Is Chime Credit Builder Considered A Credit Card

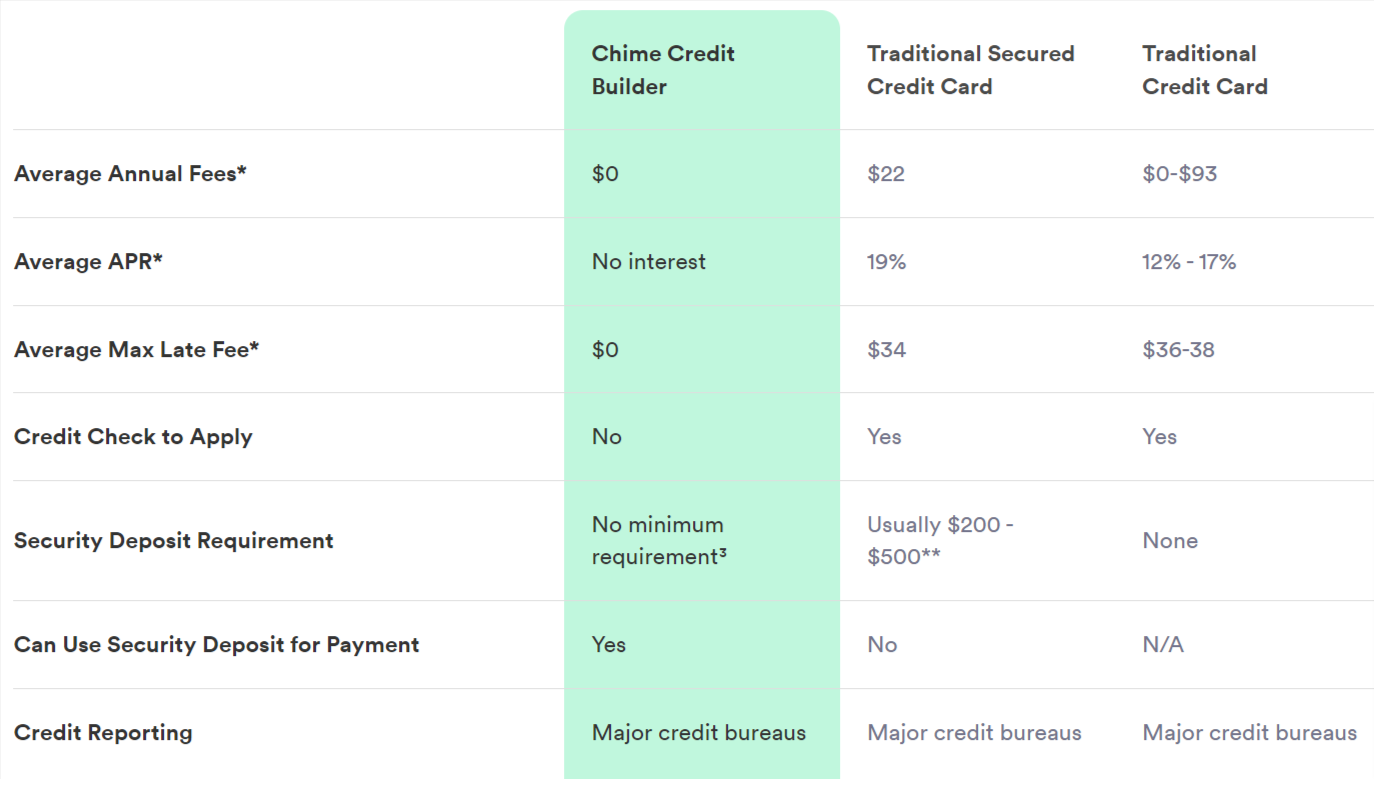

Is Chime Credit Builder Considered A Credit Card - They will soft pull your credit report and let you know in advance which. Just make sure you fund your credit builder secured deposit account, so you. The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. 1 there’s also no credit check to apply! Chime's credit builder card is a secured card with no deposit, no annual fees and 0% apr. Yes, chime credit builder is a visa secured credit card. Chime is not a credit card. Chime requires the following disclosure about the secured chime credit builder visa® credit card: The chime visa ® debit card and the secured chime credit builder visa ® credit card are issued by the bancorp bank, n.a. There’s no credit limit to report and no utilization to report. They will soft pull your credit report and let you know in advance which. The chime visa® debit card and the secured chime credit builder visa® credit card are issued by the bancorp bank, n.a. Just make sure you fund your credit builder secured deposit account, so you. Chime's credit builder secured visa credit card* is a secured credit card with no annual fee or interest that allows you to build your credit. Or stride bank, n.a., pursuant to a license from visa u.s.a. The secured chime credit builder credit card is issued by the bancorp bank, n.a. The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. Yes, the chime credit builder card is a visa credit card issued by stride bank in partnership with chime®, a financial technology company. Chime is a fintech with banking services. The secured chime credit builder visa ® credit card is a secured credit card for those looking to build or repair their credit. Your credit limit is equal to the amount you deposit in your account. You can use your chime credit builder credit card anywhere visacards are accepted. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. The chime visa ® debit card and the secured chime. And may be used everywhere. The chime secured credit builder visa®. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. The chime visa ® debit card and the secured chime credit builder visa ® credit card are issued by the bancorp bank, n.a. Chime reports. Your credit limit is equal to the amount you deposit in your account. They will soft pull your credit report and let you know in advance which. The secured chime credit builder visa ® credit card is a secured credit card for those looking to build or repair their credit. There’s no credit limit to report and no utilization to. The chime credit builder secured. The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. “ to apply for credit builder, you must have an active chime® checking. Yes, chime credit builder is a visa secured credit card. Unlike. There’s no credit limit to report and no utilization to report. Or stride bank, n.a., pursuant to a license from visa u.s.a. Chime's credit builder secured visa credit card* is a secured credit card with no annual fee or interest that allows you to build your credit. Chime's credit builder card is a secured card with no deposit, no annual. Just make sure you fund your credit builder secured deposit account, so you. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. It has no annual fees, doesn't charge interest, and. Yes, the chime credit builder card is a visa credit card issued by stride bank. “ to apply for credit builder, you must have an active chime® checking. Chime reports to the bureaus as a charge card, not a credit card. The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. It has no. Or stride bank, n.a., pursuant to licenses from visa u.s.a. “ to apply for credit builder, you must have an active chime® checking. Just make sure you fund your credit builder secured deposit account, so you. Or stride bank, n.a., pursuant to licenses from visa u.s.a. Chime requires the following disclosure about the secured chime credit builder visa® credit card: Chime is a financial technology company, but we do offer a secured credit card called the chime credit builder secured visa ® credit card. Chime's credit builder secured visa credit card* is a secured credit card with no annual fee or interest that allows you to build your credit. The chime credit builder secured. The secured chime credit builder visa. Is the chime credit builder card a credit card? And may be used everywhere. Your credit limit is equal to the amount you deposit in your account. Yes, the chime credit builder card is a visa credit card issued by stride bank in partnership with chime®, a financial technology company. Chime's credit builder secured visa credit card* is a secured. Chime's credit builder secured visa credit card* is a secured credit card with no annual fee or interest that allows you to build your credit. Chime requires the following disclosure about the secured chime credit builder visa® credit card: “ to apply for credit builder, you must have an active chime® checking. There’s no credit limit to report and no utilization to report. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. The chime secured credit builder visa®. They will soft pull your credit report and let you know in advance which. Your credit limit is equal to the amount you deposit in your account. You can use your chime credit builder credit card anywhere visacards are accepted. The chime credit builder secured. Yes, chime credit builder is a visa secured credit card. Or stride bank, n.a., pursuant to licenses from visa u.s.a. Chime is not a credit card. Chime's credit builder card is a secured card with no deposit, no annual fees and 0% apr. And may be used everywhere. 1 there’s also no credit check to apply!Chime Credit Builder Considered Secured Credit Card

Chime Credit Builder Secured Visa® Credit Card Review

Credit Builder Card Chime

US challenger bank Chime launches Credit Builder, a credit card that

Chime Credit Builder Credit Card Review Build Credit

Chime Credit Builder Considered Secured Credit Card

Secured Chime Credit Builder Visa® Credit Card An Innovative Way to

Chime Credit Builder Review What You Need To Know Clark Howard

What is a Chime Credit Builder Credit Card? Quick Introduction Seek

Chime Credit Builder Considered Secured Credit Card

Chime Is A Financial Technology Company, But We Do Offer A Secured Credit Card Called The Chime Credit Builder Secured Visa ® Credit Card.

The Secured Chime Credit Builder Visa ® Credit Card Is A Secured Credit Card For Those Looking To Build Or Repair Their Credit.

Unlike Traditional Credit Cards, Credit Builder Is A Secured Card That Helps You Build Credit History With No Annual Fees And No Interest.

The Chime Visa ® Debit Card And The Secured Chime Credit Builder Visa ® Credit Card Are Issued By The Bancorp Bank, N.a.

Related Post: