Land Cost Vs Building Cost

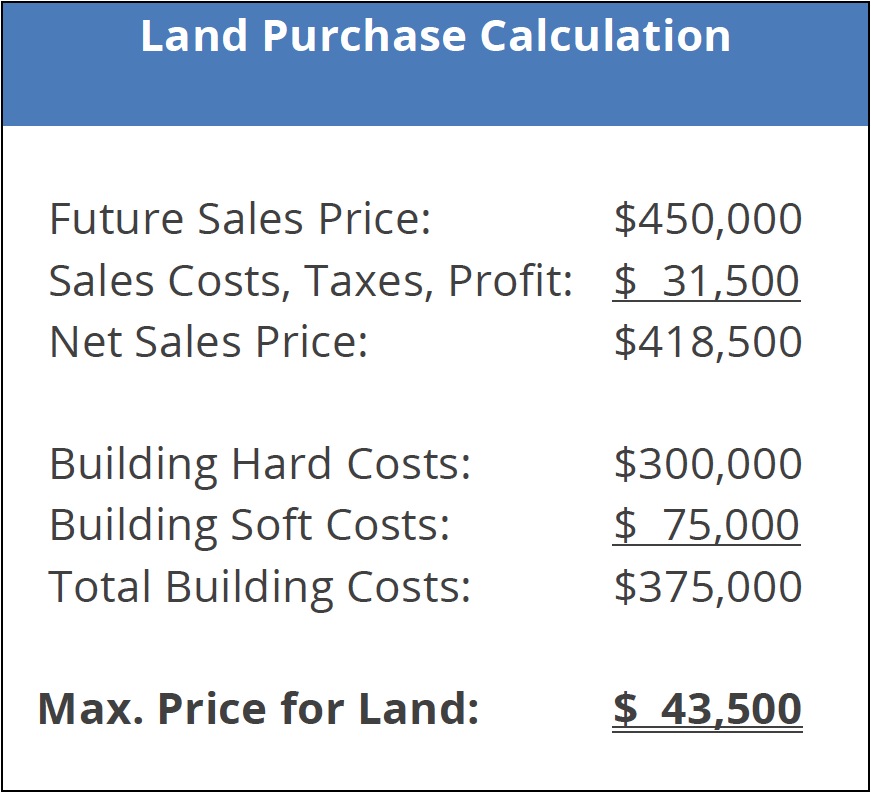

Land Cost Vs Building Cost - A recent analysis by issi romem tackles this question by plotting the building replacement value and land value in major metro areas throughout the country. In the world of cost segregation, two crucial factors play a pivotal role in determining depreciation: Land cost vs building cost. Here, you figure out what it costs to rebuild, giving you a good sense of the building's value compared to the land. When accounting for a land and building purchase, you'll need to look at your closing documents and allocate the price between your building, land and closing costs. In 2024, site work contributed an average of $32,719 to the cost of building a new home. + consider the purchase price, site development, and necessary improvements when budgeting for land. In the cost approach, it’s crucial to separate the land value from the building value. You can also calculate profits on land and buildings when. Developers buying large tracts of land to subdivide often budget more for development costs and fees than for. When accounting for a land and building purchase, you'll need to look at your closing documents and allocate the price between your building, land and closing costs. A recent analysis by issi romem tackles this question by plotting the building replacement value and land value in major metro areas throughout the country. When land and buildings are purchased for one price, tax preparers must advise their clients on the pros and cons of using various approaches to allocating the cost for tax. 3 tech tree depth on masonry:. We focus on calculating depreciation, which affects the building’s worth. The cost of land and the cost of building. In the cost approach, it’s crucial to separate the land value from the building value. Location and land costs significantly influence the overall expense of building a house. 2 happiness and 2 gold: + consider the purchase price, site development, and necessary improvements when budgeting for land. A recent analysis by issi romem tackles this question by plotting the building replacement value and land value in major metro areas throughout the country. In 2024, site work contributed an average of $32,719 to the cost of building a new home. In the world of cost segregation, two crucial factors play a pivotal role in determining depreciation: + consider. The cost of land and the cost of building. + consider the purchase price, site development, and necessary improvements when budgeting for land. Developers buying large tracts of land to subdivide often budget more for development costs and fees than for. We focus on calculating depreciation, which affects the building’s worth. Here, you figure out what it costs to rebuild,. Developers buying large tracts of land to subdivide often budget more for development costs and fees than for. Here, you figure out what it costs to rebuild, giving you a good sense of the building's value compared to the land. 2 happiness and 2 gold: If you buy buildings and your cost includes the cost of the land on which. + consider the purchase price, site development, and necessary improvements when budgeting for land. We focus on calculating depreciation, which affects the building’s worth. Here, you figure out what it costs to rebuild, giving you a good sense of the building's value compared to the land. Replacement cost info ain't just for bragging rights; You can calculate these figures, either. Land cost vs building cost. Here, you figure out what it costs to rebuild, giving you a good sense of the building's value compared to the land. We focus on calculating depreciation, which affects the building’s worth. In 2024, site work contributed an average of $32,719 to the cost of building a new home. Developers buying large tracts of land. Location and land costs significantly influence the overall expense of building a house. When accounting for a land and building purchase, you'll need to look at your closing documents and allocate the price between your building, land and closing costs. You can calculate these figures, either at the time you buy the property or when you file taxes indicating depreciation.. You can calculate these figures, either at the time you buy the property or when you file taxes indicating depreciation. You can also calculate profits on land and buildings when. The cost of land and the cost of building. When land and buildings are purchased for one price, tax preparers must advise their clients on the pros and cons of. When accounting for a land and building purchase, you'll need to look at your closing documents and allocate the price between your building, land and closing costs. Replacement cost info ain't just for bragging rights; Here, you figure out what it costs to rebuild, giving you a good sense of the building's value compared to the land. In the world. You can calculate these figures, either at the time you buy the property or when you file taxes indicating depreciation. When accounting for a land and building purchase, you'll need to look at your closing documents and allocate the price between your building, land and closing costs. We focus on calculating depreciation, which affects the building’s worth. If you buy. You can calculate these figures, either at the time you buy the property or when you file taxes indicating depreciation. Urban areas with high demand typically command premium prices for land, while rural. In the world of cost segregation, two crucial factors play a pivotal role in determining depreciation: In the cost approach, it’s crucial to separate the land value. Here, you figure out what it costs to rebuild, giving you a good sense of the building's value compared to the land. When land and buildings are purchased for one price, tax preparers must advise their clients on the pros and cons of using various approaches to allocating the cost for tax. Developers buying large tracts of land to subdivide often budget more for development costs and fees than for. Urban areas with high demand typically command premium prices for land, while rural. A recent analysis by issi romem tackles this question by plotting the building replacement value and land value in major metro areas throughout the country. In the cost approach, it’s crucial to separate the land value from the building value. In 2024, site work contributed an average of $32,719 to the cost of building a new home. If you buy buildings and your cost includes the cost of the land on which they stand, you must divide the cost between the land and the buildings to figure the basis for depreciation. You can calculate these figures, either at the time you buy the property or when you file taxes indicating depreciation. Before bidding on land, you need a rough budget for major development costs. You can also calculate profits on land and buildings when. In the world of cost segregation, two crucial factors play a pivotal role in determining depreciation: Location and land costs significantly influence the overall expense of building a house. + consider the purchase price, site development, and necessary improvements when budgeting for land. We focus on calculating depreciation, which affects the building’s worth. When accounting for a land and building purchase, you'll need to look at your closing documents and allocate the price between your building, land and closing costs.Land prices, house prices and construction costs. Download Scientific

Savills UK The value of land

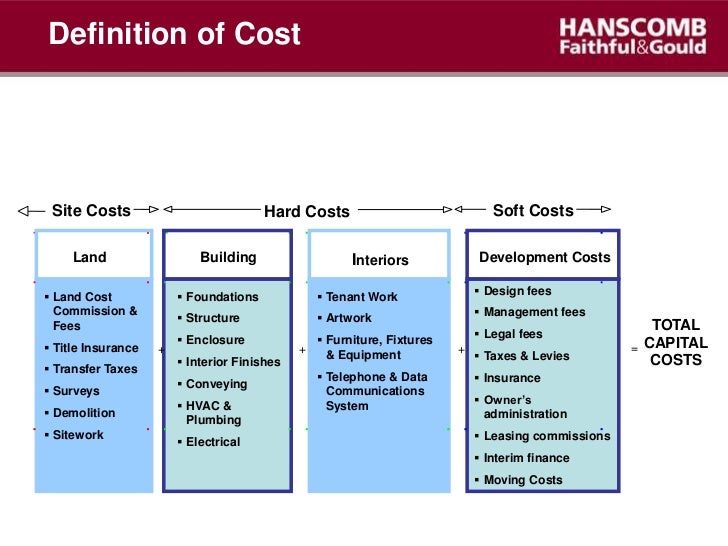

Qs Approach To Project Cost

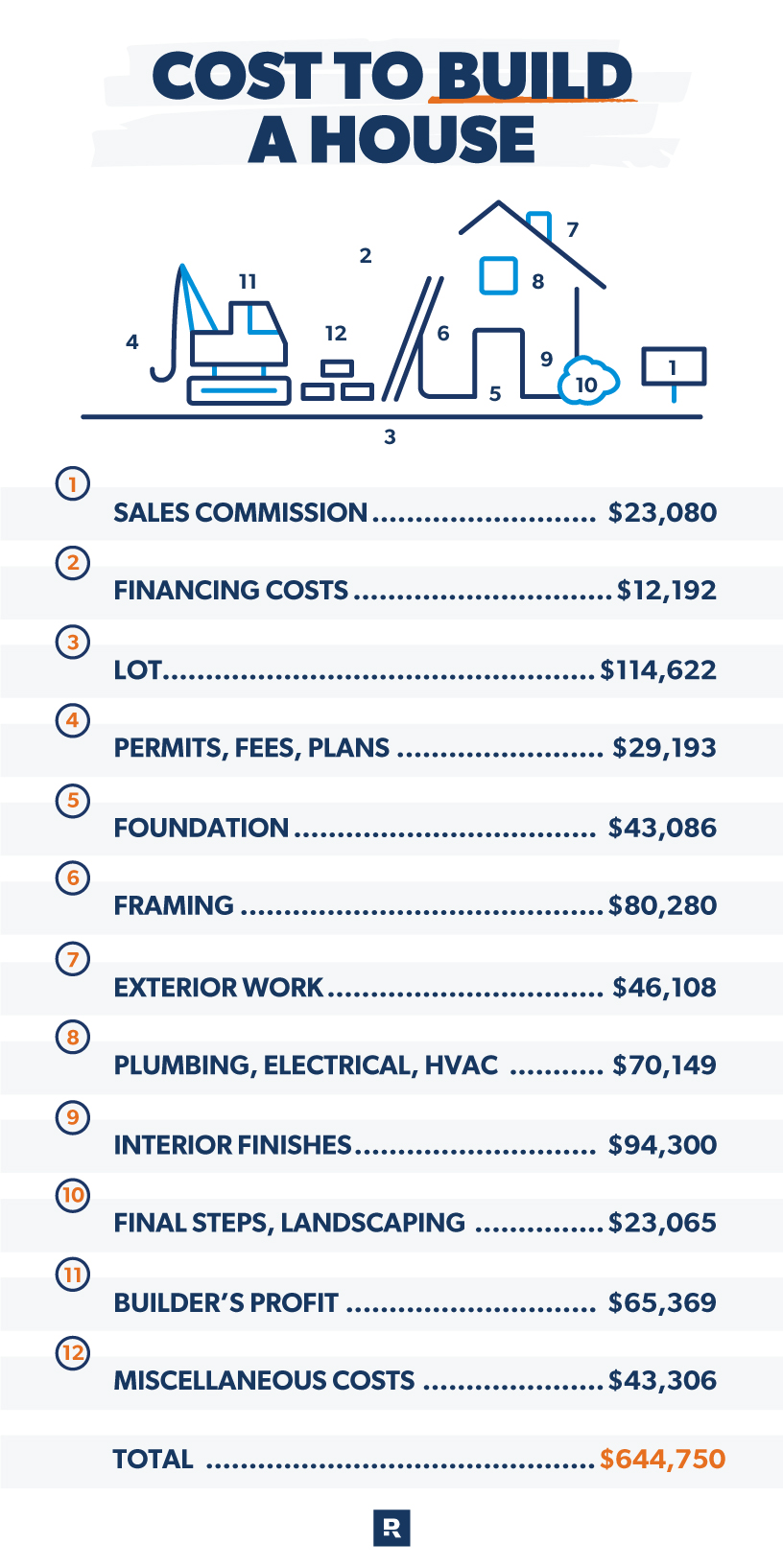

Building a House? The Pros and Cons Ramsey

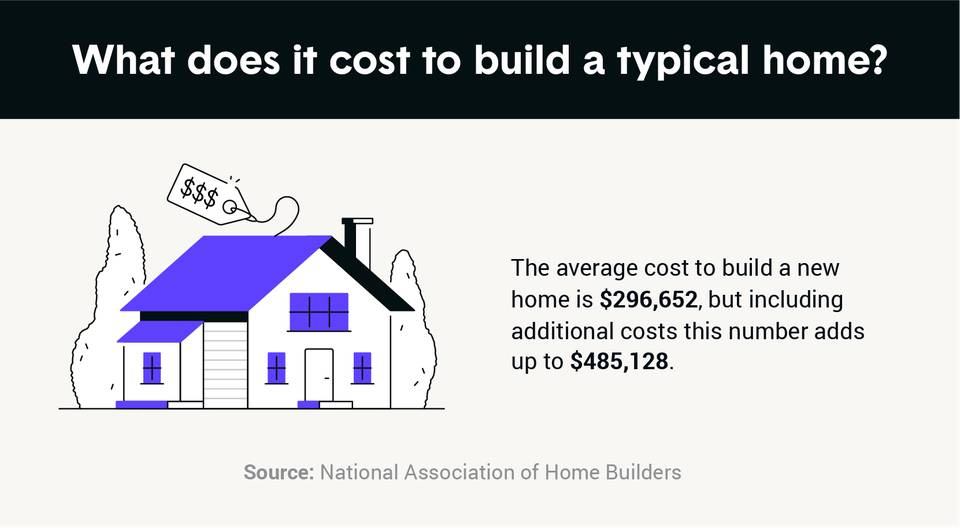

The real costs of new construction + 6 tips for building on a budget

Important Costs For Your Property Development Cost Budget

constructioncostsaffectlandvalues The Urbanist

How much does it cost to build a house after buying land kobo building

Percentage of distribution of the total development costs. Download

Construction Costs and Residential Land Prices PostCrisis Years

2 Happiness And 2 Gold:

3 Tech Tree Depth On Masonry:.

Replacement Cost Info Ain't Just For Bragging Rights;

The Cost Of Land And The Cost Of Building.

Related Post:

.png)