Is Building Owner Responsible If Business Doesnt Pay Sales Tax

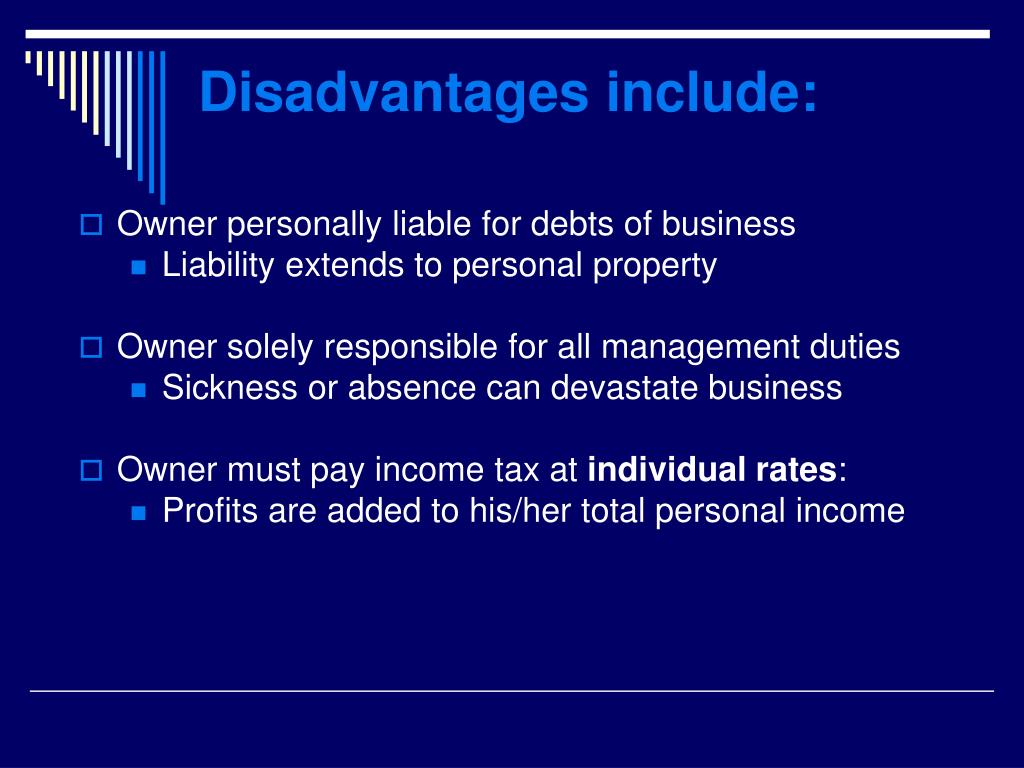

Is Building Owner Responsible If Business Doesnt Pay Sales Tax - When businesses fail to file or pay their taxes on time, they face penalties and interest charges. This means that any materials and supplies you purchase are. Although the sales tax treatment of the construction industry is unique, there are plenty of tax exemptions worth exploring. Many of the rules expressly allow. Typically, as a contractor you would need to pay sales tax on the materials you purchase for the project. Even if the only offense was a missed filing. If a business doesn’t pay sales tax or falls behind on its sales tax filings, it can expect a letter from the state sales tax agency. As a building owner, you may be wondering if you are liable for the sales tax owed by a business that occupies your property. New york state tax law (the “tax law”) imposes personal responsibility for payment of sales tax on certain owners, officers, directors, employees, managers, partners, or. Many states, and some municipalities, require retailers and service providers to charge sales tax on products and services sold to end consumers. All states with sales and use taxes have responsible party definitions and rules that impose responsibility for tax liabilities on certain parties. This can include interest charges on the unpaid tax, revocation of their. Corporate officers, owners and responsible parties of businesses with sales tax collection obligations should be aware of the consequences for failing to timely remit the tax. As a business owner, failing to pay sales tax can severely damage your business or personal (if you are personally liable) credit. Even if the only offense was a missed filing. In most states, construction contractors must pay sales tax when they purchase materials used in construction. Many states, and some municipalities, require retailers and service providers to charge sales tax on products and services sold to end consumers. Although the sales tax treatment of the construction industry is unique, there are plenty of tax exemptions worth exploring. When businesses fail to file or pay their taxes on time, they face penalties and interest charges. If a business doesn’t pay sales tax or falls behind on its sales tax filings, it can expect a letter from the state sales tax agency. Typically, as a contractor you would need to pay sales tax on the materials you purchase for the project. If a business doesn’t pay sales tax or falls behind on its sales tax filings, it can expect a letter from the state sales tax agency. Many of the rules expressly allow. This can include interest charges on the unpaid tax,. This means that any materials and supplies you purchase are. However, some businesses are not required. This can include interest charges on the unpaid tax, revocation of their. Many states, and some municipalities, require retailers and service providers to charge sales tax on products and services sold to end consumers. But you may be able to position yourself as a. In the case of new construction or capital improvements made to real estate, the construction company is generally responsible for paying sales tax on the materials and. Although the sales tax treatment of the construction industry is unique, there are plenty of tax exemptions worth exploring. Many of the rules expressly allow. The answer is not a simple yes or. In most states, construction contractors must pay sales tax when they purchase materials used in construction. In the case of new construction or capital improvements made to real estate, the construction company is generally responsible for paying sales tax on the materials and. Even if the only offense was a missed filing. Typically, as a contractor you would need to. If a state determines you owe sales taxes and you don’t respond or can’t pay, tax authorities can take assets or put liens on them, potentially damaging your credit. Some are generally applicable, such as exemptions. And labor is typically not subject to sales tax. Sales and use tax management is critical for construction companies. Typically, as a contractor you. But you may be able to position yourself as a reseller who charges. Typically, as a contractor you would need to pay sales tax on the materials you purchase for the project. This means that any materials and supplies you purchase are. In the case of new construction or capital improvements made to real estate, the construction company is generally. Some are generally applicable, such as exemptions. When businesses fail to file or pay their taxes on time, they face penalties and interest charges. Even if the only offense was a missed filing. Sales and use tax management is critical for construction companies. In the case of new construction or capital improvements made to real estate, the construction company is. They apply to the sale, purchase, and use of goods and services, and as rates approach 10%, the financial. The answer is not a simple yes or no, as it depends on various. Many of the rules expressly allow. When a business doesn’t pay sales tax, they may face penalties and fines from the government. In the case of new. New york state tax law (the “tax law”) imposes personal responsibility for payment of sales tax on certain owners, officers, directors, employees, managers, partners, or. If a state determines you owe sales taxes and you don’t respond or can’t pay, tax authorities can take assets or put liens on them, potentially damaging your credit. In most states, construction contractors must. In most states, construction contractors must pay sales tax when they purchase materials used in construction. In the case of new construction or capital improvements made to real estate, the construction company is generally responsible for paying sales tax on the materials and. Even if the only offense was a missed filing. When businesses fail to file or pay their. Although the sales tax treatment of the construction industry is unique, there are plenty of tax exemptions worth exploring. According to the irs, the penalty for failing to pay is 0.5% of unpaid taxes for every month the. And labor is typically not subject to sales tax. As a building owner, you may be wondering if you are liable for the sales tax owed by a business that occupies your property. In the case of new construction or capital improvements made to real estate, the construction company is generally responsible for paying sales tax on the materials and. The answer is not a simple yes or no, as it depends on various. Corporate officers, owners and responsible parties of businesses with sales tax collection obligations should be aware of the consequences for failing to timely remit the tax. They apply to the sale, purchase, and use of goods and services, and as rates approach 10%, the financial. Many of the rules expressly allow. But you may be able to position yourself as a reseller who charges. When a business doesn’t pay sales tax, they may face penalties and fines from the government. This can include interest charges on the unpaid tax, revocation of their. Sales and use tax management is critical for construction companies. As a business owner, failing to pay sales tax can severely damage your business or personal (if you are personally liable) credit. Many states, and some municipalities, require retailers and service providers to charge sales tax on products and services sold to end consumers. Some are generally applicable, such as exemptions.PPT Business Ownership & Legal Structure PowerPoint Presentation ID

What Happens When A Business Doesn T Pay Sales Tax? The Mumpreneur Show

Sales Tax Help Center Alizio Law, PLLC

65,697 imágenes de Building owner Imágenes, fotos y vectores de stock

Building Tax Calculation, Difference with Property Tax, Land Tax

What Happens When a Business Doesn't Pay Sales Tax Agile

Ronald Reagan Quote “You can’t tax business. Business doesn’t pay

Cautionary tale Owner personally liable for sales tax BST & Co. LLP

The Rights and Responsibilities of Building Owners Hilb Group of Florida

What Happens When a Business Doesn't Pay Sales Tax Agile

This Means That Any Materials And Supplies You Purchase Are.

All States With Sales And Use Taxes Have Responsible Party Definitions And Rules That Impose Responsibility For Tax Liabilities On Certain Parties.

If A Business Doesn’t Pay Sales Tax Or Falls Behind On Its Sales Tax Filings, It Can Expect A Letter From The State Sales Tax Agency.

However, Some Businesses Are Not Required.

Related Post: