Is It Legal To Build Your Kids Credit Score

Is It Legal To Build Your Kids Credit Score - “the updated coppa rule strengthens key protections for kids’ privacy online,” said ftc chair lina m. How to check if your child has a credit report. Yes, adding children as authorized users can help their credit scores. You can build credit as a minor by becoming an authorized user on a friend or family member’s credit card account. Typically, minors haven't built credit and don't have their own credit reports yet. But that's not always the case. These $18 ‘warm and cozy’ amazon joggers have 25k. Still, the method has some pros and cons you should know upfront. It is possible for a minor to have a credit report, but not the norm. The mortgage can show up on your credit report as if you had taken out. Explore the legality of boosting your child's credit on our blog. “by requiring parents to opt in to targeted advertising practices,. The main reason for this is. Building credit in your teen years, while it takes some time and effort to earn a score that will be favorable when the need for borrowing comes up, can pay off in significant ways. Of course, your kids can’t go out and sign up for credit cards and loans — so there are only two ways for them to have a. Credit builder loans represent a great way for your child to establish credit on his/her own. One of the main reasons to start early is that credit history, payment history, and how long you’ve been using credit all contribute to a credit score. If you are concerned that someone may have fraudulently used your child's identification to open credit accounts, you. A child usually needs to be between 13 and 15 years old. If you use credit cards, making your child an authorized user can be a first step toward building their credit. If you’re a parent, establishing credit for your children early on can serve them later in life with better credit scores and lower interest rates. It's up to the primary cardholder to maintain a healthy credit score so the authorized users can reap the benefits. Of course, your kids can’t go out and sign up for credit cards and loans. If you are concerned that someone may have fraudulently used your child's identification to open credit accounts, you. Discover if it's legal to build your kid's credit score. Building credit in your teen years, while it takes some time and effort to earn a score that will be favorable when the need for borrowing comes up, can pay off in. Your child under 18 can potentially have a credit report in. Discover if it's legal to build your kid's credit score. You are legally on the hook for that debt, even though you won’t have any equity in the house. The most common way for a child to have a credit report is for the parent to. A child usually. Typically, minors haven't built credit and don't have their own credit reports yet. It can happen in one of a few ways. Absolutely, a child of any age can have a credit report. A child usually needs to be between 13 and 15 years old. If you’re able to help your. It is possible for a minor to have a credit report, but not the norm. Your child under 18 can potentially have a credit report in. A child usually needs to be between 13 and 15 years old. If you use credit cards, making your child an authorized user can be a first step toward building their credit. The most. Credit builder loans represent a great way for your child to establish credit on his/her own. The most common way for a child to have a credit report is for the parent to. That’s because the length of credit history impacts a person’s. The main reason for this is. One of the main reasons to start early is that credit. It takes credit to build credit, not a debit card, checking or savings account. Explore the legality of boosting your child's credit on our blog. Absolutely, a child of any age can have a credit report. It can happen in one of a few ways. If you are concerned that someone may have fraudulently used your child's identification to open. Still, the method has some pros and cons you should know upfront. “by requiring parents to opt in to targeted advertising practices,. If you’re a parent, establishing credit for your children early on can serve them later in life with better credit scores and lower interest rates. Take your time and do your research before making that ultimate commitment to. Your child under 18 can potentially have a credit report in. It can happen in one of a few ways. Discover if it's legal to build your kid's credit score. “by requiring parents to opt in to targeted advertising practices,. Typically, minors haven't built credit and don't have their own credit reports yet. These $18 ‘warm and cozy’ amazon joggers have 25k. If you’re able to help your. How to check if your child has a credit report. Of course, your kids can’t go out and sign up for credit cards and loans — so there are only two ways for them to have a. While most adults have a credit score, one. If you’re able to help your. Building credit in your teen years, while it takes some time and effort to earn a score that will be favorable when the need for borrowing comes up, can pay off in significant ways. How to check if your child has a credit report. A child usually needs to be between 13 and 15 years old. While most adults have a credit score, one age group is notably absent—80% of young adults aged 18 to 19 do not have a credit score and are credit invisible. One of the main reasons to start early is that credit history, payment history, and how long you’ve been using credit all contribute to a credit score. If you use credit cards, making your child an authorized user can be a first step toward building their credit. Take your time and do your research before making that ultimate commitment to swipe right on a home. our money feature writer brad young found that being single costs. It is possible for a minor to have a credit report, but not the norm. Discover if it's legal to build your kid's credit score. It takes credit to build credit, not a debit card, checking or savings account. These $18 ‘warm and cozy’ amazon joggers have 25k. The most common way for a child to have a credit report is for the parent to. Explore the legality of boosting your child's credit on our blog. It can happen in one of a few ways. The mortgage can show up on your credit report as if you had taken out.How To Build Your Kids Credit Score To A 700 YouTube

How to Build Your Kids Credit Score 2021 YouTube

How Can I Build My Child's Credit Score LiveWell

Build Your Child’s Credit Score Together with Kitsap CU

Boost Your Child’s Credit Score With This Simple Trick Route to Retire

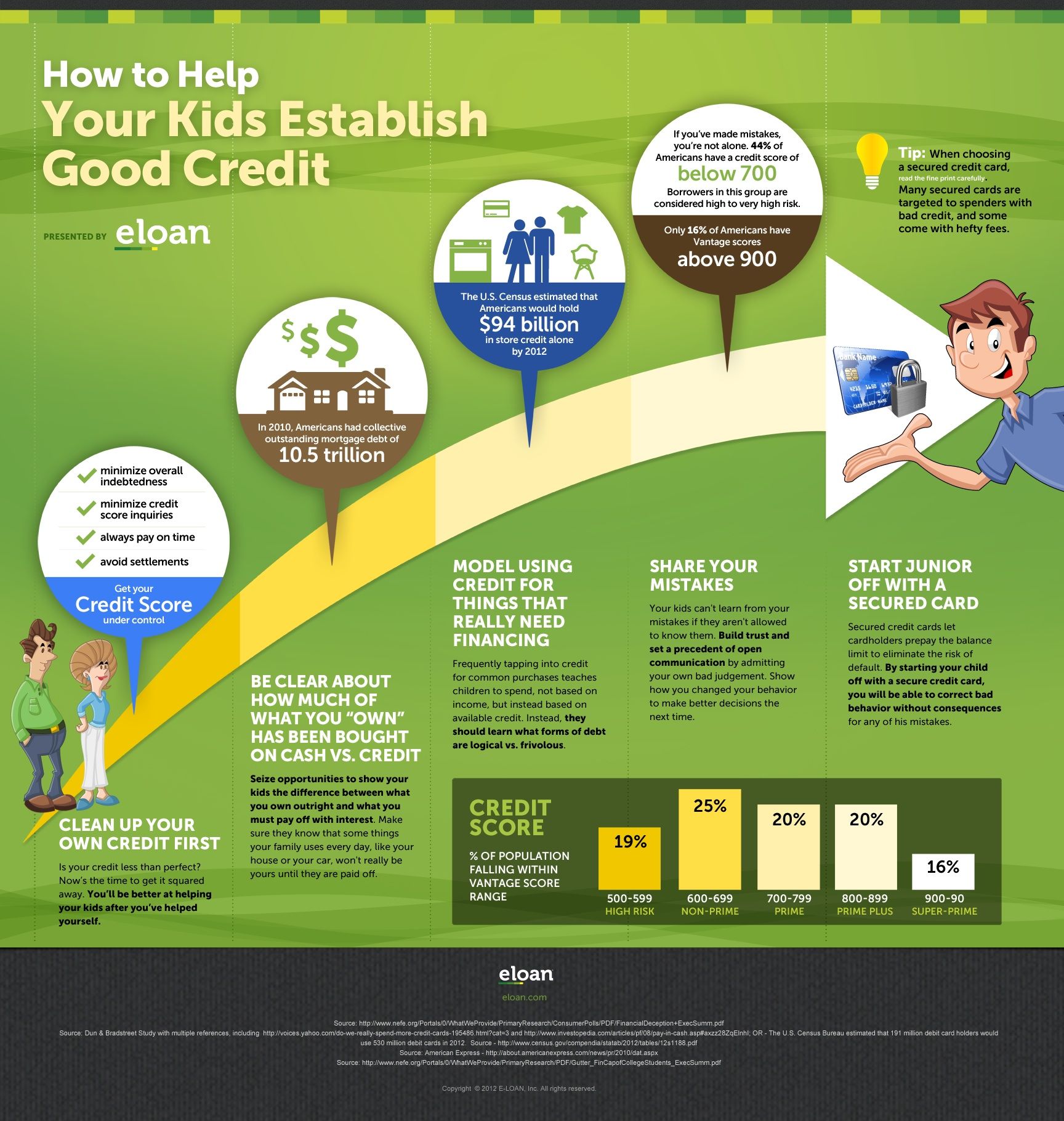

Helping Kids Establish Good Credit (infographic) ELOAN Good credit

Tips to Teach Kids the Importance of Credit Score Homey App for Families

How To Build A Perfect Credit SCORE For Your KIDS Give Your Child A

A Parent’s Guide to Teaching High School and College Students About Credit

Credit Cards for Kids How to JumpStart Your Kid’s Credit Score

You Can Build Credit As A Minor By Becoming An Authorized User On A Friend Or Family Member’s Credit Card Account.

“The Updated Coppa Rule Strengthens Key Protections For Kids’ Privacy Online,” Said Ftc Chair Lina M.

Absolutely, A Child Of Any Age Can Have A Credit Report.

You Are Legally On The Hook For That Debt, Even Though You Won’t Have Any Equity In The House.

Related Post:

.png?auto=compress)