Listed Building Insurance

Listed Building Insurance - Listed buildings insurance is an important way to help safeguard your investment in such unique structures. Builder’s risk insurance, which some refer to as course of construction insurance, is a form of commercial property insurance which covers a. Learn about the benefits and challenges of owning a listed building and how to get the right insurance cover. Looking for builders risk insurance in chicago? Listed houses insurance is a specialised type of cover designed to protect these historical gems. Elevate has extensive experience insuring listed buildings. Explore insurance options for listed buildings to protect their historical value. This type of insurance is there to protect you against sudden,. Based on our analysis, the top companies. Policies are designed to account for the market value of specialist materials and. Compare policies that protect unique architectural properties. Listed buildings insurance is an important way to help safeguard your investment in such unique structures. Elevate has extensive experience insuring listed buildings. Listed home insurance is a specialised type of insurance product tailored for properties that are officially recognized for their historical or architectural significance. It’s tailored to address the. This article breaks down what constitutes a listed building, the types of insurance needed—like building and contents insurance—and what specific aspects are covered. When choosing listed building insurance, look for a specialist insurance provider or a home insurer that offers custom home insurance for listed properties. Listed building insurance is specifically tailored to address the needs of historic properties. Learn about the benefits and challenges of owning a listed building and how to get the right insurance cover. Buildings insurance covers the structure of your home, such as the walls, roof, windows, pipes and fixtures. Listed buildings insurance is an important way to help safeguard your investment in such unique structures. This article breaks down what constitutes a listed building, the types of insurance needed—like building and contents insurance—and what specific aspects are covered. Explore insurance options for listed buildings to protect their historical value. Elevate has extensive experience insuring listed buildings. Builder’s risk insurance,. Learn about the benefits and challenges of owning a listed building and how to get the right insurance cover. Buildings insurance covers the structure of your home, such as the walls, roof, windows, pipes and fixtures. It’s tailored to address the. Explore insurance options for listed buildings to protect their historical value. John lewis finance offers bespoke and personal service. When choosing listed building insurance, look for a specialist insurance provider or a home insurer that offers custom home insurance for listed properties. Builder’s risk insurance, which some refer to as course of construction insurance, is a form of commercial property insurance which covers a. Based on our analysis, the top companies. Learn about the benefits and challenges of owning. Policies are designed to account for the market value of specialist materials and. Listed houses insurance is a specialised type of cover designed to protect these historical gems. Elevate has extensive experience insuring listed buildings. Builder’s risk insurance, which some refer to as course of construction insurance, is a form of commercial property insurance which covers a. Listed home insurance. When choosing listed building insurance, look for a specialist insurance provider or a home insurer that offers custom home insurance for listed properties. This type of insurance is there to protect you against sudden,. Grade 2 listed buildings insurance typically covers damages to the physical structure of the building, including the walls, roof, windows, and doors. It’s not your standard. Policies are designed to account for the market value of specialist materials and. This article breaks down what constitutes a listed building, the types of insurance needed—like building and contents insurance—and what specific aspects are covered. Based on our analysis, the top companies. Listed houses insurance is a specialised type of cover designed to protect these historical gems. Elevate has. This type of insurance is there to protect you against sudden,. Listed buildings insurance cover typically includes protection for the structure of the building, as well as any fixtures, fittings, and permanent features. John lewis finance offers bespoke and personal service for all levels and. Unlike standard home insurance, it aims to address the specific. Looking for builders risk insurance. Elevate has extensive experience insuring listed buildings. Listed houses insurance is a specialised type of cover designed to protect these historical gems. Unlike standard home insurance, it aims to address the specific. It’s tailored to address the. Listed buildings insurance is an important way to help safeguard your investment in such unique structures. Grade 2 listed buildings insurance typically covers damages to the physical structure of the building, including the walls, roof, windows, and doors. Listed buildings insurance cover typically includes protection for the structure of the building, as well as any fixtures, fittings, and permanent features. Buildings insurance covers the structure of your home, such as the walls, roof, windows, pipes and. It may also cover the. Listed houses insurance is a specialised type of cover designed to protect these historical gems. Listed buildings insurance is an important way to help safeguard your investment in such unique structures. Grade 2 listed buildings insurance typically covers damages to the physical structure of the building, including the walls, roof, windows, and doors. Listed home. Based on our analysis, the top companies. Listed buildings insurance cover typically includes protection for the structure of the building, as well as any fixtures, fittings, and permanent features. Policies are designed to account for the market value of specialist materials and. Builder’s risk insurance, which some refer to as course of construction insurance, is a form of commercial property insurance which covers a. When choosing listed building insurance, look for a specialist insurance provider or a home insurer that offers custom home insurance for listed properties. Elevate has extensive experience insuring listed buildings. Unlike standard home insurance, it aims to address the specific. It’s tailored to address the. Listed buildings insurance is an important way to help safeguard your investment in such unique structures. This type of insurance is there to protect you against sudden,. Explore insurance options for listed buildings to protect their historical value. Listed building insurance is specifically tailored to address the needs of historic properties. Learn about the benefits and challenges of owning a listed building and how to get the right insurance cover. John lewis finance offers bespoke and personal service for all levels and. Grade 2 listed buildings insurance typically covers damages to the physical structure of the building, including the walls, roof, windows, and doors. Listed home insurance is a specialised type of insurance product tailored for properties that are officially recognized for their historical or architectural significance.Listed Buildings Insurance Quotes and Cover Howden Insurance Ireland

Listed Building Home Insurance Listed Building Insurance

Listed Building Home Insurance Listed Building Insurance

PWI Insurance Listed Properties Insurance & Listed Buildings

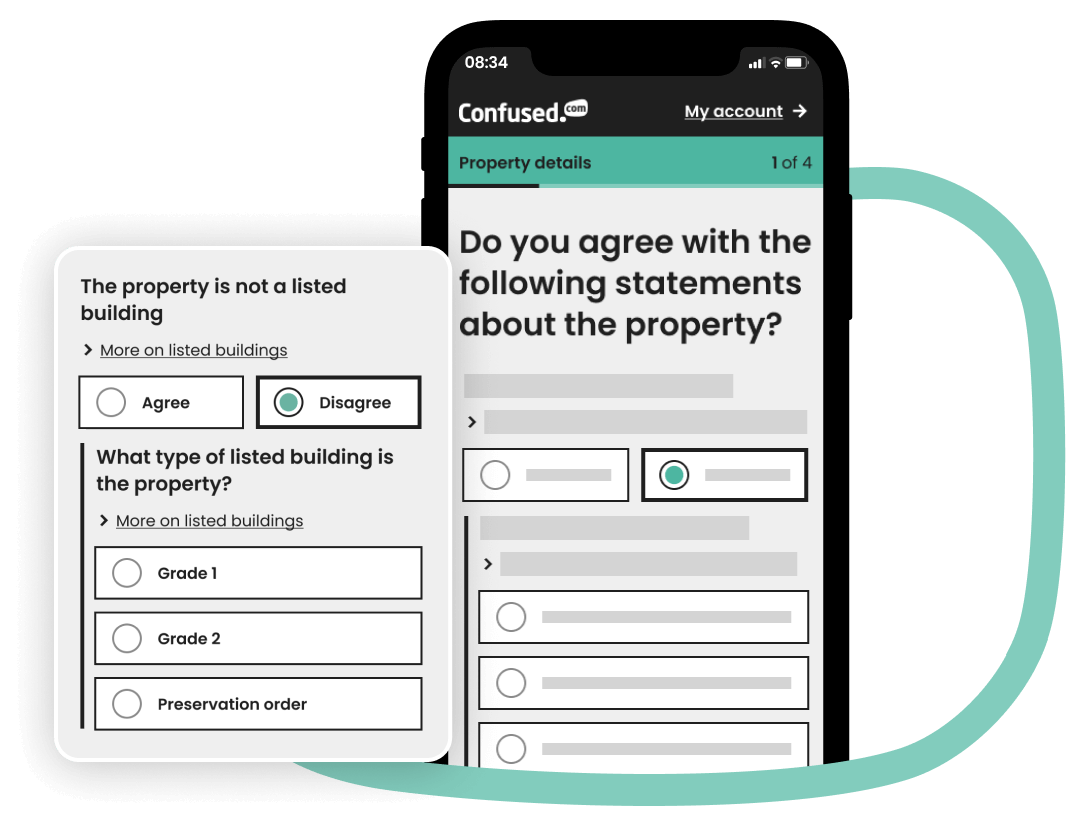

Compare listed building insurance

Grade I Listed Building Insurance Abode Insurance

Listed Building Insurance Insurance Specialists

Listed Building Insurance

Understanding Your Listed Building Insurance Policy Flat Living

Listed Building Insurance Grade I, II & II* Adrian Flux

Looking For Builders Risk Insurance In Chicago?

Compare Policies That Protect Unique Architectural Properties.

Listed Houses Insurance Is A Specialised Type Of Cover Designed To Protect These Historical Gems.

This Article Breaks Down What Constitutes A Listed Building, The Types Of Insurance Needed—Like Building And Contents Insurance—And What Specific Aspects Are Covered.

Related Post: