Revolving Credit Builder

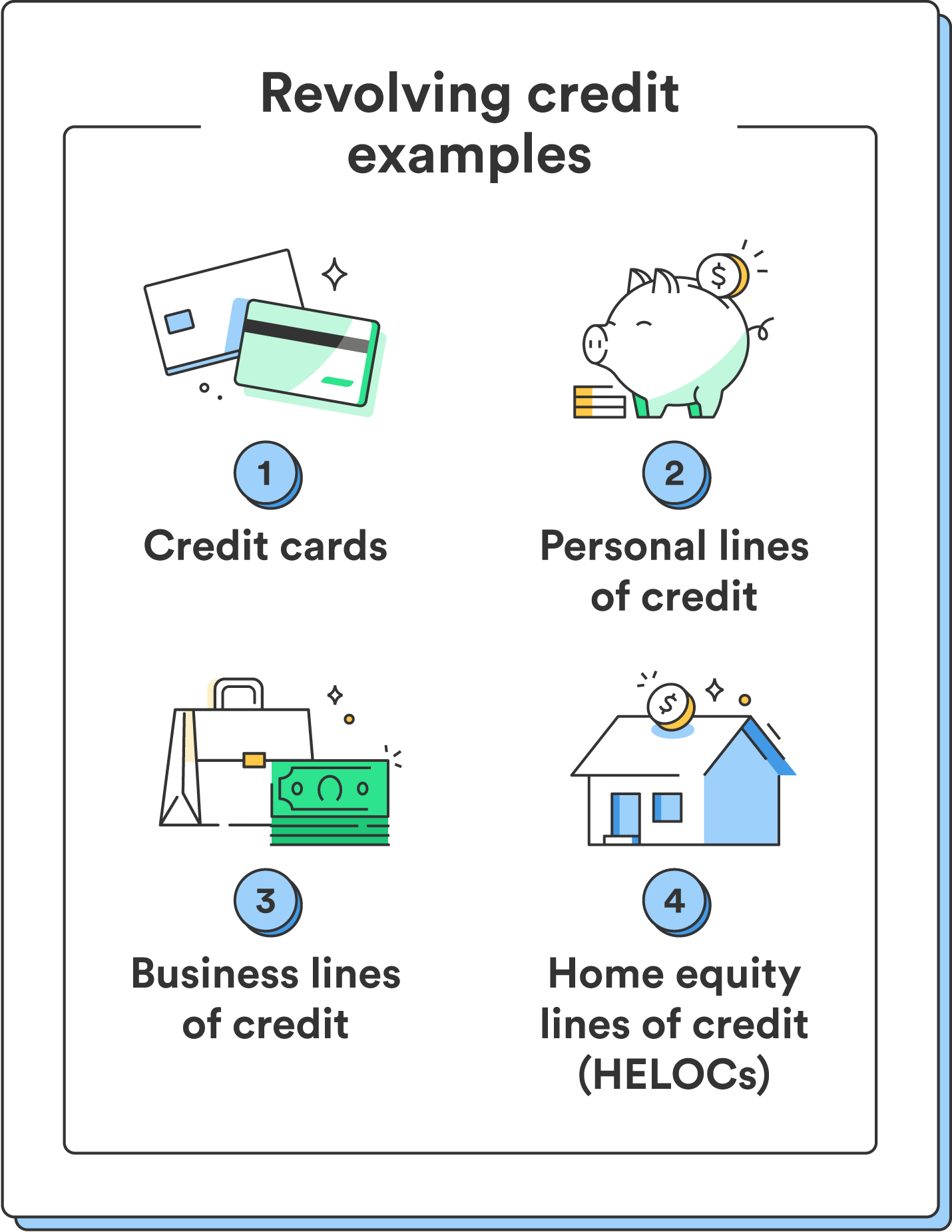

Revolving Credit Builder - Set it and forget it — no monthly payments required. Quickly build $1,000 of revolving credit; No credit needed and no hard credit pull. Each impacts different aspects of your credit score. An installment loan and a revolving credit loan (like a credit card). Forget about paying upfront fees, deposits. Rated 4.9 stars by customers. Credit builder plus membership ($19.99/mo) unlocks eligibility for credit builder loans and other exclusive services. We do not use credit. Revolving credit typically comes in the form of credit cards, and it allows you to have a line of credit to make purchases with as long as you stay within your credit limit and. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. Woodforest national bank offers a reli (secured revolving line of credit) (1) (2) loan product to assist you in managing your consumer checking account, and to build credit history while. Whether you have no or bad credit, you can start building your credit in seconds with instant approval. Rated 4.9 stars by customers. Recommended by 99% of reviewers. No credit needed and no hard credit pull. Whether you opt for one of its borrow & grow loans or a credit builder prime line of. Credit builder loans have an annual percentage rate (apr) ranging from. We do not use credit. Credit builder plus membership ($19.99/mo) unlocks eligibility for credit builder loans and other exclusive services. Many lenders offer credit builder loans as a way to build or repair a credit history as an alternative to taking on debt in the form of a credit card or a personal line of credit. Creditstrong offers two ways to boost a credit score: Recommended by 99% of reviewers. Rated 4.9 stars by customers. Build all your credit scores. Quickly build $1,000 of revolving credit; Credit builder loans are for low amounts—usually under $1,000—and they have short repayment. Set it and forget it — no monthly payments required. Unlike installment loans with fixed monthly payments,. Woodforest national bank offers a reli (secured revolving line of credit) (1) (2) loan product to assist you in managing your consumer checking account,. Allies for community business offers loans between $500 and $100,000 to early, emerging, and established businesses. In short, a credit builder loan can help you jump on board the credit train. Whether you opt for one of its borrow & grow loans or a credit builder prime line of. Revolving credit is a flexible borrowing option that lets you repeatedly. Many lenders offer credit builder loans as a way to build or repair a credit history as an alternative to taking on debt in the form of a credit card or a personal line of credit. Whether you have no or bad credit, you can start building your credit in seconds with instant approval. Forget about paying upfront fees, deposits.. Rated 4.9 stars by customers. Recommended by 99% of reviewers. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. Uccu’s credit builder loan is a loan designed for any 16 and older to build or rebuild credit. Allies for community business offers loans between $500 and $100,000 to early,. Seedfi offers personal loan and line of credit options for borrowers looking to build credit. Designed to lower utilization asap — the fastest way to boost; Whether you opt for one of its borrow & grow loans or a credit builder prime line of. Many lenders offer credit builder loans as a way to build or repair a credit history. No credit needed and no hard credit pull. We are a little different from other lenders: Revolving credit is a flexible borrowing option that lets you repeatedly access a set credit limit as long as you make payments on time. Credit builder plus membership ($19.99/mo) unlocks eligibility for credit builder loans and other exclusive services. Designed to lower utilization asap. Set it and forget it — no monthly payments required. Credit builder plus membership ($19.99/mo) unlocks eligibility for credit builder loans and other exclusive services. Each impacts different aspects of your credit score. Woodforest national bank offers a reli (secured revolving line of credit) (1) (2) loan product to assist you in managing your consumer checking account, and to build. Rated 4.9 stars by customers. As an added bonus, you earn dividends as you pay off the loan. Credit builder plus membership ($19.99/mo) unlocks eligibility for credit builder loans and other exclusive services. Build up to $3,000 of revolving credit; Creditstrong offers two ways to boost a credit score: Uccu’s credit builder loan is a loan designed for any 16 and older to build or rebuild credit. Revolving credit typically comes in the form of credit cards, and it allows you to have a line of credit to make purchases with as long as you stay within your credit limit and. Set it and forget it — no monthly. Build up to $3,000 of revolving credit; Woodforest national bank offers a reli (secured revolving line of credit) (1) (2) loan product to assist you in managing your consumer checking account, and to build credit history while. Add an optional monthly savings payment at any time to get the most out of revolv Uccu’s credit builder loan is a loan designed for any 16 and older to build or rebuild credit. Whether you opt for one of its borrow & grow loans or a credit builder prime line of. Quickly build $1,000 of revolving credit; Credit builder loans are for low amounts—usually under $1,000—and they have short repayment. This loan program displays your ability to make consistent payments on time, over time to raise. In short, a credit builder loan can help you jump on board the credit train. We are a little different from other lenders: Allies for community business offers loans between $500 and $100,000 to early, emerging, and established businesses. Designed to lower utilization asap — the fastest way to boost; No credit needed and no hard credit pull. Whether you have no or bad credit, you can start building your credit in seconds with instant approval. As an added bonus, you earn dividends as you pay off the loan. Many lenders offer credit builder loans as a way to build or repair a credit history as an alternative to taking on debt in the form of a credit card or a personal line of credit.What Is Revolving Credit score? Key Information to Know Bizagility

A Basic Guide To Revolving Credit (Mostly, Credit Cards) Self.

Business Credit Building Step 4 Getting Revolving Credit

What Is Revolving Credit? A Comprehensive Guide In 2023

What is a revolving credit mortgage? mortgagehq

How to Build Credit Best Ways to Increase Your Score

How much revolving credit is good? Leia aqui What is considered high

Revolving Credit Offers A Line Of Credit For Your Company

Building Credit With Revolving Credit Accounts

Credit Strong Revolving Credit Review! Build credit fast without a

Revolving Credit Typically Comes In The Form Of Credit Cards, And It Allows You To Have A Line Of Credit To Make Purchases With As Long As You Stay Within Your Credit Limit And.

We Do Not Use Credit.

Revolving Credit Is A Flexible Borrowing Option That Lets You Repeatedly Access A Set Credit Limit As Long As You Make Payments On Time.

Creditstrong Offers Two Ways To Boost A Credit Score:

Related Post: