Oil And Gas Midstream New Build And Expansion Projects Market

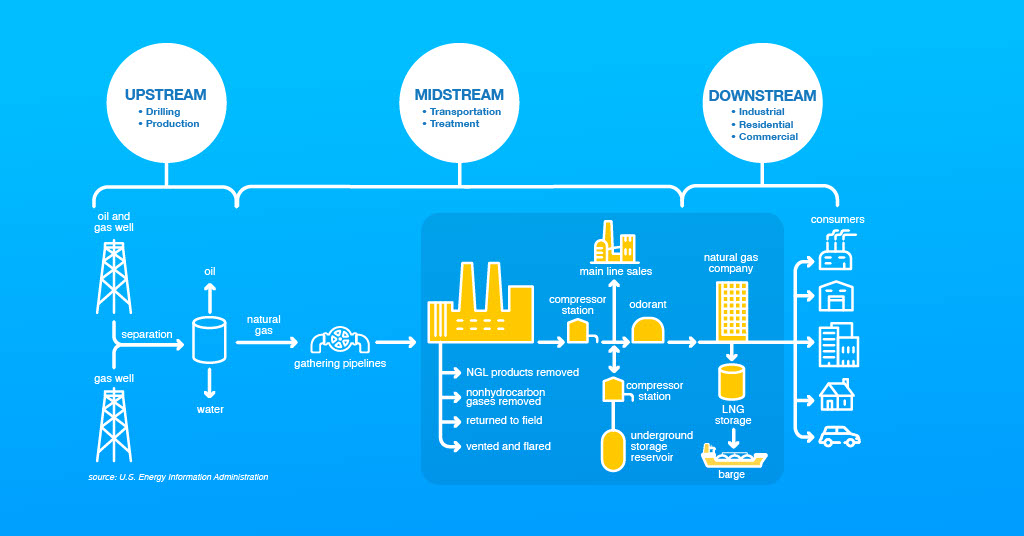

Oil And Gas Midstream New Build And Expansion Projects Market - That hit the high end of its $15.3 billion to $15.5 billion guidance range and set a new partnership record. According to areport by research and markets, the oil and gas midstream market was valued at $27.5 billion in 2022. The oil and gas midstream market is expected to grow to $43.41 billion. The offshore oil and gas industry is gearing up for a significant expansion in 2025, driven by a $54 billion wave of engineering, procurement, and construction (epc). Midstream companies process, transport, and store natural gas, natural gas liquids, crude oil, and refined products. In addition, we expect the new federal administration to be less onerous in its regulatory framework, with less stringent controls on exports as well as pipeline permitting, all. Of these, 1,159 represent new build projects and 136 are expansions of existing projects. Expansion projects, and strong market conditions. The oil and gas industry has always been a field of resilience, innovation, and growth—and 2025 looks set to amplify this even further. Of these, upstream production projects constitute 104,. These companies play a critical role in the energy supply chain, specializing in gathering, processing, transporting, storing, and exporting oil and gas. The total number of oil and gas projects in north america expected to start operations from 2021 to 2025 are 603. Of these, upstream production projects constitute 104,. In the midstream sector, the trunk/transmission. The oil and gas midstream new build and expansion projects report predicts 1,295 upcoming midstream projects to start operations during the 2023 to 2027 outlook period. The new drill down report also discusses a number of other m&a agreements, including enterprise products partners’ $950 million acquisition of piñon midstream, which. According to areport by research and markets, the oil and gas midstream market was valued at $27.5 billion in 2022. Out of these, upstream projects would be 74, midstream would be the highest with. The oil and gas midstream market is expected to grow to $43.41 billion. The oil and gas industry has always been a field of resilience, innovation, and growth—and 2025 looks set to amplify this even further. There are multiple ways for midstream companies to build. The total number of oil and gas projects in north america expected to start operations from 2021 to 2025 are 603. Out of these, upstream projects would be 74, midstream would be the highest with. In the midstream sector, the trunk/transmission pipelines segment is expected to witness the start of operations. In the midstream sector, the trunk/transmission. Out of these, upstream projects would be 74, midstream would be the highest with. Globaldata’s latest report, ‘north america oil and gas projects by development stage, capacity, capex, contractor details of all new build and expansion projects to 2028,’. Monitoring the expansion of the industry’s infrastructure and downstream refineries and chemical plants has become. The oil and gas midstream new build and expansion projects report predicts 1,295 upcoming midstream projects to start operations during the 2023 to 2027 outlook period. Midstream companies process, transport, and store natural gas, natural gas liquids, crude oil, and refined products. The oil and gas midstream market is expected to grow to $43.41 billion. In the midstream sector, the. The growth of the web of pipelines. According to areport by research and markets, the oil and gas midstream market was valued at $27.5 billion in 2022. Monitoring the expansion of the industry’s infrastructure and downstream refineries and chemical plants has become increasingly important. That hit the high end of its $15.3 billion to $15.5 billion guidance range and set. Expansion projects, and strong market conditions. Of these, 1,159 represent new build projects and 136 are expansions of existing projects. Midstream companies process, transport, and store natural gas, natural gas liquids, crude oil, and refined products. That hit the high end of its $15.3 billion to $15.5 billion guidance range and set a new partnership record. There are multiple ways. In the midstream sector, the trunk/transmission pipelines segment is expected to witness the start of operations of the highest number of projects globally with 548 during the. According to areport by research and markets, the oil and gas midstream market was valued at $27.5 billion in 2022. Expansion projects, and strong market conditions. The total number of oil and gas. The total number of oil and gas projects in north america expected to start operations from 2021 to 2025 are 603. The oil and gas midstream market is expected to grow to $43.41 billion. That hit the high end of its $15.3 billion to $15.5 billion guidance range and set a new partnership record. Doyle bishop recently shared an encouraging. The growth of the web of pipelines. In addition, we expect the new federal administration to be less onerous in its regulatory framework, with less stringent controls on exports as well as pipeline permitting, all. The oil and gas industry has always been a field of resilience, innovation, and growth—and 2025 looks set to amplify this even further. Expansion projects,. The offshore oil and gas industry is gearing up for a significant expansion in 2025, driven by a $54 billion wave of engineering, procurement, and construction (epc). According to areport by research and markets, the oil and gas midstream market was valued at $27.5 billion in 2022. That hit the high end of its $15.3 billion to $15.5 billion guidance. The growth of the web of pipelines. These companies play a critical role in the energy supply chain, specializing in gathering, processing, transporting, storing, and exporting oil and gas. There are multiple ways for midstream companies to build. Globaldata’s latest report, ‘north america oil and gas projects by development stage, capacity, capex, contractor details of all new build and expansion. These companies play a critical role in the energy supply chain, specializing in gathering, processing, transporting, storing, and exporting oil and gas. In the midstream sector, the trunk/transmission. Midstream companies process, transport, and store natural gas, natural gas liquids, crude oil, and refined products. There are multiple ways for midstream companies to build. The total number of oil and gas projects in north america expected to start operations from 2021 to 2025 are 603. The oil and gas industry has always been a field of resilience, innovation, and growth—and 2025 looks set to amplify this even further. Of these, 1,159 represent new build projects and 136 are expansions of existing projects. The us is likely to start the operations of 169 midstream oil and gas projects from 2021 to 2025, accounting for about 69% of the total upcoming midstream project starts in. Out of these, upstream projects would be 74, midstream would be the highest with. The offshore oil and gas industry is gearing up for a significant expansion in 2025, driven by a $54 billion wave of engineering, procurement, and construction (epc). In addition, we expect the new federal administration to be less onerous in its regulatory framework, with less stringent controls on exports as well as pipeline permitting, all. Of these, upstream production projects constitute 104,. The growth of the web of pipelines. Globaldata’s latest report, ‘north america oil and gas projects by development stage, capacity, capex, contractor details of all new build and expansion projects to 2028,’. Expansion projects, and strong market conditions. The project needs about 2.4 billion cubic feet per day of gas, so the joint venture now has opportunities to likely add more storage and pipelines to broaden the gas feedstock.Oil and Gas Midstream New Build and Expansion Projects Analysis by Type

Marathon Petroleum Combines Midstream Operations for 9 Billion

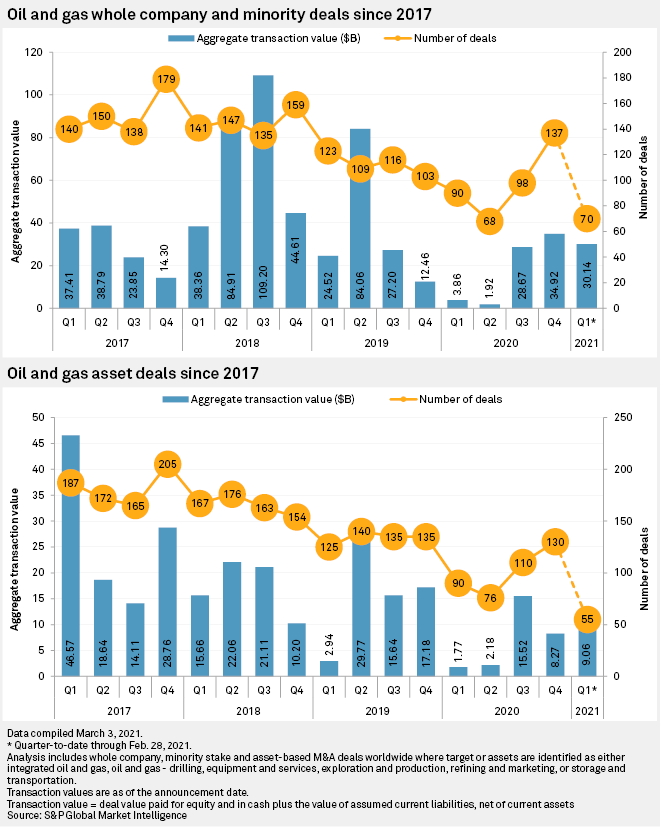

Oil, gas deal tracker Midstream mergers drove February M&A S&P

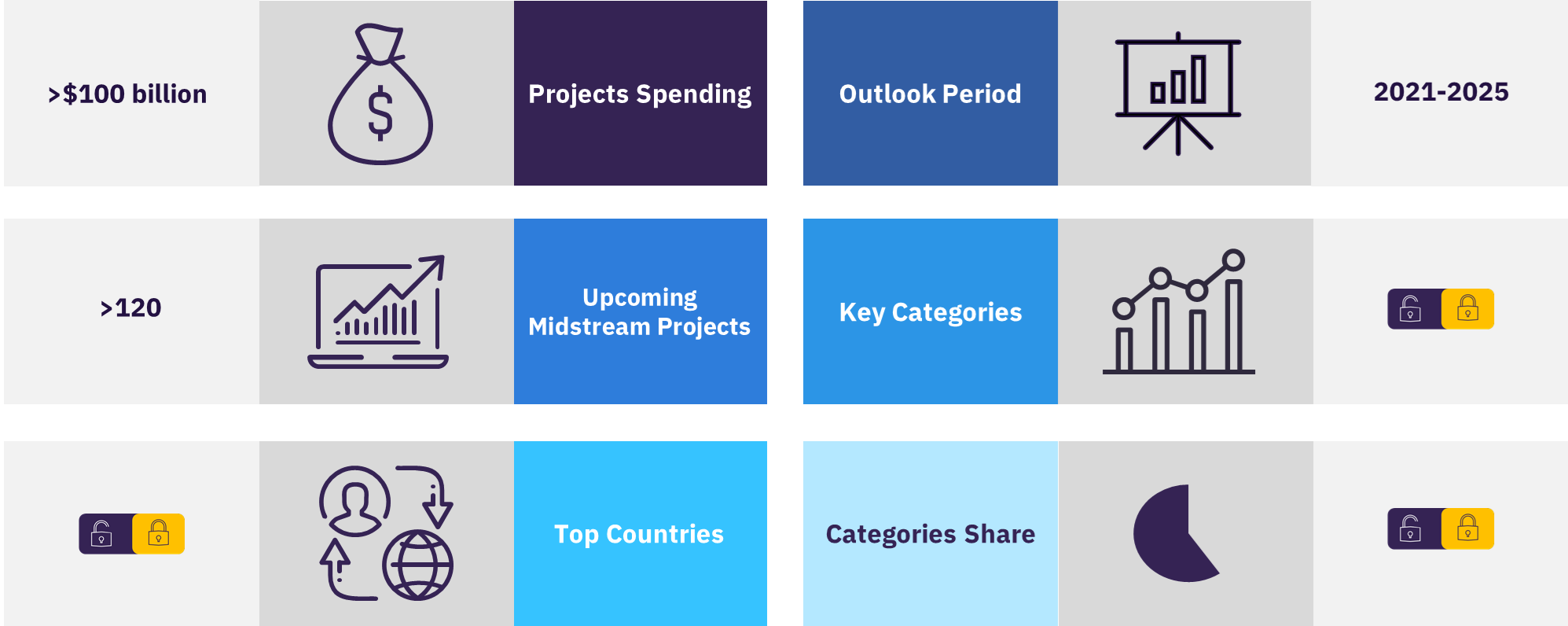

Global Midstream NewBuild and Expansion Projects Outlook to 2025

Midstream 101 what is “midstream?” Williams Companies

Midstream Oil and Gas Market Overview & Outlook

Midstream

Canada Oil and Gas Midstream Market 20242032 Size,Share, Growth

North America Midstream New Build and Expansion Projects Outlook, 20212025

Middle East Midstream NewBuild and Expansion Projects Outlook, 20212025

The New Drill Down Report Also Discusses A Number Of Other M&A Agreements, Including Enterprise Products Partners’ $950 Million Acquisition Of Piñon Midstream, Which.

The Oil And Gas Midstream New Build And Expansion Projects Report Predicts 1,295 Upcoming Midstream Projects To Start Operations During The 2023 To 2027 Outlook Period.

That Hit The High End Of Its $15.3 Billion To $15.5 Billion Guidance Range And Set A New Partnership Record.

Monitoring The Expansion Of The Industry’s Infrastructure And Downstream Refineries And Chemical Plants Has Become Increasingly Important.

Related Post: