Maximum Coverage Of Flood Insurance For A Apartment Building

Maximum Coverage Of Flood Insurance For A Apartment Building - Unlike homeowners, renters are not responsible for the structure of their building,. A maximum of $250,000 of. Most flood insurance policies do not include. For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage. Select one of the six different. Nfip policies cap personal property coverage at $100,000 but private insurer policies typically offer higher coverage limits. The lender and servicer must verify that each attached or detached individual pud unit maintains a. Georgia's commercial property insurance rates have soared due to recent hurricanes and tornadoes, pushing many business owners to seek better coverage options. Also, for an apartment building is the maximum amount of insurance you can obtain be $250,000? See the building and contents coverage deductible chart in fim section 3. A maximum of $250,000 of. The national flood insurance program (nfip) is. You can get flood insurance if you are renting an apartment. It covers the actual cash value of the physical structure of. For owners of apartment buildings, thorough flood insurance is not only a legal obligation but also a necessary part of risk control. In addition to basement coverage, private insurers accessed through floodprice.com, offer increased policy limits with building coverage up to $4 million and. Nfip policies cap personal property coverage at $100,000 but private insurer policies typically offer higher coverage limits. The lender and servicer must verify that each attached or detached individual pud unit maintains a. For the federal flood insurance side of the market, you may. Select one of the six different. It only pays for direct. The minimum required amount of coverage is $475,000 because the property’s insured value is less than the outstanding loan balance and the maximum amount of coverage under. To assist with the cost of complying with local requirements, increased cost of compliance (icc) coverage provides up to $30,000 for eligible structures, in addition to the. Higher. To assist with the cost of complying with local requirements, increased cost of compliance (icc) coverage provides up to $30,000 for eligible structures, in addition to the. Each method has its own eligibility requirements for condominium type. Flood insurance is just what it sounds like: Most flood insurance policies do not include. For the federal flood insurance side of the. Nfip policies cap personal property coverage at $100,000 but private insurer policies typically offer higher coverage limits. Live in a high risk flooding area? There are 4 methods of insuring condominiums under the national flood insurance program (nfip). It covers the actual cash value of the physical structure of. There are three important facts you should know about your coverage. Unlike homeowners, renters are not responsible for the structure of their building,. There are 4 methods of insuring condominiums under the national flood insurance program (nfip). Georgia's commercial property insurance rates have soared due to recent hurricanes and tornadoes, pushing many business owners to seek better coverage options. For owners of apartment buildings, thorough flood insurance is not only a. Nfip policies cap personal property coverage at $100,000 but private insurer policies typically offer higher coverage limits. It only pays for direct. For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage. Can you get flood insurance for an apartment? To assist with the cost of complying with local requirements,. There are three important facts you should know about your coverage under a standard flood insurance policy general property form. As a property owner of apartment buildings, you may want to make the most out of your flood insurance coverage. For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage.. Higher deductible options of $2,000, $5,000 or $10,000 are available. And yes, if you own an apartment. To assist with the cost of complying with local requirements, increased cost of compliance (icc) coverage provides up to $30,000 for eligible structures, in addition to the. Understand the maximum coverage limits and factors that affect cost. For the federal flood insurance side. Live in a high risk flooding area? The national flood insurance program (nfip) is. 100% of the replacement cost value, or the maximum coverage available from nfip. There are 4 methods of insuring condominiums under the national flood insurance program (nfip). Can you get flood insurance for an apartment? This part describes the types of properties eligible for flood insurance coverage under the program, the limits of such coverage, and the premium rates actually to be paid by insureds. There are 4 methods of insuring condominiums under the national flood insurance program (nfip). For the federal flood insurance side of the market, you may. Understand the maximum coverage limits. See the building and contents coverage deductible chart in fim section 3. Live in a high risk flooding area? You are only required to obtain flood insurance on the building that is located. 1 this table provides the maximum coverage amounts available under the emergency program and the regular program, and the columns cannot be aggregated to exceed the limits. Nfip policies cap personal property coverage at $100,000 but private insurer policies typically offer higher coverage limits. In addition to basement coverage, private insurers accessed through floodprice.com, offer increased policy limits with building coverage up to $4 million and. Investing in sufficient flood coverage is. A maximum of $250,000 of. For owners of apartment buildings, thorough flood insurance is not only a legal obligation but also a necessary part of risk control. It covers your rental home in the event that it is damaged or destroyed by a flood. To assist with the cost of complying with local requirements, increased cost of compliance (icc) coverage provides up to $30,000 for eligible structures, in addition to the. The minimum required amount of coverage is $475,000 because the property’s insured value is less than the outstanding loan balance and the maximum amount of coverage under. Most flood insurance policies do not include. See the building and contents coverage deductible chart in fim section 3. The answer is yes to both. 100% of the replacement cost value, or the maximum coverage available from nfip. Can you get flood insurance for an apartment? You are only required to obtain flood insurance on the building that is located. There are 4 methods of insuring condominiums under the national flood insurance program (nfip). You can get flood insurance if you are renting an apartment.Flood Insurance Definition, How It Works, Coverage, and Example

Are You Prepared for a Flood? [Infographic]

Preparing for Flood Season Floods and Flood Insurance

Insurance Understanding Flood Insurance

9 Building Coverage Limit for National Flood Insurance Program Policies

9 Building Coverage Limit for National Flood Insurance Program Policies

Flood Insurance Solutions • Northeast Engineers

Why You Need Flood Insurance [Infographic] Marine Agency

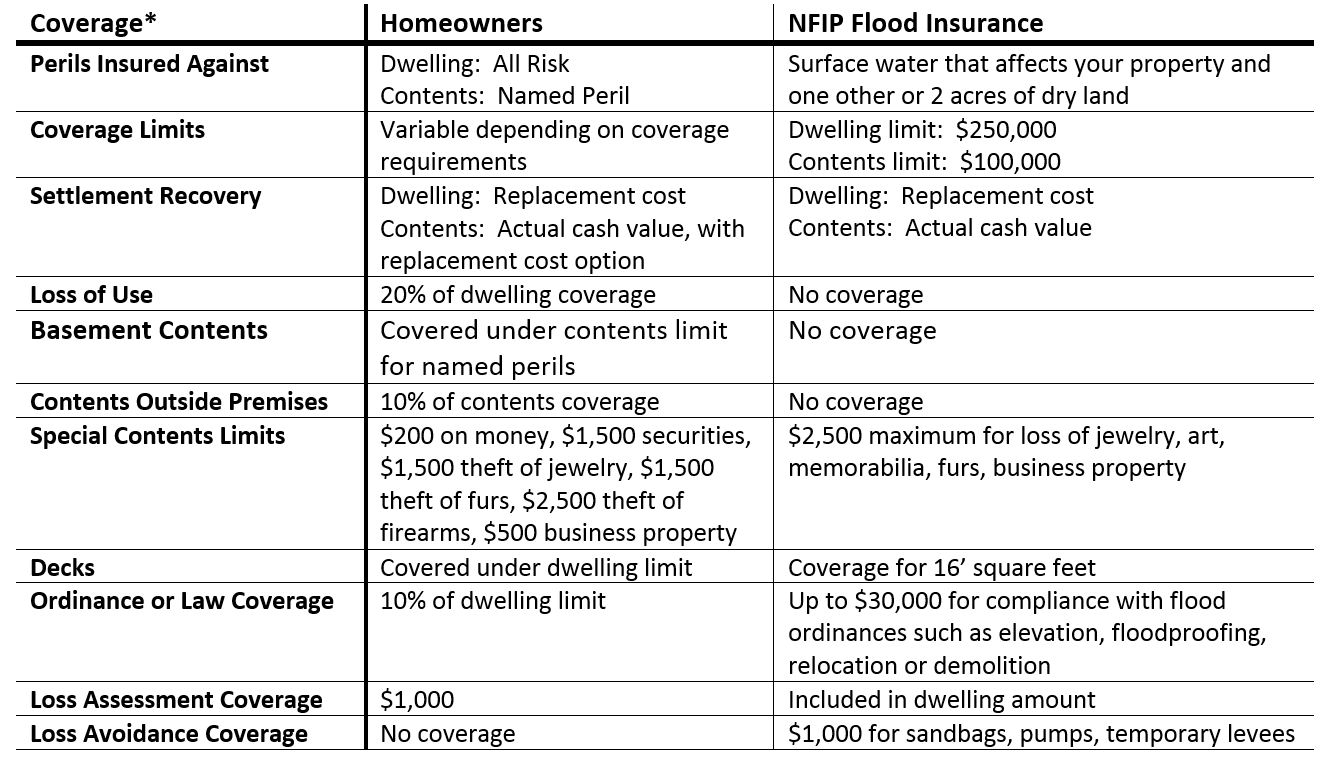

The Difference between Home Insurance and Flood Insurance

Nfip Flood Insurance Coverage Limits insurance cover mental health

Flood Insurance Is Just What It Sounds Like:

Georgia's Commercial Property Insurance Rates Have Soared Due To Recent Hurricanes And Tornadoes, Pushing Many Business Owners To Seek Better Coverage Options.

This Part Describes The Types Of Properties Eligible For Flood Insurance Coverage Under The Program, The Limits Of Such Coverage, And The Premium Rates Actually To Be Paid By Insureds.

It Covers The Actual Cash Value Of The Physical Structure Of.

Related Post:

:max_bytes(150000):strip_icc()/flood-insurance_v4-0129507a12b24aaea4fafee0eb9ed1f6.png)

![Are You Prepared for a Flood? [Infographic]](https://blog.swbc.com/hs-fs/hubfs/images/Infographics/10-Reasons-Why-Flood-Insurance-is-a-Must-Have-01.png?width=1854&height=5400&name=10-Reasons-Why-Flood-Insurance-is-a-Must-Have-01.png)

![Why You Need Flood Insurance [Infographic] Marine Agency](https://marineagency.com/wp-content/uploads/2017/05/Marine-Flood-Insurance-1024x1024.png)