Idaho Permanent Building Fund Tax

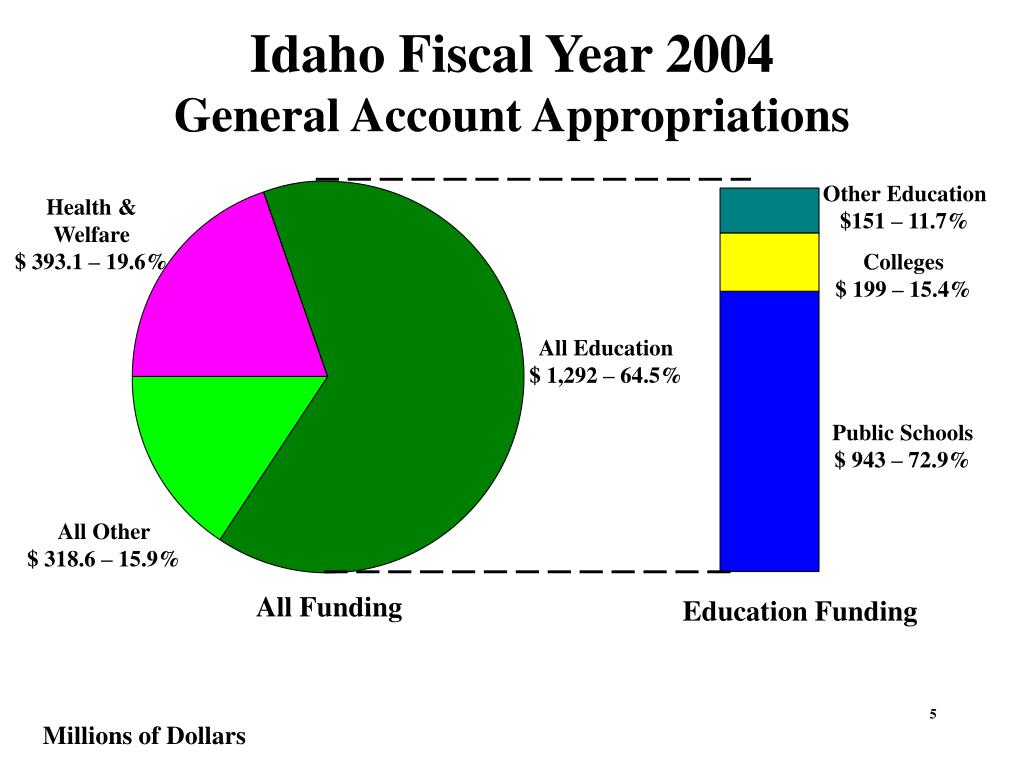

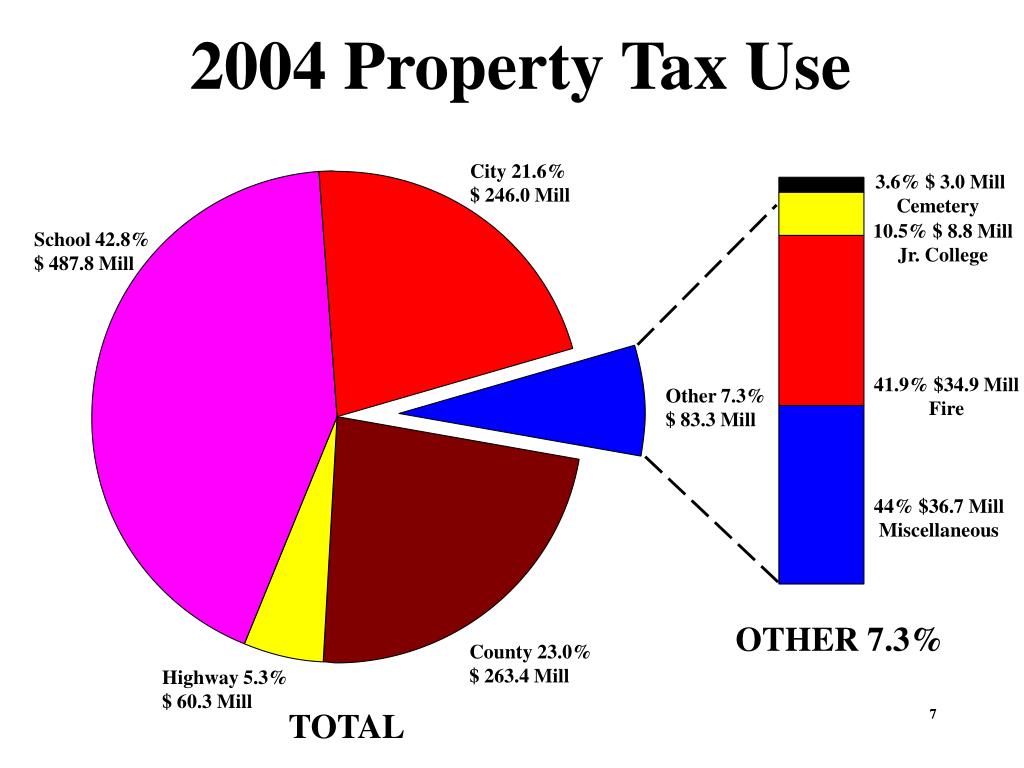

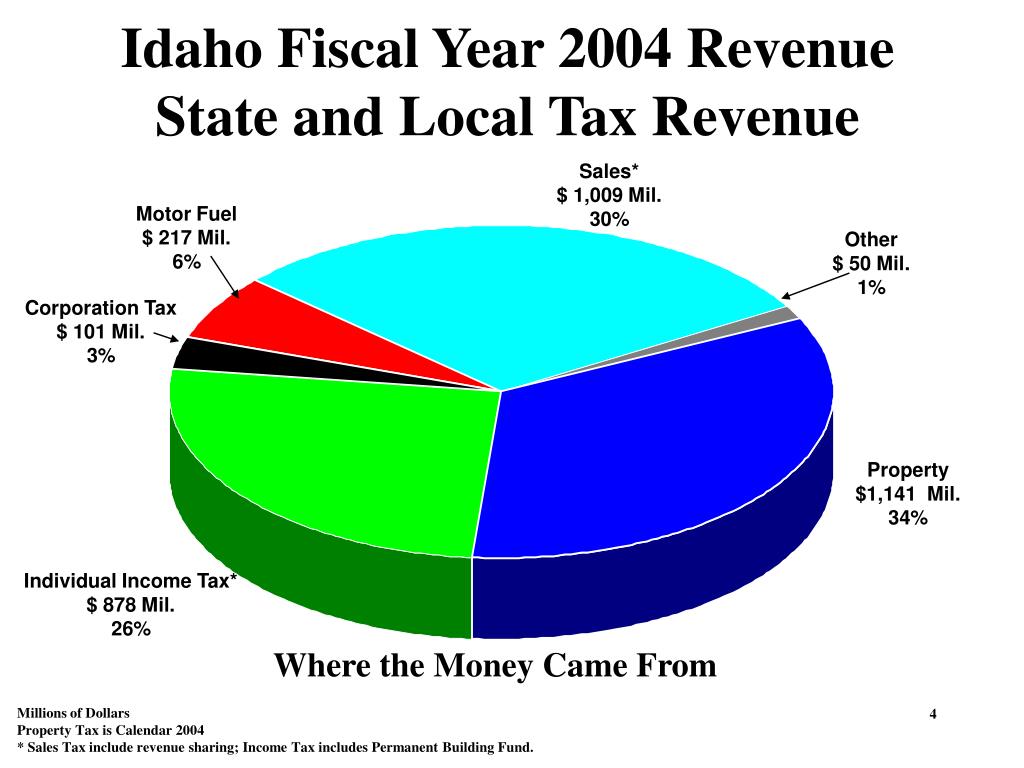

Idaho Permanent Building Fund Tax - The permanent building fund (pbf) tax in idaho is a fixed $10 charge applicable to various business entities, including c corporations, s. Every person and corporation required to file a tax return a return pays a tax of ten dollars. The state of idaho has a flat corporate income tax of 5.8% on c corporations. The permanent building fund advisory council was established in 1961 when an ongoing revenue source was created. Idaho’s budget is the state’s nancial blueprint for the money it will spend on its many and varied programs. C corporations must pay the $10 tax. Its five (5) members are appointed by the governor with. Use direct file to file your income taxes for free if you qualify. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income attributable to idaho and. Permanent building fund (pbf) tax: The permanent building fund advisory council requests the following from the permanent building fund: The state of idaho has a flat corporate income tax of 5.8% on c corporations. Its five (5) members are appointed by the governor with. C corporations must pay the $10 tax. Construction of improvement upon approval. Permanent building fund (pbf) tax: Add the $10 permanent building fund tax to the estimated income tax, and subtract the amount estimated for income tax credits. The state tax commission of the state of idaho is hereby directed to deposit ten dollars. Use direct file to file your income taxes for free if you qualify. Additional tax on filing income tax credited to permanent building fund. Additional tax on filing income tax credited to permanent building fund. C corporations must pay the $10 tax. The permanent building fund (pbf) tax in idaho is a fixed $10 charge applicable to various business entities, including c corporations, s. You are required to pay the idaho permanent building fund tax per idaho tax law. Construction of improvement upon approval. You are required to pay the idaho permanent building fund tax per idaho tax law. Permanent building fund (pbf) tax: The state of idaho has a flat corporate income tax of 5.8% on c corporations. Use direct file to file your income taxes for free if you qualify. Additional tax on filing income tax credited to permanent building fund. Permanent building fund (pbf) tax: Every person and corporation required to file a tax return a return pays a tax of ten dollars. Add the $10 permanent building fund tax to the estimated income tax, and subtract the amount estimated for income tax credits. The permanent building fund advisory council was established in 1961 when an ongoing revenue source was. Authority of legislature to make grants from permanent building fund to junior college districts. Idaho’s budget is the state’s nancial blueprint for the money it will spend on its many and varied programs. The permanent building fund (pbf) tax in idaho is a fixed $10 charge applicable to various business entities, including c corporations, s. Every person and corporation required. Permanent building fund (pbf) tax: $14,295,200 for statewide building alteration and repair projects, $800,000 for. Unitary group of corporations must pay $10 for each corporation required to file in idaho, whether the corporations file individually or the unitary. E911 prepaid wireless service fee; Idaho’s budget is the state’s nancial blueprint for the money it will spend on its many and. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income attributable to idaho and. Authority of legislature to make grants from permanent building fund to junior college districts. Idaho’s budget is the state’s nancial blueprint for the money it will spend on its many. The permanent building fund advisory council requests the following from the permanent building fund: Most businesses must pay the $10 pbf tax. The state tax commission of the state of idaho is hereby directed to deposit ten dollars. It is primarily focused on state programs and spending, but it does. Construction of improvement upon approval. Construction of improvement upon approval. E911 prepaid wireless service fee; Permanent building fund (pbf) tax: Idaho’s budget is the state’s nancial blueprint for the money it will spend on its many and varied programs. C corporations must pay the $10 tax. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income attributable to idaho and. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income. $14,295,200 for statewide building. Prior to joining the department, she served at the idaho state tax commission for 14 years. You are required to pay the idaho permanent building fund tax per idaho tax law. The permanent building fund (pbf) tax in idaho is a fixed $10 charge applicable to various business entities, including c corporations, s. $14,295,200 for statewide building alteration and repair. The permanent building fund (pbf) tax in idaho is a fixed $10 charge applicable to various business entities, including c corporations, s. Unitary group of corporations must pay $10 for each corporation required to file in idaho, whether the corporations file individually or the unitary. Additional tax on filing income tax credited to permanent building fund. $14,295,200 for statewide building alteration and repair projects, $800,000 for. It is primarily focused on state programs and spending, but it does. Additional tax on filing income tax credited to permanent building fund. Prior to joining the department, she served at the idaho state tax commission for 14 years. The state tax commission of the state of idaho is hereby directed to deposit ten dollars. The permanent building fund advisory council was established in 1961 when an ongoing revenue source was created. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income. Construction of improvement upon approval. Most businesses must pay the $10 pbf tax. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income attributable to idaho and. Add the $10 permanent building fund tax to the estimated income tax, and subtract the amount estimated for income tax credits. E911 prepaid wireless service fee; The state of idaho has a flat corporate income tax of 5.8% on c corporations.PPT University of Idaho PowerPoint Presentation, free download ID

PPT Idaho Property Taxes and the Idaho Tax Structure PowerPoint

University of Idaho Permanent Building Fund & the Annual Capital Budget

PPT Idaho Property Taxes and the Idaho Tax Structure PowerPoint

Nikole Heinz

PPT Idaho Property Taxes and the Idaho Tax Structure PowerPoint

PPT Idaho Property Taxes and the Idaho Tax Structure PowerPoint

Idaho Permanent Building Fund Tax Fill Online, Printable, Fillable

University of Idaho Permanent Building Fund & the Annual Capital Budget

PPT University of Idaho PowerPoint Presentation, free download ID

Idaho’s Budget Is The State’s Nancial Blueprint For The Money It Will Spend On Its Many And Varied Programs.

C Corporations Must Pay The $10 Tax.

Permanent Building Fund (Pbf) Tax:

The Permanent Building Fund Advisory Council Requests The Following From The Permanent Building Fund:

Related Post: