Is It Better To Build Or Buy A House

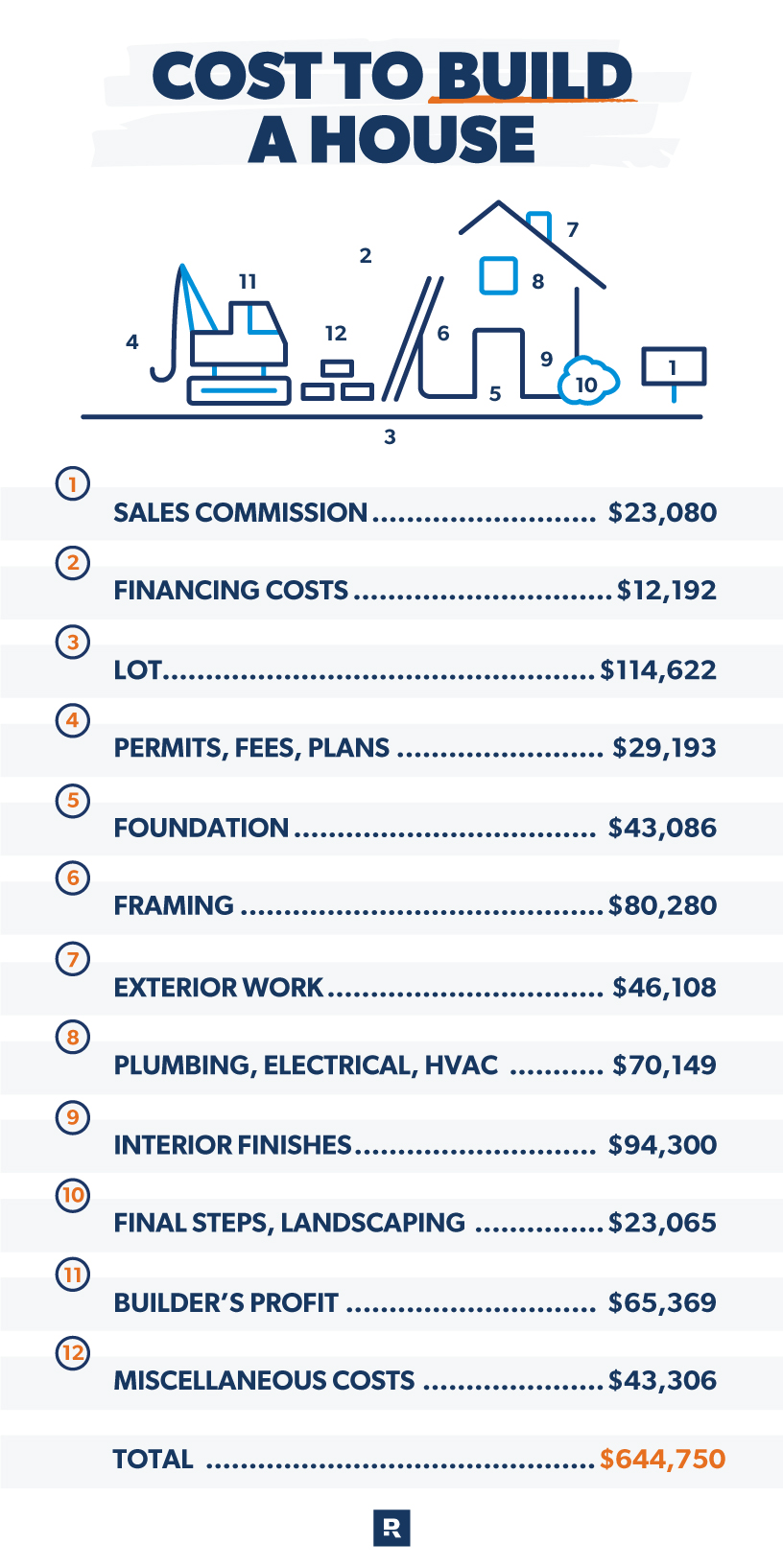

Is It Better To Build Or Buy A House - The rules regarding 401(k) withdrawals, such as incurring penalty fees and income tax for early withdrawal. Choose a real estate agent. Some builders pick up lots and build one or two homes at a time. Check out neighborhoods if you are new to town or are researching where you want to buy. Financing part of the build is an option, but typically comes with closing costs. While using your 401(k) to buy a house has a few advantages, such as receiving the funds quickly and enabling better loan terms, there are several things to consider before turning to your 401(k) to buy a house: Keep in mind that the average homeowner stays in their home 13 years, so if you’re planning to stay in your home past the breakeven point, it could make more sense to buy. But taking that same sense of color style and applying it to a tired room in an old house you just purchased is called 'sweat equity.' that has a nice ring to it. A good real estate agent will know about new developments in your area. You can refine your search on zillow to show only new construction but don’t stop there. Using the estimations above, your cost to build a house would be between $97,544 and $453,620. Financing part of the build is an option, but typically comes with closing costs. Keep in mind that the average homeowner stays in their home 13 years, so if you’re planning to stay in your home past the breakeven point, it could make more sense to buy. 'preparing in advance gives buyers a better understanding they make an offer,' kim says. This is the breakeven year. Broader market trends, the state of the economy and your local job market can also dictate a better or worse time to buy. A good rule of thumb is to talk with at least three agents before you choose one. Some builders pick up lots and build one or two homes at a time. Of course, new construction isn’t always in a new development. There is definitely an upside to renting: A good rule of thumb is to talk with at least three agents before you choose one. While using your 401(k) to buy a house has a few advantages, such as receiving the funds quickly and enabling better loan terms, there are several things to consider before turning to your 401(k) to buy a house: Smart buyers shop around for. You can refine your search on zillow to show only new construction but don’t stop there. The rules regarding 401(k) withdrawals, such as incurring penalty fees and income tax for early withdrawal. Broader market trends, the state of the economy and your local job market can also dictate a better or worse time to buy. Check out neighborhoods if you. Broader market trends, the state of the economy and your local job market can also dictate a better or worse time to buy. Rooms in new construction homes — especially bedrooms and bathrooms — tend to be larger and brighter, with lots of natural light. Any unexpected building cost will likely increase this amount. You can refine your search on. Some builders pick up lots and build one or two homes at a time. Best year for market and economy: A good rule of thumb is to talk with at least three agents before you choose one. Of course, new construction isn’t always in a new development. The larger the home, the more expensive it may be to build. The larger the home, the more expensive it may be to build. Using the estimations above, your cost to build a house would be between $97,544 and $453,620. A consumer should buy if. 'preparing in advance gives buyers a better understanding they make an offer,' kim says. Any unexpected building cost will likely increase this amount. A good rule of thumb is to talk with at least three agents before you choose one. Choose a real estate agent. Using the estimations above, your cost to build a house would be between $97,544 and $453,620. The larger the home, the more expensive it may be to build. You can refine your search on zillow to show only. The rules regarding 401(k) withdrawals, such as incurring penalty fees and income tax for early withdrawal. A consumer should buy if. Keep in mind that the average homeowner stays in their home 13 years, so if you’re planning to stay in your home past the breakeven point, it could make more sense to buy. A good real estate agent will. Broader market trends, the state of the economy and your local job market can also dictate a better or worse time to buy. Keep in mind that the average homeowner stays in their home 13 years, so if you’re planning to stay in your home past the breakeven point, it could make more sense to buy. Rooms in new construction. A consumer should buy if. 'preparing in advance gives buyers a better understanding they make an offer,' kim says. Any unexpected building cost will likely increase this amount. Some builders pick up lots and build one or two homes at a time. Best year for market and economy: Financing part of the build is an option, but typically comes with closing costs. While using your 401(k) to buy a house has a few advantages, such as receiving the funds quickly and enabling better loan terms, there are several things to consider before turning to your 401(k) to buy a house: A good real estate agent will know about. But taking that same sense of color style and applying it to a tired room in an old house you just purchased is called 'sweat equity.' that has a nice ring to it. This is the breakeven year. Check out neighborhoods if you are new to town or are researching where you want to buy. In every real estate market, there's always a best month to buy a house or best season to buy — even in a down market. Rooms in new construction homes — especially bedrooms and bathrooms — tend to be larger and brighter, with lots of natural light. Using the estimations above, your cost to build a house would be between $97,544 and $453,620. A good rule of thumb is to talk with at least three agents before you choose one. Smart buyers shop around for a real estate agent as well as a home they want to buy. Keep in mind that the average homeowner stays in their home 13 years, so if you’re planning to stay in your home past the breakeven point, it could make more sense to buy. The rules regarding 401(k) withdrawals, such as incurring penalty fees and income tax for early withdrawal. A good real estate agent will know about new developments in your area. Choose a real estate agent. Financing part of the build is an option, but typically comes with closing costs. The larger the home, the more expensive it may be to build. While using your 401(k) to buy a house has a few advantages, such as receiving the funds quickly and enabling better loan terms, there are several things to consider before turning to your 401(k) to buy a house: You can refine your search on zillow to show only new construction but don’t stop there.Building vs buying a house What is right for you? Bank Midwest

Building a House? The Pros and Cons (2023)

Building a House or Buying a Home What is Right For You?

Cost to build house vs buy Builders Villa

Buying vs. Building a Home Which One is Better? S3DA Design

Is it better to buy or build your dream home?

Should You Buy or Build Your New House? Pros & Cons

Is It Better to Build or Buy a House in Maryland in 2022?

Home Buying vs. Home Building Virmani Estates

Buy or Build a House? The Pros and Cons Advantage Realty 1

The Opposite Is True If You’re Planning To Move Sooner.

Any Unexpected Building Cost Will Likely Increase This Amount.

Best Year For Market And Economy:

They Are Confident They Will Stay, Or Can Stay, In The Home Long Enough For The Financial Benefits Of Buying Their Primary Home To Overcome The Lower Upfront Costs Of Renting The Same Unit And Investing In Stock Markets.

Related Post: