Is Chime A Good Way To Build Credit

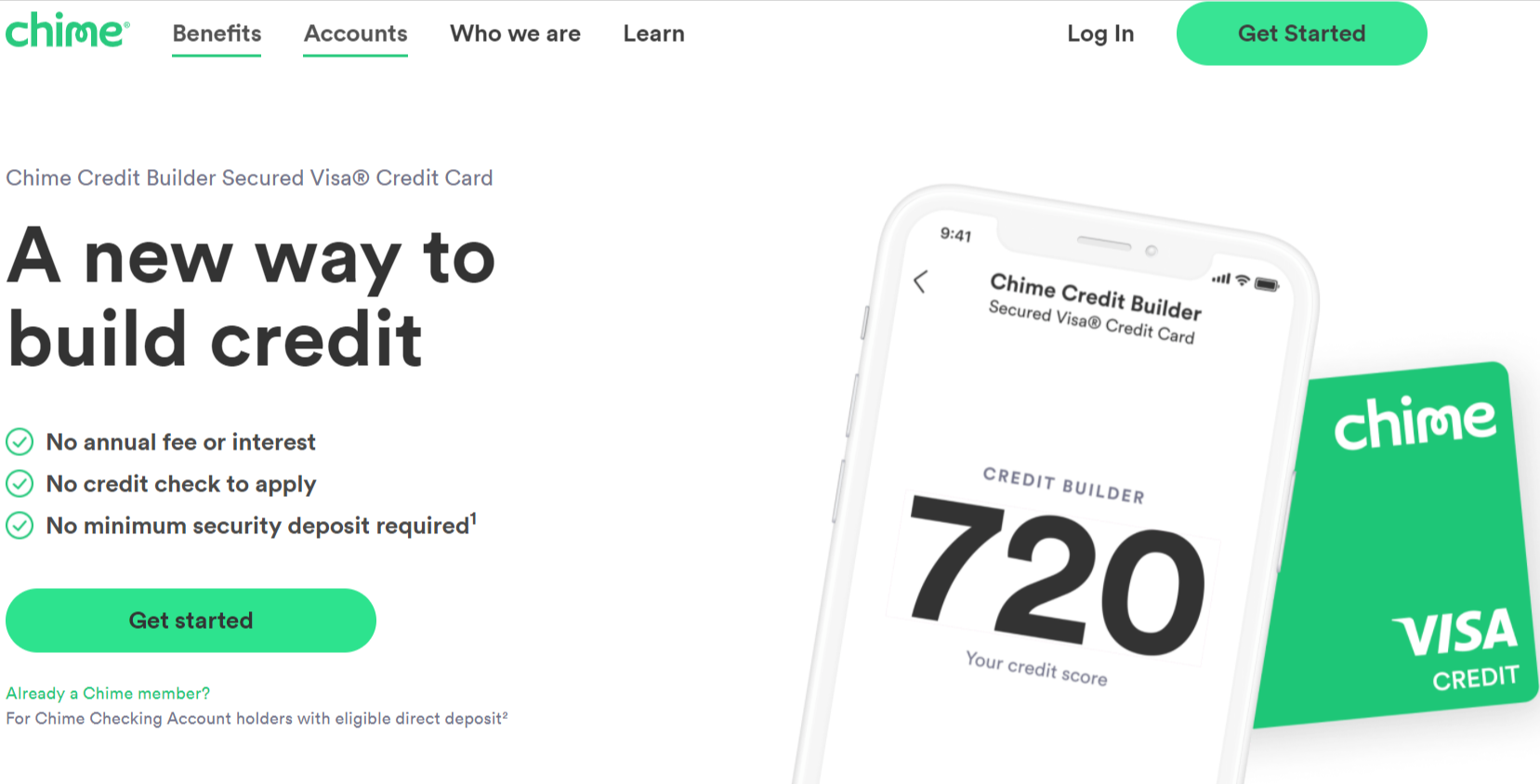

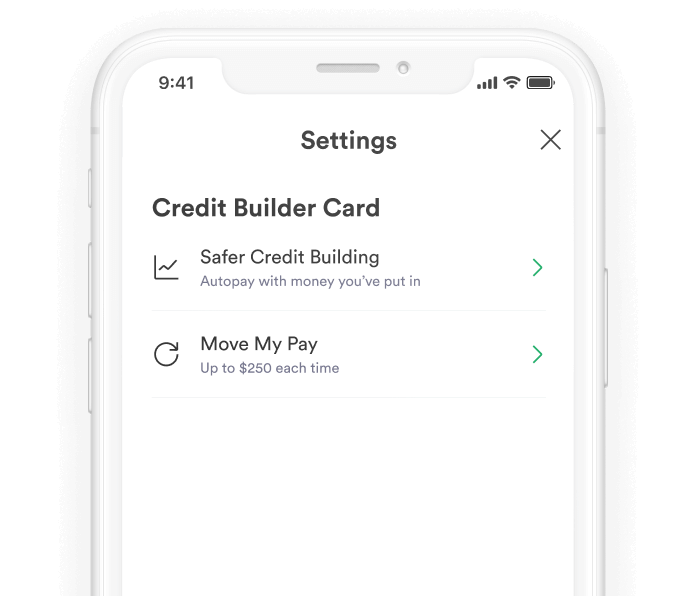

Is Chime A Good Way To Build Credit - The chime credit builder visa® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. It’s a secured card with no fees* or minimum security. Safer way to help build credit. Chime is a fintech with banking services. The card has no annual fee or interest, which makes it a more affordable option. If you want to build credit but worry about getting into debt with a traditional credit card, the chime credit builder is an excellent option for you. Overall, chime is best for anyone looking to build credit [6], save on banking fees or automate their saving. While great for building credit, it lacks some extra features of other cards. Learn how credit builder helps you build credit. Are you new to credit or are you rebuilding from a bad score? Chime is a fintech with banking services. People looking to build credit on a budget may appreciate the chime credit builder secured visa credit card. If you want to build credit but worry about getting into debt with a traditional credit card, the chime credit builder is an excellent option for you. If you have limited / poor / fair credit, the secured chime credit builder visa ® credit card could be a good option to help you build credit without incurring fees or interest**. It’s a secured card with no fees* or minimum security. Its features will allow you to focus. Overall, chime is best for anyone looking to build credit [6], save on banking fees or automate their saving. Safer way to help build credit. This chime review focuses on its personal banking products and. Chime's credit builder card is a secured card with no deposit, no annual fees and 0% apr. Are you new to credit or are you rebuilding from a bad score? If you’re just looking for an overall. If you’re just new to credit you’ve got better options that might even get you a little cash back. If you want to build credit but worry about getting into debt with a traditional credit card, the chime credit builder. Safer way to help build credit. If you’re just looking for an overall. If you want to build credit but worry about getting into debt with a traditional credit card, the chime credit builder is an excellent option for you. While great for building credit, it lacks some extra features of other cards. The chime credit builder secured visa® credit. How to build credit 7 min read. It’s a secured card with no fees* or minimum security. The chime credit builder card is a great option for those looking to improve their credit score. If you want to build credit but worry about getting into debt with a traditional credit card, the chime credit builder is an excellent option for. Build credit using your own money to limit the risk of debt and missing payments. Are you new to credit or are you rebuilding from a bad score? The chime credit builder card is a great option for those looking to improve their credit score. How to build credit 7 min read. The card has no annual fee or interest,. If you have limited / poor / fair credit, the secured chime credit builder visa ® credit card could be a good option to help you build credit without incurring fees or interest**. If you’re just new to credit you’ve got better options that might even get you a little cash back. Learn how credit builder helps you build credit.. Build credit using your own money to limit the risk of debt and missing payments. Chime is a fintech with banking services. While great for building credit, it lacks some extra features of other cards. Are you new to credit or are you rebuilding from a bad score? The chime credit builder card is a great option for those looking. Overall, chime is best for anyone looking to build credit [6], save on banking fees or automate their saving. The card has no annual fee or interest, which makes it a more affordable option. With few fees and no minimum security deposit, the chime credit builder secured visa is a simple, accessible, and inexpensive way to get a credit card. This chime review focuses on its personal banking products and. If you’re just new to credit you’ve got better options that might even get you a little cash back. Are you new to credit or are you rebuilding from a bad score? While great for building credit, it lacks some extra features of other cards. People looking to build credit. If you have limited / poor / fair credit, the secured chime credit builder visa ® credit card could be a good option to help you build credit without incurring fees or interest**. This chime review focuses on its personal banking products and. Overall, chime is best for anyone looking to build credit [6], save on banking fees or automate. This chime review focuses on its personal banking products and. If you’re just looking for an overall. The chime secured credit builder visa®. While great for building credit, it lacks some extra features of other cards. It’s a secured card with no fees* or minimum security. Chime's credit builder card is a secured card with no deposit, no annual fees and 0% apr. People looking to build credit on a budget may appreciate the chime credit builder secured visa credit card. If you’re just new to credit you’ve got better options that might even get you a little cash back. The chime credit builder card is a great option for those looking to improve their credit score. The chime credit builder credit card can help you build credit with no annual fees, no interest 1, no large security. Safer way to help build credit. Learn how credit builder helps you build credit. If you want to build credit but worry about getting into debt with a traditional credit card, the chime credit builder is an excellent option for you. Chime is a fintech with banking services. This chime review focuses on its personal banking products and. With few fees and no minimum security deposit, the chime credit builder secured visa is a simple, accessible, and inexpensive way to get a credit card and begin building or. The chime secured credit builder visa®. It’s a secured card with no fees* or minimum security. The chime credit builder visa® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. If you’re just looking for an overall. Overall, chime is best for anyone looking to build credit [6], save on banking fees or automate their saving.How to build credit with Credit Builder Chime

Chime® Credit Builder Review Best Way to Build Credit? YouTube

Credit Builder Card Chime

Chime Credit Builder Considered Secured Credit Card

Chime Secured Credit Card Great Way To Build Credit? CreditFred

Chime Credit Builder Review Is This Service Worth Using?

How to build credit with Credit Builder Chime

Credit Card To Build Credit Securely Chime

How to Build Credit The 7Step Guide Chime

Chime Credit Builder Review Can It Really Improve Your Credit?

Its Features Will Allow You To Focus.

The Chime Credit Builder Secured Visa® Credit Card Has Minimal Fees And No Minimum Deposit.

Build Credit Using Your Own Money To Limit The Risk Of Debt And Missing Payments.

While Great For Building Credit, It Lacks Some Extra Features Of Other Cards.

Related Post: