Price Earings Ratio Building Block

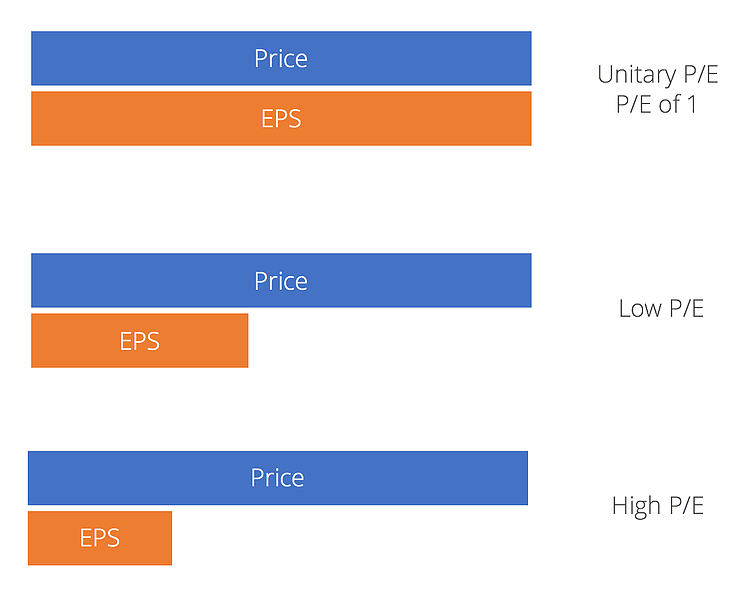

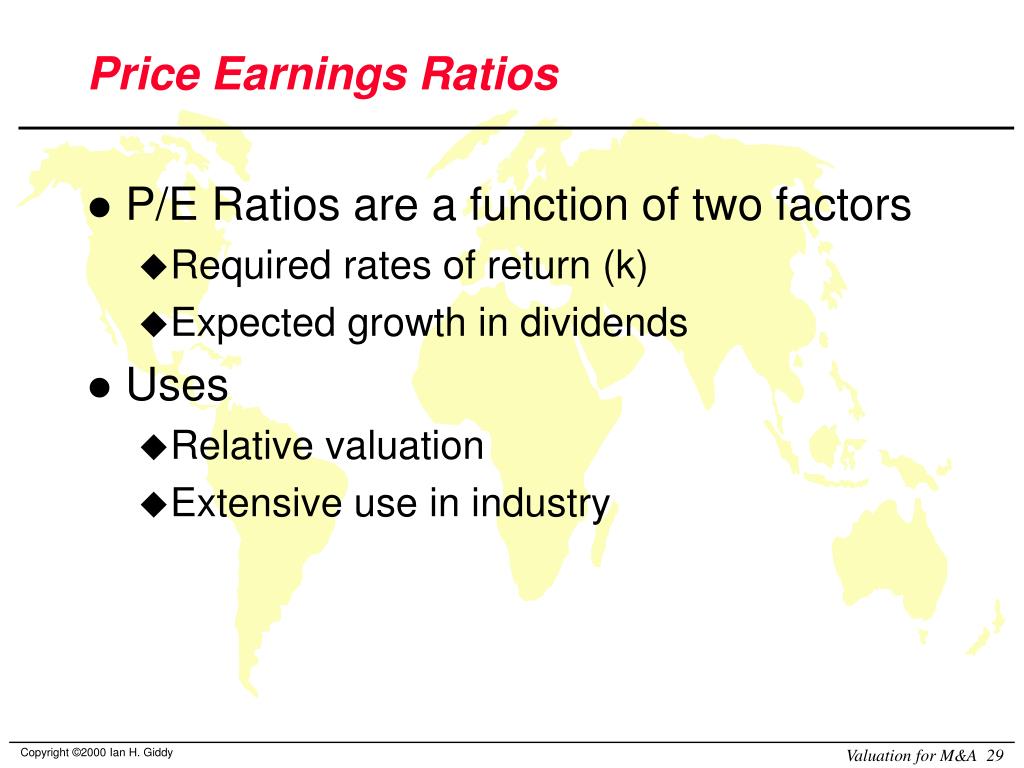

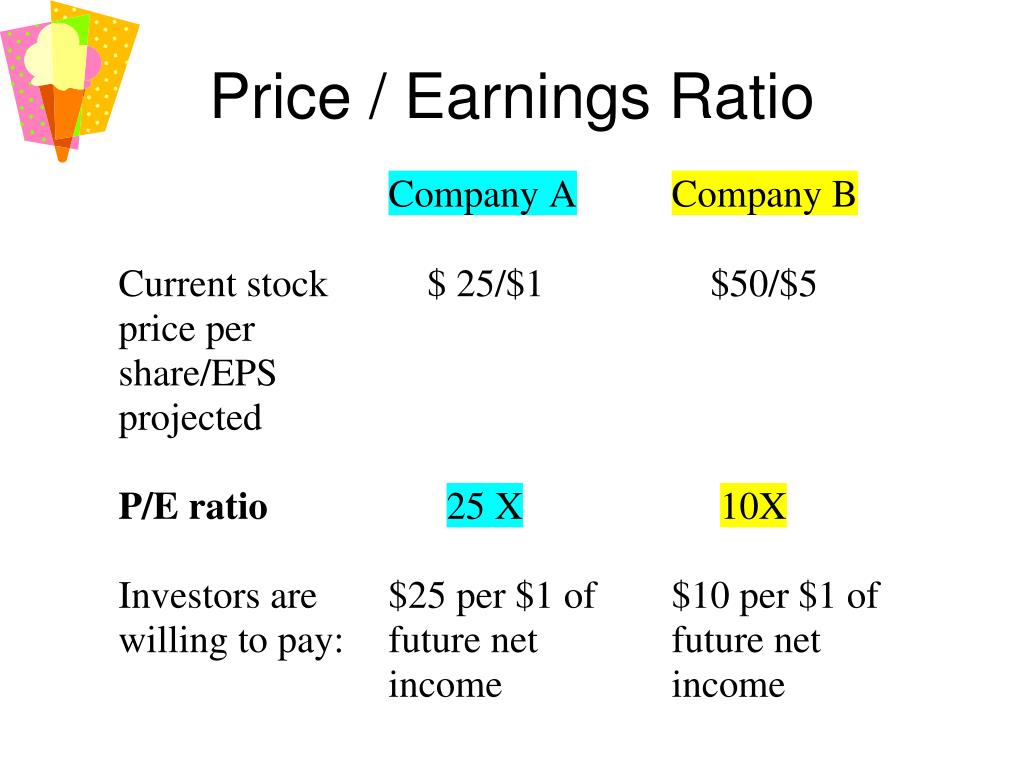

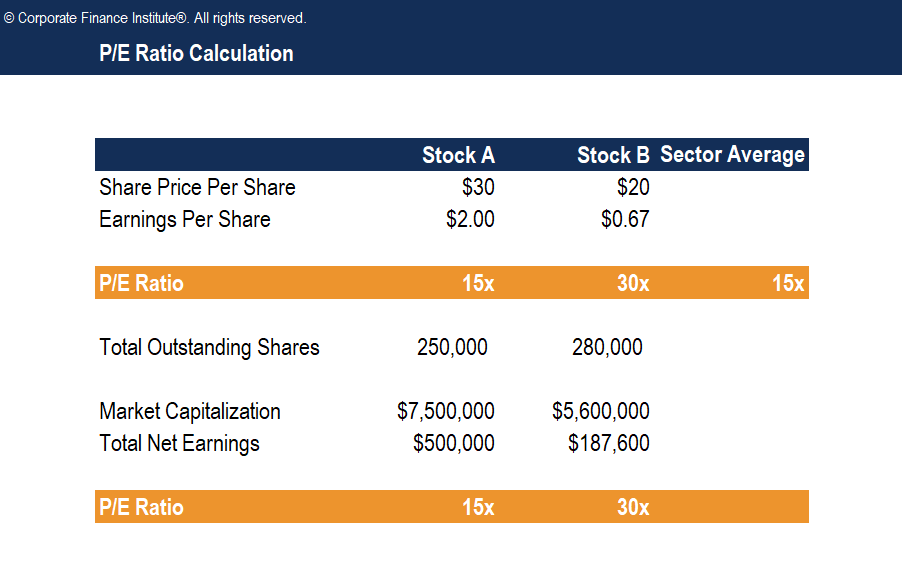

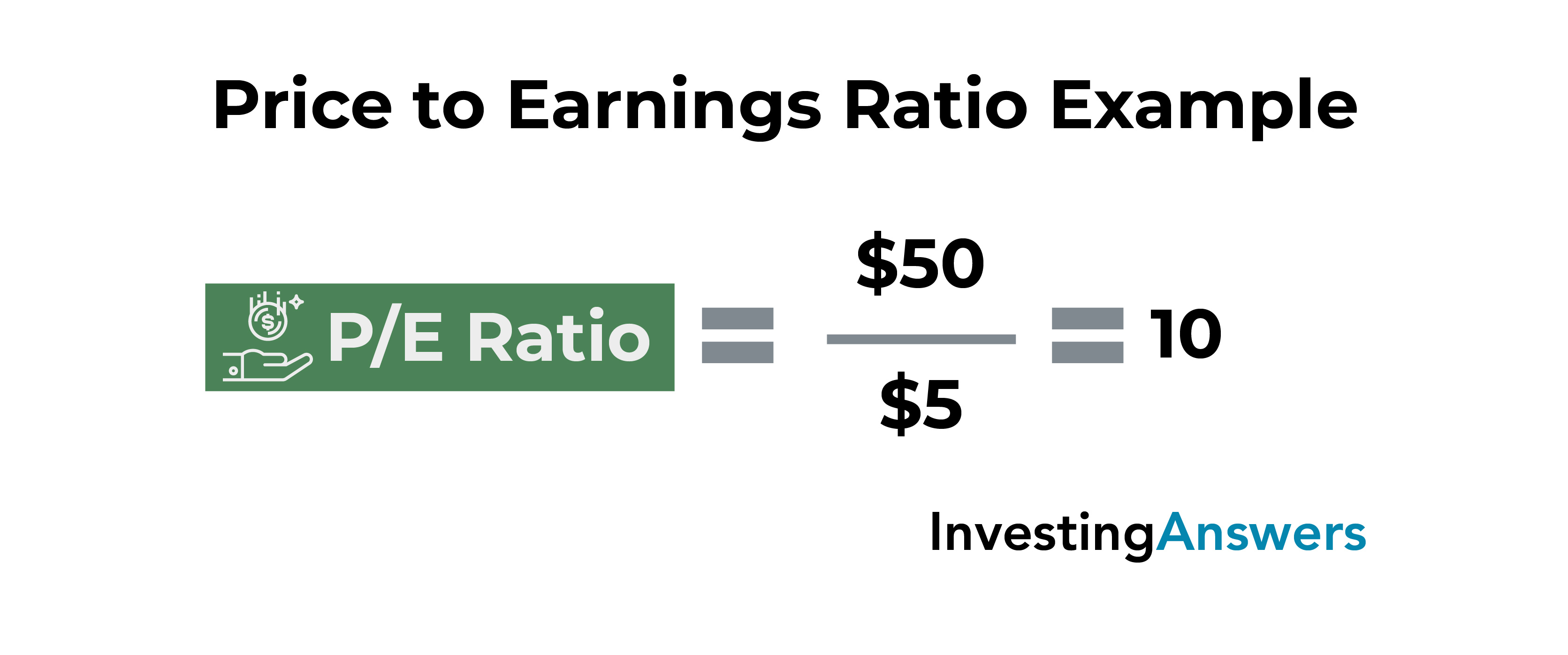

Price Earings Ratio Building Block - What is a p/e ratio? It is calculated by dividing the current. By understanding how to calculate and. Start by identifying which category days' sales uncollected best fits according to its purpose and what it measures, focusing on how it relates to either. Cvs) q4 2024 earnings call feb 12, 2025, 8:00 a.m. The chicago, il housing market is moderately competitive,. The price to earnings (p/e) ratio tells you how much investors are willing to pay for every pound of profit a company delivers. P/e ratio = market price per share / earnings per share (eps) example: It is calculated by dividing the market price per share by the earnings per share (eps). Barclays plc (nyse:bcs) q4 2024 earnings conference call february 13, 2025 4:30 am etcompany participantsc.s. By understanding how to calculate and. Start by identifying which category days' sales uncollected best fits according to its purpose and what it measures, focusing on how it relates to either. It is the most important measure that. If a stock is trading at usd 50. The price earnings (p/e) ratio is an essential tool for investors, offering insights into a company’s valuation relative to its earnings. By examining different types of p/e ratios—such as trailing, forward, and peg ratios—investors can better analyze market trends, make informed investment decisions, and gauge the. Use p/e to compare similar companies, aiding in spotting overpriced or underpriced stocks. Generally, the higher the number the. Let’s explore examples of how the p/e ratio can reflect investor sentiment and market expectations, using companies like apple inc (aapl),. The loss ratio in home warranty was 44% unchanged relative to 2023. The price to earnings (p/e) ratio tells you how much investors are willing to pay for every pound of profit a company delivers. Generally, the higher the number the. In the city of chicago, redfin data shows that the average real estate price is $328,000 and homes go pending in 69 days. There are 2 steps to solve this one.. Barclays plc (nyse:bcs) q4 2024 earnings conference call february 13, 2025 4:30 am etcompany participantsc.s. What is a p/e ratio? Let’s explore examples of how the p/e ratio can reflect investor sentiment and market expectations, using companies like apple inc (aapl),. The loss ratio in home warranty was 44% unchanged relative to 2023. Start by identifying which category days' sales. P/e ratio = market price per share / earnings per share (eps) example: Generally, the higher the number the. National index, are now published as the. In the city of chicago, redfin data shows that the average real estate price is $328,000 and homes go pending in 69 days. It is calculated by dividing the current. The chicago, il housing market is moderately competitive,. What is a good p/e ratio? P/e ratio compares stock price to earnings, signaling if a stock is valued fairly. Generally, the higher the number the. Start by identifying which category days' sales uncollected best fits according to its purpose and what it measures, focusing on how it relates to either. In the city of chicago, redfin data shows that the average real estate price is $328,000 and homes go pending in 69 days. If a stock is trading at usd 50. Start by identifying which category days' sales uncollected best fits according to its purpose and what it measures, focusing on how it relates to either. The loss ratio in. If a stock is trading at usd 50. In the city of chicago, redfin data shows that the average real estate price is $328,000 and homes go pending in 69 days. The chicago, il housing market is moderately competitive,. What is a good p/e ratio? Cvs) q4 2024 earnings call feb 12, 2025, 8:00 a.m. By understanding how to calculate and. By examining different types of p/e ratios—such as trailing, forward, and peg ratios—investors can better analyze market trends, make informed investment decisions, and gauge the. The loss ratio in home warranty was 44% unchanged relative to 2023. Use p/e to compare similar companies, aiding in spotting overpriced or underpriced stocks. The price to earnings. What is a good p/e ratio? The price earnings (p/e) ratio is an essential tool for investors, offering insights into a company’s valuation relative to its earnings. Let’s explore examples of how the p/e ratio can reflect investor sentiment and market expectations, using companies like apple inc (aapl),. Generally, the higher the number the. Barclays plc (nyse:bcs) q4 2024 earnings. Which is the change in our share price. It is calculated by dividing the market price per share by the earnings per share (eps). Cvs) q4 2024 earnings call feb 12, 2025, 8:00 a.m. There are 2 steps to solve this one. What is a good p/e ratio? By examining different types of p/e ratios—such as trailing, forward, and peg ratios—investors can better analyze market trends, make informed investment decisions, and gauge the. What is a good p/e ratio? National index, are now published as the. P/e ratio compares stock price to earnings, signaling if a stock is valued fairly. If a stock is trading at usd 50. By understanding how to calculate and. P/e ratio compares stock price to earnings, signaling if a stock is valued fairly. The price to earnings (p/e) ratio tells you how much investors are willing to pay for every pound of profit a company delivers. P/e ratio = market price per share / earnings per share (eps) example: The loss ratio in home warranty was 44% unchanged relative to 2023. The price earnings (p/e) ratio is an essential tool for investors, offering insights into a company’s valuation relative to its earnings. In the city of chicago, redfin data shows that the average real estate price is $328,000 and homes go pending in 69 days. The chicago, il housing market is moderately competitive,. Start by identifying which category days' sales uncollected best fits according to its purpose and what it measures, focusing on how it relates to either. Which is the change in our share price. Use p/e to compare similar companies, aiding in spotting overpriced or underpriced stocks. By examining different types of p/e ratios—such as trailing, forward, and peg ratios—investors can better analyze market trends, make informed investment decisions, and gauge the. What is a good p/e ratio? It is the most important measure that. Cvs) q4 2024 earnings call feb 12, 2025, 8:00 a.m. If a stock is trading at usd 50.Price to Earnings Ratio PE Ratio Definition, Perform, Examples & Excel

PPT CHAPTER 9 Financial statement analysis I PowerPoint Presentation

Price Earnings Ratio

Pengertian Dan Fungsi Price Earning Ratio Per Cara Mengembangkan Hot

Price Earnings Ratio Formula, Examples and Guide to P/E Ratio

Price to Earning Ratio Formula PE Calculator (Excel template)

PPT Valuation for Mergers & Acquisitions PowerPoint Presentation ID

PPT Foundations of Business PowerPoint Presentation, free download

Price Earnings Ratio Formula, Examples and Guide to P/E Ratio

20 Key Financial Ratios InvestingAnswers

Generally, The Higher The Number The.

Let’s Explore Examples Of How The P/E Ratio Can Reflect Investor Sentiment And Market Expectations, Using Companies Like Apple Inc (Aapl),.

National Index, Are Now Published As The.

It Is Calculated By Dividing The Market Price Per Share By The Earnings Per Share (Eps).

Related Post: