Savings Builder

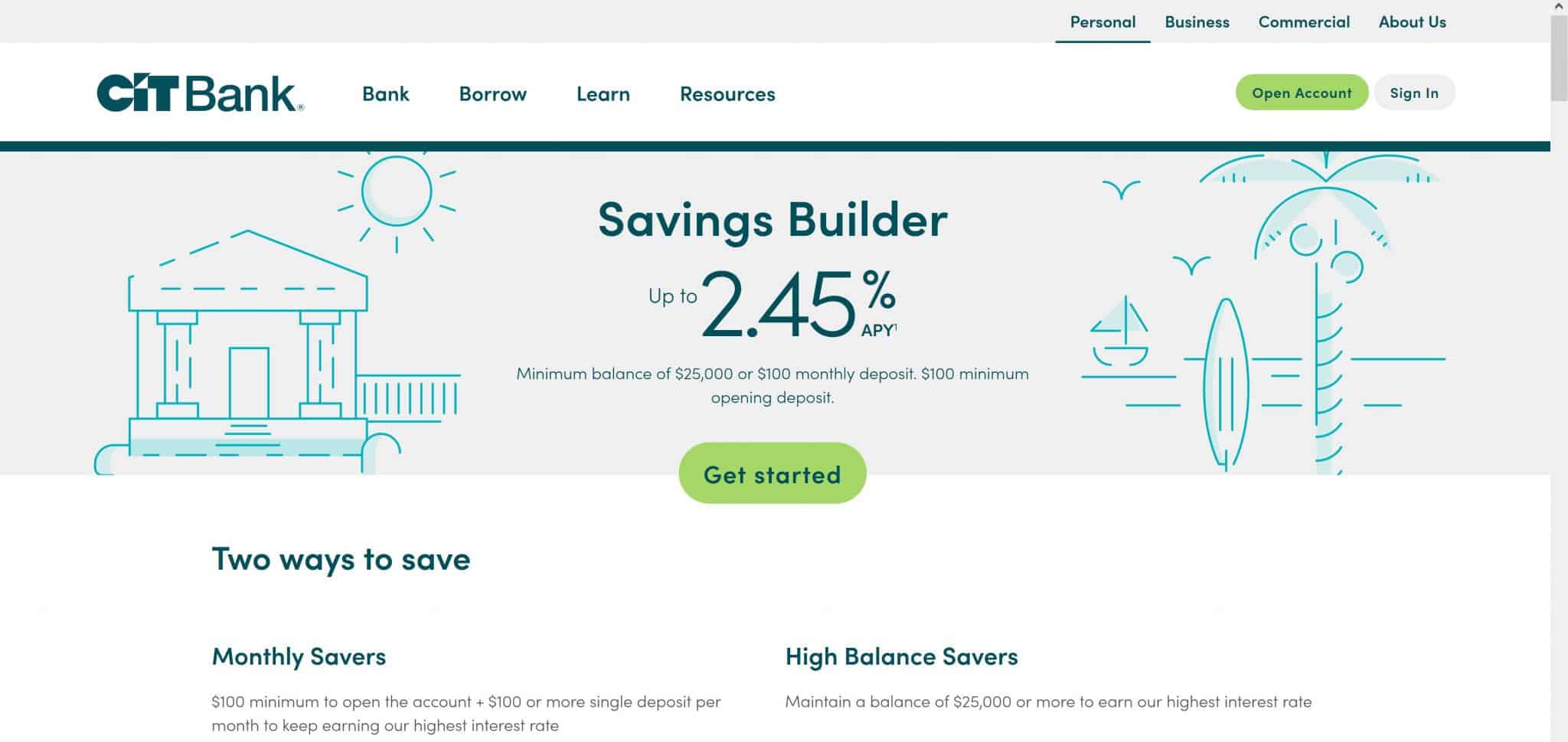

Savings Builder - Get an extra $5 a month when you grow your balance by $200 or more in a new savings builder account for the first year3. The cit bank savings builder account is a very fine option for people looking to get a little bit more return on their cash savings. So you have $100,000 and you want to build it into $1 million by retirement. Get our best rate with access2 to your. To do this, you bucket each type of retirement savings—cash, bonds, and stocks—to take care of a specific need in retirement. Save more & earn a high apy with savings builder, a tiered interest rate savings account from cit bank. The savings builder account has no monthly maintenance fee. The results display your estimated 401(k) balance at retirement, divided into three components: An easier, not thinking way to save; Saving money can be challenging, but technology is making it easier than ever. To do this, you bucket each type of retirement savings—cash, bonds, and stocks—to take care of a specific need in retirement. The minimum opening deposit is a modest $25. Save more & earn a high apy with savings builder, a tiered interest rate savings account from cit bank. Our savings builder option can help you earn higher interest rates so you can grow your savings faster. By being mindful of your spending and making small changes in your lifestyle, you will start to see a difference in your. When i first started saving, i relied on willpower alone, and i soon. The savings builder account has no monthly maintenance fee. Unlock your savings potential with hancock whitney's savings builder account. In short, i recommend cit bank to help put your savings to work, giving it a 8.5/10 score. So you have $100,000 and you want to build it into $1 million by retirement. When i first started saving, i relied on willpower alone, and i soon. Automating savings is the number one piece of advice i give my friends and family. Learn why it's the right choice for you. The minimum opening deposit is a modest $25. You can open your savings account here to start saving money,. Save more & earn a high apy with savings builder, a tiered interest rate savings account from cit bank. Reach your financial goals today with the help of cit bank. So you have $100,000 and you want to build it into $1 million by retirement. To calculate if your balance has grown by $200, we will compare the ledger balance. Get an extra $5 a month when you grow your balance by $200 or more in a new savings builder account for the first year3. Please note that it’s a. Our savings builder account rewards you with a bonus interest rate for growing your savings monthly, so you can reach your financial goals even faster. The minimum opening deposit is. Please note that it’s a. Learn why it's the right choice for you. An easier, not thinking way to save; The online cit bank savings builder account has no monthly fees and earns up to 1% apy — above the national average but significantly lower than other top savings accounts. See how easy it is to earn a higher apy. Automating savings is the number one piece of advice i give my friends and family. An easier, not thinking way to save; To do this, you bucket each type of retirement savings—cash, bonds, and stocks—to take care of a specific need in retirement. Get our best rate with access2 to your. Bitcoin fomo has come for family finances. By being mindful of your spending and making small changes in your lifestyle, you will start to see a difference in your. Your personal contributions, employer matches and investment returns.this. When i first started saving, i relied on willpower alone, and i soon. So you have $100,000 and you want to build it into $1 million by retirement. Each time. The cit bank savings builder account is a very fine option for people looking to get a little bit more return on their cash savings. So you have $100,000 and you want to build it into $1 million by retirement. Your personal contributions, employer matches and investment returns.this. Each time you swipe your debit card, savings builder will round up. Earn interest on every dollar! You can open your savings account here to start saving money,. Please note that it’s a. Get our best rate with access2 to your. By being mindful of your spending and making small changes in your lifestyle, you will start to see a difference in your. Learn why it's the right choice for you. Each time you swipe your debit card, savings builder will round up your purchase and 'save' the extra change for you! When i first started saving, i relied on willpower alone, and i soon. Reach your financial goals today with the help of cit bank. Learn about the best savings accounts in. Moving funds from a money market or premier savings account to savings builder is simple with our video. Reach your financial goals today with the help of cit bank. So you have $100,000 and you want to build it into $1 million by retirement. An easier, not thinking way to save; To calculate if your balance has grown by $200,. Moving funds from a money market or premier savings account to savings builder is simple with our video. Learn why it's the right choice for you. The savings builder account helps a. Get our best rate with access2 to your. When i first started saving, i relied on willpower alone, and i soon. Get an extra $5 a month when you grow your balance by $200 or more in a new savings builder account for the first year3. See how easy it is to earn a higher apy. The account can be opened online or in a branch. Automating savings is the number one piece of advice i give my friends and family. Accelerate your savings with cit bank savings builder, a tiered interest rate savings account. Our savings builder option can help you earn higher interest rates so you can grow your savings faster. Reach your financial goals today with the help of cit bank. Even if you have less — perhaps a lot less — than $100,000, there are multiple. Knowing the sum of money doubles every 15 years due to the interest rate, we can consider the actual money saving will reach 1 million$ after 20 years. One of those is cit bank. In short, i recommend cit bank to help put your savings to work, giving it a 8.5/10 score.CIT Bank Savings Builder Review 2024

Five best savings building strategies for 2023

CIT Savings Builder Review After 2 Years Earn More Interest

CIT Savings Builder Review After 2 Years Earn More Interest

10 Best saving accounts of 2024 Responsible Economy

5 Best Online Savings Accounts With High Interest Rates Smart Saving

CIT Savings Builder Review After 2 Years Earn More Interest

CIT Bank Review 2023 HighYield Online Savings Accounts With No Fees

CIT Bank Savings Builder Review [2021 Update]

CIT Bank Savings Builder Review 2024

An Easier, Not Thinking Way To Save;

Bitcoin Fomo Has Come For Family Finances.

Please Note That It’s A.

You Can Open Your Savings Account Here To Start Saving Money,.

Related Post:

![CIT Bank Savings Builder Review [2021 Update]](https://wellkeptwallet.com/wp-content/uploads/CIT-Bank-Saving-builder-Review-Pinterest.jpg)