How To Build Credit On Chime

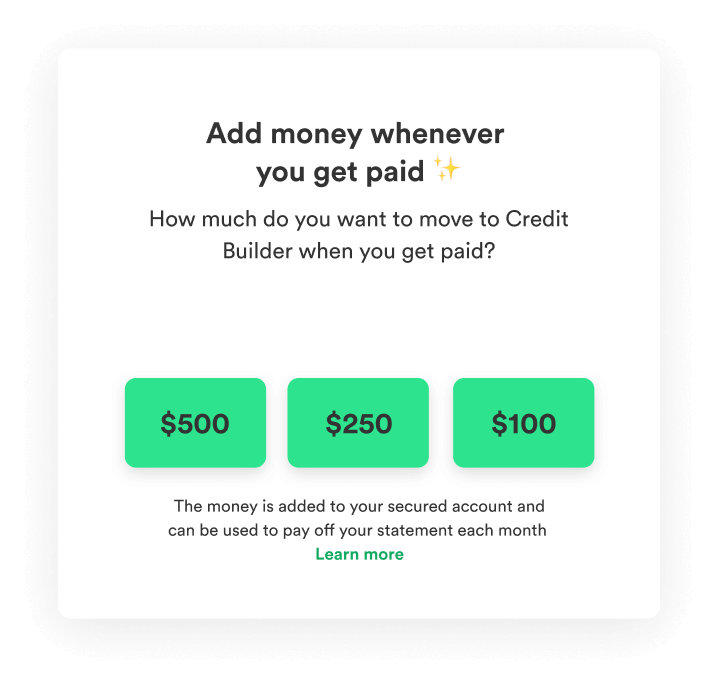

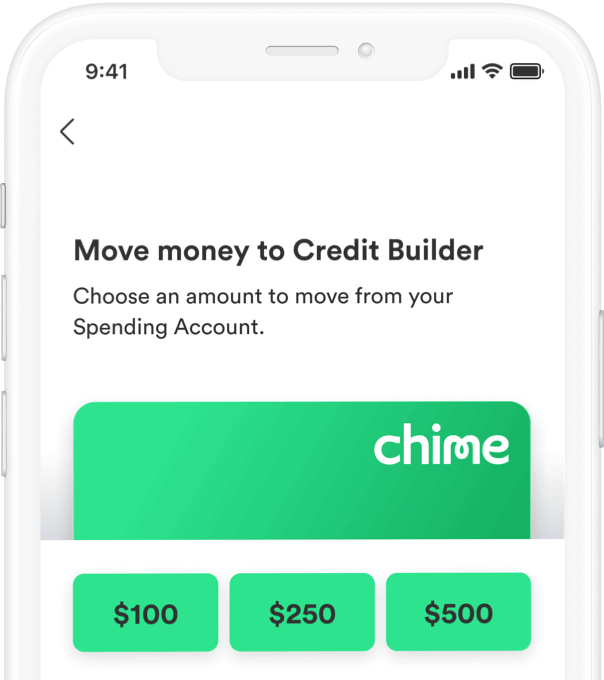

How To Build Credit On Chime - Apply for a chime credit builder card to fuel your credit journey. To be eligible, that deposit must be made in. What is credit builder and how to enroll; To be eligible to apply, you must have an active chime checking account. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. How to use credit builder; Current is a checking account available only through a mobile app aimed at those seeking to build up their credit. If you’re wondering how long it takes to rebuild. If you’re new to building credit, you can generally expect it to take at least six months to establish your first credit score. The app offers payday advances and free overdraft coverage. The chime credit builder card is available to united. Or stride bank, n.a., members fdic. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. Chime is a financial technology company, not a. Mypay™ line of credit provided by. Chime makes it possible for people with no credit history to build credit with its secured credit card, chime credit builder. To use the chime credit builder to build credit, you must have at least one direct deposit of $200 into the chime spending account. You can enroll in credit builder in your chime app: How to use credit builder; Read on to learn more. Apply for a chime credit builder card to fuel your credit journey. If you’re wondering how long it takes to rebuild. Introducing credit builder (effective 10/28/24, members can apply for credit builder without $200+ direct deposit requirement), to apply for credit builder, you must have an active. Why does chime report my credit builder balance to a credit bureau? Chime. The app offers payday advances and free overdraft coverage. Chime is a financial technology company, not a. The chime credit builder card is available to united. But chime®* has a unique approach to credit building that doesn't require a minimum security deposit or charge interest on your card balance. What is credit builder and how to enroll; If you’re wondering how long it takes to rebuild. Chime ® is a financial technology company, not a bank. Introducing credit builder (effective 10/28/24, members can apply for credit builder without $200+ direct deposit requirement), to apply for credit builder, you must have an active. Read on to learn more. But chime®* has a unique approach to credit building that. How do i apply for credit builder? How to use credit builder; But chime®* has a unique approach to credit building that doesn't require a minimum security deposit or charge interest on your card balance. Why does chime report my credit builder balance to a credit bureau? Chime makes it possible for people with no credit history to build credit. Banking services provided by the bancorp bank, n.a. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. In june, chime announced the launch of a credit card marketed as “a new way to build credit.” the unique product requires no minimum deposit, charges no fees. You can enroll in credit builder in your chime app: To be eligible, that deposit must be made in. Apply for a chime credit builder card to fuel your credit journey. Or stride bank, n.a., members fdic. Read on to learn more. In june, chime announced the launch of a credit card marketed as “a new way to build credit.” the unique product requires no minimum deposit, charges no fees and ensures. Or stride bank, n.a., members fdic. Current is a checking account available only through a mobile app aimed at those seeking to build up their credit. If you’re wondering how. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. Chime makes it possible for people with no credit history to build credit with its secured credit card, chime credit builder. If you’re wondering how long it takes to rebuild. Introducing credit builder (effective 10/28/24, members. Current is a checking account available only through a mobile app aimed at those seeking to build up their credit. To be eligible to apply, you must have an active chime checking account. Or stride bank, n.a., members fdic. To be eligible, that deposit must be made in. Chime ® is a financial technology company, not a bank. Or stride bank, n.a., members fdic. In june, chime announced the launch of a credit card marketed as “a new way to build credit.” the unique product requires no minimum deposit, charges no fees and ensures. To use the chime credit builder to build credit, you must have at least one direct deposit of $200 into the chime spending account.. Chime ® is a financial technology company, not a bank. How to use credit builder; But chime®* has a unique approach to credit building that doesn't require a minimum security deposit or charge interest on your card balance. If you’re new to building credit, you can generally expect it to take at least six months to establish your first credit score. Chime makes it possible for people with no credit history to build credit with its secured credit card, chime credit builder. To use the chime credit builder to build credit, you must have at least one direct deposit of $200 into the chime spending account. What is credit builder and how to enroll; Or stride bank, n.a., members fdic. Current is a checking account available only through a mobile app aimed at those seeking to build up their credit. To be eligible to apply, you must have an active chime checking account. In june, chime announced the launch of a credit card marketed as “a new way to build credit.” the unique product requires no minimum deposit, charges no fees and ensures. You can enroll in credit builder in your chime app: To be eligible, that deposit must be made in. The app offers payday advances and free overdraft coverage. Introducing credit builder (effective 10/28/24, members can apply for credit builder without $200+ direct deposit requirement), to apply for credit builder, you must have an active. Banking services provided by the bancorp bank, n.a.Chime® Credit Builder Review Best Way to Build Credit? YouTube

How to Build Credit The 7Step Guide Chime

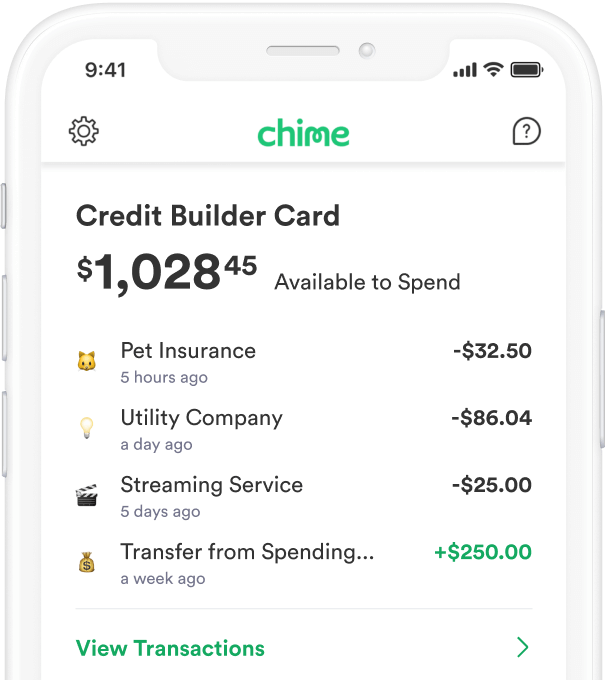

Secured Credit Card to Build Credit Chime

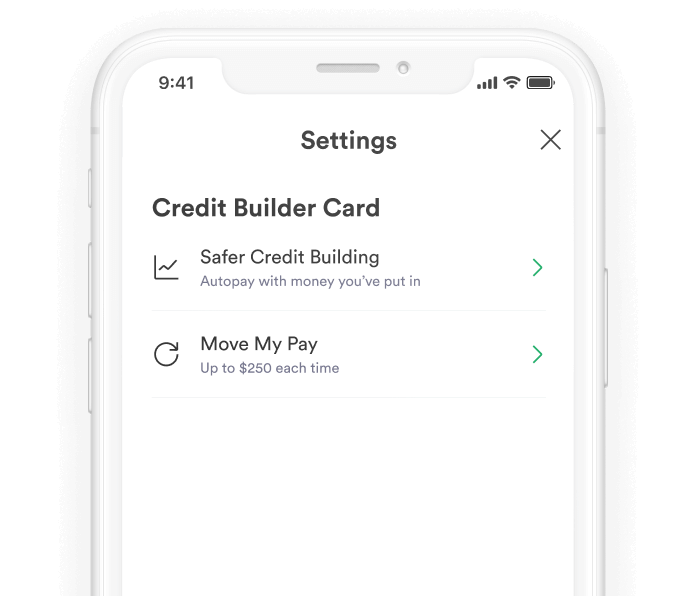

How to build credit with Credit Builder Chime

Credit Card To Build Credit Securely Chime

How to build credit with Credit Builder Chime

Credit Card To Build Credit Securely Chime

How to Build Credit The 7Step Guide Chime

How to build credit with Credit Builder Chime

How to build credit with Chime shorts chime credit creditcard

Chime Is A Financial Technology Company, Not A.

Why Does Chime Report My Credit Builder Balance To A Credit Bureau?

Mypay™ Line Of Credit Provided By.

The Chime Credit Builder Card Is Available To United.

Related Post: