How To Build Llc Business Credit

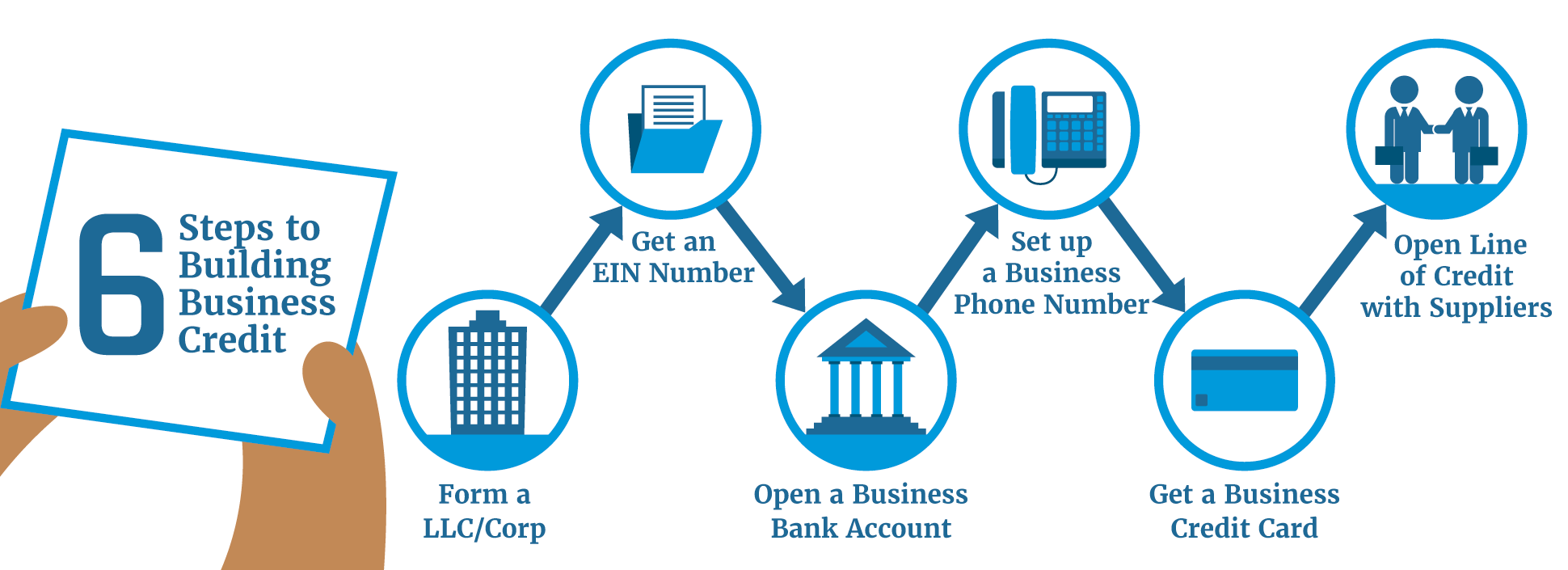

How To Build Llc Business Credit - In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. This information can show others how you have managed. In other words, how risky a lender considers your business to be. It can also help you negotiate supply. Building business credit should be on your to do list, because the sooner you get started, the sooner you can build a good business credit history. We’ve broken down how to build business credit into 10 steps. Establishing your company as a legal entity. Make small purchases on your business credit card and pay them off in full every month to build a solid credit history. Building business credit can benefit your small business in many ways. The business credit umbrella involves two terms: Your business must be a corporation or limited liability company (llc) to be assigned a business. Building business credit is like laying the groundwork for future success. The business credit umbrella involves two terms: Make small purchases on your business credit card and pay them off in full every month to build a solid credit history. Establishing your company as a legal entity. Your llc can build a business credit profile with agencies like dun & bradstreet, experian business, and equifax business. In other words, how risky a lender considers your business to be. It’s not just about getting a loan when you’re in a pinch. It may not be possible to build a strong business credit history right away, but starting early is key. Our guide on how to establish business credit will take you through all the essential steps required to establish, maintain and grow your credit profile. Apply for a business line of credit or loan once. Building business credit is like laying the groundwork for future success. These are the first steps you need to take to establish business credit for your business. As soon as you start your llc, begin setting up your. The first four steps will help you establish your business identity. These are the first steps you need to take to establish business credit for your business. It can also help you negotiate supply. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. To build business credit, follow these steps. Business credit is a term that describes several tools. This article provides a concise guide outlining the key steps on how to build. We’ll discuss the following steps to building business credit fast. Choose your legal form of business and register your company to begin the process of establishing its. Strong business credit can make it easier or less expensive to get certain types of financing, business. As soon. Our guide on how to establish business credit will take you through all the essential steps required to establish, maintain and grow your credit profile. These contain your company’s credit history. Strong business credit can make it easier or less expensive to get certain types of financing, business. Make small purchases on your business credit card and pay them off. Build your business credit early. Choose your legal form of business and register your company to begin the process of establishing its. Establishing and managing business credit can help your company secure financing when you need it and with better terms. The business credit umbrella involves two terms: The first four steps will help you establish your business identity. These profiles track the company’s loans, credit. Now you know the main influencing factors, here are 6 handy tips to build your business credit score: It may not be possible to build a strong business credit history right away, but starting early is key. We’ve broken down how to build business credit into 10 steps. Small business trends is the. Build your business credit early. Small business trends is the online spot for small business owners and entrepreneurs. Your llc can build a business credit profile with agencies like dun & bradstreet, experian business, and equifax business. In other words, how risky a lender considers your business to be. To build business credit, follow these steps. Building business credit should be on your to do list, because the sooner you get started, the sooner you can build a good business credit history. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Our guide on how to establish business credit will take you through all the essential. This article provides a concise guide outlining the key steps on how to build. It is important to note that business credit is distinct and separate from one’s personal credit. A solid business credit profile can open doors to. Your business must be a corporation or limited liability company (llc) to be assigned a business. These profiles track the company’s. A solid business credit profile can open doors to. Establishing and managing business credit can help your company secure financing when you need it and with better terms. In other words, how risky a lender considers your business to be. It is important to note that business credit is distinct and separate from one’s personal credit. As soon as you. Strong business credit can make it easier or less expensive to get certain types of financing, business. To build business credit, follow these steps. Now you know the main influencing factors, here are 6 handy tips to build your business credit score: We’ll discuss the following steps to building business credit fast. Your llc can build a business credit profile with agencies like dun & bradstreet, experian business, and equifax business. Read from start to finish, or click on any of the links to jump to the business credit topic you need to know about. Make small purchases on your business credit card and pay them off in full every month to build a solid credit history. These profiles track the company’s loans, credit. We’ve broken down how to build business credit into 10 steps. Small business trends is the online spot for small business owners and entrepreneurs. It is important to note that business credit is distinct and separate from one’s personal credit. Building business credit is like laying the groundwork for future success. This article provides a concise guide outlining the key steps on how to build. It can also help you negotiate supply. A solid business credit profile can open doors to. This information can show others how you have managed.5 Tips to Build Your Business Credit

How to Build Business Credit (StepbyStep Guide) WealthFit

How To Build Up Business Credit in 6 Simple Steps

How To Get Business Credit With An LLC — Business Credit Easy

How to Build Business Credit for LLC • Business Credit Builder Software

How Long Does It Take To Build Business Credit? Self. Credit Builder.

How to Build Business Credit 7 Expert Tips to Build Credit Fast (2024)

How To Build Credit For Your Business Behalfessay9

How to build business credit for an LLC

How to Build Business Credit for a Small Business

It May Not Be Possible To Build A Strong Business Credit History Right Away, But Starting Early Is Key.

Establishing And Managing Business Credit Can Help Your Company Secure Financing When You Need It And With Better Terms.

Building Business Credit Can Benefit Your Small Business In Many Ways.

Here’s Everything You Need To Know.

Related Post: