How To Use Home Equity To Build Wealth

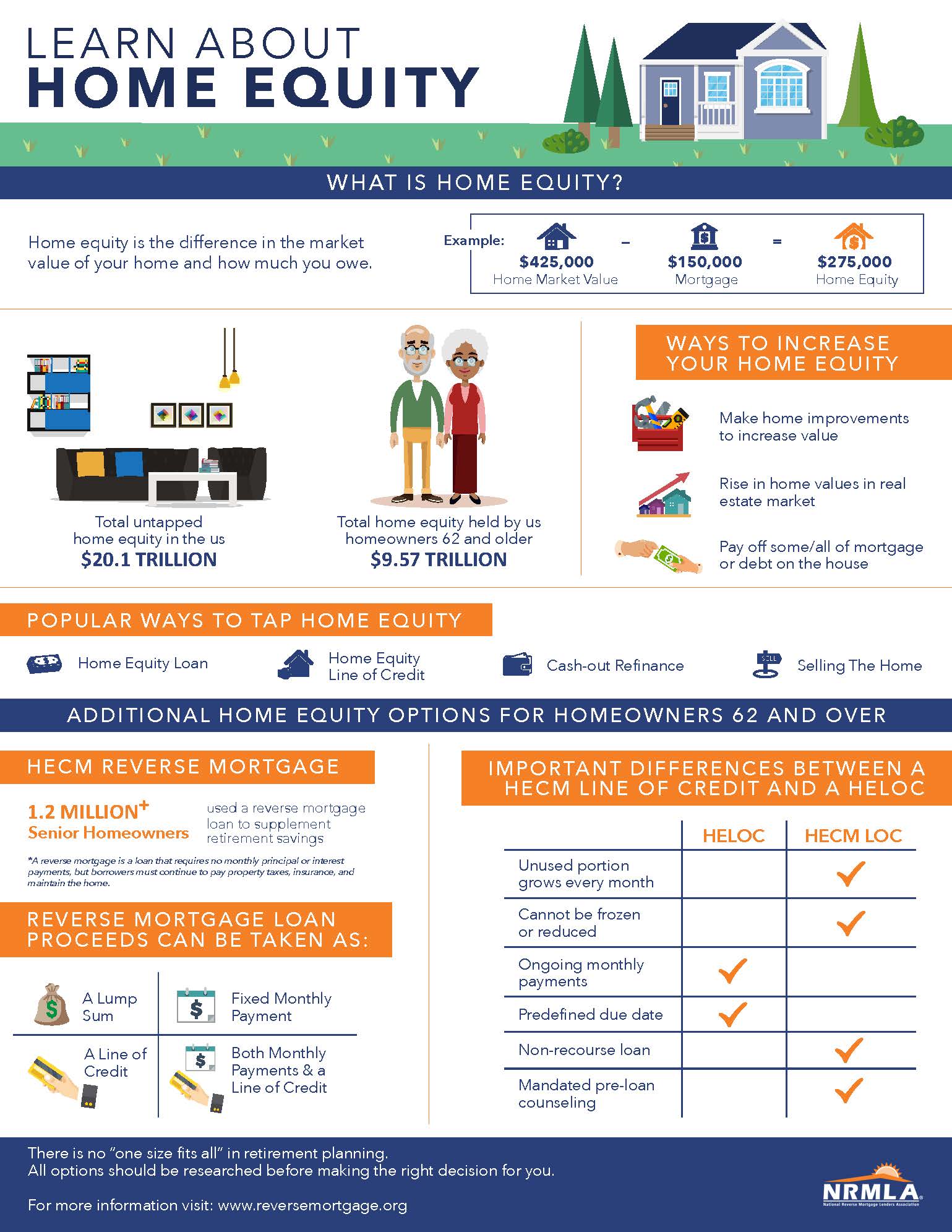

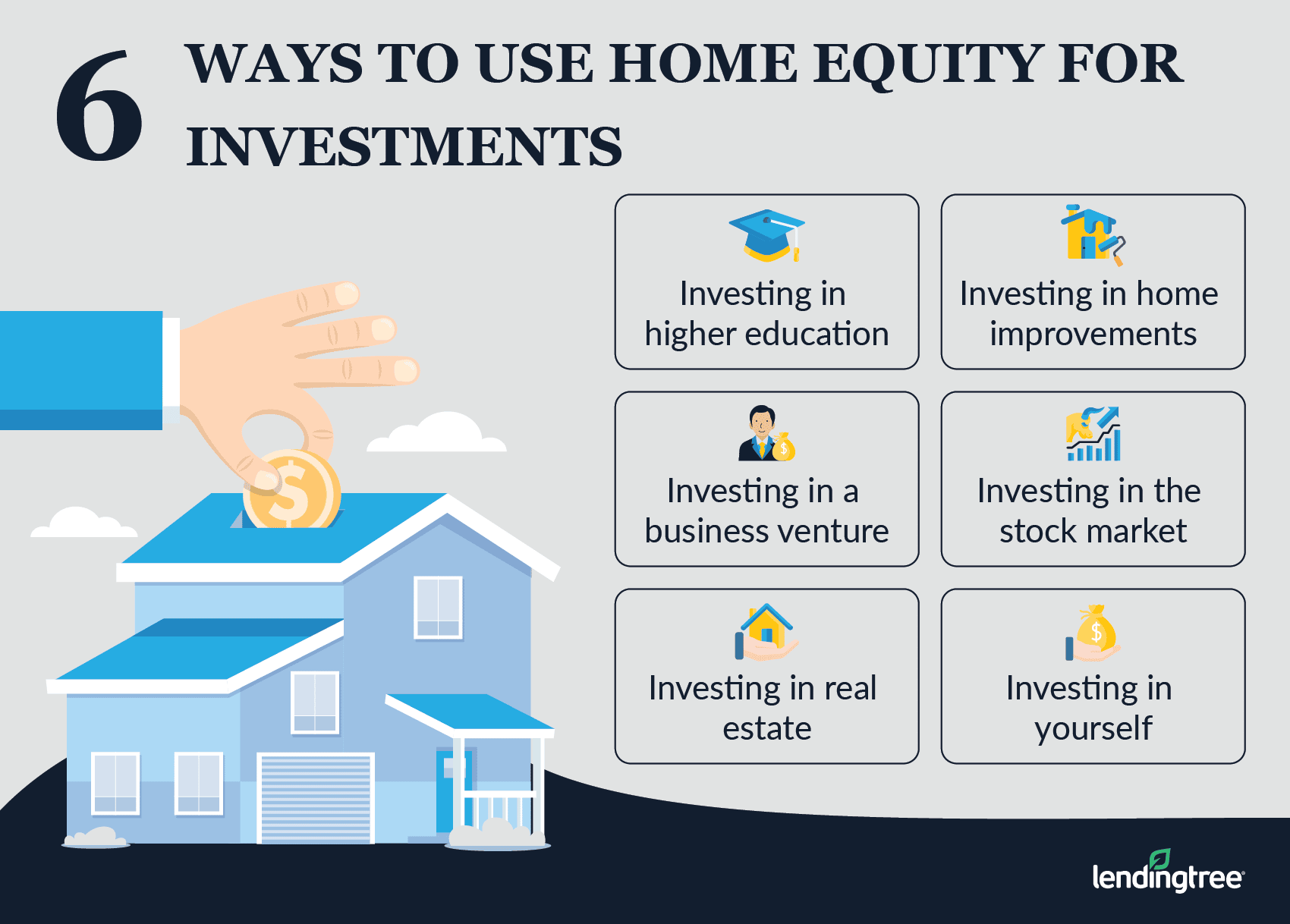

How To Use Home Equity To Build Wealth - It is calculated by subtracting the outstanding balance of your mortgage from the current market value of your. When considering how to use home equity to build wealth, it’s ideal to choose investments that will both appreciate and produce cash flow. Home rose by nearly 45% for the decade ending at the close of 2024. That way, the investment itself can make the. Each of these has its. Tapping into your home equity using a heloc is one way to potentially build wealth, especially because rates tend to be low when compared to other forms of borrowing. One of the most common and practical uses of a heloc is for home. Home equity refers to the portion of a home’s value that you truly own. The median price of a u.s. Once you’ve built up a significant amount of equity in your home, you may be able to use it to build wealth in other ways, using a home equity loan, home equity line of credit (or. When considering how to use home equity to build wealth, it’s ideal to choose investments that will both appreciate and produce cash flow. There are several ways to build equity in your home, including. By leveraging the equity you've built in your home, you can access funds that can be strategically invested to build wealth over time — and there are a few strategic ways you. The most common ways to pull equity out of your house are through home equity loans, cash refinances, and home equity lines of credit or helocs. When it comes to building wealth, one of the most powerful tools at your disposal is home equity. Tapping into your home equity using a heloc is one way to potentially build wealth, especially because rates tend to be low when compared to other forms of borrowing. Using home equity to invest in real estate can create additional income streams and diversify your portfolio. In this guide, we’ll show you how to use your home equity strategically to build wealth and secure your financial future. Building home equity is important. That way, the investment itself can make the. In this guide, we’ll show you how to use your home equity strategically to build wealth and secure your financial future. By increasing income eligibility to 120 percent of ami and expanding the network of servicers, this initiative underscores the city's commitment to creating housing stability and. Since home equity is equal to the. When considering how to use home. When considering how to use home equity to build wealth, it’s ideal to choose investments that will both appreciate and produce cash flow. Tapping into your home equity using a heloc is one way to potentially build wealth, especially because rates tend to be low when compared to other forms of borrowing. Home equity refers to the portion of a. Building home equity is important because it allows homeowners to gain financial stability and wealth over time. It is calculated by subtracting the outstanding balance of your mortgage from the current market value of your. Deploying equity in real estate. Using home equity for business financing. Is home equity an asset? The most common ways to pull equity out of your house are through home equity loans, cash refinances, and home equity lines of credit or helocs. This approach involves developing a new platform to support home equity lending. Home equity refers to the portion of a home’s value that you truly own. Tapping into your home equity using a heloc. Tapping into home equity can provide substantial funds for home improvements at lower interest rates than personal loans or credit cards. That’s because you get to pocket the value of your equity when you sell your home. Using home equity to invest in real estate can create additional income streams and diversify your portfolio. This approach involves developing a new. That way, the investment itself can make the. One of the most common and practical uses of a heloc is for home. Using home equity for business financing. When considering how to use home equity to build wealth, it’s ideal to choose investments that will both appreciate and produce cash flow. Once you’ve built up a significant amount of equity. Each of these has its. The median price of a u.s. Using home equity for business financing. The most common ways to pull equity out of your house are through home equity loans, cash refinances, and home equity lines of credit or helocs. You could also use funds from a heloc to cover other home improvements and repairs. In this guide, we’ll show you how to use your home equity strategically to build wealth and secure your financial future. Tapping into your home equity using a heloc is one way to potentially build wealth, especially because rates tend to be low when compared to other forms of borrowing. Using home equity for business financing. Building home equity is. Building home equity is important because it allows homeowners to gain financial stability and wealth over time. When considering how to use home equity to build wealth, it’s ideal to choose investments that will both appreciate and produce cash flow. For example, you might use the money to replace a damaged roof or fix a broken. When it comes to. By increasing income eligibility to 120 percent of ami and expanding the network of servicers, this initiative underscores the city's commitment to creating housing stability and. That’s because you get to pocket the value of your equity when you sell your home. One of the most common and practical uses of a heloc is for home. That way, the investment. Since home equity is equal to the. By leveraging the equity you've built in your home, you can access funds that can be strategically invested to build wealth over time — and there are a few strategic ways you. Home equity refers to the portion of a home’s value that you truly own. The most common ways to pull equity out of your house are through home equity loans, cash refinances, and home equity lines of credit or helocs. That way, the investment itself can make the. Tapping into home equity can provide substantial funds for home improvements at lower interest rates than personal loans or credit cards. By increasing income eligibility to 120 percent of ami and expanding the network of servicers, this initiative underscores the city's commitment to creating housing stability and. Building home equity is important because it allows homeowners to gain financial stability and wealth over time. When it comes to building wealth, one of the most powerful tools at your disposal is home equity. There are a few different (and simple) ways that you can use a heloc to build wealth, including: Home rose by nearly 45% for the decade ending at the close of 2024. Using home equity to invest in real estate can create additional income streams and diversify your portfolio. But what exactly is equity, and how can you maximize it to secure your financial. This approach involves developing a new platform to support home equity lending. One of the most common and practical uses of a heloc is for home. The median price of a u.s.What is Home Equity? Reverse Mortgage

What Is Home Equity and How to Calculate Yours? Oberer Homes

How To Use Home Equity To Build Wealth 7 Ways You Can Do It

How To Use Home Equity To Build Wealth 7 Ways You Can Do It

How to use home equity to build wealth? YouTube

How To Use Home Equity To Build Wealth 7 Ways You Can Do It

How To Use Home Equity To Build Wealth? in 2023

Home Equity What Is It and How Can You Use It?

How to Use Home Equity to Build Wealth Private Wealth Academy Blog

How to Use Home Equity to Build Wealth? in 2022 Wealth building, Home

Tapping Into Your Home Equity Using A Heloc Is One Way To Potentially Build Wealth, Especially Because Rates Tend To Be Low When Compared To Other Forms Of Borrowing.

You Could Also Use Funds From A Heloc To Cover Other Home Improvements And Repairs.

Building Home Equity Is Important.

That’s Because You Get To Pocket The Value Of Your Equity When You Sell Your Home.

Related Post: