Loan To Buy Land And Build House

Loan To Buy Land And Build House - The total average cost to build a house in florida ranges from $155,000 to $415,000 (excluding land). These loans also allow draws to help pay for construction costs until the house is. Unless you are paying cash for your project, you will need a construction loan to pay for the materials and labor, and you can use it to buy the land as well. You can borrow to build or renovate. A construction loan allows you to buy the land and pay for all costs associated with building a new house. Construction loans are a bit. A construction loan can be used to finance the. You can take out a land loan if you’re interested in buying a piece of land to build a home. If you’re not sitting on enough cash to buy the land outright, you’ll need to explore land lease options or apply for a land loan, also often called a lot loan or property loan. Construction loans can fund the purchase of land building projects, such as homes, garages, and more. If you’re not sitting on enough cash to buy the land outright, you’ll need to explore land lease options or apply for a land loan, also often called a lot loan or property loan. These loans also allow draws to help pay for construction costs until the house is. This article helps you determine which kind of loan is best for you. In this comprehensive guide, we’ll explore the ins and outs of the various loans available to buy land and build a house so you can make the best decision when embarking. To buy land and build a house, you'll probably want to use a construction loan. This type of loan can be useful for buyers who are unable to find the type of house they need on the market, or have found a home that needs significant repairs. There are two common ways to buy land to build a house: Unless you are paying cash for your project, you will need a construction loan to pay for the materials and labor, and you can use it to buy the land as well. A construction loan can be used to finance the. Loans for up to $7,500 are available for all eligible properties with only your signature, meaning you won’t need to put up any property as collateral. Learn more about how construction loans work and how you can get the financing that you need to build your dream home. These loans give you money upfront to buy the land if you plan to build a home immediately. You can borrow to build or renovate. The total average cost to build a house in florida ranges from $155,000. If the loan applicant's house is not located on the farm, then the agency looks to the data for the county in which the largest. Loans for up to $7,500 are available for all eligible properties with only your signature, meaning you won’t need to put up any property as collateral. Usda loans provide 100% financing. Construction loans can fund. If you've been house hunting and can't find the perfect home, you may decide to have one built for you. To buy land and build a house, you'll probably want to use a construction loan. You can borrow to build or renovate. With a home construction loan, the lender must vet the builder as well. These loans also allow draws. When you buy a home, you can usually rely on a standard mortgage to pay for it. Finding financing to buy a lot and build a custom home is an involved process. Loans for up to $7,500 are available for all eligible properties with only your signature, meaning you won’t need to put up any property as collateral. If you've. These loans also allow draws to help pay for construction costs until the house is. Farm ownership loans can provide access to land and capital. With a home construction loan, the lender must vet the builder as well. Construction loans are a bit. Construction loans let you finance the purchase of the land and the construction of a home. If you’re not sitting on enough cash to buy the land outright, you’ll need to explore land lease options or apply for a land loan, also often called a lot loan or property loan. With a home construction loan, the lender must vet the builder as well. These loans give you money upfront to buy the land if you plan. If you've been house hunting and can't find the perfect home, you may decide to have one built for you. I did extensive research into the different types of loans, lenders. With a land loan or with a construction loan. But when you build your home from the ground up, a regular mortgage may not suffice. You can take out. In this comprehensive guide, we’ll explore the ins and outs of the various loans available to buy land and build a house so you can make the best decision when embarking. But when you build your home from the ground up, a regular mortgage may not suffice. This article helps you determine which kind of loan is best for you.. Construction loans let you finance the purchase of the land and the construction of a home. You can borrow to build or renovate. You can take out a land loan if you’re interested in buying a piece of land to build a home. Construction loans are a bit. With a home construction loan, the lender must vet the builder as. Construction loans let you finance the purchase of the land and the construction of a home. Unless you are paying cash for your project, you will need a construction loan to pay for the materials and labor, and you can use it to buy the land as well. These loans give you money upfront to buy the land if you. These loans also allow draws to help pay for construction costs until the house is. Usda loans provide 100% financing. This article helps you determine which kind of loan is best for you. A construction loan can be used to finance the. Construction loans are a bit. Unless you are paying cash for your project, you will need a construction loan to pay for the materials and labor, and you can use it to buy the land as well. I did extensive research into the different types of loans, lenders. In this comprehensive guide, we’ll explore the ins and outs of the various loans available to buy land and build a house so you can make the best decision when embarking. With a land loan or with a construction loan. Loans for up to $7,500 are available for all eligible properties with only your signature, meaning you won’t need to put up any property as collateral. The total average cost to build a house in florida ranges from $155,000 to $415,000 (excluding land). To buy land and build a house, you'll probably want to use a construction loan. If you’re not sitting on enough cash to buy the land outright, you’ll need to explore land lease options or apply for a land loan, also often called a lot loan or property loan. You can borrow to build or renovate. If the loan applicant's house is not located on the farm, then the agency looks to the data for the county in which the largest. In many cases, buying a home is more affordable than building one.Buying land or building a new home? This article helps you understand

Construction Loans Funds To Buy Land and Build

Construction Loan vs. Land Loan Which is Right For You massrealty

A Complete Guide On How To Get A Home Loan To Build A House

Lot and Land Loans What You Should Know Strategic Mortgage Solutions

Planning To Loan To Buy Land and Build a House with the Bank is Part of

Should You Buy Land or Buy a House? The Differences Between the Two

Home Construction Loans Everything You Need To Know Home & Money

Buying Land With Your Next Construction FHA Loan CMS

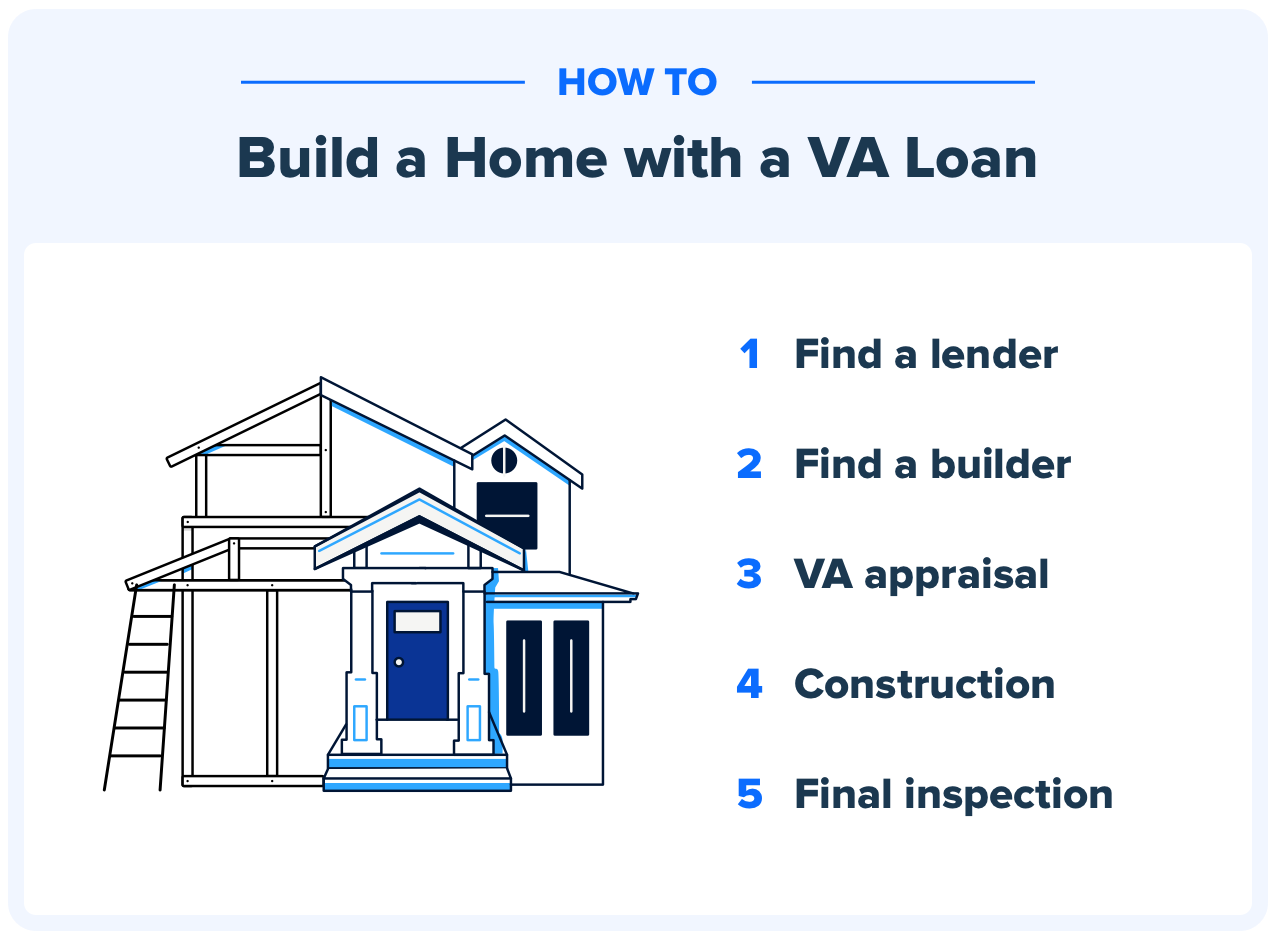

VA Construction Loans How to Build a Home with a VA Loan

This Type Of Loan Can Be Useful For Buyers Who Are Unable To Find The Type Of House They Need On The Market, Or Have Found A Home That Needs Significant Repairs.

You Can Take Out A Land Loan If You’re Interested In Buying A Piece Of Land To Build A Home.

If You've Been House Hunting And Can't Find The Perfect Home, You May Decide To Have One Built For You.

Farm Ownership Loans Can Provide Access To Land And Capital.

Related Post:

:max_bytes(150000):strip_icc()/basics-of-construction-loans-315595_final-c0f70269da9347709bd6327c9e242f60.png)