Is Chimes Credit Builder Good

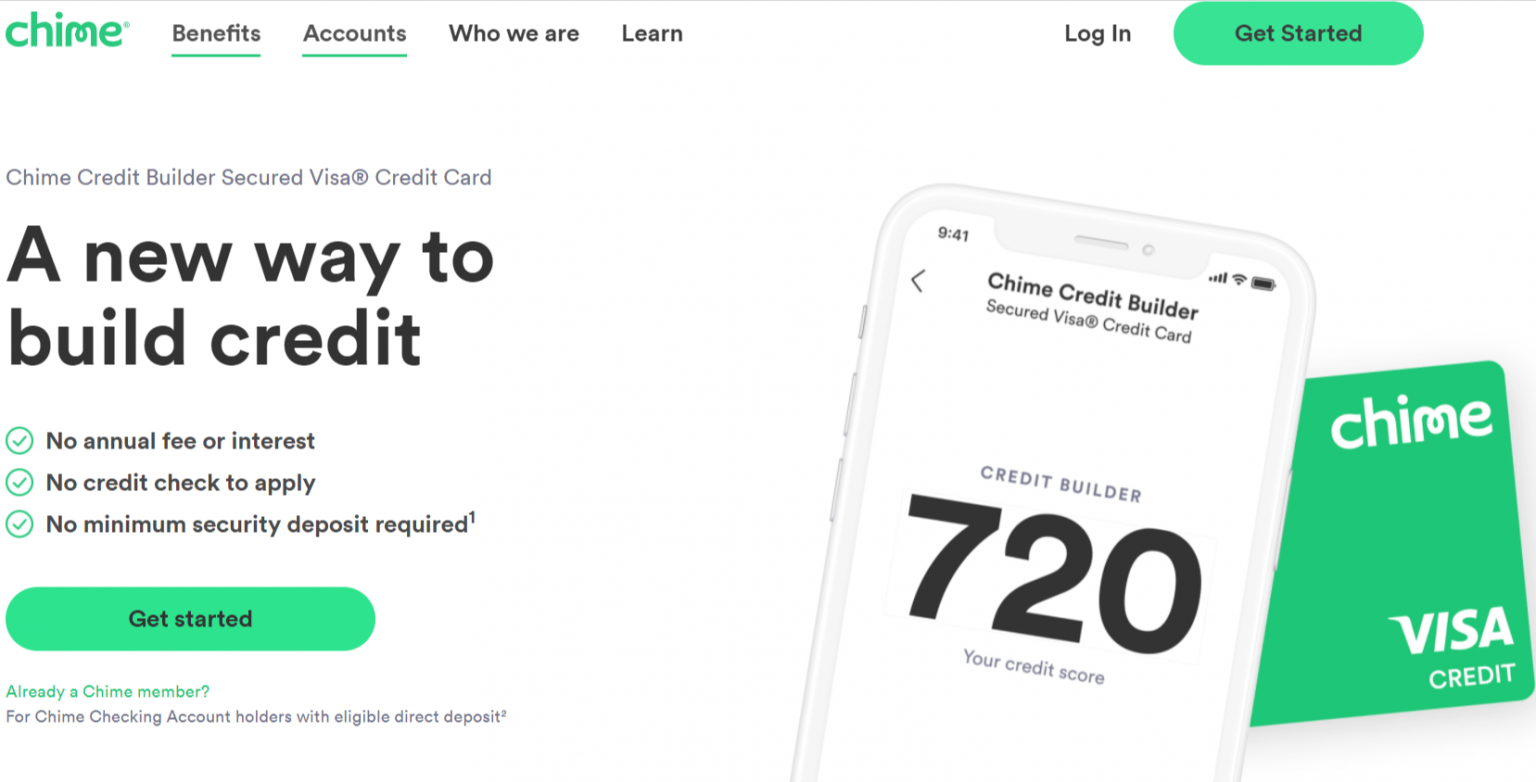

Is Chimes Credit Builder Good - It works just turn on safer credit building so you don’t have to worry about missing a payment. The chime credit builder visa credit card may be a good option for current chime customers to build credit history with no credit check and no annual fee. Unlike some secured cards that report to only one or two credit bureaus, chime. As a secured credit card offered by chime, a trusted financial technology company, it comes with its. But there are some things to know about it before signing up. It’s a secured card with no fees* or minimum security. The chime credit builder card is great for helping you build or improve your credit. You don ’ t have to worry about that with credit builder because chime does not report credit utilization. Money expert clark howard says utilizing this fintech company (chime® is not a bank) for this type of credit card is a much better alternative than dealing with a traditional. If you’re in a ton of debt and aren’t paying it off, credit builder can only help so much. Is the chime credit builder secured visa® a good card? You don ’ t have to worry about that with credit builder because chime does not report credit utilization. I raised my score 78. Discover how chime credit builder can help you improve your credit score. It works just turn on safer credit building so you don’t have to worry about missing a payment. If you’re in a ton of debt and aren’t paying it off, credit builder can only help so much. Money expert clark howard says utilizing this fintech company (chime® is not a bank) for this type of credit card is a much better alternative than dealing with a traditional. People looking to build credit on a budget may appreciate the chime credit builder secured visa credit card. With no annual fee or other. You will get a little cash back from every purchase too. But there are some things to know about it before signing up. The chime credit builder visa secured credit card can help you build credit. The chime credit builder visa credit card may be a good option for current chime customers to build credit history with no credit check and no annual fee. Discover how chime credit builder can help. The chime credit builder card is great for helping you build or improve your credit. It has all the safety features to keep you from harming your credit. Is the chime credit builder secured visa® a good card? With no annual fee or other. You don ’ t have to worry about that with credit builder because chime does not. Credit building with chime is made more efficient due to its comprehensive reporting. The chime credit builder visa credit card may be a good option for current chime customers to build credit history with no credit check and no annual fee. Money expert clark howard says utilizing this fintech company (chime® is not a bank) for this type of credit. It works just turn on safer credit building so you don’t have to worry about missing a payment. No annual fees or interest 1, no credit check to apply, and no minimum security deposit required 2. While great for building credit, it lacks some extra features of other cards. The chime credit builder secured visa® credit card has minimal fees. The chime credit builder card is great for helping you build or improve your credit. I raised my score 78. Just be sure you can pay your credit card bill in full, every month, and you’ll never have to pay a dime of interest. With no annual fee or other. The chime credit builder secured visa® credit card has minimal. It has all the safety features to keep you from harming your credit. If you just lack credit,. Is the chime credit builder secured visa® a good card? But there are some things to know about it before signing up. People looking to build credit on a budget may appreciate the chime credit builder secured visa credit card. I raised my score 78. If you’re looking to build your credit, chime credit builder could be an attractive option. While great for building credit, it lacks some extra features of other cards. People looking to build credit on a budget may appreciate the chime credit builder secured visa credit card. Discover how chime credit builder can help you improve. No annual fees or interest 1, no credit check to apply, and no minimum security deposit required 2. Money expert clark howard says utilizing this fintech company (chime® is not a bank) for this type of credit card is a much better alternative than dealing with a traditional. Unlike some secured cards that report to only one or two credit. Is the chime credit builder secured visa® a good card? Unlike some secured cards that report to only one or two credit bureaus, chime. Credit building with chime is made more efficient due to its comprehensive reporting. With no annual fee or other. Money expert clark howard says utilizing this fintech company (chime® is not a bank) for this type. Only helpful for thin credit files or recovering, poor credit. It’s a secured card with no fees* or minimum security. Discover how chime credit builder can help you improve your credit score. Is the chime credit builder secured visa® a good card? It works just turn on safer credit building so you don’t have to worry about missing a payment. Only helpful for thin credit files or recovering, poor credit. Unlike some secured cards that report to only one or two credit bureaus, chime. If you just lack credit,. No annual fees or interest 1, no credit check to apply, and no minimum security deposit required 2. While great for building credit, it lacks some extra features of other cards. Discover how chime credit builder can help you improve your credit score. The chime credit builder visa secured credit card can help you build credit. As a secured credit card offered by chime, a trusted financial technology company, it comes with its. If you’re looking to build your credit, chime credit builder could be an attractive option. The chime credit builder visa credit card may be a good option for current chime customers to build credit history with no credit check and no annual fee. If you’re in a ton of debt and aren’t paying it off, credit builder can only help so much. I raised my score 78. With no annual fee or other. But there are some things to know about it before signing up. You will get a little cash back from every purchase too. It’s a secured card with no fees* or minimum security.Chime Credit Builder Review Can It Really Improve Your Credit?

Chime Credit Builder Considered Secured Credit Card

Chime Credit Builder Visa® Card Review (2024)

Chime Credit Builder Review What You Need To Know Clark Howard

Chime Credit Builder Review Is This Service Worth Using?

Chime Credit Builder Credit Card Review Build Credit

Chime Credit Builder Review Is This Service Worth Using?

Chime® Credit Builder Review Best Way to Build Credit? YouTube

What is a Chime Credit Builder Credit Card? Quick Introduction Seek

Chime Credit Builder Review 2023 Best Secured Credit Card?

People Looking To Build Credit On A Budget May Appreciate The Chime Credit Builder Secured Visa Credit Card.

The Chime Credit Builder Secured Visa® Credit Card Has Minimal Fees And No Minimum Deposit.

Just Be Sure You Can Pay Your Credit Card Bill In Full, Every Month, And You’ll Never Have To Pay A Dime Of Interest.

Is The Chime Credit Builder Secured Visa® A Good Card?

Related Post: