Lease A Building

Lease A Building - Here are seven of the most critical items to review and understand before acquiring a commercial property for rent: Consider initial leasing and rent costs as. Search chicago, il commercial real estate for lease or sale properties by space availability, square footage, or lease rate. A single net lease is a types of commercial lease where the tenant pays rent plus property taxes, while the landlord covers operating expenses. Knowing the types of leases available, and what each structure does or does not include in the quoted rent price, will help you budget for your next commercial space. It is important to understand the needs of your business when reviewing a lease. • your business is growing and you are not sure how fast you. The most common type of commercial lease used in the market, a net lease is an agreement where the tenant covers the base rent on top of other costs, like utilities and maintenance. There are a few reasons it could make more sense for your business to lease a commercial property, including: A leasehold property means you own the building but not the land it sits on. First month rent due upon signing lease. A building lease is a legal contract used by landlords and tenants to formally agree on the rental terms of commercial buildings that are used for office, industrial, or retail purposes. Factors that include lease terms, room for expansion, and property accessibility must all be considered. A gsa spokesperson confirmed that usaid had been removed from the lease and the building would be repurposed for other government uses. There are a few reasons it could make more sense for your business to lease a commercial property, including: Find commercial space and listings in chicago. • your business is growing and you are not sure how fast you. What is a single net lease? Here are seven of the most critical items to review and understand before acquiring a commercial property for rent: A leasehold property means you own the building but not the land it sits on. You pay the rent on top of the property taxes. The most common type of commercial lease used in the market, a net lease is an agreement where the tenant covers the base rent on top of other costs, like utilities and maintenance. Follow these steps when evaluating a commercial building lease before making a final decision: View expiring lease/occupancy. • your business is growing and you are not sure how fast you. First month rent due upon signing lease. Up to 25% cash back renting commercial space is a big responsibility—the success or failure of your business could ride on certain terms of the lease. Instead, you lease the land from the freeholder (landowner) for a set period, which. A leasehold property means you own the building but not the land it sits on. Search chicago, il commercial real estate for lease or sale properties by space availability, square footage, or lease rate. Find commercial space and listings in chicago. Browse this list of states/provinces to find all of the buildings for which zillow has data. A gsa spokesperson. Search chicago commercial real estate for sale or lease on century 21. A leasehold property means you own the building but not the land it sits on. Read and understand the contract, and have an. Completely renovated building all utilities included first month rent due upon signing lease minimum 650 credit score and verifiable income of $5700 a month cosigners. Up to 25% cash back renting commercial space is a big responsibility—the success or failure of your business could ride on certain terms of the lease. Find commercial space and listings in chicago. You pay the rent on top of the property taxes. Follow these steps when evaluating a commercial building lease before making a final decision: Instead, you lease. Search chicago commercial real estate for sale or lease on century 21. First month rent due upon signing lease. Partner insights spoke to jay sugarman to get more insight into his firm’s approach to ground leasing in the modern markets. A gsa spokesperson confirmed that usaid had been removed from the lease and the building would be repurposed for other. Here are seven of the most critical items to review and understand before acquiring a commercial property for rent: First month rent due upon signing lease. You pay the rent on top of the property taxes. What is a single net lease? To ensure that your decision is the right one, here are 18 rental questions you'll. What is a single net lease? Up to 25% cash back renting commercial space is a big responsibility—the success or failure of your business could ride on certain terms of the lease. Browse this list of states/provinces to find all of the buildings for which zillow has data. • your business is growing and you are not sure how fast. A building lease is a legal contract used by landlords and tenants to formally agree on the rental terms of commercial buildings that are used for office, industrial, or retail purposes. Completely renovated building all utilities included first month rent due upon signing lease minimum 650 credit score and verifiable income of $5700 a month cosigners are ok please. A. Work with a commercial real. A building lease is a legal contract used by landlords and tenants to formally agree on the rental terms of commercial buildings that are used for office, industrial, or retail purposes. Consider initial leasing and rent costs as. Building lease agreements are often seen in commercial leasing and are beneficial in protecting the rights of. Here are seven of the most critical items to review and understand before acquiring a commercial property for rent: View expiring lease/occupancy information for more than 8,600 leased and 1,500 government owned buildings. A building lease is a legal contract used by landlords and tenants to formally agree on the rental terms of commercial buildings that are used for office, industrial, or retail purposes. It is important to understand the needs of your business when reviewing a lease. Completely renovated building all utilities included first month rent due upon signing lease minimum 650 credit score and verifiable income of $5700 a month cosigners are ok please. First month rent due upon signing lease. Work with a commercial real. Partner insights spoke to jay sugarman to get more insight into his firm’s approach to ground leasing in the modern markets. A single net lease is a types of commercial lease where the tenant pays rent plus property taxes, while the landlord covers operating expenses. Follow these steps when evaluating a commercial building lease before making a final decision: Consider initial leasing and rent costs as. There are a few reasons it could make more sense for your business to lease a commercial property, including: • your business is growing and you are not sure how fast you. Sugarman is the chairman and ceo of safehold, a. Read and understand the contract, and have an. Search chicago, il commercial real estate for lease or sale properties by space availability, square footage, or lease rate.How to Lease Commercial Real Estate The Ultimate Guide

Lease Plans Lasertech Floorplans

A Commercial Lease Guide For Real Estate Tenants TXRE Properties

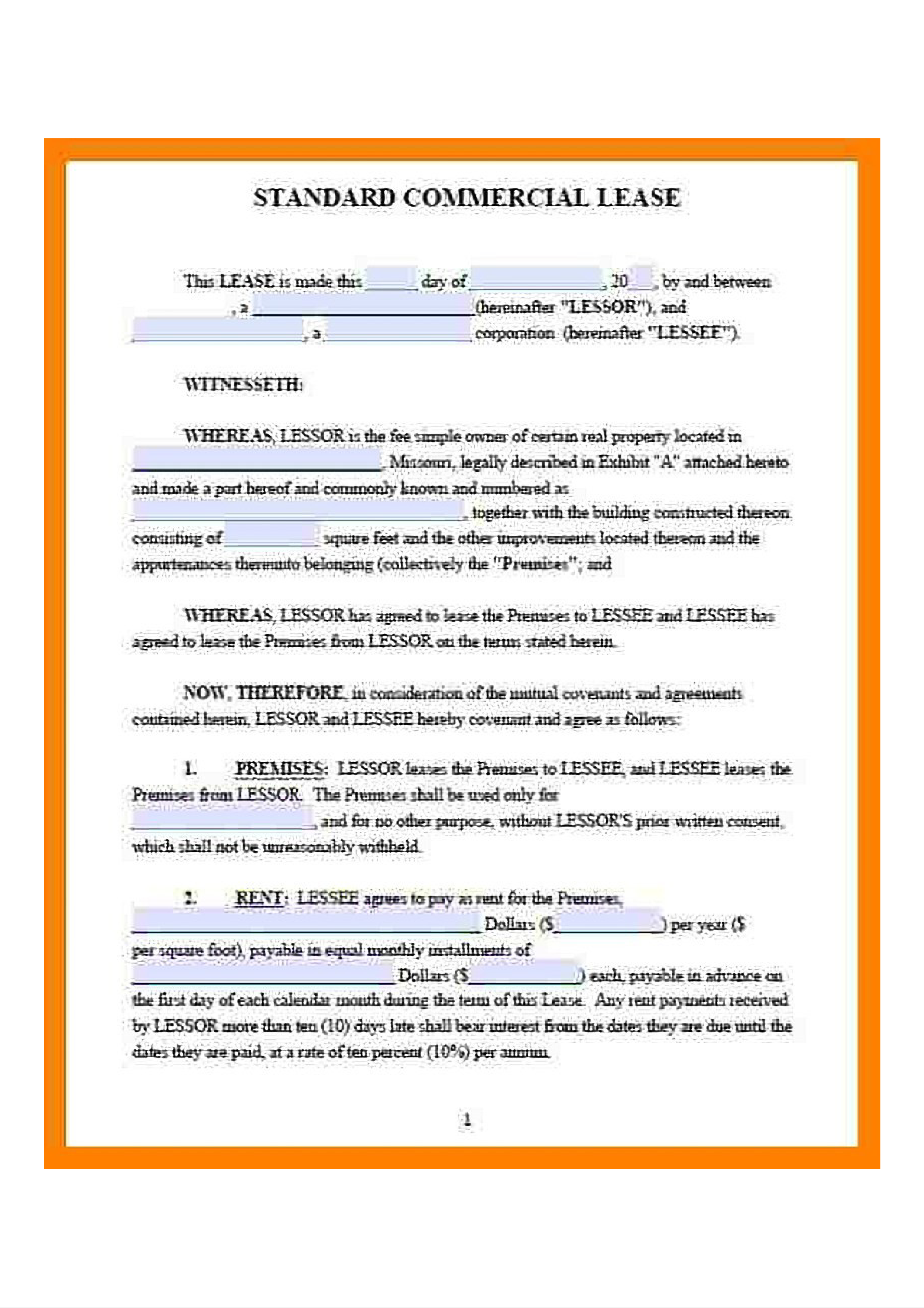

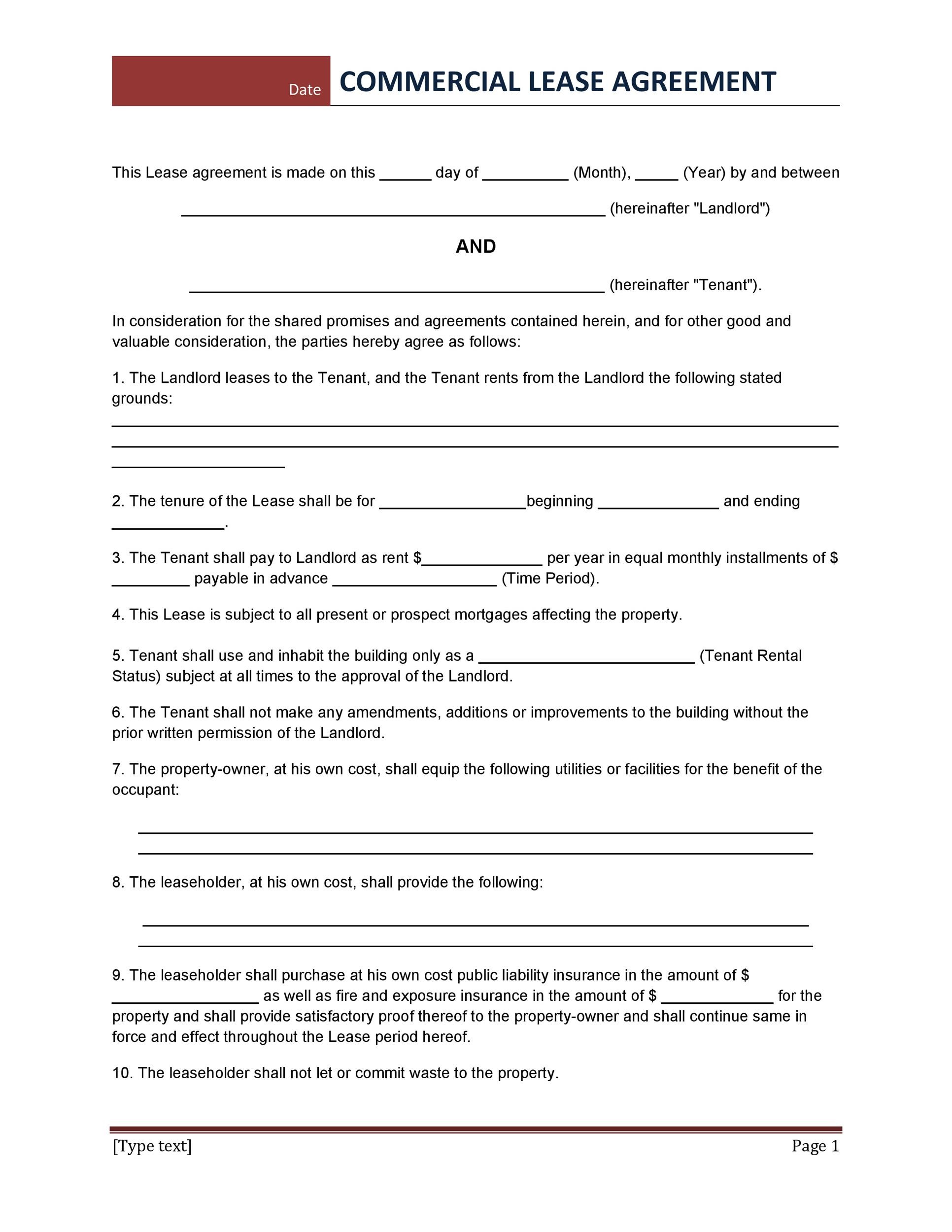

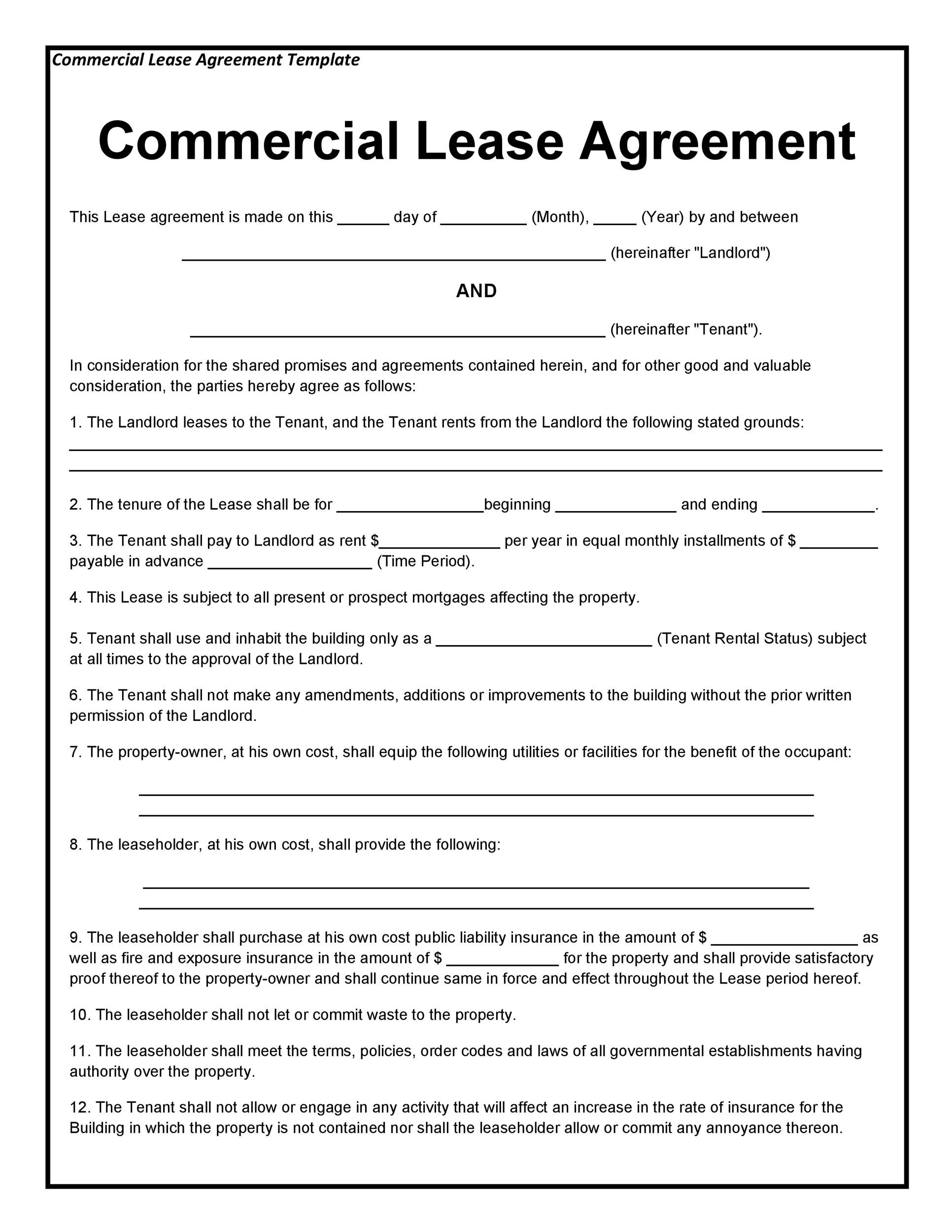

Free Commercial Lease Agreement Template (US) LawDepot

FREE 6+ Sample Commercial Lease Templates in PDF

Free Rental & Lease Agreement Templates PDF & Word

Property Lease Agreement Sample Templates at

Lease Agreement Templates 12+ Free Word, Excel & PDF Formats, Samples

Lease Agreement Templates 12+ Free Word, Excel & PDF Formats, Samples

FREE 49+ Lease Agreement Formats & Templates in PDF MS Word Google

The Most Common Type Of Commercial Lease Used In The Market, A Net Lease Is An Agreement Where The Tenant Covers The Base Rent On Top Of Other Costs, Like Utilities And Maintenance.

Up To 25% Cash Back Renting Commercial Space Is A Big Responsibility—The Success Or Failure Of Your Business Could Ride On Certain Terms Of The Lease.

A Gsa Spokesperson Confirmed That Usaid Had Been Removed From The Lease And The Building Would Be Repurposed For Other Government Uses.

Building Lease Agreements Are Often Seen In Commercial Leasing And Are Beneficial In Protecting The Rights Of Both The Landlord And The Tenant.

Related Post: