How To Build Equifax Business Credit

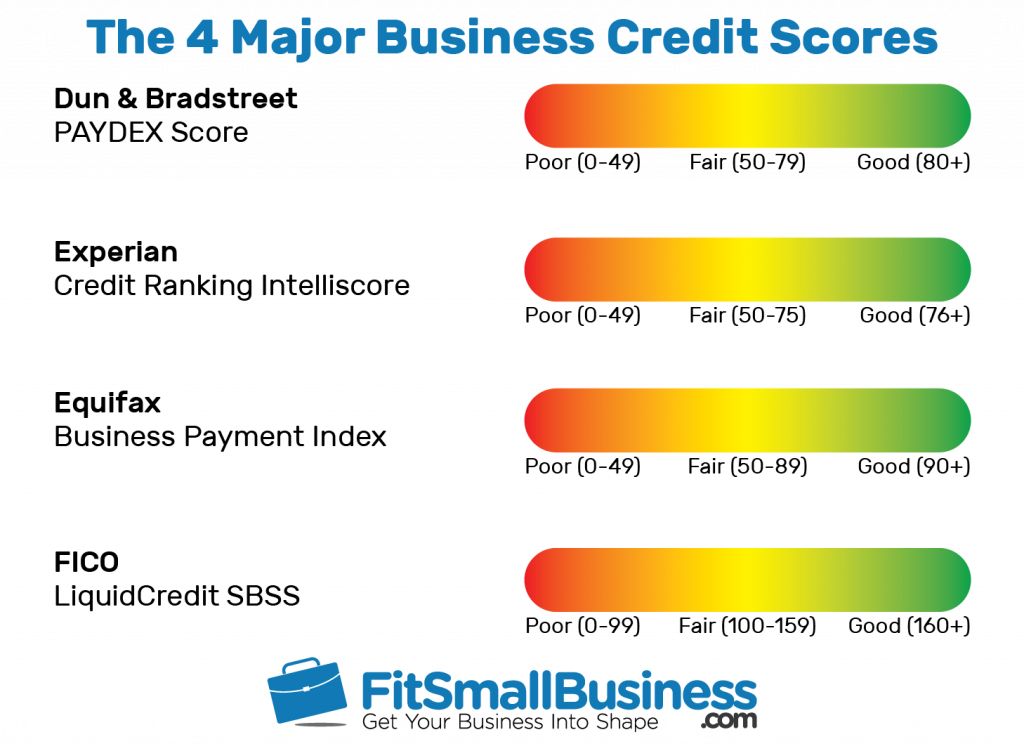

How To Build Equifax Business Credit - Before you sign a contract with a new business partner, create an order, or ship the order, make sure you know who you're doing business with. There are several steps involved in establishing and building credit files with the major commercial credit bureaus. Register with major credit bureaus; Create your business credit file. To start building business credit, make sure your business is listed with: The major business credit bureaus offer unique scoring models: It is a financial tool that assesses a company's financial health and ability to repay debts. Strong business credit scores can be key to getting your company approved for trade credit and financing. Here’s everything you need to know. But they can be very different than personal credit scores. To start building business credit, make sure your business is listed with: Equifax business credit reports give you the deepest level of insight into the validity, financial stability, and performance of more businesses. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. There are several steps involved in establishing and building credit files with the major commercial credit bureaus. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. It is a financial tool that assesses a company's financial health and ability to repay debts. These business credit scores can help you assess competitors,. Equifax business credit reports give business owners insights into the financial health of other companies. Create your business credit file. A solid business credit profile can open doors to. Here’s everything you need to know. Strong business credit scores can be key to getting your company approved for trade credit and financing. Equifax business credit reports give you the deepest level of insight into the validity, financial stability, and performance of more businesses. Register with major credit bureaus; Building business credit can help lower your borrowing costs, reduce insurance. These business credit scores can help you assess competitors,. Here’s everything you need to know. The image below shows seven steps. The major business credit bureaus offer unique scoring models: Business credit is important for small business success. Create your business credit file. But they can be very different than personal credit scores. It is a financial tool that assesses a company's financial health and ability to repay debts. Building business credit can help lower your borrowing costs, reduce insurance rates, and build stronger relationships with your vendors. To establish business credit, you must first register your business,. Building business credit is like laying the groundwork for future success. Just as your personal financial history is tracked on an equifax personal credit report, an equifax small business credit report is a look at your company’s payment history. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences.. Business credit is important for small business success. Equifax business credit risk score: Dun & bradstreet paydex score: A solid business credit profile can open doors to. But they can be very different than personal credit scores. Equifax business credit risk score: Create your business credit file. Dun & bradstreet paydex score: Control access to your equifax credit report, with certain exceptions, with the freedom to lock and unlock it. Equifax business credit reports give you the deepest level of insight into the validity, financial stability, and performance of more businesses. It’s not just about getting a loan when you’re in a pinch. Here is an overview of the business credit score ranges for experian, equifax and transunion and what constitutes a good score: Checking the credit history and financial well. A solid business credit profile can open doors to. Business credit is important for small business success. Building business credit is like laying the groundwork for future success. As a global data, analytics and technology company, we. Building business credit can help lower your borrowing costs, reduce insurance rates, and build stronger relationships with your vendors. The major business credit bureaus offer unique scoring models: Building up your business credit works in a similar fashion to your. Here’s everything you need to know. Dun & bradstreet paydex score: Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. To establish business credit, you must first register your business, set up a business credit profile and start building credit; The major business credit bureaus offer unique scoring. Create your business credit file. The major business credit bureaus offer unique scoring models: Read on for tips on how to build a strong business credit. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Business credit is important for small business success. Equifax business credit risk score: Read on for tips on how to build a strong business credit. Create your business credit file. Business credit is important for small business success. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Just as your personal financial history is tracked on an equifax personal credit report, an equifax small business credit report is a look at your company’s payment history. The major business credit bureaus offer unique scoring models: It’s not just about getting a loan when you’re in a pinch. To establish business credit, you must first register your business, set up a business credit profile and start building credit; Control access to your equifax credit report, with certain exceptions, with the freedom to lock and unlock it. The image below shows seven steps. We offer a full suite of solutions so you can choose the business credit report that best meets your needs. To start building business credit, make sure your business is listed with: Building business credit can help lower your borrowing costs, reduce insurance rates, and build stronger relationships with your vendors. Equifax business credit reports give business owners insights into the financial health of other companies. Building business credit is like laying the groundwork for future success.Maximize your commercial business with Equifax reports and risk scores

5 Vendor Net 30 Accounts with Easy Approval that Report to

25,000 NO PG BUSINESS CREDIT BUILDER LOAN! BUILD BUSINESS CREDIT

How to build your Equifax Business Credit Score (the REAL way) YouTube

How to Build Business Credit in 7 Steps

How to Build Business Credit With Ecredable Reports to Experian

What is a Good Business Credit Score and How it Helps?

How to Build Business Credit

How To Build Equifax Business Credit? (2024) YouTube

Equifax Business Credit Report What It Is, How to Use It NerdWallet

Dun & Bradstreet Paydex Score:

Checking The Credit History And Financial Well.

Before You Sign A Contract With A New Business Partner, Create An Order, Or Ship The Order, Make Sure You Know Who You're Doing Business With.

But They Can Be Very Different Than Personal Credit Scores.

Related Post: