Safer Credit Building Chime

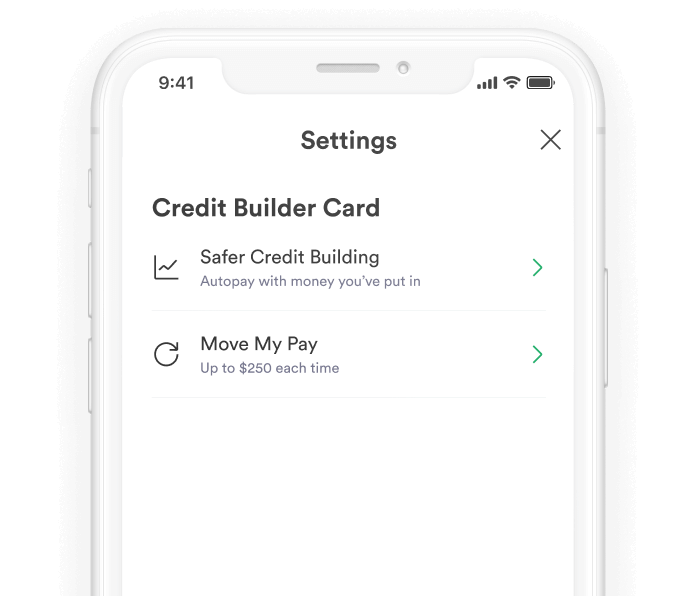

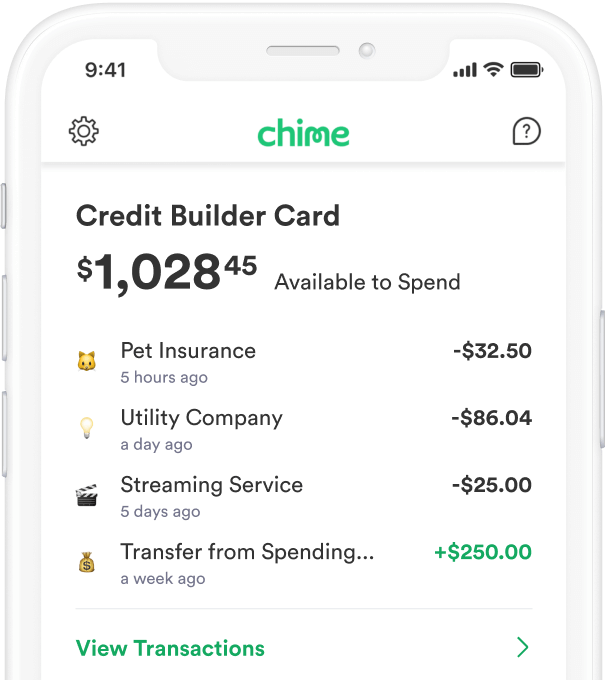

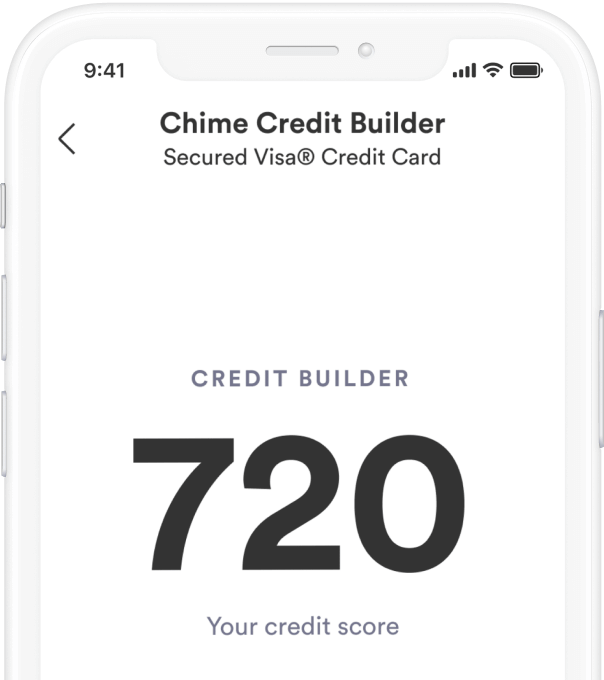

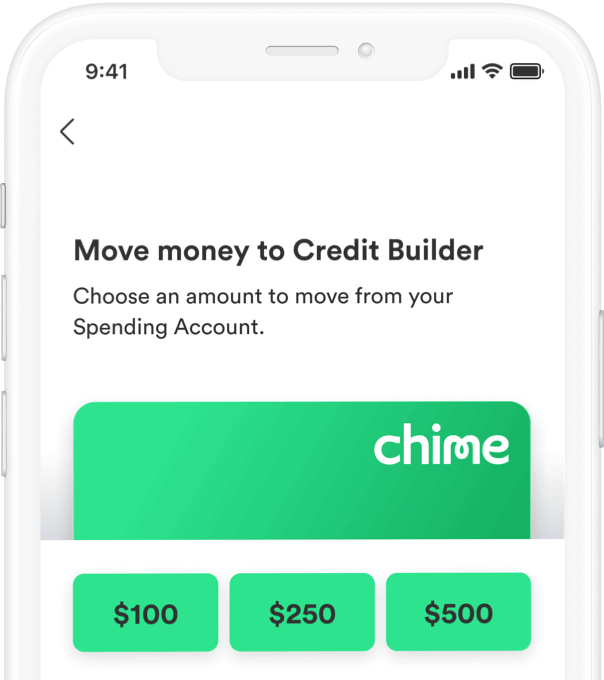

Safer Credit Building Chime - Opt in to safer credit building.² when you make a purchase with safer credit building enabled, the money spent is put on hold in your secured account — and will be. Chime reports to all three major credit bureaus. One of the main reasons chime decided to invest in our chicago team is because the city’s community matters to us: “a large number of chime’s members live in and around. Enabling safer credit building ensures that your balance is. By turning on safer credit building, you authorize chime to automatically make transfers from your secured deposit account to your card account to pay off the monthly billing statement’s. Though their stay in the new office was cut short by. The chime credit builder card offers people with a poor credit score a safe way to build credit without taking on an additional monthly loan payment, interest charges, or fees. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. You can also pay manually. It uses the money you have in your secured account to pay off your credit builder monthly card account balance in full. Here are two ways you can make a payment to your chime credit builder secured visa ® card. With safer credit building turned… Opt in to safer credit building.² when you make a purchase with safer credit building enabled, the money spent is put on hold in your secured account — and will be. You can pay the monthly balance automatically with the safer credit building feature. Safer credit building is an autopay feature. This can help you build your. Turn on chime’s safer credit building feature to never miss a payment. By turning on safer credit building, you authorize chime to automatically make transfers from your secured deposit account to your card account to pay off the monthly billing statement’s. Chime reports to all three major credit bureaus. When safer credit building is enabled, this money in your secured account is automatically used to pay off your balance. Opt in to safer credit building.² when you make a purchase with safer credit building enabled, the money spent is put on hold in your secured account — and will be. You can pay the monthly balance automatically with the. Safer credit building is an autopay feature. By turning on safer credit building, you authorize chime to automatically make transfers from your secured deposit account to your card account to pay off the monthly billing statement’s. With safer credit building turned… From my understanding, the absolute only difference is that when disabled you have to manually push a button to. I was told that the funds transfered to the credit builder account sets the spending limit for the card, and without the safer credit building option enabled the funds will not be pulled from. One of the main reasons chime decided to invest in our chicago team is because the city’s community matters to us: Though their stay in the. I was told that the funds transfered to the credit builder account sets the spending limit for the card, and without the safer credit building option enabled the funds will not be pulled from. Though their stay in the new office was cut short by. When safer credit building is enabled, this money in your secured account is automatically used. This can help you build your. With safer credit building turned… It uses the money you have in your secured account to pay off your credit builder monthly card account balance in full. One of the main reasons chime decided to invest in our chicago team is because the city’s community matters to us: Though their stay in the new. Safer credit building is an autopay feature. You can also pay manually. Chime reports to all three major credit bureaus. With safer credit building disabled, you have to manually pay off your. With safer credit building turned… You can also pay manually. One of the main reasons chime decided to invest in our chicago team is because the city’s community matters to us: Turn on chime’s safer credit building feature to never miss a payment. When safer credit building is enabled, this money in your secured account is automatically used to pay off your balance. Opt in. You can also pay manually. Chime chicago started in an office in fulton market as a team of 3, then moving inside the loop and growing to a team of 8. With safer credit building disabled, you have to manually pay off your. Enabling safer credit building ensures that your balance is. Though their stay in the new office was. Safer credit building is an autopay feature. I was told that the funds transfered to the credit builder account sets the spending limit for the card, and without the safer credit building option enabled the funds will not be pulled from. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that. Though their stay in the new office was cut short by. By turning on safer credit building, you authorize chime to automatically make transfers from your secured deposit account to your card account to pay off the monthly billing statement’s. You have 50$ in there, for example. The chime credit builder card offers people with a poor credit score a. You can pay the monthly balance automatically with the safer credit building feature. Here are two ways you can make a payment to your chime credit builder secured visa ® card. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. Enabling safer credit building ensures that your balance is. The chime credit builder card offers people with a poor credit score a safe way to build credit without taking on an additional monthly loan payment, interest charges, or fees. You transfer money from your spending account into your credit builder account. This can help you build your. When safer credit building is enabled, this money in your secured account is automatically used to pay off your balance. With safer credit building disabled, you have to manually pay off your. Roderick woodson of morgan park saw $997 mysteriously drained from his chime financial account in minutes. I was told that the funds transfered to the credit builder account sets the spending limit for the card, and without the safer credit building option enabled the funds will not be pulled from. Safer credit building is an autopay feature. From my understanding, the absolute only difference is that when disabled you have to manually push a button to pay your balance, whereas when it's enabled it just pays it automatically. “a large number of chime’s members live in and around. Turn on chime’s safer credit building feature to never miss a payment. Chime reports to all three major credit bureaus.How to build credit with Credit Builder Chime

Credit Builder Card Chime

Credit Card To Build Credit Securely Chime

Is this bad? What does this mean? I use safer credit building r

Chime Credit Builder Review Can It Really Improve Your Credit?

Credit Card To Build Credit Securely Chime

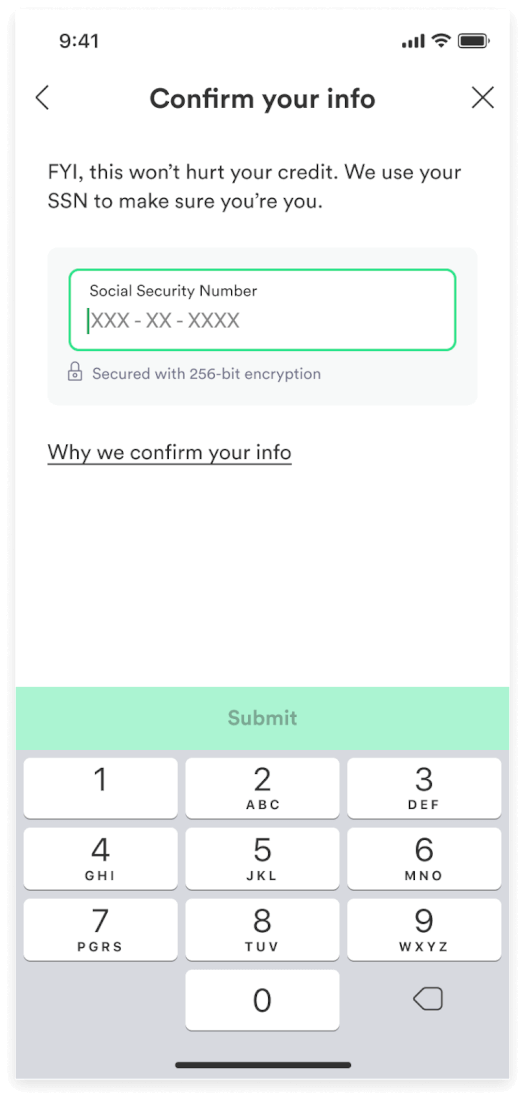

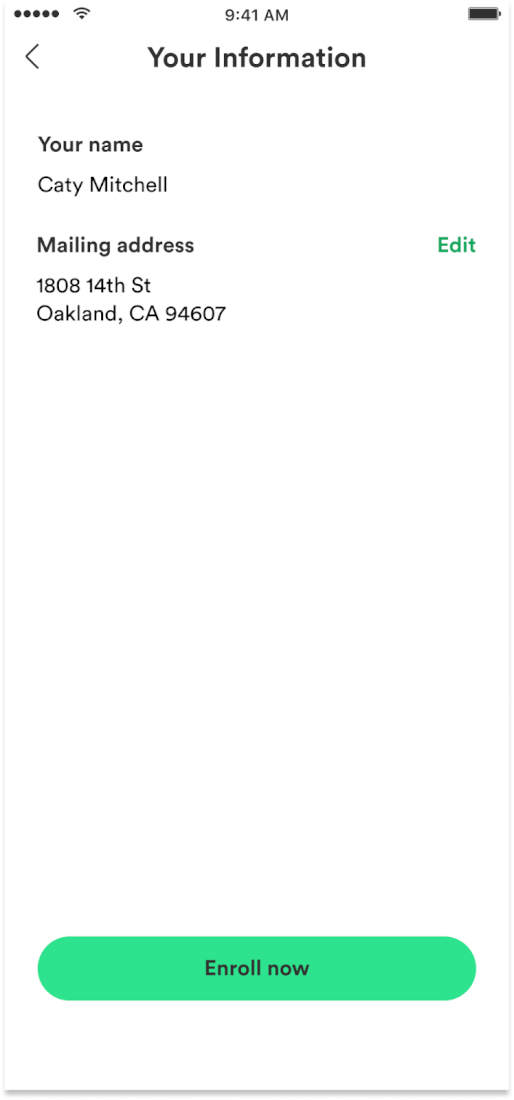

How to Sign Up for Chime Credit Builder Chime

How to Sign Up for Chime Credit Builder Chime

Credit Builder Card Chime

Credit Card To Build Credit Securely Chime

Though Their Stay In The New Office Was Cut Short By.

Opt In To Safer Credit Building.² When You Make A Purchase With Safer Credit Building Enabled, The Money Spent Is Put On Hold In Your Secured Account — And Will Be.

By Turning On Safer Credit Building, You Authorize Chime To Automatically Make Transfers From Your Secured Deposit Account To Your Card Account To Pay Off The Monthly Billing Statement’s.

With Safer Credit Building Turned…

Related Post: