How To Qualify For Ownerbuilder Construction Loans

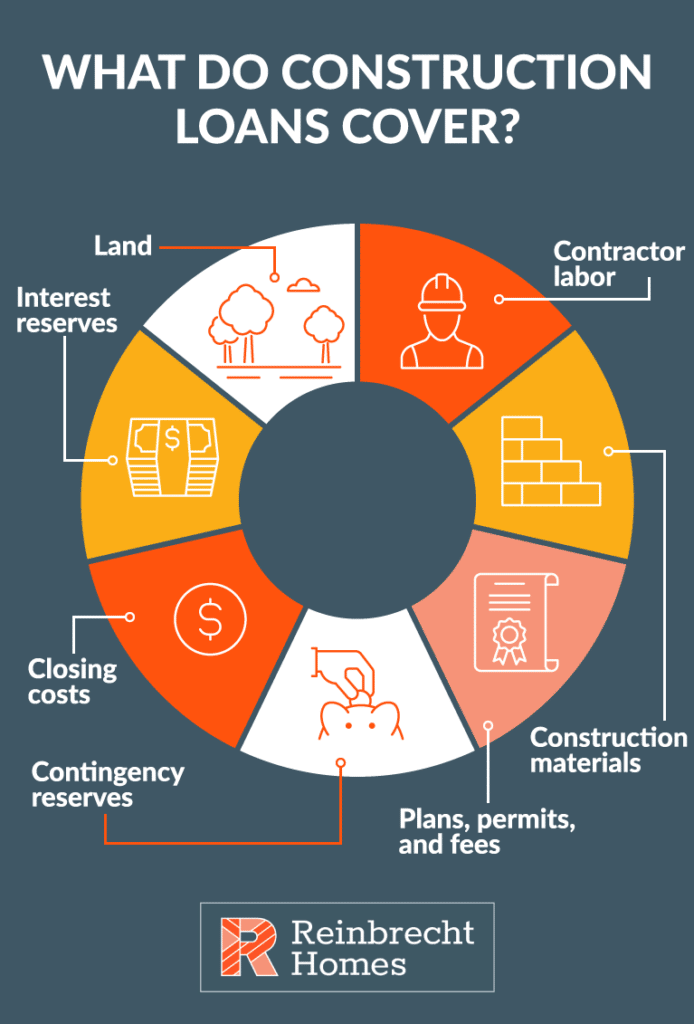

How To Qualify For Ownerbuilder Construction Loans - This flat is available for possession on. To qualify for a construction loan, lenders look carefully at your financial profile. Whether you need an owner builder construction loan in california, idaho, utah or any other state, use lendersearch.com and select “homeowner is the builder” in the borrower field. How to apply for construction grants. Qualifying for an owner builder loan is more challenging than a regular mortgage. You also can often use this money to purchase. If you plan to act as your. This under construction flat in sahastradhara road comes at a price of inr 66.6 lac. Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. Read on to understand how these loans work, and find some of the best. Some construction loans can be converted to mortgages after your home is finished. The bank wants to know that you can afford the loan with enough cash left over to complete the house, and that the contractor. This under construction flat in sahastradhara road comes at a price of inr 66.6 lac. These specialized loans work like a mortgage but give you the needed cash to build your dream home. How to apply for construction grants. Qualifying for an owner builder loan is more challenging than a regular mortgage. The first thing you want to do is make sure you qualify for an fha construction loan. This article examines the workings of construction loans, covering qualifying criteria, financing types, collateral, budgeting, interest reserves, and loan structuring. Learn how to qualify for owner builder construction loans with our comprehensive guide. Borrowers for these loans will need to show a resume of experience, be a professional home builder or hold a general contractor license. Qualifying for an owner builder loan is more challenging than a regular mortgage. Learn how to qualify for owner builder construction loans with our comprehensive guide. This under construction flat in sahastradhara road comes at a price of inr 66.6 lac. You also can often use this money to purchase. Once the land is purchased, associated bank may provide construction. Some construction loans can be converted to mortgages after your home is finished. Once the land is purchased, associated bank may provide construction loan financing for building your new home. If you plan to act as your. To qualify for a construction loan, lenders look carefully at your financial profile. This article examines the workings of construction loans, covering qualifying. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. Here are some common eligibility factors: Some construction loans can be converted to mortgages after your home is finished. The bank wants to know that you can afford the loan with enough cash left over to complete the house, and that the contractor. These. Learn how to qualify for owner builder construction loans with our comprehensive guide. If you plan to act as your. Both you and your contractor must be approved for the loan. Understand the needed qualifications, steps to apply, and tips for approval. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. This article examines the workings of construction loans, covering qualifying criteria, financing types, collateral, budgeting, interest reserves, and loan structuring. Some construction loans can be converted to mortgages after your home is finished. Requirements to qualify for owner builder loans. Read on to understand how these loans work, and find some of the best. This under construction flat in sahastradhara. Qualifying for an owner builder loan is more challenging than a regular mortgage. This article examines the workings of construction loans, covering qualifying criteria, financing types, collateral, budgeting, interest reserves, and loan structuring. Requirements to qualify for owner builder loans. These specialized loans work like a mortgage but give you the needed cash to build your dream home. To qualify. If you plan to act as your. Plus, you can use your lot equity toward the down payment of a construction. These specialized loans work like a mortgage but give you the needed cash to build your dream home. Learn how to qualify for owner builder construction loans with our comprehensive guide. Requirements to qualify for owner builder loans. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. Read on to understand how these loans work, and find some of the best. Borrowers for these loans will need to show a resume of experience, be a professional home builder or hold a general contractor license. Both you and your contractor must be. Qualifying for an owner builder loan is more challenging than a regular mortgage. Requirements to qualify for owner builder loans. It is strategically situated in ametek doon square. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. The bank wants to know that you can afford the loan with enough cash left over. The bank wants to know that you can afford the loan with enough cash left over to complete the house, and that the contractor. This under construction flat in sahastradhara road comes at a price of inr 66.6 lac. Borrowers for these loans will need to show a resume of experience, be a professional home builder or hold a general. Once an applicant finds the grants that apply best to them, they can usually apply online through a set process. Here are some typical requirements: These specialized loans work like a mortgage but give you the needed cash to build your dream home. Both you and your contractor must be approved for the loan. Borrowers for these loans will need to show a resume of experience, be a professional home builder or hold a general contractor license. This flat is available for possession on. This under construction flat in sahastradhara road comes at a price of inr 66.6 lac. Here are some common eligibility factors: Read on to understand how these loans work, and find some of the best. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. It is strategically situated in ametek doon square. Some construction loans can be converted to mortgages after your home is finished. How to apply for construction grants. Understand the needed qualifications, steps to apply, and tips for approval. Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. Requirements to qualify for owner builder loans.Everything You Need to Know About Construction to Permanent Loan

Construction Loans 101 Everything You Need To Know

How To Qualify For OwnerBuilder Construction Loans? LiveWell

🆕construction Loan For Your Projects In New Zeland Construction Loans

PPT Construction Loans To Owner Builders PowerPoint Presentation

How to Qualify for OwnerBuilder Construction Loans Construction

Construction Loans 101 Everything You Need To Know

19 How to Get an Owner Builder Construction Loan YouTube

Owner Builder Construction Loans Everything You Should Know HomeProfy

Owner Builder Loans Construction Loans for the DoItYourself Home

You Also Can Often Use This Money To Purchase.

The First Thing You Want To Do Is Make Sure You Qualify For An Fha Construction Loan.

This Article Examines The Workings Of Construction Loans, Covering Qualifying Criteria, Financing Types, Collateral, Budgeting, Interest Reserves, And Loan Structuring.

Qualifying For An Owner Builder Loan Is More Challenging Than A Regular Mortgage.

Related Post: