How To Build Credit For Business

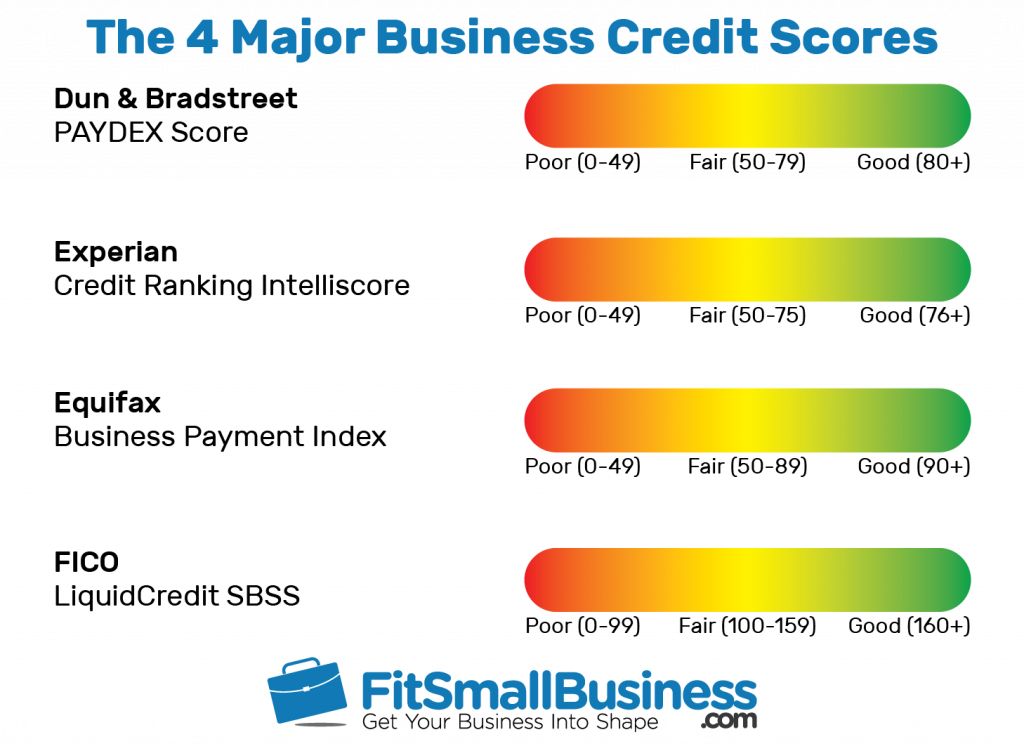

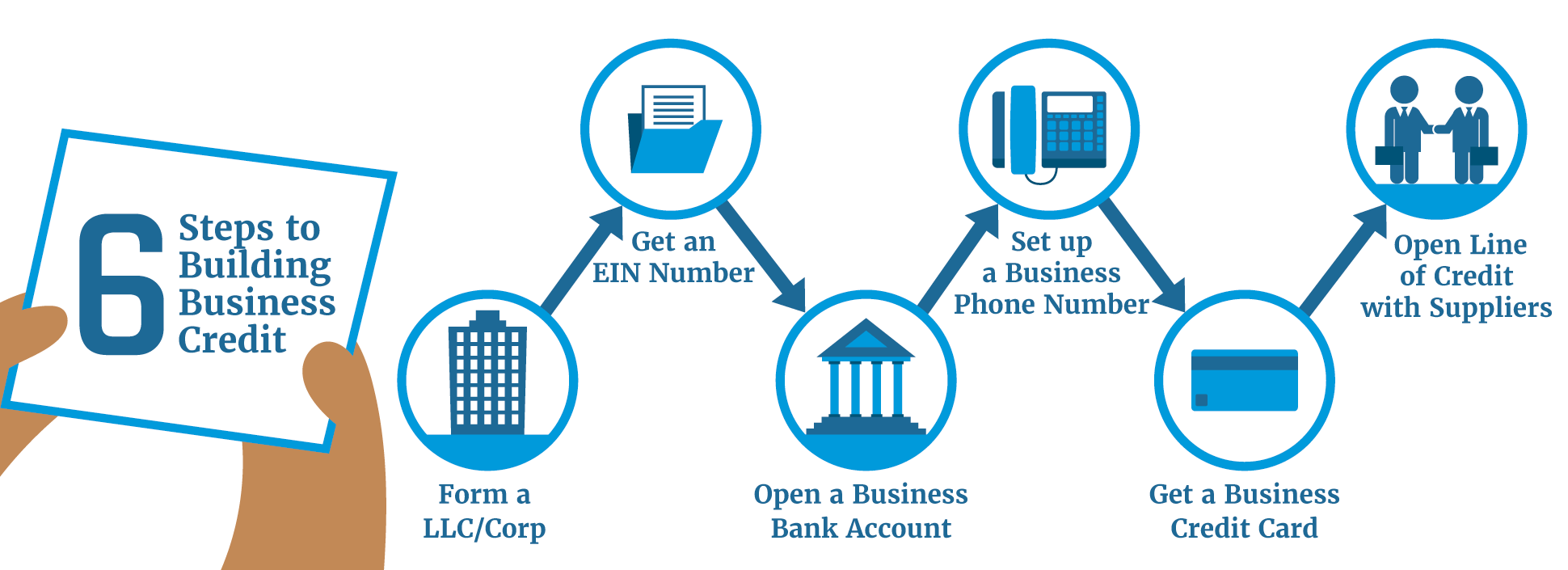

How To Build Credit For Business - Establish a business address and phone number. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. The money basics guides are a series of learning. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. By doing so, you not only. Our guide will set your business on the path to financial success by helping you access credit lines and funding by growing your credit score. We’ll discuss the following steps to building business credit fast. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Building business credit can benefit your small business in many ways. Open a business banking account. By doing so, you not only. Building business credit can benefit your small business in many ways. Four steps you can take to ensure creditors can validate your business information. This article provides a concise guide outlining the key steps on how to build. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Boosting your business credit can help open doors for more funding opportunities, such as increasing your eligibility for small business loans, working capital loans (like business. Strong business credit can make it easier or less expensive to get certain types of financing, business. Learn how to establish your business credit rating. Read from start to finish, or click on any of the links to jump to the business credit topic you need to know about. Best vendor accounts to build business credit fast. Four steps you can take to ensure creditors can validate your business information. Common mistakes to avoid when building business credit. Our guide will set your business on the path to financial success by helping you access credit lines and funding by growing your credit score. Taking on debt and managing credit comes with risks. It can also help you. A solid business credit profile can open doors to. Here’s everything you need to know. Four steps you can take to ensure creditors can validate your business information. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. Strong business. Four steps you can take to ensure creditors can validate your business information. By doing so, you not only. We’ll discuss the following steps to building business credit fast. Taking on debt and managing credit comes with risks. You’ll want to consider the business structure that’s right for your business. Open a business banking account. Building business credit can benefit your small business in many ways. You’ll want to consider the business structure that’s right for your business. Building good business credit entails consistently paying bills on time, maintaining healthy relationships with vendors and managing credit responsibly. Common mistakes to avoid when building business credit. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. The first step toward building business credit is to establish your business legally as a. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your business grow. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Building up your business credit works in a similar fashion to your personal. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your business grow. Here’s everything you need to know. Before you can establish credit for your. Our guide will set your business on the path to financial success by helping you access credit lines and funding by growing your credit score. Best vendor accounts to build business credit fast. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan options. Establishing and managing business credit. We’ll discuss the following steps to building business credit fast. Our how to build business credit. Four steps you can take to ensure creditors can validate your business information. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. By doing so, you not only. Building business credit is like laying the groundwork for future success. In this article, we’ll explore how to. It’s not just about getting a loan when you’re in a pinch. This article provides a concise guide outlining the key steps on how to build. Building up your business credit works in a similar fashion to your personal credit score, but. Learn how to establish your business credit rating. It’s not just about getting a loan when you’re in a pinch. Common mistakes to avoid when building business credit. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Here’s everything you need to know. Building good business credit entails consistently paying bills on time, maintaining healthy relationships with vendors and managing credit responsibly. Our how to build business credit. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. Building business credit can benefit your small business in many ways. By doing so, you not only. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Open a business banking account. Building business credit is like laying the groundwork for future success. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Our guide will set your business on the path to financial success by helping you access credit lines and funding by growing your credit score. A solid business credit profile can open doors to.How to Build Business Credit (StepbyStep Guide) WealthFit

How to Build Business Credit in 7 Steps

5 Tips to Build Your Business Credit

How to Build Business Credit Establish Business Credit

How to Build Business Credit 7 Expert Tips to Build Credit Fast (2024)

How to Build Business Credit Fast The 10 Best Ways AMP Advance

How to Build Business Credit for a Small Business

How to Build Business Credit CreditDonkey

Detailed step by step of how to build business credit Paper & Party

How To Build Credit For Your Business Behalfessay9

In This Article, We’ll Explore How To.

Taking On Debt And Managing Credit Comes With Risks.

Read From Start To Finish, Or Click On Any Of The Links To Jump To The Business Credit Topic You Need To Know About.

The Money Basics Guides Are A Series Of Learning.

Related Post: