Liability Insurance On House While Building A House

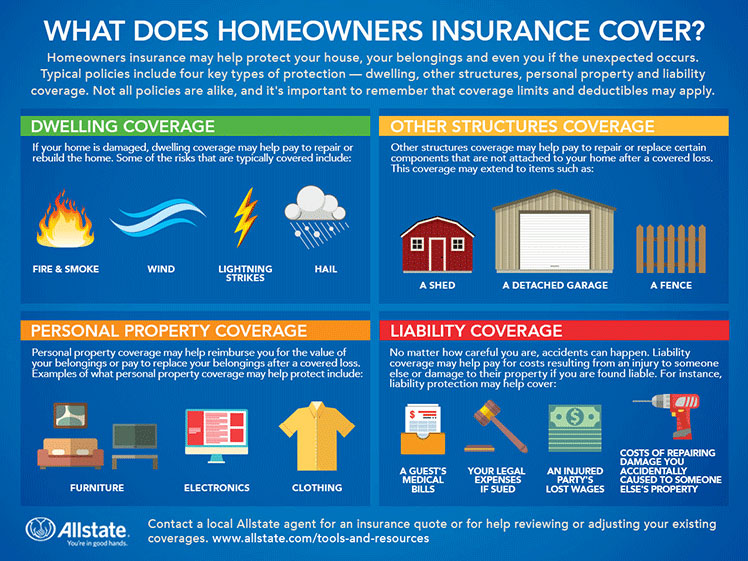

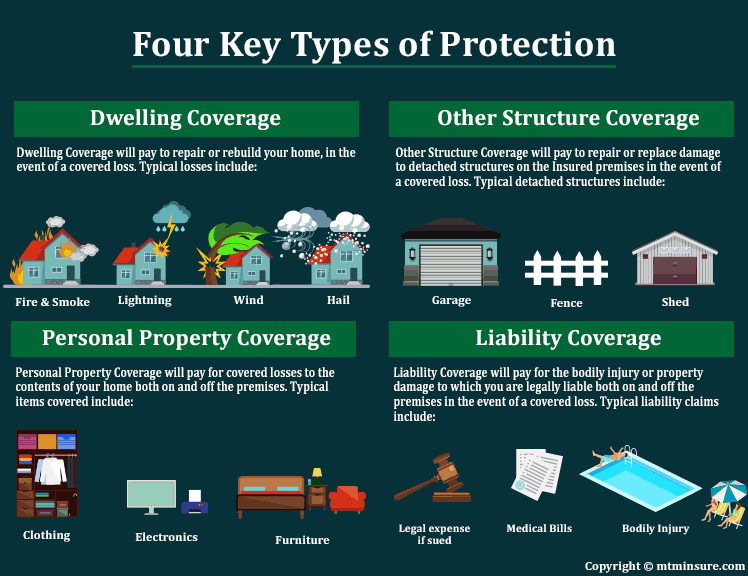

Liability Insurance On House While Building A House - Builders risk insurance focuses on protecting the construction project itself, while premises liability covers legal and medical costs arising from injuries. Unlike builder’s risk, which protects the construction site, home insurance protects the property owner. Your homeowner’s insurance will also include liability coverage, so you’ll be safe in the event that someone gets injured on the property before the home is completed. While general liability is a powerful start, it simply can’t cover every eventuality. Your existing insurance agent may be able to help you with a. Comprehensive coverage for the project. Even when your house is being built, you still need insurance coverage. Here are the six steps you can take to insure your new home during construction: Builders risk insurance is a. It will cover risks to building materials, whether they are on the construction site, stored at another. Here are the six steps you can take to insure your new home during construction: Specifically, it provides personal liability coverage in the event of an. Dwelling under construction insurance will protect a house while it is being built. Comprehensive coverage for the project. In some cases, liability insurance is. Builders risk insurance covers property during a construction project, while general liability coverage broadly insures businesses against bodily injury, property damage and. With a business owner's policy and other common small business insurance coverages like commercial auto, workers compensation, and cyber, you'll have protection from risks like. Builders risk insurance focuses on protecting the construction project itself, while premises liability covers legal and medical costs arising from injuries. It will cover risks to building materials, whether they are on the construction site, stored at another. Do you need homeowners insurance while your home is under construction? Dwelling under construction insurance will protect a house while it is being built. Unlike builder’s risk, which protects the construction site, home insurance protects the property owner. Your homeowner’s insurance will also include liability coverage, so you’ll be safe in the event that someone gets injured on the property before the home is completed. Here are the six steps you. It covers your liability with the land (such as if a child wanders onto the job site and hurts himself on your property on a sunday afternoon while nobody is there), and also covers property you. Even when your house is being built, you still need insurance coverage. Builders risk insurance is a. Your existing insurance agent may be able. Builders risk insurance focuses on protecting the construction project itself, while premises liability covers legal and medical costs arising from injuries. Specifically, it provides personal liability coverage in the event of an. It covers your liability with the land (such as if a child wanders onto the job site and hurts himself on your property on a sunday afternoon while. In some cases, liability insurance is. Dwelling under construction insurance will protect a house while it is being built. Specifically, it provides personal liability coverage in the event of an. With a business owner's policy and other common small business insurance coverages like commercial auto, workers compensation, and cyber, you'll have protection from risks like. While general liability is a. Unlike builder’s risk, which protects the construction site, home insurance protects the property owner. It covers your liability with the land (such as if a child wanders onto the job site and hurts himself on your property on a sunday afternoon while nobody is there), and also covers property you. Comprehensive coverage for the project. Builders risk insurance covers property. Your homeowner’s insurance will also include liability coverage, so you’ll be safe in the event that someone gets injured on the property before the home is completed. Your existing insurance agent may be able to help you with a. Comprehensive coverage for the project. With a business owner's policy and other common small business insurance coverages like commercial auto, workers. Even when your house is being built, you still need insurance coverage. With a business owner's policy and other common small business insurance coverages like commercial auto, workers compensation, and cyber, you'll have protection from risks like. While general liability is a powerful start, it simply can’t cover every eventuality. Dwelling under construction insurance will protect a house while it. Your homeowner’s insurance will also include liability coverage, so you’ll be safe in the event that someone gets injured on the property before the home is completed. Dwelling under construction insurance will protect a house while it is being built. It will cover risks to building materials, whether they are on the construction site, stored at another. Liability coverage will. Your existing insurance agent may be able to help you with a. Builders risk insurance is a. Before getting started on your project, ensure the building contractor you hire has adequate insurance coverage, including liability and worker's compensation. Here are the six steps you can take to insure your new home during construction: It covers your liability with the land. Before getting started on your project, ensure the building contractor you hire has adequate insurance coverage, including liability and worker's compensation. Here are the six steps you can take to insure your new home during construction: While general liability is a powerful start, it simply can’t cover every eventuality. In some cases, liability insurance is. Unlike builder’s risk, which protects. Comprehensive coverage for the project. Dwelling under construction insurance will protect a house while it is being built. Specifically, it provides personal liability coverage in the event of an. Builders risk insurance focuses on protecting the construction project itself, while premises liability covers legal and medical costs arising from injuries. Even when your house is being built, you still need insurance coverage. Builders risk insurance is a. Do you need homeowners insurance while your home is under construction? It will cover risks to building materials, whether they are on the construction site, stored at another. Your existing insurance agent may be able to help you with a. Before getting started on your project, ensure the building contractor you hire has adequate insurance coverage, including liability and worker's compensation. While general liability is a powerful start, it simply can’t cover every eventuality. Unlike builder’s risk, which protects the construction site, home insurance protects the property owner. In some cases, liability insurance is. It covers your liability with the land (such as if a child wanders onto the job site and hurts himself on your property on a sunday afternoon while nobody is there), and also covers property you. Your homeowner’s insurance will also include liability coverage, so you’ll be safe in the event that someone gets injured on the property before the home is completed.What Is Personal Liability Home Insurance? Types, Advantages

House Insurance while Building is Under Construction Home insurance

Self Build Insurance What Insurance You Need & When Build It

Builders Liability Insurance Insurance Hub

Is your builder insured? Insurance, Building, Liability insurance

Landlord Liability Insurance Guide for NYC Building Owners

Builders Public Liability Insurance, Construction Liability Insurance

Homeowners Insurance 101 Allstate

How Much Does Builders Risk Insurance Cost? Commercial Insurance

Save Money and Time Homeowner Insurance Get Quotes MA NH

Liability Coverage Will Help You Cover Some Of The Costs Of Legal Expenses If Someone Is Injured On Your Building Site.

Here Are The Six Steps You Can Take To Insure Your New Home During Construction:

Builders Risk Insurance Covers Property During A Construction Project, While General Liability Coverage Broadly Insures Businesses Against Bodily Injury, Property Damage And.

With A Business Owner's Policy And Other Common Small Business Insurance Coverages Like Commercial Auto, Workers Compensation, And Cyber, You'll Have Protection From Risks Like.

Related Post: