Permanent Building Fund Tax Idaho

Permanent Building Fund Tax Idaho - The permanent building fund budget includes construction and maintenance costs for state buildings, including those at the college, universities and community colleges, funded from the. Its five (5) members are appointed by the governor with. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income. The permanent building fund advisory council was established in 1961 when an ongoing revenue source was created. Unitary group of corporations must pay $10 for each corporation required to file in idaho, whether the corporations file individually or the unitary. Distributive share of idaho additions, subtractions, and credit information. Below are the most common taxes a small business or business owner may be required to pay listed by the agencies that assess them. Creation of permanent building fund. Idaho statutes are updated to the website july 1 following the legislative session. Additional tax on filing income tax credited to permanent building fund. Appropriation — purpose — limitations and. Creation of permanent building fund. The state tax commission of the state of idaho is hereby directed to deposit ten dollars ($10.00) for each tax return it processes in regard to which the taxpayer is required to pay the tax. C corporations must pay the $10 tax. Every person and corporation required to file a tax return a return pays a tax of ten dollars. Use direct file to file your income taxes for free if you qualify. Additional tax on filing income tax credited to permanent building fund. This includes corporations, partnerships, estates, and trusts. Importantly, c corporations pay $10. Add the $10 permanent building fund tax to the estimated income tax, and subtract the amount estimated for income tax credits. The state of idaho also requires most businesses to pay a permanent building fund tax. The permanent building fund advisory council was established in 1961 when an ongoing revenue source was created. Add the $10 permanent building fund tax to the estimated income tax, and subtract the amount estimated for income tax credits. Idaho statutes are updated to the website. Use direct file to file your income taxes for free if you qualify. Its five (5) members are appointed by the governor with. The state of idaho has a flat corporate income tax of 5.8% on c corporations. The state tax commission of the state of idaho is hereby directed to deposit ten dollars ($10.00) for each tax return it. Most businesses must pay the $10 pbf tax. The permanent building fund budget includes construction and maintenance costs for state buildings, including those at the college, universities and community colleges, funded from the. Use direct file to file your income taxes for free if you qualify. Importantly, c corporations pay $10. The permanent building fund tax applies to each member. Idaho statutes are updated to the website july 1 following the legislative session. The permanent building fund budget includes construction and maintenance costs for state buildings, including those at the college, universities and community colleges, funded from the. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in. The state of idaho also requires most businesses to pay a permanent building fund tax. Permanent building fund (pbf) tax: You are required to pay the idaho permanent building fund tax per idaho tax law. Most businesses must pay the $10 pbf tax. The state tax commission of the state of idaho is hereby directed to deposit ten dollars ($10.00). Add the $10 permanent building fund tax to the estimated income tax, and subtract the amount estimated for income tax credits. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income. The state tax commission of the state of idaho is hereby directed to. The state tax commission of the state of idaho is hereby directed to deposit ten dollars ($10.00) for each tax return it processes in regard to which the taxpayer is required to pay the tax. Every person and corporation required to file a tax return a return pays a tax of ten dollars. Below are the most common taxes a. Importantly, c corporations pay $10. Unitary group of corporations must pay $10 for each corporation required to file in idaho, whether the corporations file individually or the unitary. Creation of permanent building fund. The state of idaho has a flat corporate income tax of 5.8% on c corporations. The permanent building fund advisory council was established in 1961 when an. Its five (5) members are appointed by the governor with. Most businesses must pay the $10 pbf tax. Use direct file to file your income taxes for free if you qualify. Permanent building fund (pbf) tax: Appropriation — purpose — limitations and. Add the $10 permanent building fund tax to the estimated income tax, and subtract the amount estimated for income tax credits. Importantly, c corporations pay $10. Appropriation — purpose — limitations and. The state tax commission of the state of idaho is hereby directed to deposit ten dollars ($10.00) for each tax return it processes in regard to which the. The state of idaho also requires most businesses to pay a permanent building fund tax. The state tax commission of the state of idaho is hereby directed to deposit ten dollars ($10.00) for each tax return it processes in regard to which the taxpayer is required to pay the tax. Use direct file to file your income taxes for free if you qualify. The permanent building fund budget includes construction and maintenance costs for state buildings, including those at the college, universities and community colleges, funded from the. Your business may be eligible for a. The permanent building fund tax applies to each member of a unitary group transacting business in idaho, authorized to transact business in idaho, or having income. The permanent building fund advisory council was established in 1961 when an ongoing revenue source was created. Distributive share of idaho additions, subtractions, and credit information. Importantly, c corporations pay $10. Permanent building fund (pbf) tax: The state of idaho has a flat corporate income tax of 5.8% on c corporations. Creation of permanent building fund. C corporations must pay the $10 tax. Unitary group of corporations must pay $10 for each corporation required to file in idaho, whether the corporations file individually or the unitary. Below are the most common taxes a small business or business owner may be required to pay listed by the agencies that assess them. Appropriation — purpose — limitations and.University of Idaho Permanent Building Fund & the Annual Capital Budget

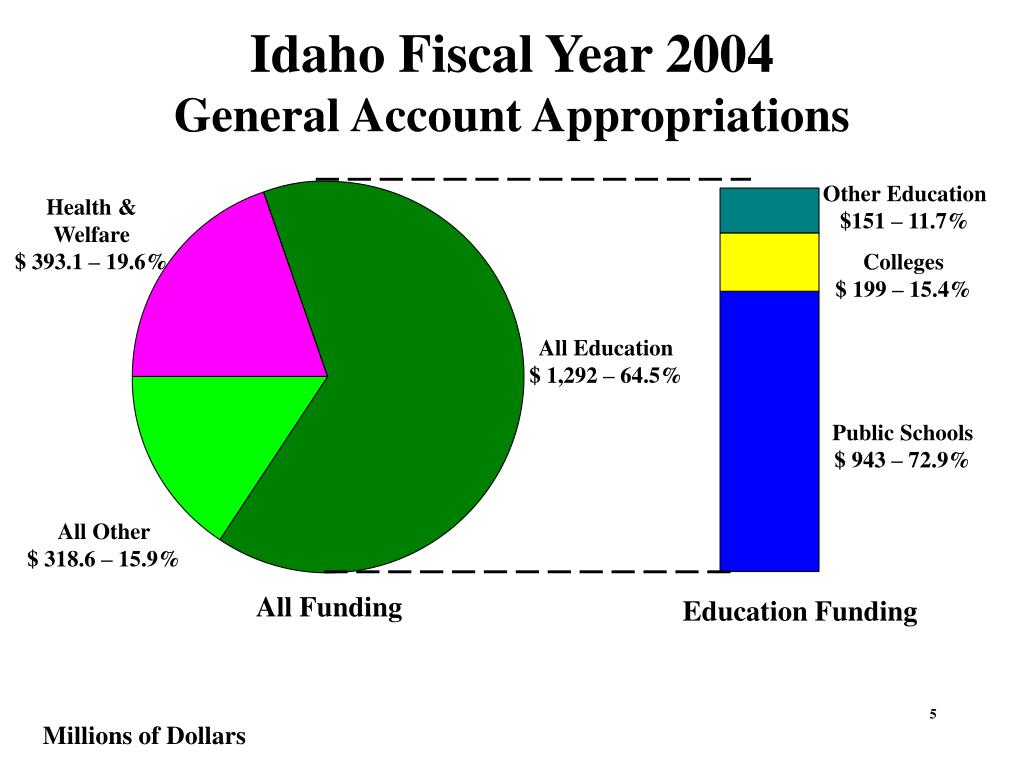

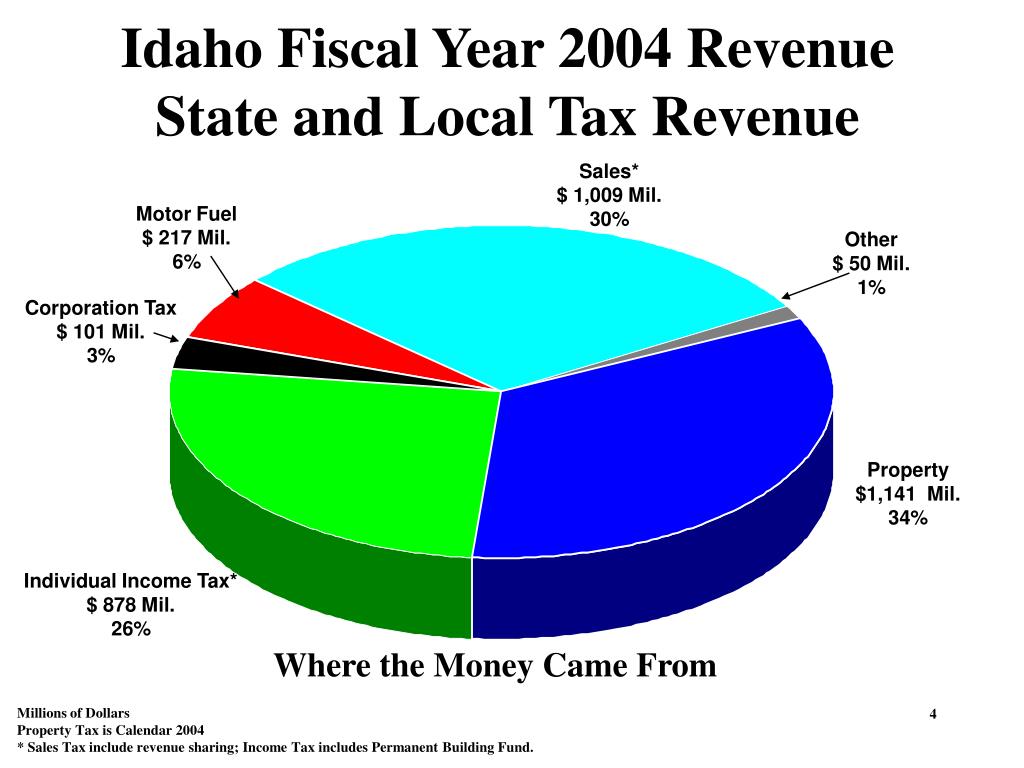

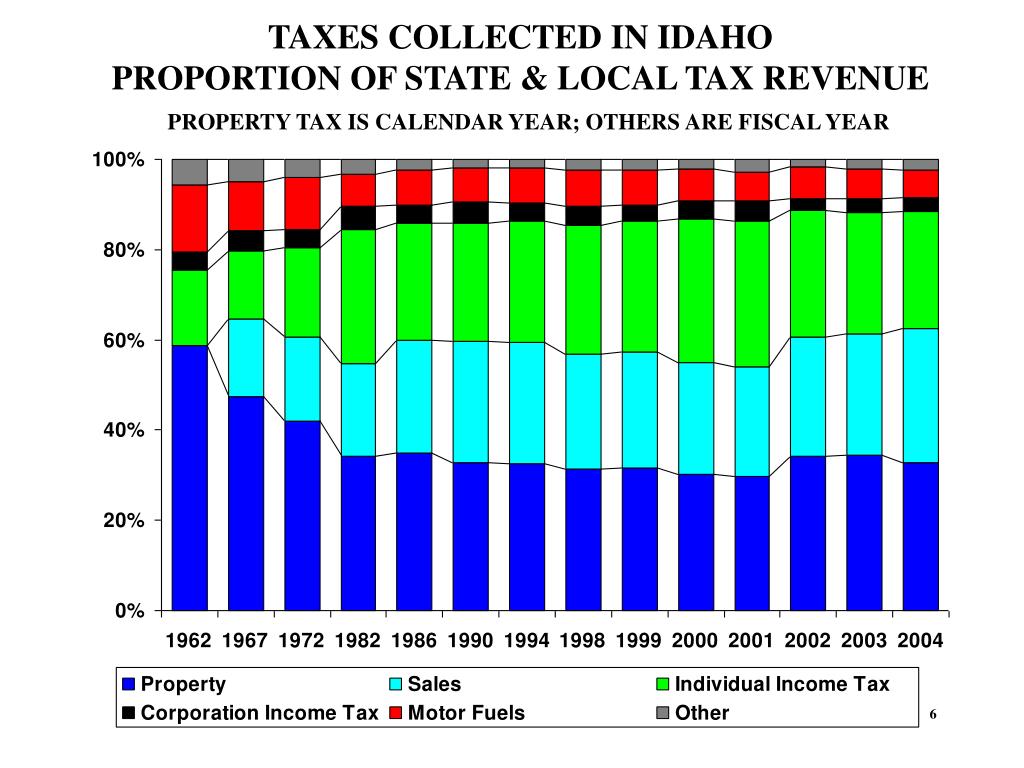

PPT Idaho Property Taxes and the Idaho Tax Structure PowerPoint

University of Idaho Permanent Building Fund & the Annual Capital Budget

Menard Law Building, University of Idaho. Dedication. LR President

PPT University of Idaho PowerPoint Presentation, free download ID

University of Idaho Permanent Building Fund & the Annual Capital Budget

PPT University of Idaho PowerPoint Presentation, free download ID

PPT Idaho Property Taxes and the Idaho Tax Structure PowerPoint

PPT Idaho Property Taxes and the Idaho Tax Structure PowerPoint

Idaho Permanent Building Fund Tax Fill Online, Printable, Fillable

The Permanent Building Fund (Pbf) Tax In Idaho Is A Fixed $10 Charge Applicable To Various Business Entities, Including C Corporations, S.

Its Five (5) Members Are Appointed By The Governor With.

Additional Tax On Filing Income Tax Credited To Permanent Building Fund.

Add The $10 Permanent Building Fund Tax To The Estimated Income Tax, And Subtract The Amount Estimated For Income Tax Credits.

Related Post: