Leveraging Real Estate To Build Wealth

Leveraging Real Estate To Build Wealth - Let's explore the top 10 strategies to use real estate as a powerful tool for building wealth with actionable insights and proven methods. Real estate has long been recognized as a solid investment strategy, offering both stability and potential for significant returns. Align real estate investments with family goals—whether for wealth preservation, income generation or legacy building. Flippers try to buy undervalued real estate, fix it up, and sell it for. Both understood that capital and leverage are essential to building serious wealth. Use the $500,000 in capital. We give you exactly what you need to find deals, close profitable investments, and grow your income through real estate! Understanding your goals can narrow down. Build wealth with rental properties. And the significant step of any investor is to get hold of. Here are bny mellon wealth’s six key tips for how to leverage real estate investment strategies to grow generational wealth. You could build a diverse portfolio of real estate investments across property types and geographies by investing in multiple dsts. Both understood that capital and leverage are essential to building serious wealth. Understanding your goals can narrow down. Communicate this vision clearly to maintain alignment. It is all about making clever decisions and taking strategic risks. Build wealth with rental properties. What makes real estate so special? Financing, or leveraging, a real estate investment can help you buy a larger or more valuable property than you otherwise could have. Strategies to expedite wealth building in. So if you’re looking to create true financial freedom, part of your investing strategy should include building a real estate portfolio. If you are interested in creating a valuable,. Some of the ways are. Build wealth with rental properties. Here are bny mellon wealth’s six key tips for how to leverage real estate investment strategies to grow generational wealth. Strategies to expedite wealth building in. So if you’re looking to create true financial freedom, part of your investing strategy should include building a real estate portfolio. Align real estate investments with family goals—whether for wealth preservation, income generation or legacy building. Build wealth with rental properties. The first step of the brrrr. Align real estate investments with family goals—whether for wealth preservation, income generation or legacy building. Using the $1 million hypothetical investment. So if you’re looking to create true financial freedom, part of your investing strategy should include building a real estate portfolio. Here are bny mellon wealth’s six key tips for how to leverage real estate investment strategies to grow. Let's explore the top 10 strategies to use real estate as a powerful tool for building wealth with actionable insights and proven methods. Here are bny mellon wealth’s six key tips for how to leverage real estate investment strategies to grow generational wealth. If you are interested in creating a valuable,. Flippers try to buy undervalued real estate, fix it. Some of the ways are. Use the $500,000 in capital. Both understood that capital and leverage are essential to building serious wealth. One of the key ways investors can make money in real estate is to become a landlord of a rental property. Understanding your goals can narrow down. This article discusses how housing debt can be used to both create and destroy wealth and things one should consider with leveraging real estate. So if you’re looking to create true financial freedom, part of your investing strategy should include building a real estate portfolio. The brrrr process allows investors to build passive income over time by leveraging the real. Build wealth with rental properties. Communicate this vision clearly to maintain alignment. This article discusses how housing debt can be used to both create and destroy wealth and things one should consider with leveraging real estate. And the significant step of any investor is to get hold of. One of the key ways investors can make money in real estate. Use the $500,000 in capital. Both understood that capital and leverage are essential to building serious wealth. Real estate has long been recognized as a solid investment strategy, offering both stability and potential for significant returns. Communicate this vision clearly to maintain alignment. One of the key ways investors can make money in real estate is to become a landlord. Flippers try to buy undervalued real estate, fix it up, and sell it for. There are huge opportunities to yield wealth in real estate investing. If you are interested in creating a valuable,. Using the $1 million hypothetical investment. Build a portfolio of 5 or more rental properties that generate cash flow and equity growth. You could build a diverse portfolio of real estate investments across property types and geographies by investing in multiple dsts. The brrrr process allows investors to build passive income over time by leveraging the real estate market to their advantage. Build wealth with rental properties. And the significant step of any investor is to get hold of. The first step. We give you exactly what you need to find deals, close profitable investments, and grow your income through real estate! There are huge opportunities to yield wealth in real estate investing. One of the key ways investors can make money in real estate is to become a landlord of a rental property. If you are interested in creating a valuable,. What makes real estate so special? Build wealth with rental properties. Use the $500,000 in capital. You could build a diverse portfolio of real estate investments across property types and geographies by investing in multiple dsts. The brrrr process allows investors to build passive income over time by leveraging the real estate market to their advantage. Strategies to expedite wealth building in. Align real estate investments with family goals—whether for wealth preservation, income generation or legacy building. Flippers try to buy undervalued real estate, fix it up, and sell it for. Let's explore the top 10 strategies to use real estate as a powerful tool for building wealth with actionable insights and proven methods. It is all about making clever decisions and taking strategic risks. So if you’re looking to create true financial freedom, part of your investing strategy should include building a real estate portfolio. Real estate investments can also help you diversify your portfolio and protect it from stock market volatility.Things To Consider When Leveraging Real Estate To Build Wealth

How investors use leverage in real estate to build wealth

How To Build Wealth With Real Estate

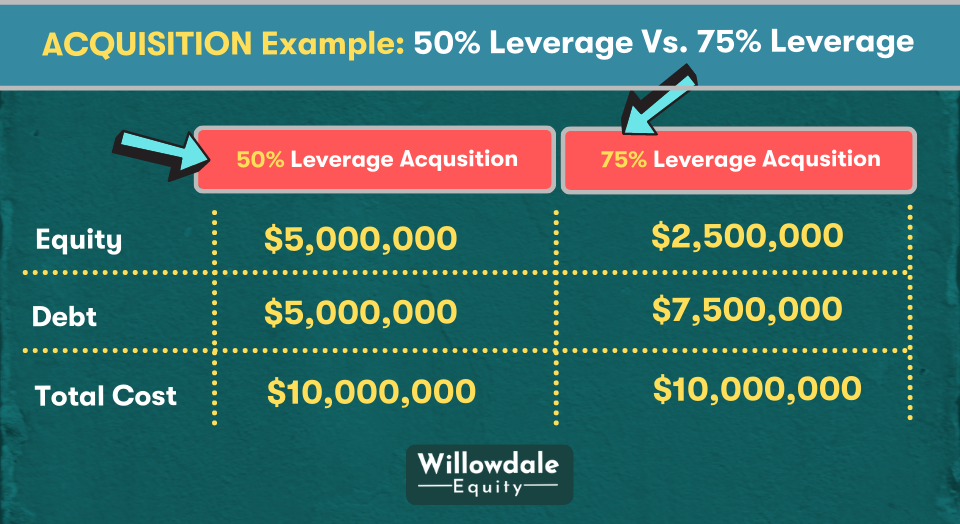

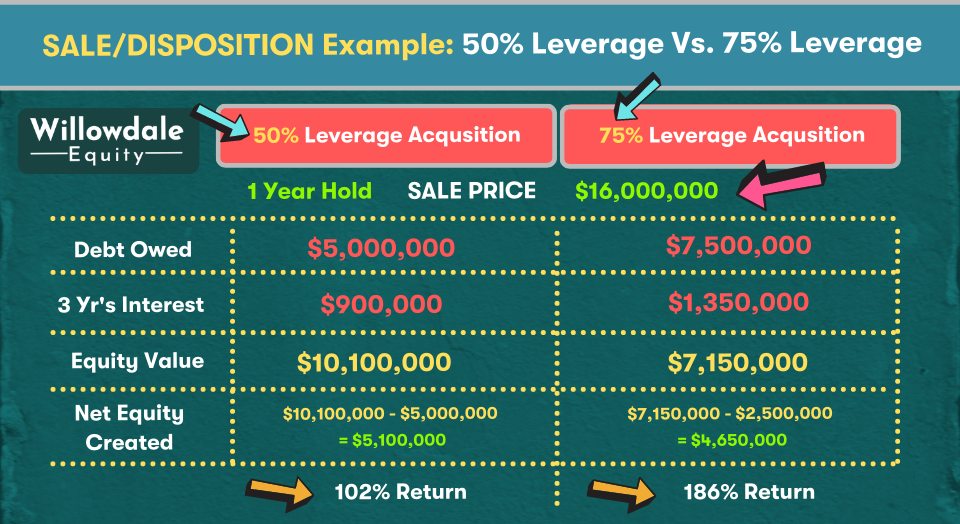

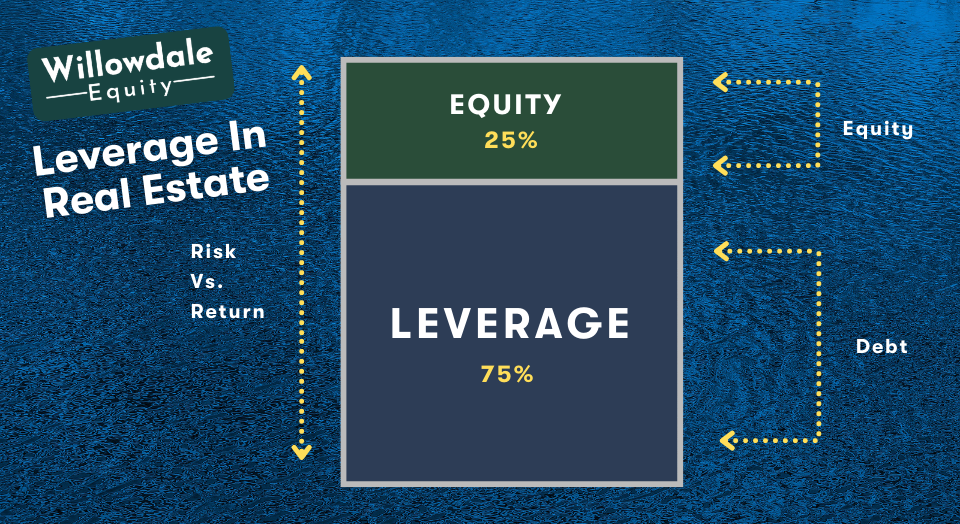

Using Leverage in Real Estate to Build Wealth & Generate Returns

How to Leverage Real Estate to Build Consistent Wealth

Using Leverage in Real Estate to Build Wealth & Generate Returns

Transform Your Life How to Leverage Real Estate to Build Wealth YouTube

How Practical Is It To Leverage Real Estate To Build Wealth? Here’s The

Using Leverage in Real Estate to Build Wealth & Generate Returns

How to Start Leveraging Real Estate to Build Wealth

Understanding Your Goals Can Narrow Down.

Sebastian Jania, The Owner Of Ontario Property Buyers, Added, “When One Invests In Real Estate, They’re Able To Build Wealth Through A Couple Different Ways.

Real Estate Has Long Been Recognized As A Solid Investment Strategy, Offering Both Stability And Potential For Significant Returns.

The First Step Of The Brrrr.

Related Post: