Is Building Owner Responsible For Sales Tax In Kansas

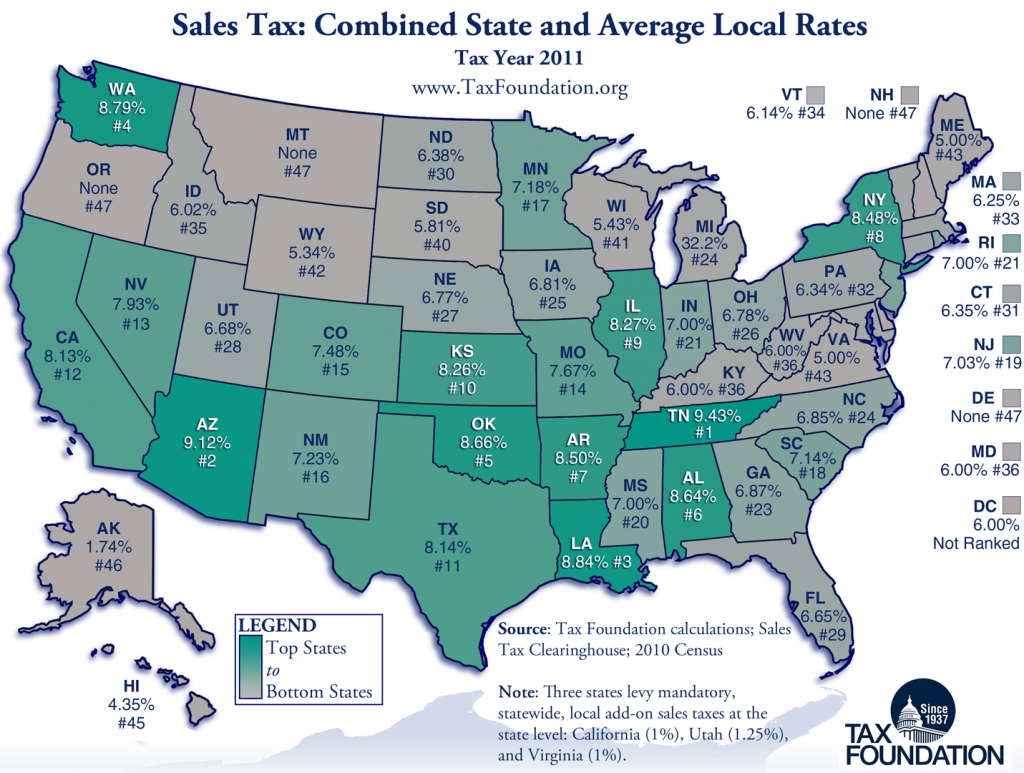

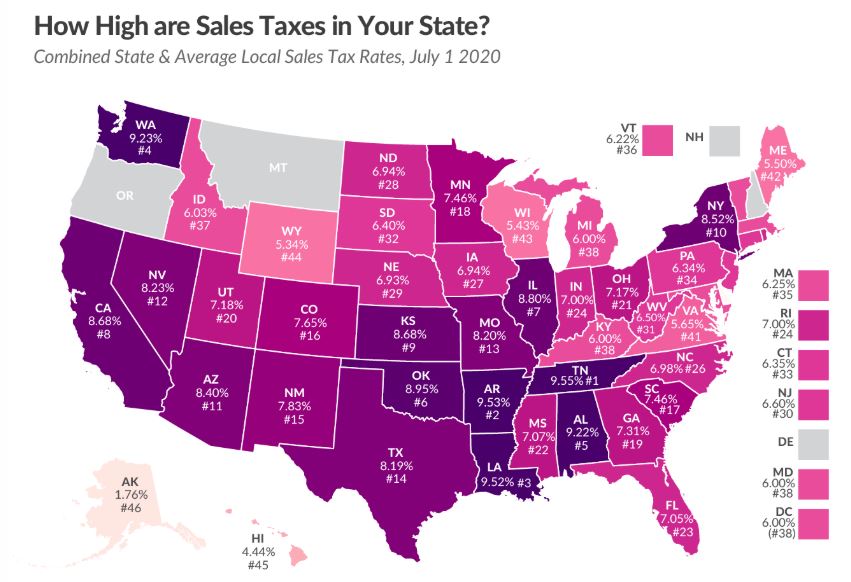

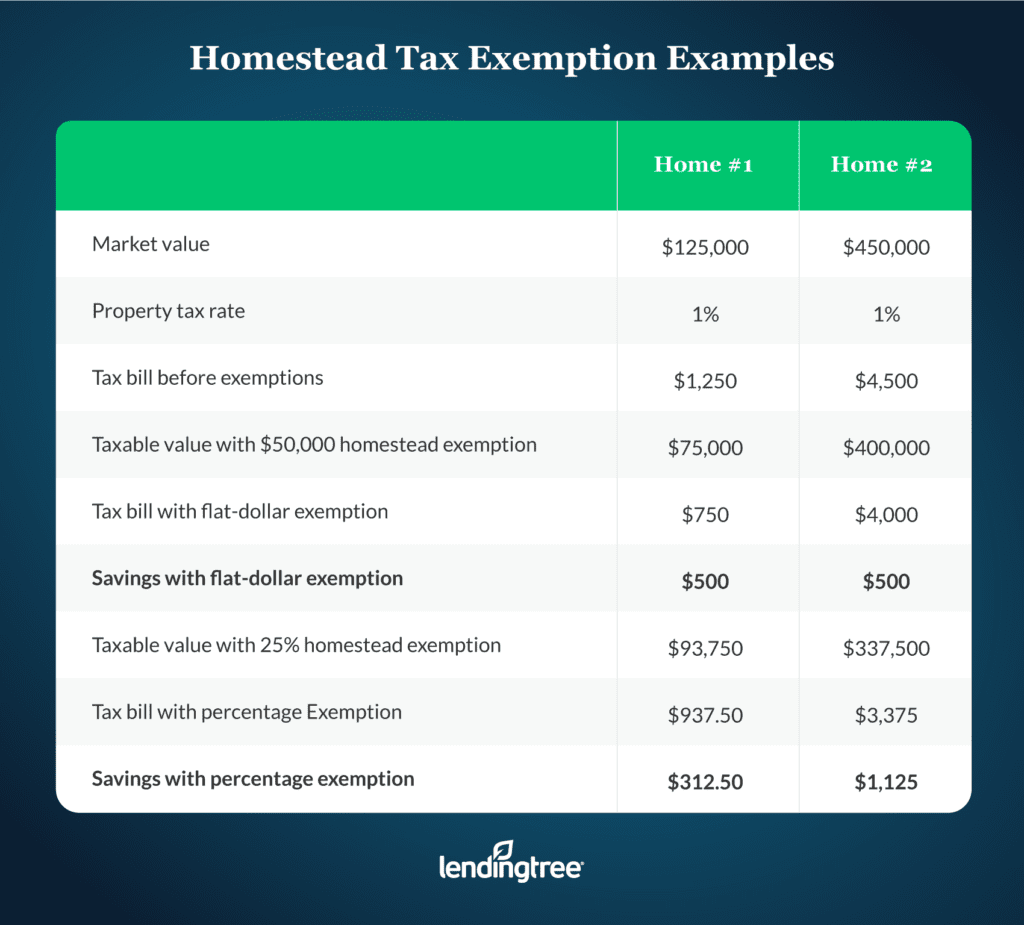

Is Building Owner Responsible For Sales Tax In Kansas - A library of current policy information is also available on the kansas department off revenue’s website during: A contractor in olathe, ks will pay sales tax on building materials purchased. Kansas is one of 45 states plus the district of columbia* that levy a sales and the companion compensating use tax. There are a total of 533 local tax jurisdictions across the state, collecting an. Retail sale, rental or lease of tangible personal. Sales (retailers) kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local taxes on the: Construction services performed on a warehouse to alter its use were subject to tax, according to a letter ruling released by the kansas department of revenue. The process of property valuation is. Ksrevenue.gov sales and use tax on building construction pdf printable. Kansas sales or compensating use tax applies to those purchases identified or designated as taxable in the chart below. Kansas is one of 45 states plus the district of columbia* that levy a sales and the companion compensating use tax. Therefore, the labor fee contractors and subcontractors charge to install or apply the materials is subject to sales tax. (a) sales of building material or other property to contractors, subcontractors or repairmen for use by them in building, constructing, erecting, equipping, furnishing, repairing, servicing, altering,. Yielding higher sales prices for incumbent. Sales (retailers) kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local taxes on the: Kansas sales or compensating use tax applies to those purchases identified or designated as taxable in the chart below. Kansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4%. A library of current policy information is also available on the kansas department off revenue’s website during: In kansas, property owners are subject to property taxes, which are calculated based on the assessed value of their real estate holdings. A kansas retailer is responsible for collecting sales tax from its customers on taxable transactions. Ksrevenue.gov sales and use tax on building construction pdf printable. (a) sales of building material or other property to contractors, subcontractors or repairmen for use by them in building, constructing, erecting, equipping, furnishing, repairing, servicing, altering,. Sales tax is due at the time of purchase even when the materials are used on a project in another state. Kansas has state. There are a total of 533 local tax jurisdictions across the state, collecting an. Yielding higher sales prices for incumbent. Therefore, the labor fee contractors and subcontractors charge to install or apply the materials is subject to sales tax. Yes, the building owner is responsible for paying sales tax in kansas. Ksrevenue.gov sales and use tax on building construction pdf. Kansas is one of 45 states plus the district of columbia* that levy a sales and the companion compensating use tax. Sales tax is due at the time of purchase even when the materials are used on a project in another state. Yielding higher sales prices for incumbent. The applicable kansas sales or kansas consumers’ use tax must. To determine. In kansas, property owners are subject to property taxes, which are calculated based on the assessed value of their real estate holdings. Retail sale, rental or lease of tangible personal. Taxes must be collected and remitted to. Sales tax is due at the time of purchase even when the materials are used on a project in another state. There are. There are a total of 533 local tax jurisdictions across the state, collecting an. Ksrevenue.gov sales and use tax on building construction pdf printable. Sales tax should be paid to the vendor or accrued and paid directly to the state of kansas. Yielding higher sales prices for incumbent. Taxes must be collected and remitted to. The following described property, to the extent herein specified, shall be and is hereby exempt from all property or ad valorem taxes levied under the laws of the state of kansas: Yes, a building owner in kansas is responsible for sales tax if they engage in taxable activities like renting space or selling goods. Sales (retailers) kansas imposes a 6.5. There are a total of 533 local tax jurisdictions across the state, collecting an. A contractor in olathe, ks will pay sales tax on building materials purchased. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). Yes, a building owner in kansas is responsible for sales tax if they engage in. Retail sale, rental or lease of tangible personal. Ksrevenue.gov sales and use tax on building construction pdf printable. (a) sales of building material or other property to contractors, subcontractors or repairmen for use by them in building, constructing, erecting, equipping, furnishing, repairing, servicing, altering,. Sales (retailers) kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax,. The process of property valuation is. Sales tax should be paid to the vendor or accrued and paid directly to the state of kansas. Kansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4%. Yes, the building owner is responsible for paying sales tax in kansas. There are. The kansas department of revenue has explained how to apply retailers' sales and use tax to the construction, remodeling, and repair industries and provided information on. Kansas sales or compensating use tax applies to those purchases identified or designated as taxable in the chart below. Kansas has state sales tax of 6.5%, and allows local governments to collect a local. In collecting sales tax, you are acting as an agent or partner Construction services performed on a warehouse to alter its use were subject to tax, according to a letter ruling released by the kansas department of revenue. A contractor in olathe, ks will pay sales tax on building materials purchased. Sales tax should be paid to the vendor or accrued and paid directly to the state of kansas. Yielding higher sales prices for incumbent. There are a total of 533 local tax jurisdictions across the state, collecting an. Ksrevenue.gov sales and use tax on building construction pdf printable. Yes, a building owner in kansas is responsible for sales tax if they engage in taxable activities like renting space or selling goods. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). The kansas retailers’ sales tax was enacted in. We’ll explore these in more detail below. Kansas is one of 45 states plus the district of columbia* that levy a sales and the companion compensating use tax. Kansas sales or compensating use tax applies to those purchases identified or designated as taxable in the chart below. The applicable kansas sales or kansas consumers’ use tax must. In kansas, property owners are subject to property taxes, which are calculated based on the assessed value of their real estate holdings. A kansas retailer is responsible for collecting sales tax from its customers on taxable transactions.Kansas Sales Tax Guide for Businesses Polston Tax

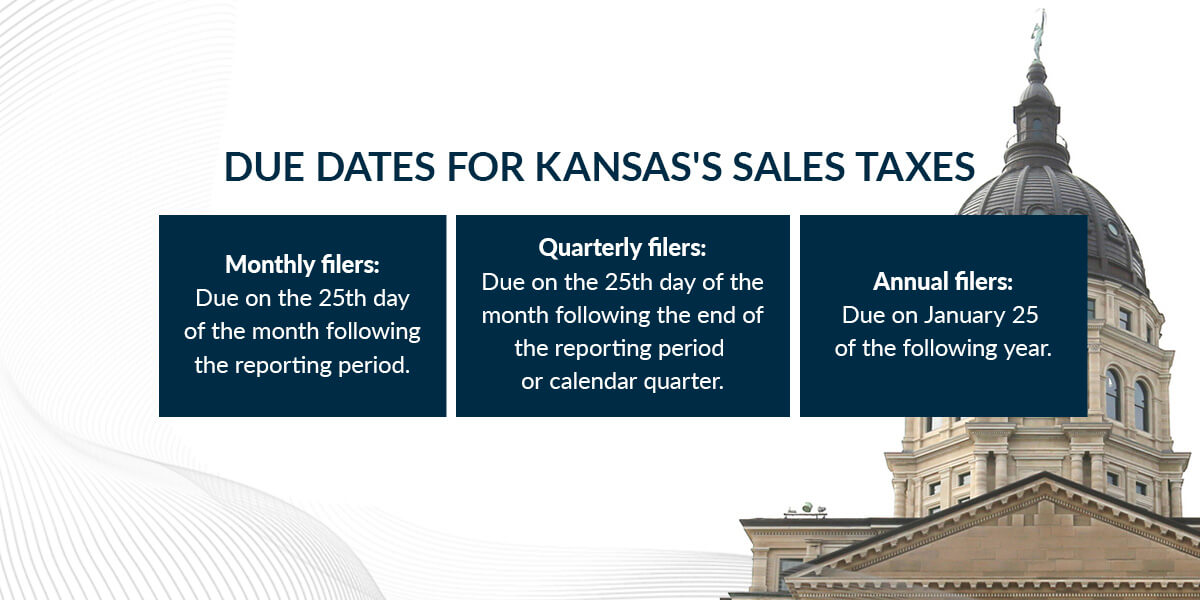

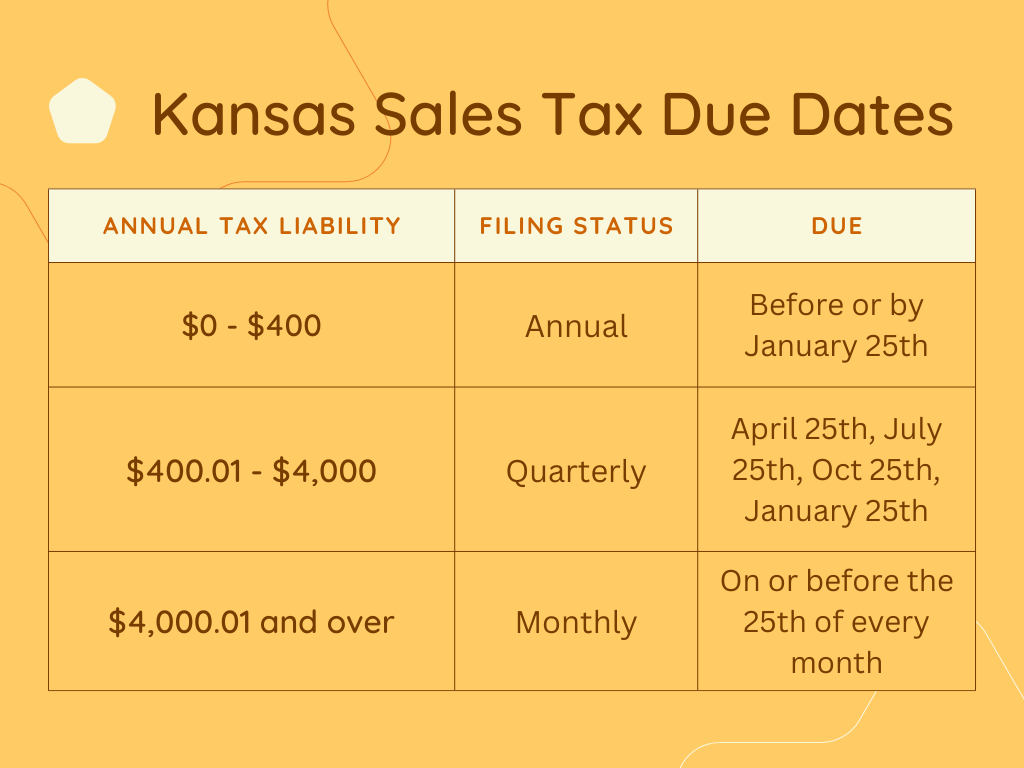

Sales Tax In Kansas State Of Kansas Sales Tax Filing

Kansas Sales Tax Guide for Businesses Polston Tax

Kansas 2023 Sales Tax Guide

Carriage House Plans Kansas Sales Tax

sales taxes Archives The Sentinel

Ultimate Kansas Sales Tax Guide Zamp

Sales Tax Exemptions In Kansas

Kansas Sales Tax Guide for Businesses

Kansas Sales Tax Guide for Businesses Polston Tax

Retail Sale, Rental Or Lease Of Tangible Personal.

The Process Of Property Valuation Is.

However, There Are Some Exceptions And Nuances To Consider.

The Following Described Property, To The Extent Herein Specified, Shall Be And Is Hereby Exempt From All Property Or Ad Valorem Taxes Levied Under The Laws Of The State Of Kansas:

Related Post: