New Build Interest Rates

New Build Interest Rates - So, while a builder’s incentives may seem wasteful, you still might end up with a better deal on a new home, all things considered. 2) rate each stakeholder’s level of influence and interest; Learn the ins and outs of buying a new construction home, including new construction loan types, interest rates, and the loan process. Buying a new home still in the development or building stage is a little. Eric lee/the new york times. A brand new home for around $400,000 with a 5% interest rate could be a better value than a “used” home at 6%. Homebuilders are reducing prices and offering incentives. Qualified borrowers benefit from lower interest rates, a lower down payment and more flexible credit standards than with conventional construction loans. Interest rates on construction loans are variable, meaning they can change throughout the loan term. Builder incentives can save you tens of thousands of dollars on the initial cost of your home, and over the lifetime of your mortgage. In other words, if a builder offers a. You may find that you’re charged a higher interest rate for a mortgage on a new build property. Homebuilders are reducing prices and offering incentives. Learn the ins and outs of buying a new construction home, including new construction loan types, interest rates, and the loan process. Mortgage rates are high right now, and it is understandable that some potential buyers are scared off by the prospect of paying too much in interest. Learn about construction loan rates in 2024, including types, factors affecting rates, and tips for securing the best rates. Read this guide to understand how interest rates and other economic factors impact the housing market and what this means for building a new home. There are five steps you can take to create a power map: Home buyers should look at new homes in addition to resales from existing homeowners. So buyers out there today that are buying new. Learn the ins and outs of buying a new construction home, including new construction loan types, interest rates, and the loan process. Homebuilders are reducing prices and offering incentives. In other words, if a builder offers a. A brand new home for around $400,000 with a 5% interest rate could be a better value than a “used” home at 6%.. Mortgage rates are high right now, and it is understandable that some potential buyers are scared off by the prospect of paying too much in interest. Eric lee/the new york times. Learn the ins and outs of buying a new construction home, including new construction loan types, interest rates, and the loan process. 1) identify your potential stakeholders; Builder incentives. In other words, if a builder offers a. Homebuilders are reducing prices and offering incentives. Buying a new home still in the development or building stage is a little. 10 at a 6.25 percent interest rate. Taking the time to compare the actual cost. Learn the ins and outs of buying a new construction home, including new construction loan types, interest rates, and the loan process. Mortgage rates are high right now, and it is understandable that some potential buyers are scared off by the prospect of paying too much in interest. Homebuilders are reducing prices and offering incentives. Builder incentives can save you. Mortgage rates are high right now, and it is understandable that some potential buyers are scared off by the prospect of paying too much in interest. 2) rate each stakeholder’s level of influence and interest; Eric lee/the new york times. Learn the ins and outs of buying a new construction home, including new construction loan types, interest rates, and the. Buying a new home still in the development or building stage is a little. Qualified borrowers benefit from lower interest rates, a lower down payment and more flexible credit standards than with conventional construction loans. Builder incentives can save you tens of thousands of dollars on the initial cost of your home, and over the lifetime of your mortgage. Interest. 1) identify your potential stakeholders; Homebuilders are reducing prices and offering incentives. While the average mortgage rate remains stuck above 6%, buyers of new homes are getting a much better deal, according to one expert. Mortgage rates are high right now, and it is understandable that some potential buyers are scared off by the prospect of paying too much in. Read this guide to understand how interest rates and other economic factors impact the housing market and what this means for building a new home. Eric lee/the new york times. Interest rates on construction loans are variable, meaning they can change throughout the loan term. 1) identify your potential stakeholders; Qualified borrowers benefit from lower interest rates, a lower down. So buyers out there today that are buying new. Learn the ins and outs of buying a new construction home, including new construction loan types, interest rates, and the loan process. Homebuilders are reducing prices and offering incentives. Mortgage rates are high right now, and it is understandable that some potential buyers are scared off by the prospect of paying. But in general, construction loan rates are typically around 1 percent. Learn the ins and outs of buying a new construction home, including new construction loan types, interest rates, and the loan process. So, while a builder’s incentives may seem wasteful, you still might end up with a better deal on a new home, all things considered. So buyers out. In other words, if a builder offers a. Taking the time to compare the actual cost. Buying a new home still in the development or building stage is a little. This is because lenders see these mortgages as riskier, due to the possibility that the value of. Home buyers should look at new homes in addition to resales from existing homeowners. 1) identify your potential stakeholders; A brand new home for around $400,000 with a 5% interest rate could be a better value than a “used” home at 6%. Read this guide to understand how interest rates and other economic factors impact the housing market and what this means for building a new home. But in general, construction loan rates are typically around 1 percent. Interest rates on construction loans are variable, meaning they can change throughout the loan term. 2) rate each stakeholder’s level of influence and interest; Learn about construction loan rates in 2024, including types, factors affecting rates, and tips for securing the best rates. Homebuilders are reducing prices and offering incentives. 10 at a 6.25 percent interest rate. So buyers out there today that are buying new. There are five steps you can take to create a power map:30 Year Mortgage Rates Projection 2024 Pdf Shea Josefa

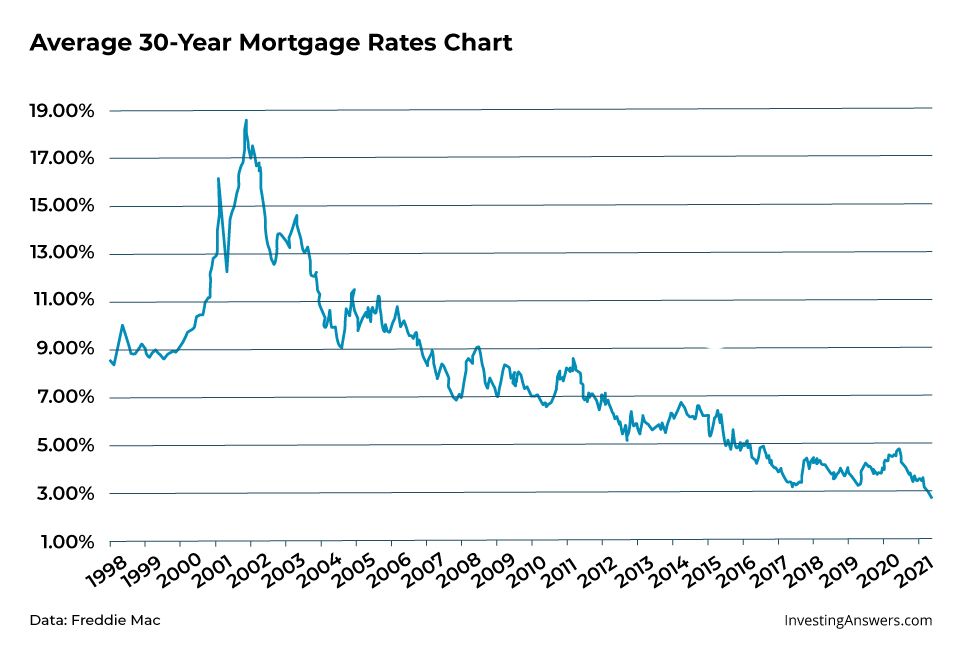

Best Mortgage Rates for 2021 InvestingAnswers

SelfBuild Mortgage Rates, Brokers, Calculator Checkatrade

New Construction Homes What Is An Interest Rate Buy Down? Conner

Understanding Interest Rates + Your Mortgage [2020 Guide]

What is the Interest Rate Forecast for Housing in 2024?

SelfBuild Mortgage Rates, Brokers, Calculator Checkatrade

Home Mortgage Rates by Decade [INFOGRAPHIC] in 2021 Mortgage interest

Mortgage Rates 2024 Charta 77 Ilise Leandra

Mortgage rate increases, designed to cool market, create new headwinds

You May Find That You’re Charged A Higher Interest Rate For A Mortgage On A New Build Property.

Learn The Ins And Outs Of Buying A New Construction Home, Including New Construction Loan Types, Interest Rates, And The Loan Process.

Builder Incentives Can Save You Tens Of Thousands Of Dollars On The Initial Cost Of Your Home, And Over The Lifetime Of Your Mortgage.

Qualified Borrowers Benefit From Lower Interest Rates, A Lower Down Payment And More Flexible Credit Standards Than With Conventional Construction Loans.

Related Post:

![Understanding Interest Rates + Your Mortgage [2020 Guide]](http://www.edgehomes.com/wp-content/uploads/2019/04/LoanPaymentChartExample.jpg)

![Home Mortgage Rates by Decade [INFOGRAPHIC] in 2021 Mortgage interest](https://i.pinimg.com/originals/bc/44/87/bc4487bd8eef7b71fd5e0ba6ac3744ce.png)