Hvac Depreciation For Commercial Building

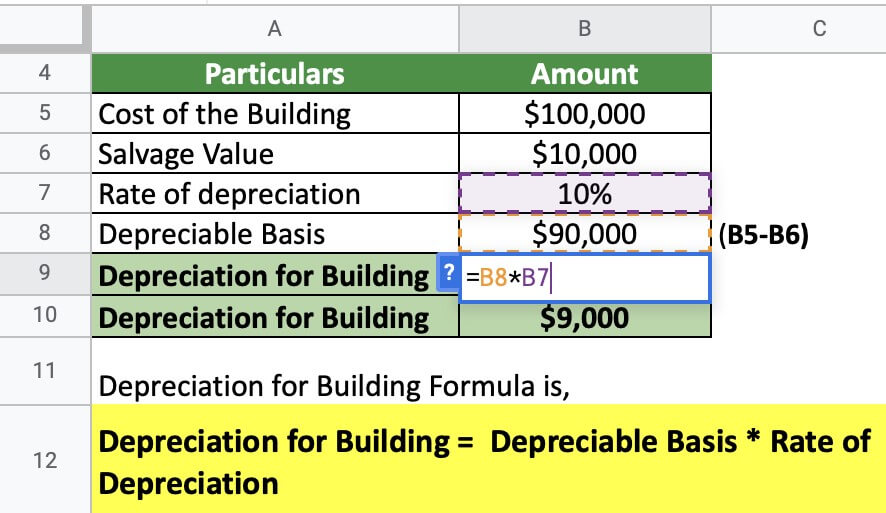

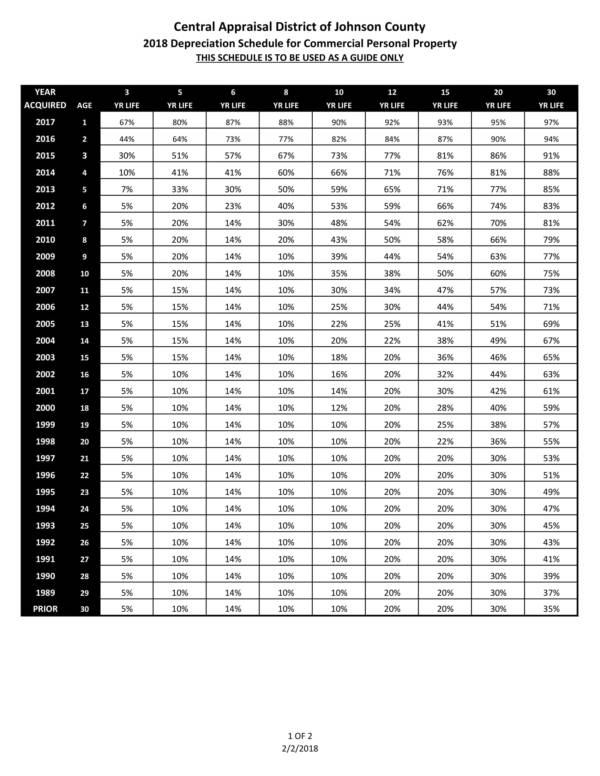

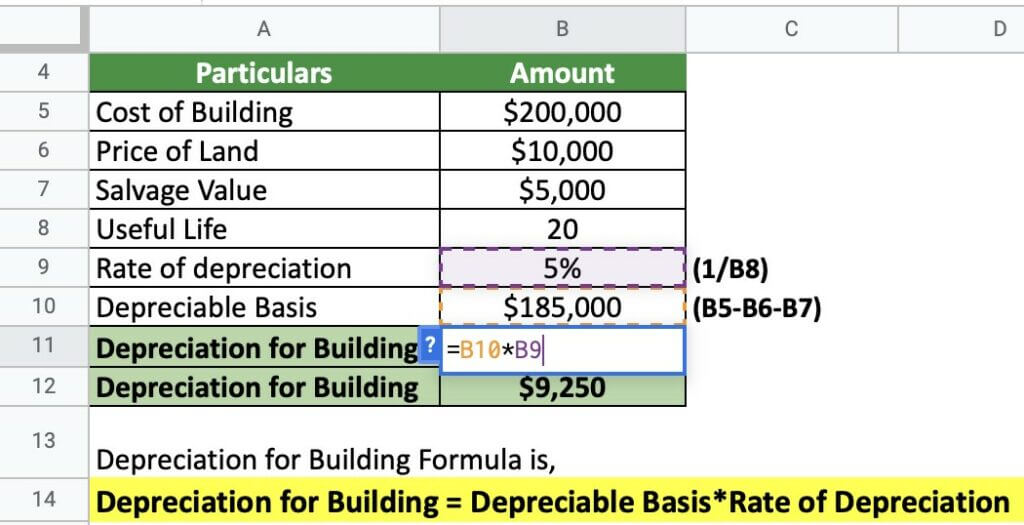

Hvac Depreciation For Commercial Building - The firm is then permitted to receive revenue each year equal to: Find out about how to. Heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or lease real estate. Hvac products to be immediately expensed. In the past, major improvements such. Understanding depreciation in rental property. In 2021, businesses can deduct the full price of qualified hvac equipment purchases, up to $1,050,000. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Hvac systems in commercial properties typically have a depreciable life of 39 years under the modified accelerated cost recovery system (macrs),. Ive got a client replacing the roof and hvac ducting. Simultaneously, the annual depreciation of the firm’s assets is subtracted from the rab. Hvac can be depreciated in tax codes, allowing businesses to recover costs over time instead of all at once. If they are stand alone units, more like window ac units (i.e. Heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or lease real estate. As for depreciation, if they are part of the central hvac system you have to depreciate them over 27.5 years. Depreciation provides financial benefits and incentives for investing. Find out about how to. Understand hvac depreciation & get an assessment of your existing commercial system with recommendations for upgrades and replacements. While the roof structure is typically. There's a total equipment purchase limit of $2,620,000. Simultaneously, the annual depreciation of the firm’s assets is subtracted from the rab. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. The 2020 extension of the section 179 tax deduction in the 2017 tcja means that businesses can take a 100% deduction for up to $1,040,000 million in qualifying. There's a total equipment purchase. There's a total equipment purchase limit of $2,620,000. Hvac products to be immediately expensed. In 2021, businesses can deduct the full price of qualified hvac equipment purchases, up to $1,050,000. For buildings, the standard depreciation rate is 10% for commercial and industrial buildings, while residential properties often have a lower rate. The 2020 extension of the section 179 tax deduction. Hvac can be depreciated in tax codes, allowing businesses to recover costs over time instead of all at once. The 2020 extension of the section 179 tax deduction in the 2017 tcja means that businesses can take a 100% deduction for up to $1,040,000 million in qualifying. Understand the factors influencing the depreciation life of commercial roofs and explore methods. In the past, major improvements such. If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? For buildings, the standard depreciation rate is 10% for commercial and industrial buildings, while residential properties often have a lower rate. There’s a total equipment purchase limit of $2,700,000.. Hvac products to be immediately expensed. Understanding the depreciation life of hvac systems is essential for businesses and property owners aiming to optimize tax benefits and manage financial planning. In 2022, businesses can deduct the full price of qualified hvac equipment purchases, up to $1,160,000. Find out about how to. Heating, ventilation, and air conditioning (“hvac”) replacement costs can be. Depreciation provides financial benefits and incentives for investing. Simultaneously, the annual depreciation of the firm’s assets is subtracted from the rab. Understanding the depreciation life of hvac systems is essential for businesses and property owners aiming to optimize tax benefits and manage financial planning. In general, real property and improvements to real property are depreciated over either 27.5 years (residential. Now, for purchases of new and used hvac equipment up to $2.5 million, equipment costs can be immediately deducted as a business expense, with a deduction limit. Understand hvac depreciation & get an assessment of your existing commercial system with recommendations for upgrades and replacements. Ive got a client replacing the roof and hvac ducting. There’s a total equipment purchase. In the past, major improvements such. Understanding depreciation in rental property. Depreciation provides financial benefits and incentives for investing. Understand hvac depreciation & get an assessment of your existing commercial system with recommendations for upgrades and replacements. This guide is intended to. For buildings, the standard depreciation rate is 10% for commercial and industrial buildings, while residential properties often have a lower rate. Understand hvac depreciation & get an assessment of your existing commercial system with recommendations for upgrades and replacements. In the past, major improvements such. In 2021, businesses can deduct the full price of qualified hvac equipment purchases, up to. If they are stand alone units, more like window ac units (i.e. Understanding the depreciation life of hvac systems is essential for businesses and property owners aiming to optimize tax benefits and manage financial planning. In 2022, businesses can deduct the full price of qualified hvac equipment purchases, up to $1,160,000. Find out about how to. This guide is intended. In 2022, businesses can deduct the full price of qualified hvac equipment purchases, up to $1,160,000. Hvac systems in commercial properties typically have a depreciable life of 39 years under the modified accelerated cost recovery system (macrs),. Simultaneously, the annual depreciation of the firm’s assets is subtracted from the rab. For buildings, the standard depreciation rate is 10% for commercial and industrial buildings, while residential properties often have a lower rate. While the roof structure is typically. In the past, major improvements such. Heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or lease real estate. Depreciation provides financial benefits and incentives for investing. Now, for purchases of new and used hvac equipment up to $2.5 million, equipment costs can be immediately deducted as a business expense, with a deduction limit. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Understanding depreciation in rental property. Hvac products to be immediately expensed. In 2021, businesses can deduct the full price of qualified hvac equipment purchases, up to $1,050,000. The firm is then permitted to receive revenue each year equal to: If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? There's a total equipment purchase limit of $2,620,000.Depreciation for Building Definition, Formula, and Excel Examples

Commercial building amortization schedule VickiiJohnnie

How Many Years Does Hvac Depreciation at Leonard Oconnell blog

Depreciation for Building Definition, Formula, and Excel Examples

How Many Years Does Hvac Depreciation at Leonard Oconnell blog

HVAC Taxes Commercial Air Conditioner Depreciation

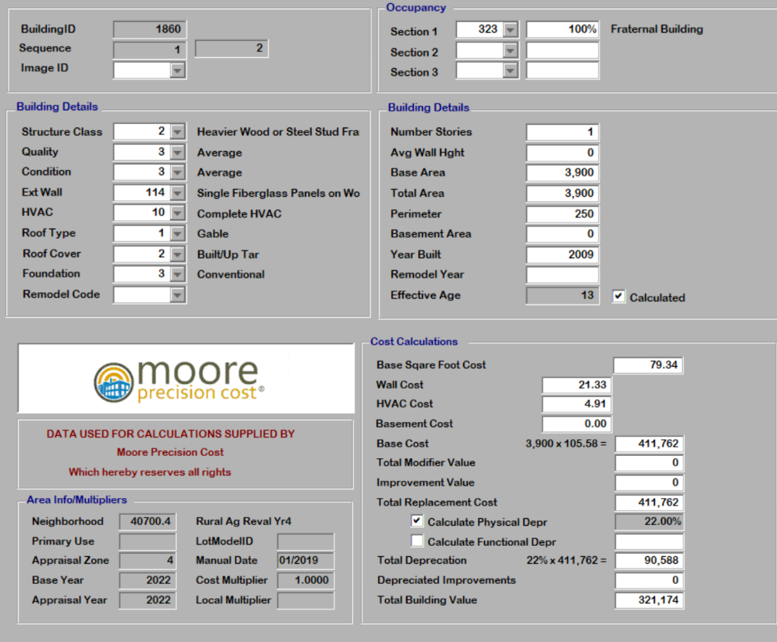

Commercial Building Depreciation Commercial Appraisal File 1

How to Depreciate HVAC in Commercial Rental Real Estate

How Long Do You Depreciate An Air Conditioner In A Rental at Claire

HVAC Depreciation Life Guide to Expensing HVAC Costs Anderson Air

There’s A Total Equipment Purchase Limit Of $2,700,000.

Hvac Can Be Depreciated In Tax Codes, Allowing Businesses To Recover Costs Over Time Instead Of All At Once.

In General, Real Property And Improvements To Real Property Are Depreciated Over Either 27.5 Years (Residential Property) Or 39 Years (Commercial Property).

If They Are Stand Alone Units, More Like Window Ac Units (I.e.

Related Post: