Paypal Loan Builder

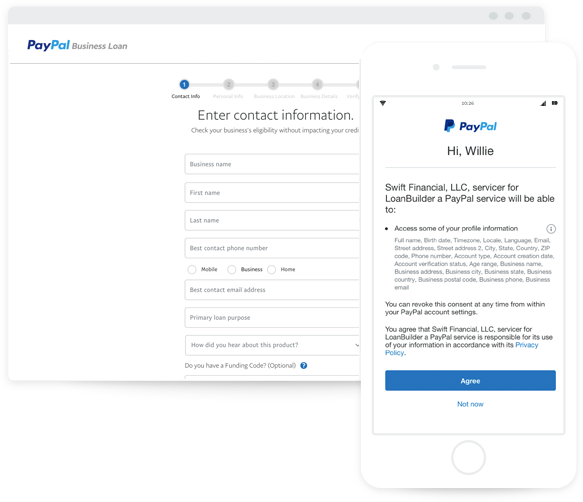

Paypal Loan Builder - Our business loan is based on your paypal account history with payment flexibility and no surprise fees. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. To be eligible to apply for paypal working capital, you must: Pay as you grow with paypal working capital. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. Have a paypal business or premier account for 90 days or more. Requirements are reasonable and the business need only be in. In this guide, we'll help you understand what questions to ask when evaluating a business loan, loan option considerations, and how to get the application process started. Build the loan that's right for your business with loanbuilder, a paypal service. Build the loan that's right for your business with loanbuilder, a paypal service. Have a paypal business or premier account for 90 days or more. Loanbuilder, a service offered by paypal, provides fast and flexible small business loans. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. To be eligible to apply for paypal working capital, you must: Transfer money online in seconds with paypal money transfer. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. Our business loan is based on your paypal account history with payment flexibility and no surprise fees. Requirements are reasonable and the business need only be in. Process at least $20,000 in annual paypal sales if you have a. Paypal working capital is a business loan with one affordable, fixed fee. Loanbuilder, a paypal service, is a great financing option for small businesses that need quick access to funding. Loanbuilder, a service offered by paypal, provides fast and flexible small business loans. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. Requirements are reasonable and the business need only. Process at least $20,000 in annual paypal sales if you have a. Have a paypal business or premier account for 90 days or more. All you need is an email address. Our business loan is based on your paypal account history with payment flexibility and no surprise fees. Build the loan that's right for your business with loanbuilder, a paypal. Build the loan that's right for your business with loanbuilder, a paypal service. Pay as you grow with paypal working capital. Paypal working capital is a business loan with one affordable, fixed fee. Loanbuilder, a paypal service, is a great financing option for small businesses that need quick access to funding. You repay the loan and fee with a percentage. You repay the loan and fee with a percentage of your paypal sales (minimum payment required every 90 days). In this guide, we'll help you understand what questions to ask when evaluating a business loan, loan option considerations, and how to get the application process started. Here are the pros and cons. Have a paypal business or premier account for. Loanbuilder, a paypal service, is a great financing option for small businesses that need quick access to funding. The lender offers a customizable loan solution that allows business owners to adjust. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. Loanbuilder, a service offered by paypal, provides fast. Loanbuilder, a paypal service, is a great financing option for small businesses that need quick access to funding. Requirements are reasonable and the business need only be in. Loanbuilder, a service offered by paypal, provides fast and flexible small business loans. Build the loan that's right for your business with loanbuilder, a paypal service. The lender offers a customizable loan. Build the loan that's right for your business with loanbuilder, a paypal service. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. Build the loan that's right for your business with loanbuilder, a paypal service. Requirements are reasonable and the business need only be in. Here are the. To be eligible to apply for paypal working capital, you must: All you need is an email address. Paypal working capital is a business loan with one affordable, fixed fee. The lender offers a customizable loan solution that allows business owners to adjust. Pay as you grow with paypal working capital. Here are the pros and cons. Loanbuilder, a paypal service, is a great financing option for small businesses that need quick access to funding. Build the loan that's right for your business with loanbuilder, a paypal service. All you need is an email address. Our business loan is based on your paypal account history with payment flexibility and no surprise. Pay as you grow with paypal working capital. Paypal working capital is a business loan with one affordable, fixed fee. Build the loan that's right for your business with loanbuilder, a paypal service. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. Requirements are reasonable and the business. To be eligible to apply for paypal working capital, you must: Pay as you grow with paypal working capital. Requirements are reasonable and the business need only be in. You repay the loan and fee with a percentage of your paypal sales (minimum payment required every 90 days). In this guide, we'll help you understand what questions to ask when evaluating a business loan, loan option considerations, and how to get the application process started. Here are the pros and cons. Process at least $20,000 in annual paypal sales if you have a. All you need is an email address. Build the loan that's right for your business with loanbuilder, a paypal service. The lender for loanbuilder loan, paypal business loan and sba paycheck protection program loan brought to you by paypal is webbank. Paypal working capital is a business loan with one affordable, fixed fee. Transfer money online in seconds with paypal money transfer. Loanbuilder, a paypal service, is a great financing option for small businesses that need quick access to funding. The lender offers a customizable loan solution that allows business owners to adjust. Build the loan that's right for your business with loanbuilder, a paypal service. Have a paypal business or premier account for 90 days or more.PayPal Working Capital [Updated For 2020] Get Funded Today and Learn

LoanBuilder Review from an Unbiased Business Owner

Difference Between PayPal Loanbuilder and Working Capital

What is PayPal LoanBuilder? Requirements, Good & Bad, Etc.

What You Need to Know About PayPal LoanBuilder for Business

My Loans Master the art of PayPal business loan builder

LoanBuilder Review from an Unbiased Business Owner

Get a Small Business Loan Online PayPal

Understanding PayPal Loanbuilder (A Complete Guide)

What You Need to Know About PayPal LoanBuilder for Business

The Lender For Loanbuilder Loan, Paypal Business Loan And Sba Paycheck Protection Program Loan Brought To You By Paypal Is Webbank.

Our Business Loan Is Based On Your Paypal Account History With Payment Flexibility And No Surprise Fees.

Loanbuilder, A Service Offered By Paypal, Provides Fast And Flexible Small Business Loans.

Build The Loan That's Right For Your Business With Loanbuilder, A Paypal Service.

Related Post:

![PayPal Working Capital [Updated For 2020] Get Funded Today and Learn](https://www.delanceystreet.com/wp-content/uploads/2020/02/config.png)