How To Build Credit To Buy A House

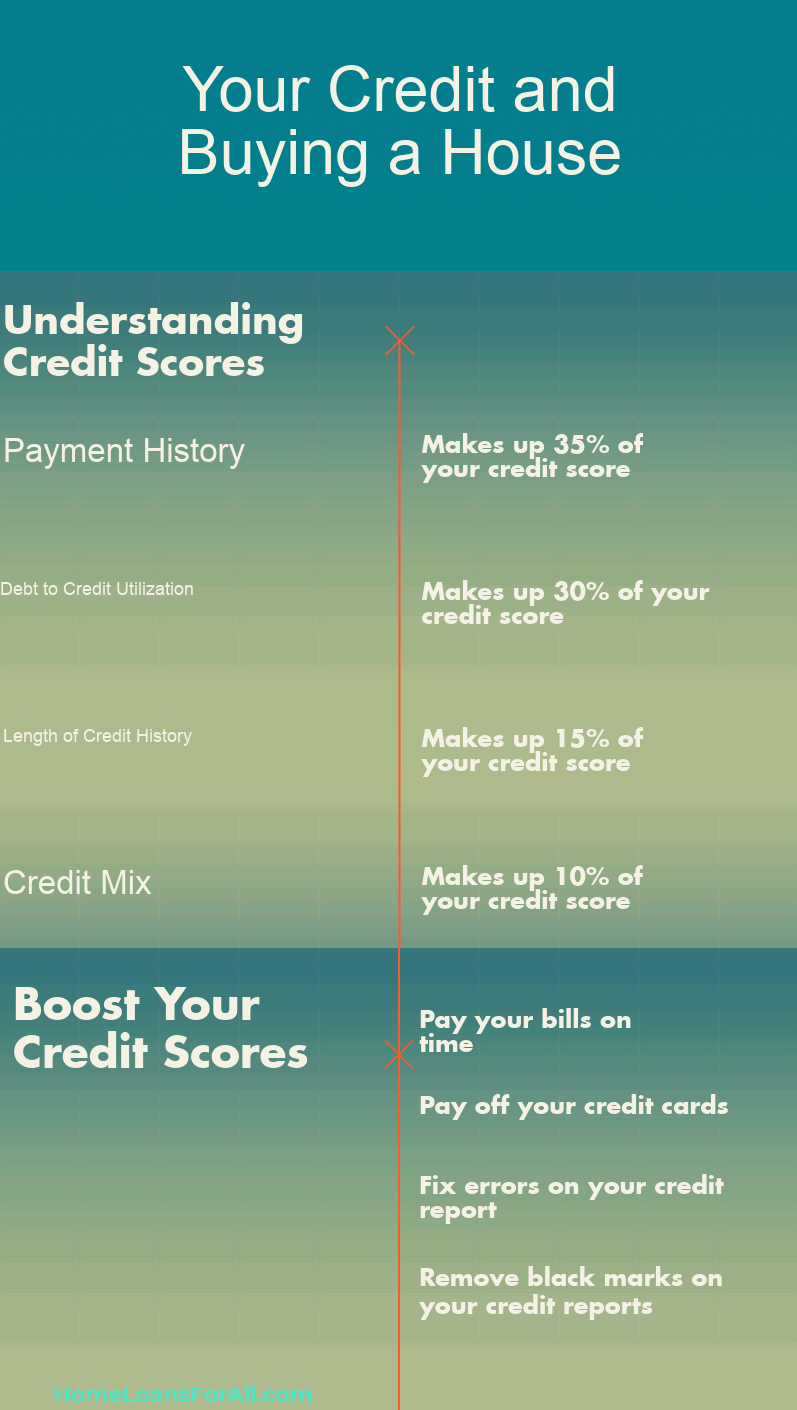

How To Build Credit To Buy A House - Use our free mortgage calculator to get an idea of what your monthly mortgage payment could. The minimum credit score needed to qualify for different types of mortgages ranges. We will explore the essential steps you can take to boost. Here’s everything you need to know about how to improve your credit score to buy a house. Learn where your credit score comes from, how to check your credit report, and how to raise your score to get the best mortgage loan and rate. Even if you build a new home, it won’t stay new forever, nor will those expensive appliances. There are things you can do to ensure that you're building credit to buy a home, even when your rating is shaky. Building credit is an essential step in achieving financial stability and unlocking opportunities, such as buying a house. That means getting your credit score in order and being preapproved for. The programs can ease some of the daunting numbers behind buying a house. Here’s everything you need to know about how to improve your credit score to buy a house. A good credit score not only helps you qualify for. In this article, we will guide you on how to build and improve your credit to increase your chances of purchasing a house. Before you start house hunting, you need to know how much house you can afford. Fortunately, there are ways to improve your credit to qualify for a. That means getting your credit score in order and being preapproved for. When you’re buying a home, lenders will pore over every aspect of your finances,. You will need to devise a timeline for yourself. There are things you can do to ensure that you're building credit to buy a home, even when your rating is shaky. Use our free mortgage calculator to get an idea of what your monthly mortgage payment could. It’s also a good idea to avoid opening new credit accounts in the months leading up to your home purchase. Fortunately, there are ways to improve your credit to qualify for a. A lower score will mean a more expensive mortgage, while a strong credit rating will result in a better interest rate and lower costs. That means getting your. We will explore the essential steps you can take to boost. Want to buy a home soon but aren’t sure your credit score is high enough to get approved for a mortgage? Here’s everything you need to know about how to improve your credit score to buy a house. Use our free mortgage calculator to get an idea of what. Buying a house with no money down is possible with a va or usda loan. Want to buy a home soon but aren’t sure your credit score is high enough to get approved for a mortgage? The most affordable places to buy a home the share of homes that are affordable is growing across the country, due largely to lower. Building credit is an essential step in achieving financial stability and unlocking opportunities, such as buying a house. There are ways to build credit before you apply for a mortgage. The most affordable places to buy a home the share of homes that are affordable is growing across the country, due largely to lower mortgage interest rates and more homes. We’ll break down the importance of good credit and show you how to build it fast to buy a home. Here’s everything you need to know about how to improve your credit score to buy a house. Before you start house hunting, you need to know how much house you can afford. There are things you can do to ensure. Here’s everything you need to know about how to improve your credit score to buy a house. It’s also a good idea to avoid opening new credit accounts in the months leading up to your home purchase. A good credit score not only helps you qualify for. The most affordable places to buy a home the share of homes that. The minimum credit score needed to qualify for different types of mortgages ranges. The most affordable places to buy a home the share of homes that are affordable is growing across the country, due largely to lower mortgage interest rates and more homes listed for. In this article, we will guide you on how to build and improve your credit. There are ways to build credit before you apply for a mortgage. Even if you build a new home, it won’t stay new forever, nor will those expensive appliances. And the good news is, even improving your credit score by 50 or 60 points can lead to significant savings. Building credit is an essential step in achieving financial stability and. There are ways to build credit before you apply for a mortgage. We will explore the essential steps you can take to boost. Building good credit can feel insurmountable — but even if you don’t have a perfect score, or if you have no credit at all, with a little help from the experts, you can build up. Check your. Buying a house with no money down is possible with a va or usda loan. Here’s everything you need to know about how to improve your credit score to buy a house. There are things you can do to ensure that you're building credit to buy a home, even when your rating is shaky. While a new credit card might. If you want to buy a home soon, pay attention to your credit reports. Learn where your credit score comes from, how to check your credit report, and how to raise your score to get the best mortgage loan and rate. Here’s everything you need to know about how to improve your credit score to buy a house. We will explore the essential steps you can take to boost. It’s also a good idea to avoid opening new credit accounts in the months leading up to your home purchase. We’ll break down the importance of good credit and show you how to build it fast to buy a home. If you’re wondering how you can build your credit score, the good news is that there are several options available to help you establish credit and get on the path toward homeownership. A lower score will mean a more expensive mortgage, while a strong credit rating will result in a better interest rate and lower costs. While a new credit card might seem like a great idea, it could temporarily lower your. The minimum credit score needed to qualify for different types of mortgages ranges. When you’re buying a home, lenders will pore over every aspect of your finances,. Buying a house with no money down is possible with a va or usda loan. A good credit score not only helps you qualify for. And the good news is, even improving your credit score by 50 or 60 points can lead to significant savings. There are ways to build credit before you apply for a mortgage. That means getting your credit score in order and being preapproved for.How to Build Credit The 7Step Guide Chime

How To Build Credit Fast To Buy a House 2022 YouTube

How To Build Credit To Buy A Home YouTube

What Bills Help Build Credit? Self. Credit Builder.

How To Build Credit To Buy A House Personal Finance Blogger

How To Build Credit Fast To Buy A House YouTube

What Credit Score Is Needed To Buy A House (Updated For 2018)

What Should My Credit Score be to Buy a House? YouTube

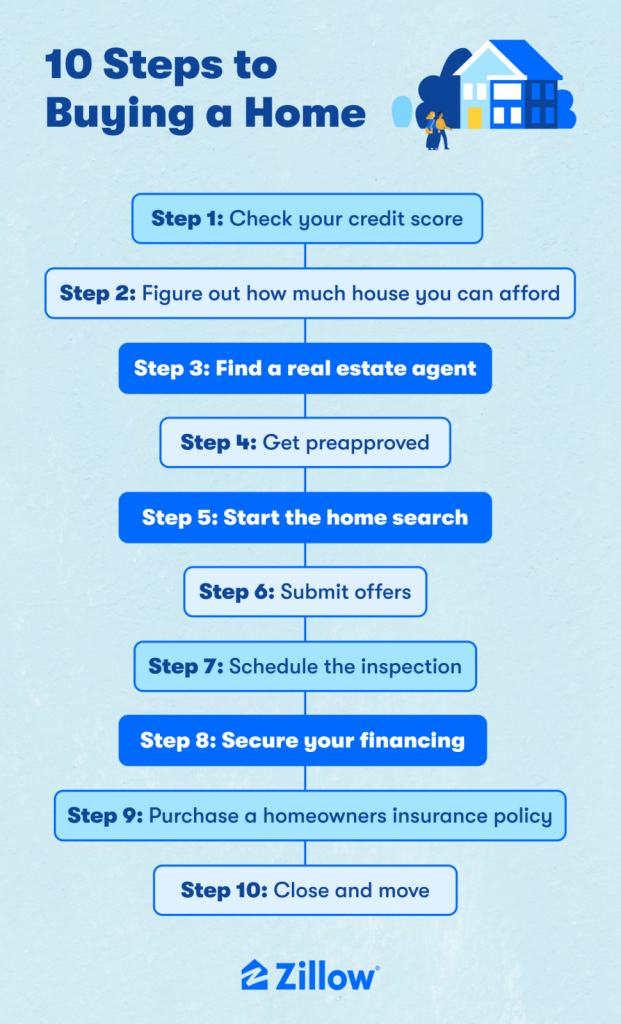

10 Most Important Steps to Buying a House Zillow

How to Build Credit to Buy a House YouTube

Building Credit Is An Essential Step In Achieving Financial Stability And Unlocking Opportunities, Such As Buying A House.

In This Article, We Will Guide You On How To Build And Improve Your Credit To Increase Your Chances Of Purchasing A House.

Before You Start House Hunting, You Need To Know How Much House You Can Afford.

The Programs Can Ease Some Of The Daunting Numbers Behind Buying A House.

Related Post: