Is Self A Good Way To Build Credit

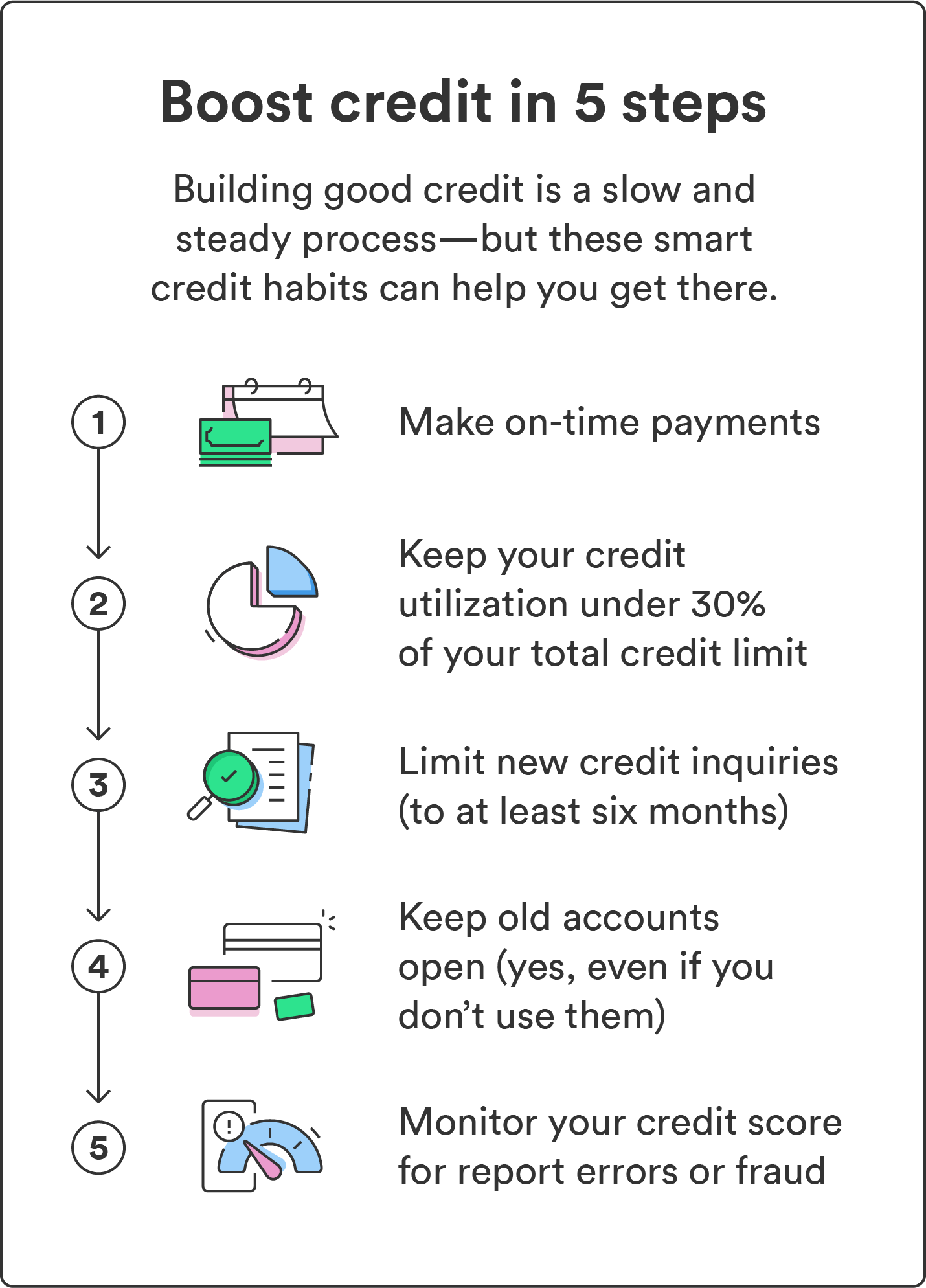

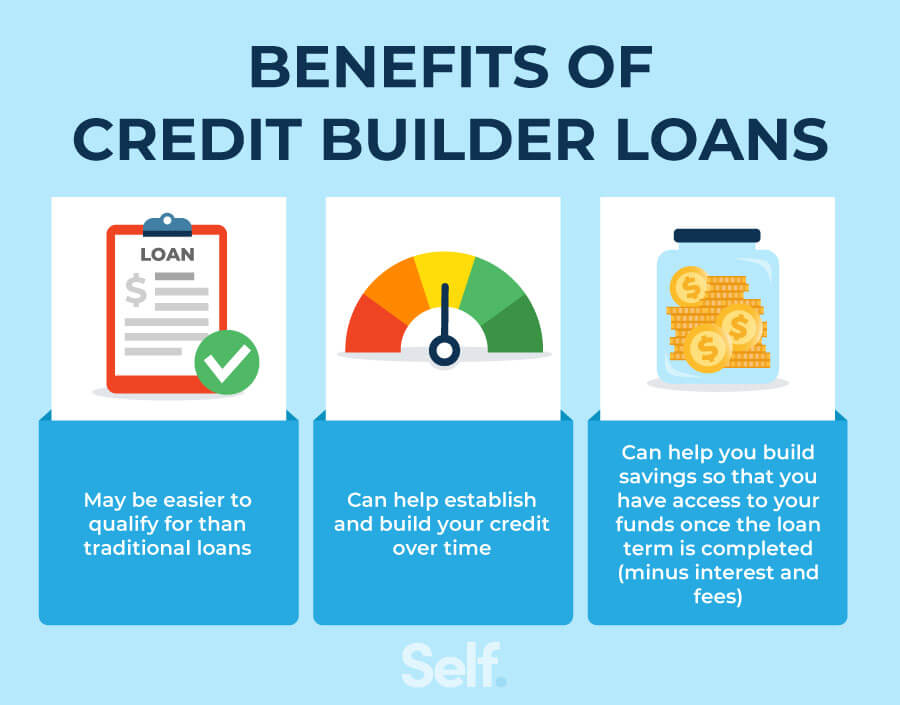

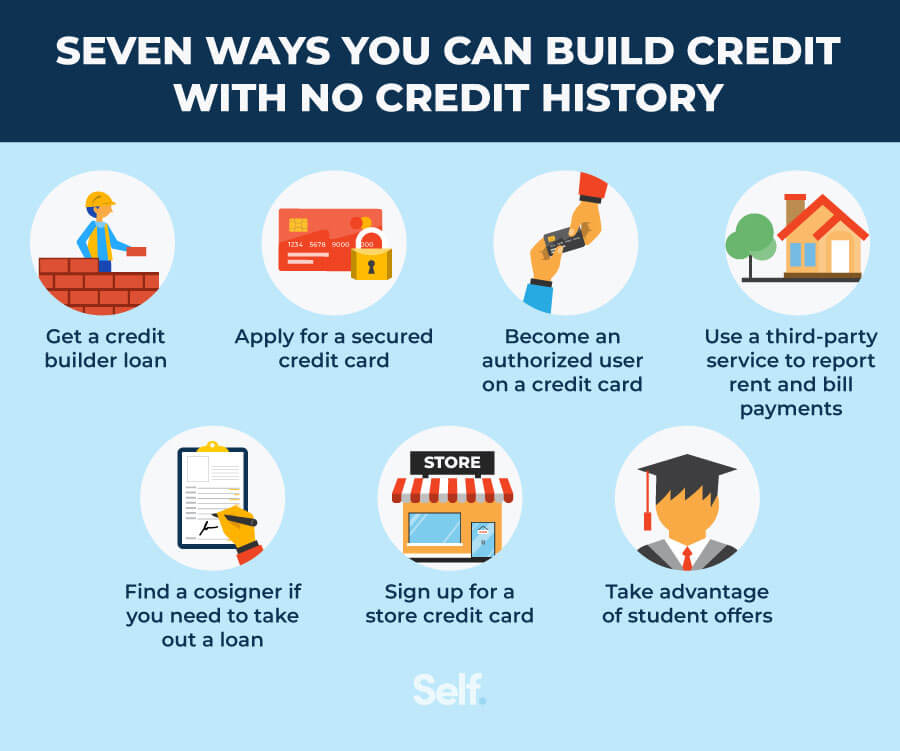

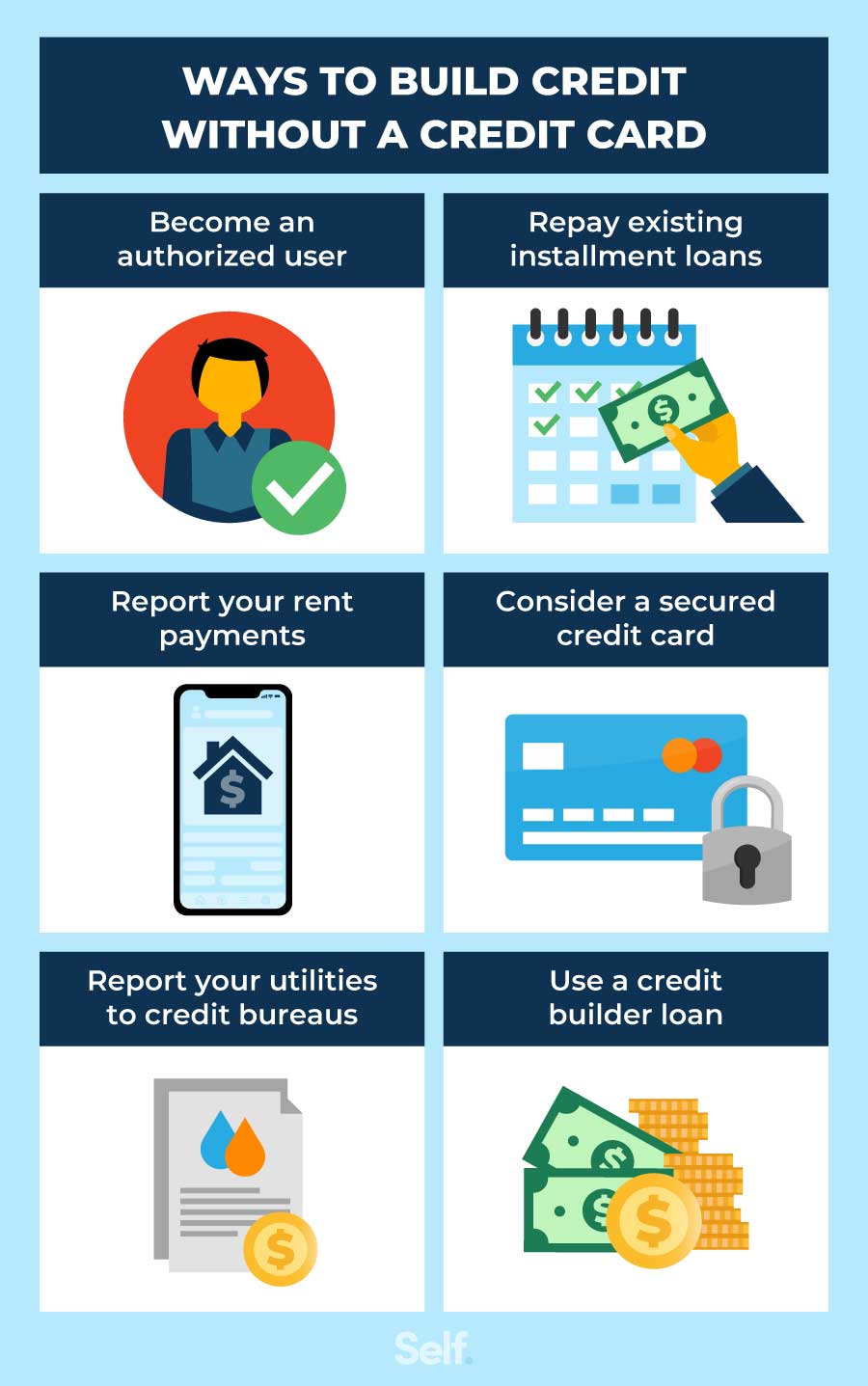

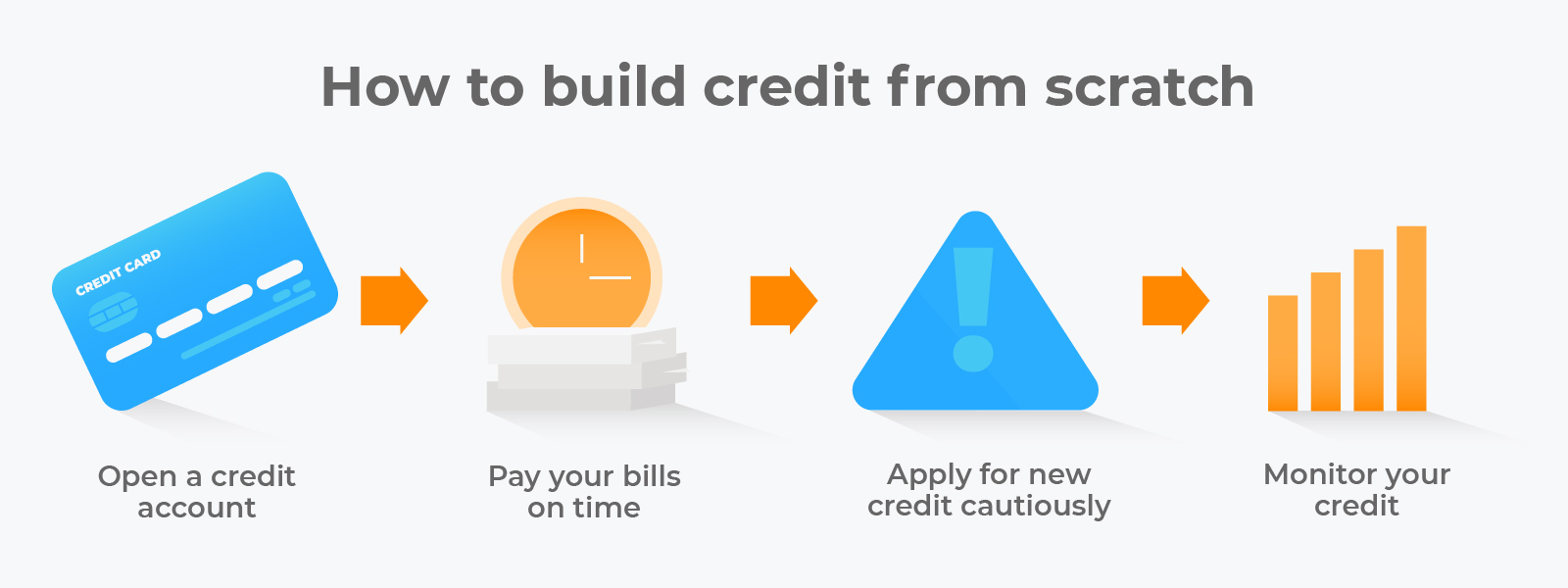

Is Self A Good Way To Build Credit - Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. With monthly payments that fit your budget and features like payment automation, it's a clear. Rent reporting and credit builder account. Reviews include the credit builder. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. Self could be a good way to build credit because it offers two options: Forgive yourself for missing a day, and intend to return to. Selfis a free credit monitoring system. Looking to build or rebuild credit without a credit check? No hard pull on your credit. Turn on your camera during zoom meetings, comment on your friends’ social media. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. It gives you access to your credit history at all times. Self could be a good way to build credit because it offers two options: Use a secured credit card: Self is best if you want to build credit and savings. Self is one of the best credit building tools of 2023, and for good reason. There will be days when things get in the way—you oversleep, forget to set your alarm, or feel overly tired. Just let yourself be seen. Selfis a free credit monitoring system. Self provides the credit builder account in the form of a certificate of deposit (cd), facilitated by their banking partners. The answer, put simply, is yes — self should help your credit scores as long as your credit builder account (and any other credit accounts in your name) is managed responsibly. With monthly payments that fit your budget and features. Rent reporting and credit builder account. Use a secured credit card: Selfis a free credit monitoring system. This is where they make their money. They provide all of this free of cost. They provide all of this free of cost. There will be days when things get in the way—you oversleep, forget to set your alarm, or feel overly tired. Ready to take control of your credit score? Self is best if you want to build credit and savings. But they also offer a credit builder accounts. Self provides the credit builder account in the form of a certificate of deposit (cd), facilitated by their banking partners. Use a secured credit card: Ready to take control of your credit score? This helps you establish and build credit. This is where they make their money. Self is best if you want to build credit and savings. Looking to build or rebuild credit without a credit check? See reviews from actual customers of self financial. Self could be a good way to build credit because it offers two options: Rent reporting and credit builder account. This is where they make their money. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. Rent reporting and credit builder account. Self is one of the best credit building tools of 2023, and for good reason. Looking to build or rebuild credit without a credit check? This helps you establish and build credit. Self is one of the best credit building tools of 2023, and for good reason. They provide all of this free of cost. Self is best if you want to build credit and savings. No hard pull on your credit. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. They provide all of this free of cost. Use the self credit builder account to show you can responsibly pay an installment loan and the self. Self provides the credit builder account in the form of a certificate of deposit (cd), facilitated by. Selfis a free credit monitoring system. But they also offer a credit builder accounts. Looking to build or rebuild credit without a credit check? This is where they make their money. Building a good credit score might sound intimidating. Self provides the credit builder account in the form of a certificate of deposit (cd), facilitated by their banking partners. The secured self visa® credit card¹ is crafted for the credit builder in mind. With no credit check or prior credit required, anyone can. Forgive yourself for missing a day, and intend to return to. There will be days when. They provide all of this free of cost. Selfis a free credit monitoring system. Self is best if you want to build credit and savings. Ready to take control of your credit score? Just let yourself be seen. Building a good credit score might sound intimidating. The secured self visa® credit card¹ is crafted for the credit builder in mind. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. The answer, put simply, is yes — self should help your credit scores as long as your credit builder account (and any other credit accounts in your name) is managed responsibly. However, if you’re starting from scratch and don’t have access to credit, you have options, such as credit builder loans. Self is one of the best credit building tools of 2023, and for good reason. It gives you access to your credit history at all times. See reviews from actual customers of self financial. With monthly payments that fit your budget and features like payment automation, it's a clear. Forgive yourself for missing a day, and intend to return to. Get your rent payments reported to all three credit bureaus for free, or pay a monthly.How to Build Credit Self. Credit Builder.

How to Build Credit The 7Step Guide Chime

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

Great Ways to Build Your Credit — Nonprofit Financial Services

Best Ways to Build Good Credit to Reach Your Financial Goals Good

7 Strategies to Build Credit with No Credit History

Is self a good way to build credit? Leia aqui How fast does self build

How To Build Credit Without a Credit Card Self. Credit Builder.

How to Build Credit in 7+ Ways Self. Credit Builder.

How Do I Build Good Credit From Scratch? NFCC National Foundation

No Hard Pull On Your Credit.

Self Could Be A Good Way To Build Credit Because It Offers Two Options:

This Helps You Establish And Build Credit.

As A Rule Of Thumb, I Like To Think That A Reasonable Rate Would Be Anything Around 1.5 Times The Current 10.

Related Post: