New Build Closing Costs

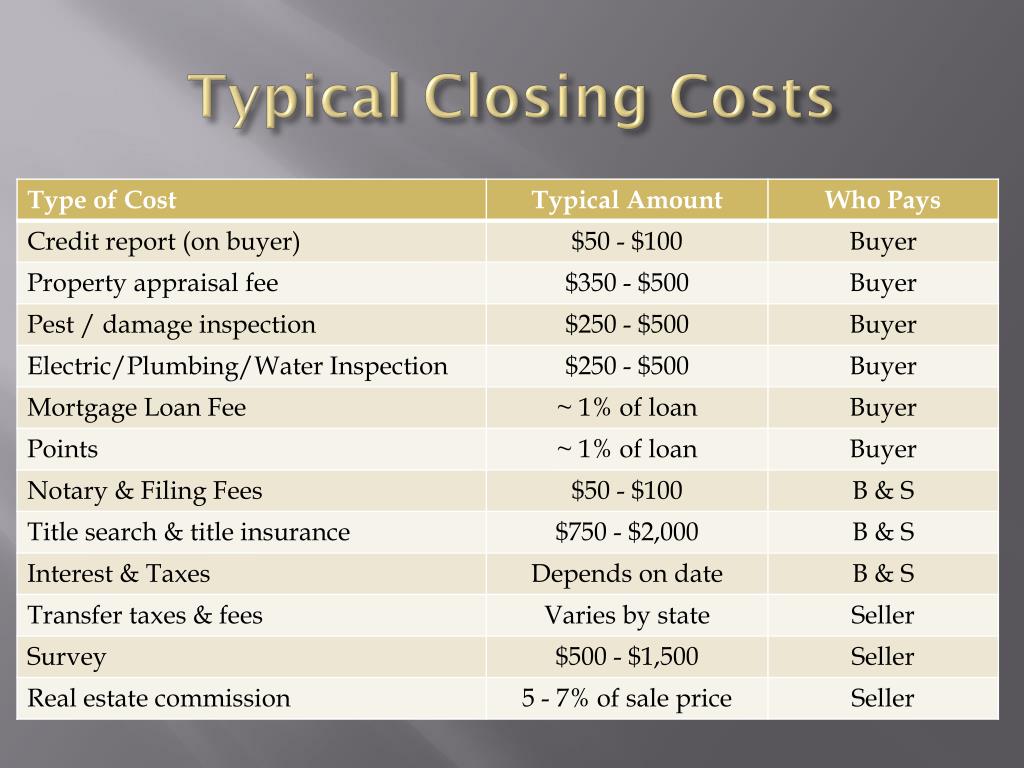

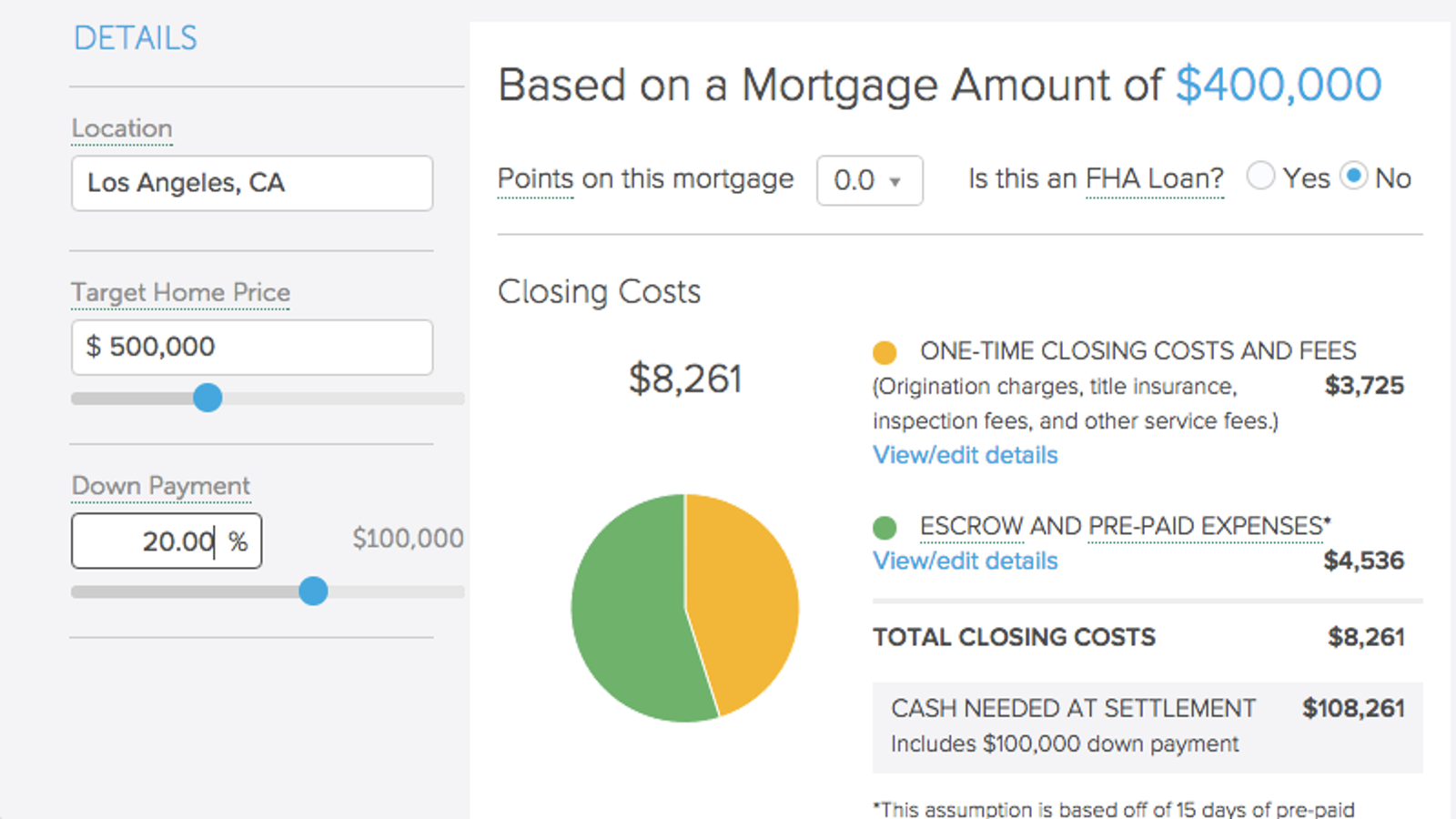

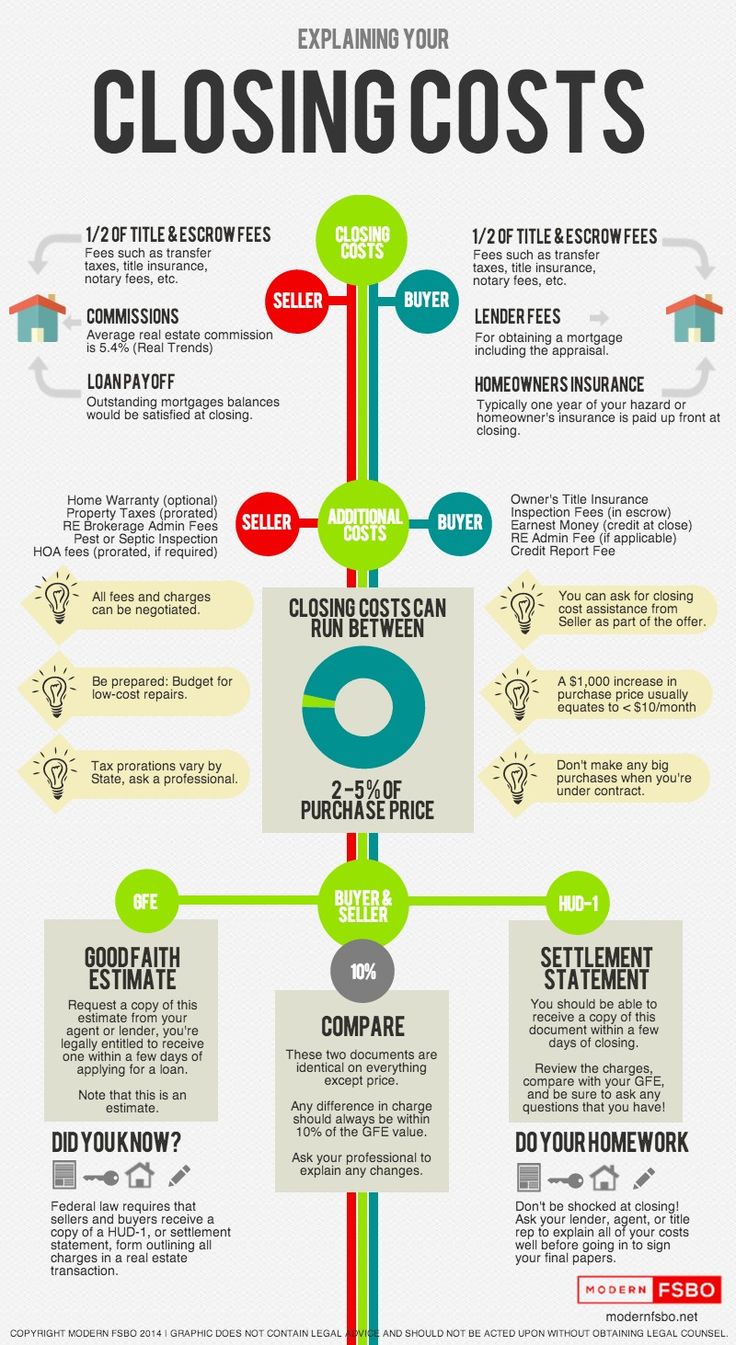

New Build Closing Costs - “ popular builder incentives such as. Buyer closing costs typically range from 2% to 5% of the loan amount. From land purchase costs to construction loans and builder. Typical closing costs include a mortgage origination fee, property appraisal fee, title search fee, title insurance premium, and. But what about new constructions?. So for example, if you get approved for a $300,000 construction loan, you can expect to pay. So for a $300,000 build, you can expect to pay $6,000 to $15,000 in. When consumers have grown accustomed to the price breaks and can’t imagine doing a deal without them in place to lower their costs. These costs could include things like. They include things like paying the bank for your loan and. How much are closing costs? In 2024, site work contributed an average of $32,719 to the cost of building a new home. From land purchase costs to construction loans and builder. “ popular builder incentives such as. Closing costs are a collection of charges that home buyers must pay during the process of purchasing a property. When you finish buying a house, there are extra fees you have to pay. When consumers have grown accustomed to the price breaks and can’t imagine doing a deal without them in place to lower their costs. These expenses are separate and in addition to the property’s price. Get expert insight for your new build closing costs including closing cost faqs. When gearing up to buy your new construction home, it’s crucial you get a handle on the potential costs you’ll be expected to cover, from your down payment to the closing. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Examples of closing costs include mortgage origination fees, owner’s and lender’s title insurance, escrow or settlement fees, transfer taxes, and government recording fees. Closing costs are a collection of charges that home buyers must pay during the process of purchasing a property. When purchasing a. Unlike sellers, who pay closing costs based on the home’s sale price, buyers’ expenses are primarily. Closing costs on a new construction home are calculated based on a variety of factors such as the purchase price, the loan type and the location of the home. When purchasing a newly constructed home, buyers often encounter higher closing costs compared to buying. When consumers have grown accustomed to the price breaks and can’t imagine doing a deal without them in place to lower their costs. So for example, if you get approved for a $300,000 construction loan, you can expect to pay. How much are closing costs? Buyer closing costs typically range from 2% to 5% of the loan amount. These expenses. From land purchase costs to construction loans and builder. When consumers have grown accustomed to the price breaks and can’t imagine doing a deal without them in place to lower their costs. Understand closing costs on new construction with our comprehensive guide. In 2024, site work contributed an average of $32,719 to the cost of building a new home. Closing. You can handle closing costs with confidence and. Typical closing costs include a mortgage origination fee, property appraisal fee, title search fee, title insurance premium, and. These are called closing costs. When you finish buying a house, there are extra fees you have to pay. These expenses are separate and in addition to the property’s price. Get expert insight for your new build closing costs including closing cost faqs. For example, on a $400,000 home, closing costs might range from. When gearing up to buy your new construction home, it’s crucial you get a handle on the potential costs you’ll be expected to cover, from your down payment to the closing. When purchasing a newly constructed. How much are closing costs on a new build? From land purchase costs to construction loans and builder. Examples of closing costs include mortgage origination fees, owner’s and lender’s title insurance, escrow or settlement fees, transfer taxes, and government recording fees. A lot goes into preparing a site to be turned into a home, from engineering and. “ popular builder. Buyer closing costs typically range from 2% to 5% of the loan amount. But what about new constructions?. So for a $300,000 build, you can expect to pay $6,000 to $15,000 in. A lot goes into preparing a site to be turned into a home, from engineering and. When you finish buying a house, there are extra fees you have. Typical closing costs for construction loans range from 2% to 5% of the total construction budget. When purchasing a newly constructed home, buyers often encounter higher closing costs compared to buying an existing home. In 2024, site work contributed an average of $32,719 to the cost of building a new home. When gearing up to buy your new construction home,. You can handle closing costs with confidence and. Understand closing costs on new construction with our comprehensive guide. For example, on a $400,000 home, closing costs might range from. Closing costs for new construction homes are a crucial element to consider when planning and budgeting your home purchase. Examples of closing costs include mortgage origination fees, owner’s and lender’s title. “ popular builder incentives such as. Unlike sellers, who pay closing costs based on the home’s sale price, buyers’ expenses are primarily. You can handle closing costs with confidence and. Buyer closing costs typically range from 2% to 5% of the loan amount. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Understand closing costs on new construction with our comprehensive guide. But what about new constructions?. When consumers have grown accustomed to the price breaks and can’t imagine doing a deal without them in place to lower their costs. For example, on a $400,000 home, closing costs might range from. These expenses are separate and in addition to the property’s price. Closing costs are a collection of charges that home buyers must pay during the process of purchasing a property. When gearing up to buy your new construction home, it’s crucial you get a handle on the potential costs you’ll be expected to cover, from your down payment to the closing. These fees can vary depending on the. So for example, if you get approved for a $300,000 construction loan, you can expect to pay. Typical closing costs for construction loans range from 2% to 5% of the total construction budget. These costs could include things like.PPT Buying a house PowerPoint Presentation, free download ID1543981

New build Closing Costs Explained What is Included in Pre

Understanding New Construction Closing Costs What You Need to Know

This Calculator Estimates Your Home's Closing Costs, Based on Your Location

Closing Costs for the Buyer of a New Construction Home

Editable Spreadsheet Home Construction Cost Breakdown Sheet Build New

Closing Costs 101 How to Budget Like a Pro and Seal the Deal on Your

Closing cost worksheet for new build in FL. Does this look normal

What Are Typical Real Estate Closing Costs? Ashley Howie, The

Janice Cofield FACTS ABOUT CLOSING COSTS [INFOGRAPHIC] Cofield Real

When You Finish Buying A House, There Are Extra Fees You Have To Pay.

The Closing Costs On A New Build Are Estimated To Be $10,000 To $20,000 On A New Construction Home.

Closing Costs On New Construction And Resale Homes Typically Run Between 3% And 5% Of The Home’s Purchase Price.

How Much Are Closing Costs On A New Build?

Related Post:

![Janice Cofield FACTS ABOUT CLOSING COSTS [INFOGRAPHIC] Cofield Real](https://files.keepingcurrentmatters.com/content/images/20230330/Facts-About-Closing-Costs-MEM.png)