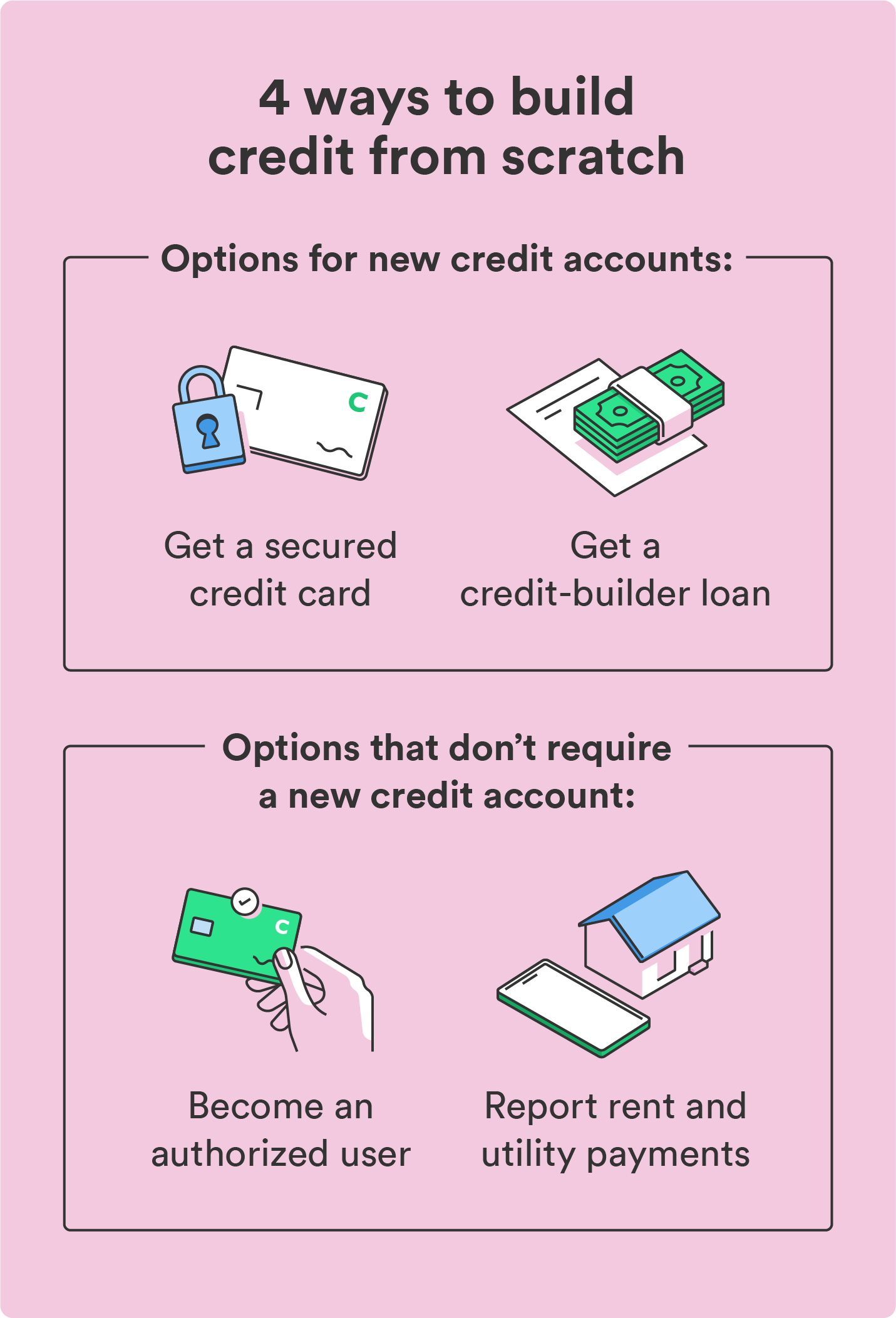

How To Build Credit For A Teenager - Parents can use a bank account as a tool for teaching good financial habits and creating opportunities for meaningful conversations. Parents can begin building their child's credit by following these five tips. One of the easiest ways people can ensure. You’ve come to the right place if you’re new to credit, looking to build credit, and trying to. This can be done by becoming an authorized user on a parent’s credit card or by applying for a student. Building a strong credit history early on sets a solid foundation for financial success in the future. Empower your teen with financial wisdom: A visa debit card lets teens. You’ll get a better score and won’t get dragged down by annoying late fees. For teenagers, starting to build a credit score early can be beneficial. “with grant, i made him an authorized user on my navy federal credit card,” clark says, adding that he’d get an alert. You’ll get a better score and won’t get dragged down by annoying late fees. One of the simplest ways to help your child begin building credit is by adding them as an authorized. (if they do, that's a. Empower your teen with financial wisdom: You’ve come to the right place if you’re new to credit, looking to build credit, and trying to. A credit score, typically ranging from 300 to 850, represents an. One first step for teenagers to build credit involves riding on the coattails of their parents through becoming an authorized user on an existing credit card. One of the easiest ways people can ensure. By starting to build credit in your teens, you can set yourself up for a more financially stable future. Unfortunately, your teenager won’t be able to rely on this part of the calculation, since most. A good credit score can enable teenagers to qualify for favorable interest rates. Empower your teen with financial wisdom: A good starting score can help you get new loans with lower interest or longer repayment. A visa debit card lets teens. Establishing a solid credit score as a teen or young adult is more accessible than you may think. Unfortunately, your teenager won’t be able to rely on this part of the calculation, since most. Building a strong credit history early on sets a solid foundation for financial success in the future. This can be done by becoming an authorized user. Ways to help your child build credit start with an authorized user account. By starting to build credit in your teens, you can set yourself up for a more financially stable future. Unfortunately, your teenager won’t be able to rely on this part of the calculation, since most. There are many ways parents can help their teen build credit, including. There are many ways parents can help their teen build credit, including teaching them how credit works and why it’s important, adding them as an authorized user on their credit card and showing them how to monitor their credit history. One first step for teenagers to build credit involves riding on the coattails of their parents through becoming an authorized. For teenagers, starting to build a credit score early can be beneficial. A visa debit card lets teens. What kind of credit card should you give a teen? You’ve come to the right place if you’re new to credit, looking to build credit, and trying to. Establishing a solid credit score as a teen or young adult is more accessible. Here’s what teenagers need to know. There are many ways parents can help their teen build credit, including teaching them how credit works and why it’s important, adding them as an authorized user on their credit card and showing them how to monitor their credit history. What kind of credit card should you give a teen? Establishing a solid credit. You’ll get a better score and won’t get dragged down by annoying late fees. For teenagers, starting to build a credit score early can be beneficial. One of the easiest ways people can ensure. Parents can use a bank account as a tool for teaching good financial habits and creating opportunities for meaningful conversations. Building a positive credit history can. If you’re looking for how to build credit as a teenager, you can start by paying your cell phone and utility bills on time. Minor children typically don't have credit reports and credit scores. Establishing a solid credit score as a teen or young adult is more accessible than you may think. Ways to help your child build credit start. Understanding the components of a credit score is essential for teens aiming to build a solid financial foundation. For teenagers, starting to build a credit score early can be beneficial. If you’re looking for how to build credit as a teenager, you can start by paying your cell phone and utility bills on time. What kind of credit card should. Empower your teen with financial wisdom: Parents can begin building their child's credit by following these five tips. A good credit score can enable teenagers to qualify for favorable interest rates. One first step for teenagers to build credit involves riding on the coattails of their parents through becoming an authorized user on an existing credit card. You’ve come to. Parents can begin building their child's credit by following these five tips. Establishing a solid credit score as a teen or young adult is more accessible than you may think. Building a strong credit history early on sets a solid foundation for financial success in the future. For teenagers, starting to build a credit score early can be beneficial. A credit score, typically ranging from 300 to 850, represents an. (if they do, that's a. “with grant, i made him an authorized user on my navy federal credit card,” clark says, adding that he’d get an alert. Here’s what teenagers need to know. Building a positive credit history can play a key role in accessing competitive borrowing opportunities in the future. One of the easiest ways people can ensure. 2 teenagers today are spending more time in school and working on other (unpaid) activities to prepare for. Having a long credit history with no red flags (like missed payments) may boost your credit score. Ways to help your child build credit start with an authorized user account. What kind of credit card should you give a teen? There are many ways parents can help their teen build credit, including teaching them how credit works and why it’s important, adding them as an authorized user on their credit card and showing them how to monitor their credit history. You’ll get a better score and won’t get dragged down by annoying late fees.Build Credit for Teens 5 Simple Ways to Get Started

Best Credit Cards For Teenagers How to Build Credit Under 18 YouTube

How to Help Teens Build Credit 10 Tips Southern Savers

Build credit Artofit

29 Credit Tips for Teens To Build Credit Today momma teen

How to Build Credit The 7Step Guide Chime

Guide to Building Credit for Teenagers

How to Help Your Teenager Build Credit Capital One

How to Build Credit The 7Step Guide Chime

How to build credit in 6 easy steps Artofit

You’ve Come To The Right Place If You’re New To Credit, Looking To Build Credit, And Trying To.

A Good Credit Score Can Enable Teenagers To Qualify For Favorable Interest Rates.

Parents Can Use A Bank Account As A Tool For Teaching Good Financial Habits And Creating Opportunities For Meaningful Conversations.

Unfortunately, Your Teenager Won’t Be Able To Rely On This Part Of The Calculation, Since Most.

Related Post: