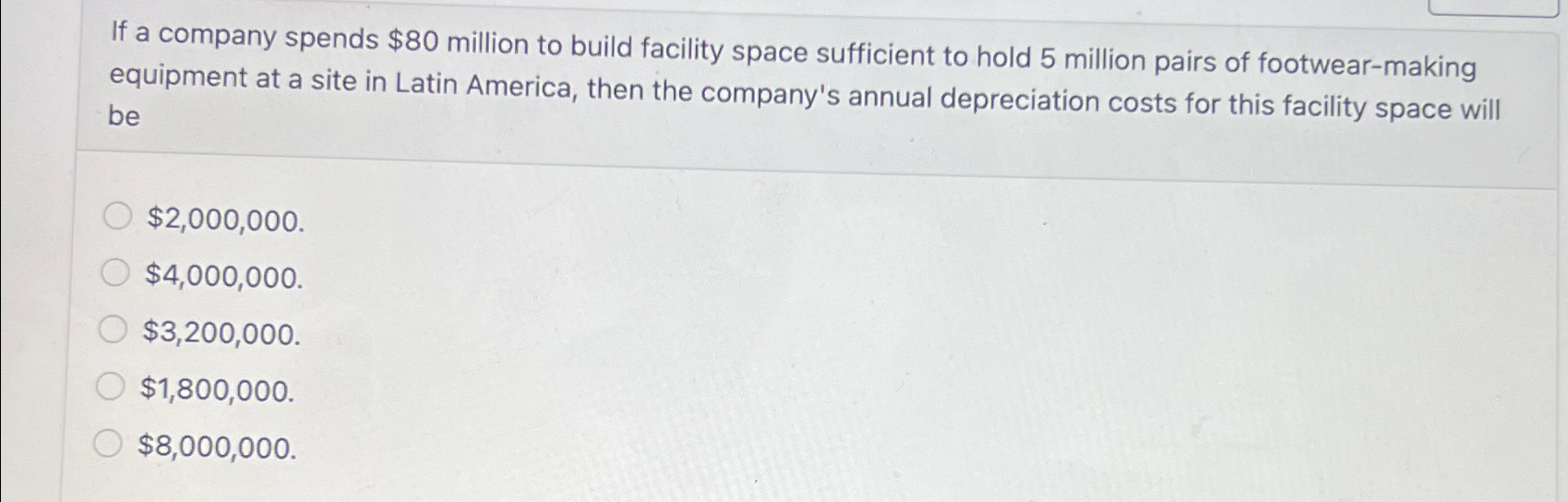

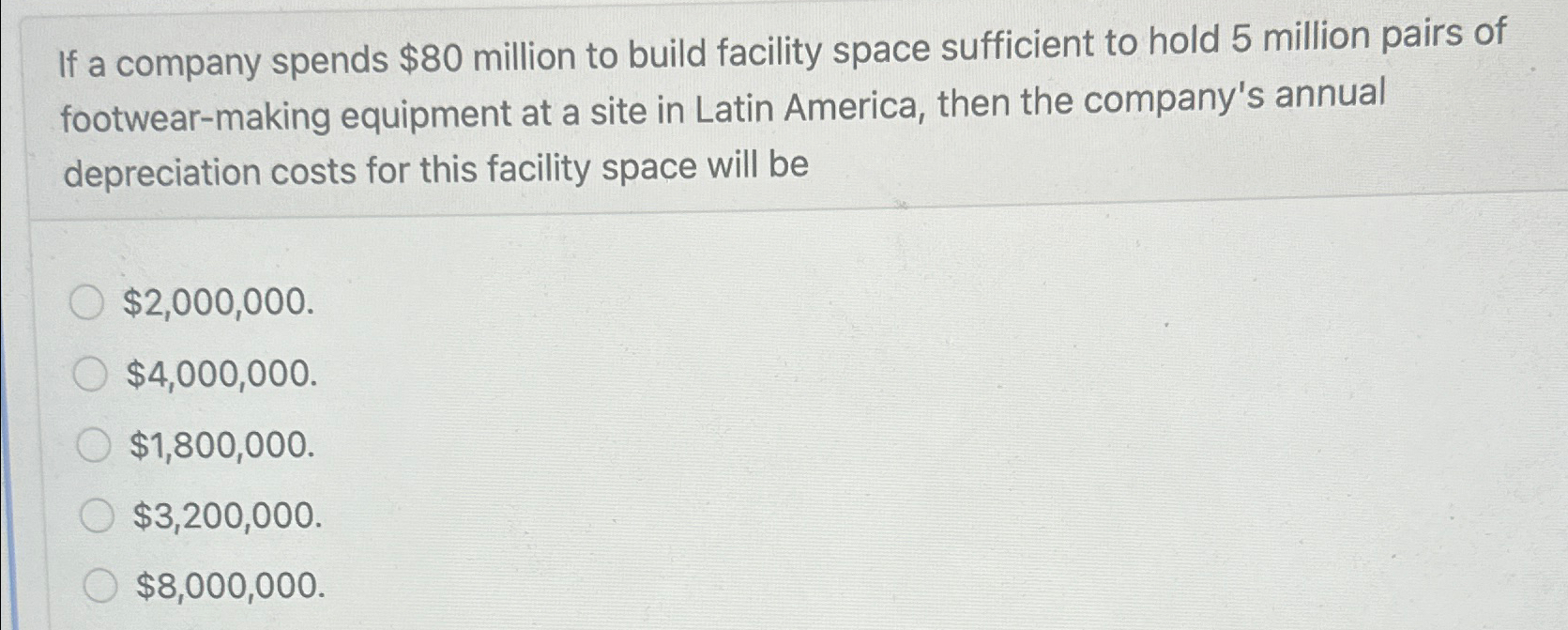

If A Company Spends 80 Million To Build Facility Space

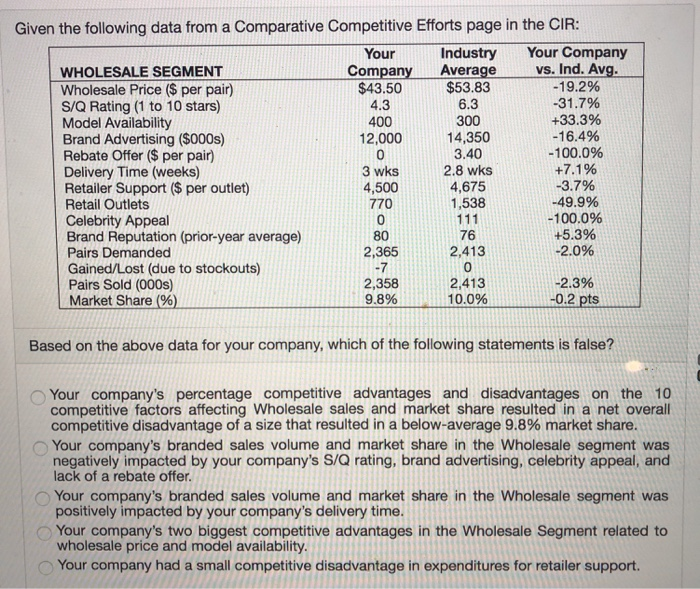

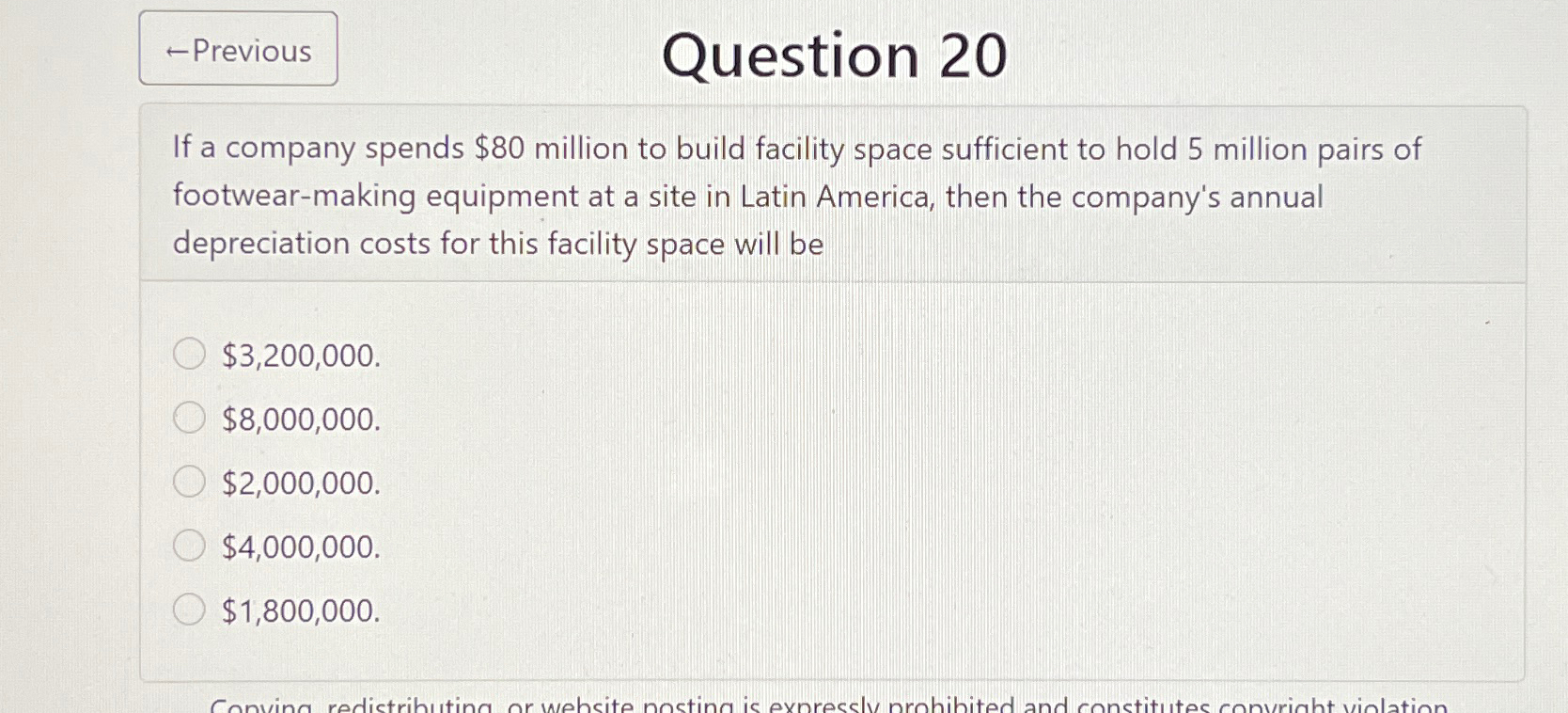

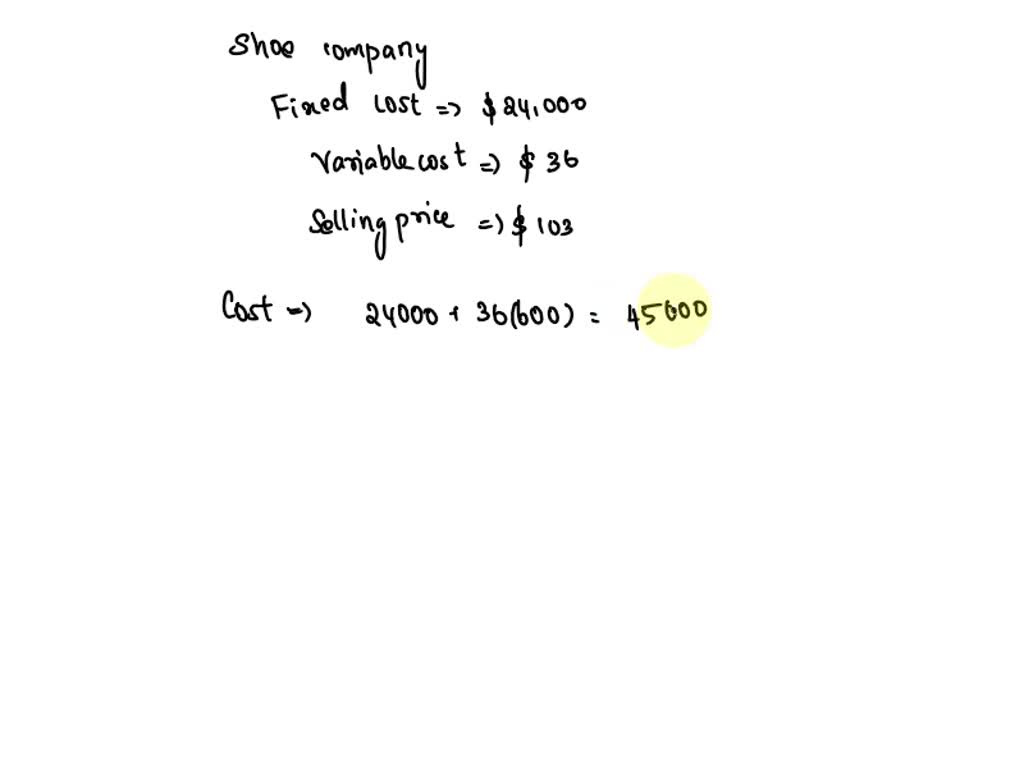

If A Company Spends 80 Million To Build Facility Space - It reflects the decline in value of an asset due to wear and tear, obsolescence, or other factors. This method is one of the simplest ways to determine how. To find the annual depreciation cost, calculate 10% of the initial cost of the asset, which is $80,000,000. Here’s the best way to solve it. Annual depreciation costs = depreciation rate × cost of building = 10% × $80,000,000 =. From the question given, the cost of the building facility is $80 million. The annual depreciation cost is the yearly. First, identify the given cost of building the facility space and the default depreciation rate. There are 2 steps to solve this one. From the question given, the cost of the building facility is $80 million. Also, it should be noted that the default rate for depreciation is given as 10%, therefore, the company's annual depreciation. To find the annual depreciation cost, calculate 10% of the initial cost of the asset, which is $80,000,000. Here’s the best way to solve it. From the question given, the cost of the building facility is $80 million. Annual depreciation costs = depreciation rate × cost of building = 10% × $80,000,000 =. It reflects the decline in value of an asset due to wear and tear, obsolescence, or other factors. There are 2 steps to solve this one. This method is one of the simplest ways to determine how. As a result, the company will incur the following annual depreciation costs for this facility space: The amount of money spent on building the. The depreciation cost is the amount of money that the company spends to depreciate, or write down, the value of the facility space over time. Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. If we assume a standard depreciation rate of 10% per year, we can calculate the annual. Here’s the best. The question states that the company spent $80 million to build the facility. Given, cost of building facility space = $80 million depreciation rate by default = 10%. The depreciation cost is the amount of money that the company spends to depreciate, or write down, the value of the facility space over time. Here’s the best way to solve it.. The annual depreciation cost is the yearly. Annual depreciation costs = depreciation rate × cost of building = 10% × $80,000,000 =. The question states that the company spent $80 million to build the facility. Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. This method is one of the simplest ways to. The depreciation cost is calculated as the total. Here’s the best way to solve it. If we assume a standard depreciation rate of 10% per year, we can calculate the annual. From the question given, the cost of the building facility is $80 million. Annual depreciation costs = depreciation rate × cost of building = 10% × $80,000,000 =. Also, it should be noted that the default rate for depreciation is given as 10%, therefore, the company's annual depreciation. Here’s the best way to solve it. As a result, the company will incur the following annual depreciation costs for this facility space: Given, cost of building facility space = $80 million depreciation rate by default = 10%. This method. The question states that the company spent $80 million to build the facility. If we assume a standard depreciation rate of 10% per year, we can calculate the annual. The depreciation cost is the amount of money that the company spends to depreciate, or write down, the value of the facility space over time. It reflects the decline in value. From the question given, the cost of the building facility is $80 million. To find the annual depreciation cost, calculate 10% of the initial cost of the asset, which is $80,000,000. Here’s the best way to solve it. Annual depreciation costs = depreciation rate × cost of building = 10% × $80,000,000 =. There are 2 steps to solve this. There are 2 steps to solve this one. From the question given, the cost of the building facility is $80 million. To find the annual depreciation cost, calculate 10% of the initial cost of the asset, which is $80,000,000. There are 2 steps to solve this one. Given, cost of building facility space = $80 million depreciation rate by default. If a company spends $80 million to build facility space sufficient to hold 5 million pairs of footwear making equipment at a site in latin america, then the company's annual. From the question given, the cost of the building facility is $80 million. Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. If. The annual depreciation cost is the yearly. Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. The depreciation cost is the amount of money that the company spends to depreciate, or write down, the value of the facility space over time. From the question given, the cost of the building facility is $80. Also, it should be noted that the default rate for depreciation is given as 10%, therefore, the company's annual depreciation. As a result, the company will incur the following annual depreciation costs for this facility space: It reflects the decline in value of an asset due to wear and tear, obsolescence, or other factors. The annual depreciation cost is the yearly. First, identify the given cost of building the facility space and the default depreciation rate. If we assume a standard depreciation rate of 10% per year, we can calculate the annual. This method is one of the simplest ways to determine how. The depreciation cost is the amount of money that the company spends to depreciate, or write down, the value of the facility space over time. From the question given, the cost of the building facility is $80 million. There are 2 steps to solve this one. Also, it should be noted that the default rate for depreciation is given as 10%, therefore, the company's annual depreciation. To find the annual depreciation cost, calculate 10% of the initial cost of the asset, which is $80,000,000. From the question given, the cost of the building facility is $80 million. Annual depreciation costs = depreciation rate × cost of building = 10% × $80,000,000 =. If a company spends $80 million to build facility space sufficient to hold 5 million pairs of footwear making equipment at a site in latin america, then the company's annual depreciation costs for this facility space will e. If a company spends $80 million to build facility space sufficient to hold 5 million pairs of footwear making equipment at a site in latin america, then the company's annual.Solved If a company spends 80

SpaceX Mission

Solved If a company spends 80 million to build facility

Solved If a company spends 80 million to build facility

Solved If a company spends 80

Solved If a company spends 80 million to build facility

If a company spends 80 million to build facility space sufficient to

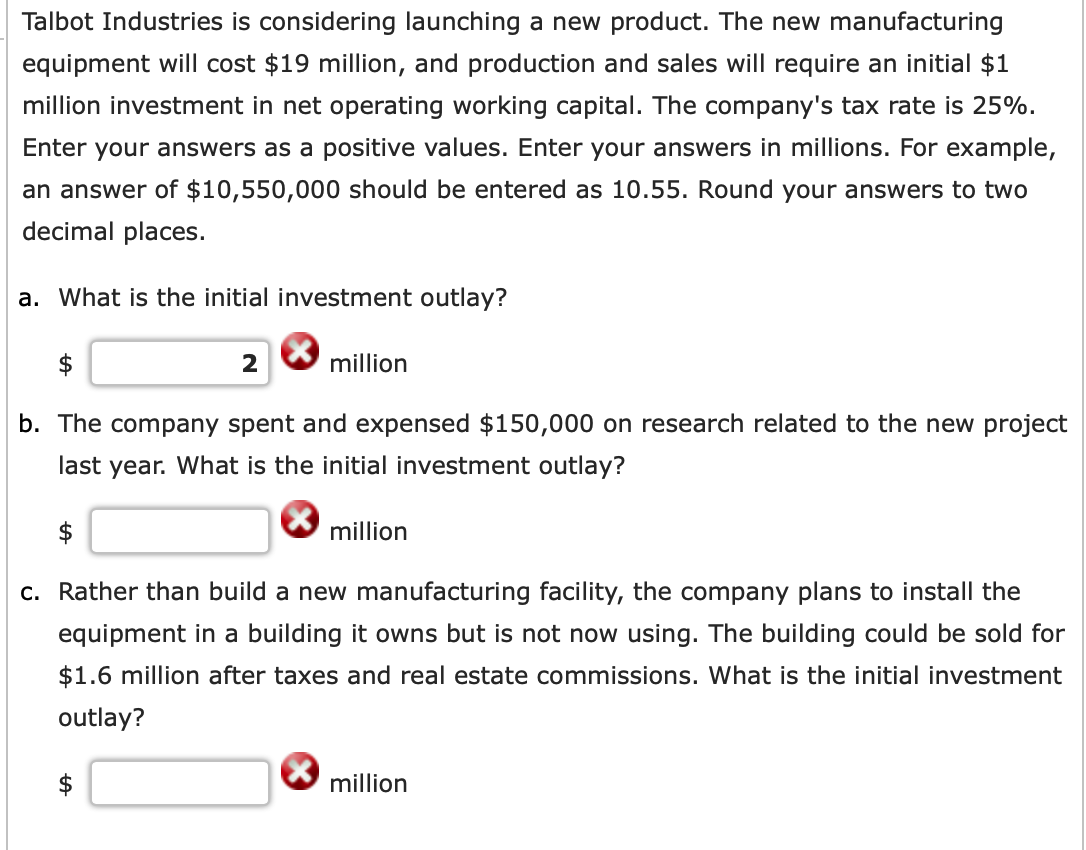

Solved Talbot Industries is considering launching a new

Solved Question 20If a company spends 80 million to build

SOLVED If a company spends 28.8 million to install refurbished

Depreciation Is The Systematic Allocation Of The Cost Of A Tangible Asset Over Its Useful Life.

The Amount Of Money Spent On Building The.

There Are 2 Steps To Solve This One.

Here’s The Best Way To Solve It.

Related Post: