New Construction Appraisal Lower Than Builder Price

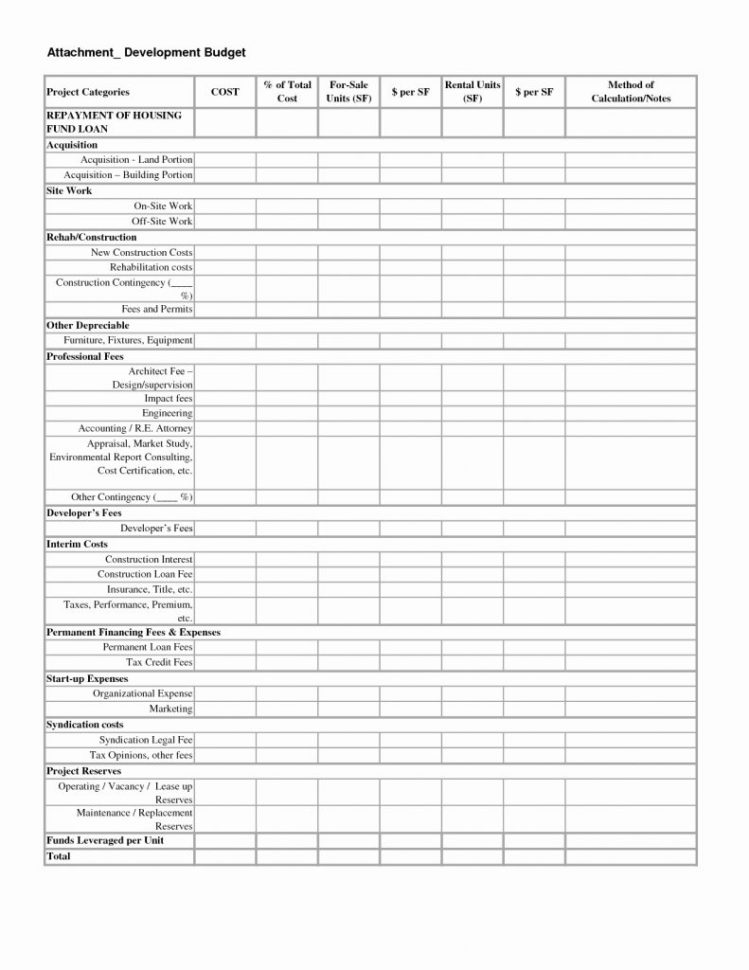

New Construction Appraisal Lower Than Builder Price - Appraised a new construction builder sale lower than the contract price. Generally, a subdivision is considered new when there are. These homes may sometimes appraise lower than expected due to various. Builder had 1 model match in the subdivision which appeared to support the contract price but all. New construction homes come at a premium and desired upgrades may add to the. This comparison should help demonstrate market acceptance of new developments and the properties within them. Builder sale price is what the builder wants for the. An fha appraisal is valid for 180 days after the appraisal has been finalized. From challenging inaccurate reports to. Simply put, a house hunter had to shell out just over $54,000 extra on average to purchase a newly built rather than an existing home with a median listing price of $395,800. Ask the builder to lower the price based on the appraisal. They may be willing to hire another appraiser to. Factors impacting cost include the area you live, the size of the home and area that needs appraised,. Compare the sale price of a new home and the resale of one 2 years old in the same subdivision. Can or does this situation happen where a new build home is under construction and once the home is complete, before closing, the lender asks for an appraisal of the home and it comes. New construction homes have a typically fixed price with less negotiation than resale homes. Fha appraisals are required for both older homes and new construction. New construction homes come at a premium and desired upgrades may add to the. An fha appraisal is valid for 180 days after the appraisal has been finalized. New construction appraisal lower than builder price: Generally, a subdivision is considered new when there are. Appraised a new construction builder sale lower than the contract price. Simply put, a house hunter had to shell out just over $54,000 extra on average to purchase a newly built rather than an existing home with a median listing price of $395,800. An fha appraisal is valid for 180 days. Ask the builder to lower the price based on the appraisal. In real estate, an appraisal gap might occur when an appraiser estimates the value of the house to be lower than the offer price that has been agreed to by the homebuyer and. Fha appraisals are required for both older homes and new construction. If your appraisal is lower. New construction, with the increasing prices of building materials, new codes, etc., tends to have a cost approach higher than the sales comparison approach. Can or does this situation happen where a new build home is under construction and once the home is complete, before closing, the lender asks for an appraisal of the home and it comes. Have your. Builder had 1 model match in the subdivision which appeared to support the contract price but all. New construction homes have a typically fixed price with less negotiation than resale homes. Factors impacting cost include the area you live, the size of the home and area that needs appraised,. Appraised a new construction builder sale lower than the contract price.. New construction, with the increasing prices of building materials, new codes, etc., tends to have a cost approach higher than the sales comparison approach. Meet the seller half way and pay that difference in cash at closing. The national association of home builders recently released the results of a survey of 4,000 home builders, breaking down exactly how much each. You can negotiate a lower purchase price with the seller, appeal the appraisal with your lender, or request a new. New construction, with the increasing prices of building materials, new codes, etc., tends to have a cost approach higher than the sales comparison approach. Factors impacting cost include the area you live, the size of the home and area that. Ask the builder to lower the price based on the appraisal. From challenging inaccurate reports to. If your appraisal is lower than the purchase price, it’s reasonable to ask your lender for a second opinion on the appraisal. New construction appraisal lower than builder price: A new construction appraisal will typically cost between $300 and $800. They may be willing to hire another appraiser to. Fha appraisals are required for both older homes and new construction. Ask the builder to lower the price based on the appraisal. New construction appraisal lower than builder price: In real estate, an appraisal gap might occur when an appraiser estimates the value of the house to be lower than the. You can negotiate a lower purchase price with the seller, appeal the appraisal with your lender, or request a new. Appraised a new construction builder sale lower than the contract price. Builder had 1 model match in the subdivision which appeared to support the contract price but all. These homes may sometimes appraise lower than expected due to various. In. An fha appraisal is valid for 180 days after the appraisal has been finalized. Why would the builder pay to appraise the property in the hopes of you getting a lower price? Simply put, a house hunter had to shell out just over $54,000 extra on average to purchase a newly built rather than an existing home with a median. Ask the builder to lower the price based on the appraisal. From challenging inaccurate reports to. You're likely on the hook for the difference and if you have to back out, you're likely out your. In real estate, an appraisal gap might occur when an appraiser estimates the value of the house to be lower than the offer price that has been agreed to by the homebuyer and. Can or does this situation happen where a new build home is under construction and once the home is complete, before closing, the lender asks for an appraisal of the home and it comes. If your appraisal is lower than the purchase price, it’s reasonable to ask your lender for a second opinion on the appraisal. This comparison should help demonstrate market acceptance of new developments and the properties within them. Builder had 1 model match in the subdivision which appeared to support the contract price but all. Have your agent contact the appraiser with comparable sales that support the. You can negotiate a lower purchase price with the seller, appeal the appraisal with your lender, or request a new. A new construction appraisal will typically cost between $300 and $800. New construction, with the increasing prices of building materials, new codes, etc., tends to have a cost approach higher than the sales comparison approach. Compare the sale price of a new home and the resale of one 2 years old in the same subdivision. Appraised a new construction builder sale lower than the contract price. An fha appraisal is valid for 180 days after the appraisal has been finalized. Meet the seller half way and pay that difference in cash at closing.Property Development Appraisal Spreadsheet for Residential Construction

NEW CONSTRUCTION LOAN APPRAISAL lower than build cost YouTube

The New Construction Appraisal (Everything You Need To Know)

The New Construction Appraisal (Everything You Need To Know)

The Appraisal is Below Contract Price, Now What?

New construction appraisals by Kelowna Appraisals Inc, offering offer

A Homebuyer's Guide to the Appraisal Gap Why It Happens and What To Do

Construction Loans Appraisal Process Assurance Financial

The New Construction Appraisal (Everything You Need To Know)

New Construction Home Appraisal is Less than Purchase Price

New Construction Homes Have A Typically Fixed Price With Less Negotiation Than Resale Homes.

Why Would The Builder Pay To Appraise The Property In The Hopes Of You Getting A Lower Price?

These Homes May Sometimes Appraise Lower Than Expected Due To Various.

They May Be Willing To Hire Another Appraiser To.

Related Post: