Sales Tax When Building A New House In Oklahoma

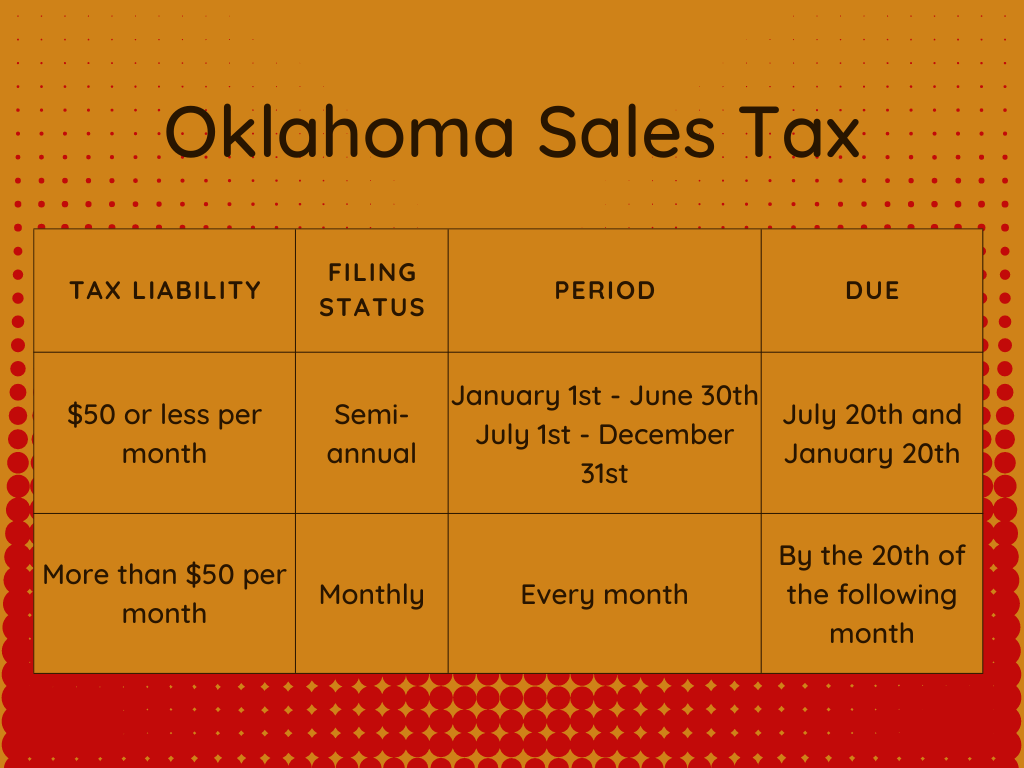

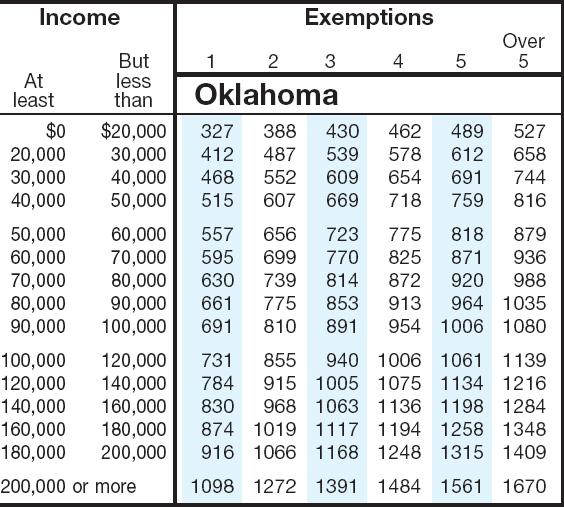

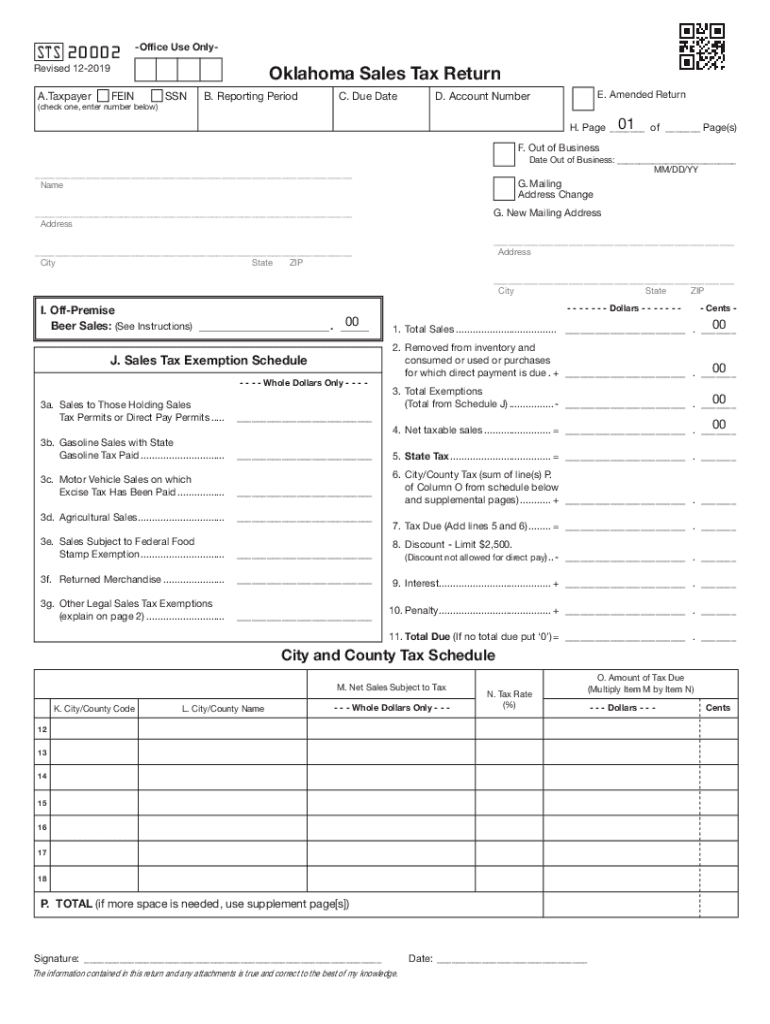

Sales Tax When Building A New House In Oklahoma - (a) any building structure permanently attached to land will not be subject to sales tax upon the sale of that structure, even though it is located on leased land or railroad right of. Find out if you need to pay. Oklahoma sales tax is levied at 4.5% of the gross receipts from the sale or rental of tangible personal property and from the furnishing of specific services. It will provide comprehensive information on federal and state incentives, energy tax credits, and. Land costs can add a hefty $19,600 per acre. Goods that are subject to sales. You are required to obtain a sales tax permit and collect sales tax for the state if you sell products or goods. As a result, construction contractors who convert tangible personal property (tpp) into real property are generally considered to be the taxable user or consumer of the tpp. Change in ownership of business; If a city or county is not listed, they do not have a sales or use tax. Oklahoma imposes a transfer tax on sales of real property where the consideration exchanged exceeds $100.[28] the tax is equal to 75 cents. Oac 710:65 oklahoma tax commission 1 chapter 65. You're taking the sales tax deduction, as opposed to. Land costs can add a hefty $19,600 per acre. Buildings, land) are exempt from sales and use tax in all states. What transactions are generally subject to sales tax in oklahoma? You are required to obtain a sales tax permit and collect sales tax for the state if you sell products or goods. If a city or county is not listed, they do not have a sales or use tax. Do i need to pay use tax? Determining whether or not the products or services your company sells are taxable in oklahoma is the first step in sales tax compliance. You're taking the sales tax deduction, as opposed to. These transactions are excluded from. Determining whether or not the products or services your company sells are taxable in oklahoma is the first step in sales tax compliance. If you build the house. You can deduct the sales tax on your home renovation or construction if all of these conditions apply: If you ship goods, you will need to collect at the rate(s) in effect at the location where delivery occurs. It costs anywhere from $250,000 to $450,000 to build a custom home in oklahoma. Up to 24% cash back the sales tax code and use tax code (hereinafter collectively “tax code”)impose a tax on the end user or consumer of. In the state of oklahoma, sales tax is legally required to be collected from all tangible, physical products being sold to a. Use tax tax paid on the state, county and city level (where applicable) on tangible personal property purchased and. What transactions are generally subject to sales tax in oklahoma? This guide will look into the world of tax. Use tax tax paid on the state, county and city level (where applicable) on tangible personal property purchased and. Determining whether or not the products or services your company sells are taxable in oklahoma is the first step in sales tax compliance. Change in ownership of business; Oac 710:65 oklahoma tax commission 1 chapter 65. You can deduct the sales. Land costs can add a hefty $19,600 per acre. Oac 710:65 oklahoma tax commission 1 chapter 65. It will provide comprehensive information on federal and state incentives, energy tax credits, and. Oklahoma sales tax is levied at 4.5% of the gross receipts from the sale or rental of tangible personal property and from the furnishing of specific services. You're taking. You're taking the sales tax deduction, as opposed to. Change in ownership of business; The statewide sales tax in oklahoma is 4.50%; Buildings, land) are exempt from sales and use tax in all states. Do i need to pay use tax? Determining whether or not the products or services your company sells are taxable in oklahoma is the first step in sales tax compliance. The statewide sales tax in oklahoma is 4.50%; Oklahoma sales tax is levied at 4.5% of the gross receipts from the sale or rental of tangible personal property and from the furnishing of specific services. Oklahoma imposes. Oac 710:65 oklahoma tax commission 1 chapter 65. It costs anywhere from $250,000 to $450,000 to build a custom home in oklahoma. Do i need to pay use tax? As a result, construction contractors who convert tangible personal property (tpp) into real property are generally considered to be the taxable user or consumer of the tpp. These transactions are excluded. Determining whether or not the products or services your company sells are taxable in oklahoma is the first step in sales tax compliance. Change in ownership of business; It will provide comprehensive information on federal and state incentives, energy tax credits, and. Use tax tax paid on the state, county and city level (where applicable) on tangible personal property purchased. Sales of real property (e.g. Buildings, land) are exempt from sales and use tax in all states. Oac 710:65 oklahoma tax commission 1 chapter 65. Use tax tax paid on the state, county and city level (where applicable) on tangible personal property purchased and. Also if you lease or rent products you are required to obtain a sales tax permit. Goods that are subject to sales. Also if you lease or rent products you are required to obtain a sales tax permit and. It costs anywhere from $250,000 to $450,000 to build a custom home in oklahoma. The statewide sales tax in oklahoma is 4.50%; Oac 710:65 oklahoma tax commission 1 chapter 65. As a result, construction contractors who convert tangible personal property (tpp) into real property are generally considered to be the taxable user or consumer of the tpp. Oklahoma imposes a transfer tax on sales of real property where the consideration exchanged exceeds $100.[28] the tax is equal to 75 cents. In the state of oklahoma, sales tax is legally required to be collected from all tangible, physical products being sold to a. Buildings, land) are exempt from sales and use tax in all states. If you ship goods, you will need to collect at the rate(s) in effect at the location where delivery occurs. If you build the house. If you bought a house from a builder and he doesn't list the sales tax, then you just don't know about it, but it's in there (similar to the tax on gasoline). Oklahoma sales tax is levied at 4.5% of the gross receipts from the sale or rental of tangible personal property and from the furnishing of specific services. Determining whether or not the products or services your company sells are taxable in oklahoma is the first step in sales tax compliance. You're taking the sales tax deduction, as opposed to. (a) any building structure permanently attached to land will not be subject to sales tax upon the sale of that structure, even though it is located on leased land or railroad right of.Oklahoma Sales Tax 2023 2024

Oklahoma Sales Tax Calculator and Local Rates 2021 Wise

Oklahoma 2023 Sales Tax Guide

Sales Tax Oklahoma Filing Oklahoma Sales Tax Online

Oklahoma Sales Tax Rate Changes 2024 Trish Henrieta

Oklahoma 20192025 Form Fill Out and Sign Printable PDF Template

Oklahoma Tax Sales Tax Deeds YouTube

Oklahoma Sales Tax Guide for Businesses

How to Register For a Sales Tax Permit in Oklahoma?

Oklahoma Packet E Oklahoma Sales Tax Exemption Packet Fill Out

Documentary Stamp Tax And Sales Tax.

This Guide Will Look Into The World Of Tax Credits For New Home Construction.

If A City Or County Is Not Listed, They Do Not Have A Sales Or Use Tax.

And That’s Just For Construction!

Related Post: