Secured Loans To Build Credit

Secured Loans To Build Credit - • credit builder loans and secured credit cards can help build credit history. Learning how to build credit can help if you have a bad credit score or want to improve your current score. Track your credit health with enhanced credit monitoring and access a credit builder loan to help build credit. A savings secured loan or secured credit card can be a smart way to build or repair your credit so you can borrow the funds you need later on in life. Rv loans might be secured, much like auto loans, by the item you’re financing. You make payments before you receive your funds, versus receiving funds and making payments like you would. This secured loan uses money as collateral, and your payment. When these moments occur, a personal loan, can provide access to cash when you need it. Complete challenges designed to help you build credit and earn. Life happens and there will be times when needing immediate access to additional cash arises. A shared secured loan is a great first step to build or rebuild your. • credit builder loans and secured credit cards can help build credit history. You can start by getting a secured credit card, becoming an. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. Use a secured credit card: Life happens and there will be times when needing immediate access to additional cash arises. But if credit cards helped get you into this mess,. Track your credit health with enhanced credit monitoring and access a credit builder loan to help build credit. When these moments occur, a personal loan, can provide access to cash when you need it. These loans are collateralized by assets like the borrower’s home or vehicle, and may make it easier for less. And because rvs tend to be expensive, you can usually get approved for a loan large enough to. If you primarily want to take out a secured loan to help build your credit, you can use a credit builder loan. When these moments occur, a personal loan, can provide access to cash when you need it. Life happens and there. Track your credit health with enhanced credit monitoring and access a credit builder loan to help build credit. Start rebuilding your credit after financial hardship with our secured loan option, ranging from $250 to $1,000. Regions bank offers secured personal loans as small as $250, which should help you not have to borrow more than you need. And because rvs. If you primarily want to take out a secured loan to help build your credit, you can use a credit builder loan. You make payments before you receive your funds, versus receiving funds and making payments like you would. Shared accounts remain the responsibility of both parties unless refinanced or closed.; Start rebuilding your credit after financial hardship with our. You make payments before you receive your funds, versus receiving funds and making payments like you would. Complete challenges designed to help you build credit and earn. Secured personal loans offer a more accessible alternative. Use a secured credit card: Secured debt is basically a loan that’s backed by an asset. If you primarily want to take out a secured loan to help build your credit, you can use a credit builder loan. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. Complete challenges designed to help you build credit and earn. You can start by getting a secured credit card, becoming an.. Start rebuilding your credit after financial hardship with our secured loan option, ranging from $250 to $1,000. This secured loan uses money as collateral, and your payment. You can start by getting a secured credit card, becoming an. Life happens and there will be times when needing immediate access to additional cash arises. Instead of using an unsecured credit card,. If you primarily want to take out a secured loan to help build your credit, you can use a credit builder loan. Learning how to build credit can help if you have a bad credit score or want to improve your current score. Rv loans might be secured, much like auto loans, by the item you’re financing. Track your credit. Use a secured credit card: Shared accounts remain the responsibility of both parties unless refinanced or closed.; Track your credit health with enhanced credit monitoring and access a credit builder loan to help build credit. Rv loans might be secured, much like auto loans, by the item you’re financing. Why a regions bank personal loan stands out:some personal loan lenders. Secured personal loans offer a more accessible alternative. Regions bank offers secured personal loans as small as $250, which should help you not have to borrow more than you need. Think of it as the lender asking for a little insurance in case you don’t end up making those monthly payments. Start rebuilding your credit after financial hardship with our. A savings secured loan or secured credit card can be a smart way to build or repair your credit so you can borrow the funds you need later on in life. If you primarily want to take out a secured loan to help build your credit, you can use a credit builder loan. Secured debt is basically a loan that’s. Learning how to build credit can help if you have a bad credit score or want to improve your current score. Track your credit health with enhanced credit monitoring and access a credit builder loan to help build credit. A shared secured loan is a great first step to build or rebuild your. Why a regions bank personal loan stands out:some personal loan lenders have minimum loan amounts of $1,000 or more. And because rvs tend to be expensive, you can usually get approved for a loan large enough to. If you’re asking yourself, “is a shared loan good for credit?,” the answer is “yes” you can use a secured loan to build credit. When these moments occur, a personal loan, can provide access to cash when you need it. Secured debt is basically a loan that’s backed by an asset. Use a secured credit card: But if credit cards helped get you into this mess,. If you can get a secured credit card and use it responsibly, you’ll get the benefit of building credit without paying any interest. Life happens and there will be times when needing immediate access to additional cash arises. You make payments before you receive your funds, versus receiving funds and making payments like you would. A savings secured loan or secured credit card can be a smart way to build or repair your credit so you can borrow the funds you need later on in life. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. You can start by getting a secured credit card, becoming an.How to use your own money as collateral to build credit Improve

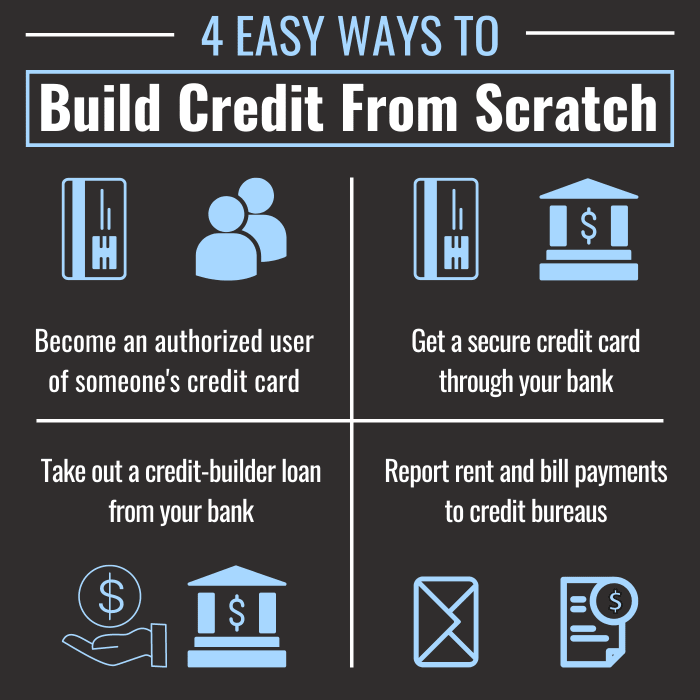

4 Ways to Safely Build Credit When You Have None TheStreet

How to Build Credit The 7Step Guide Chime

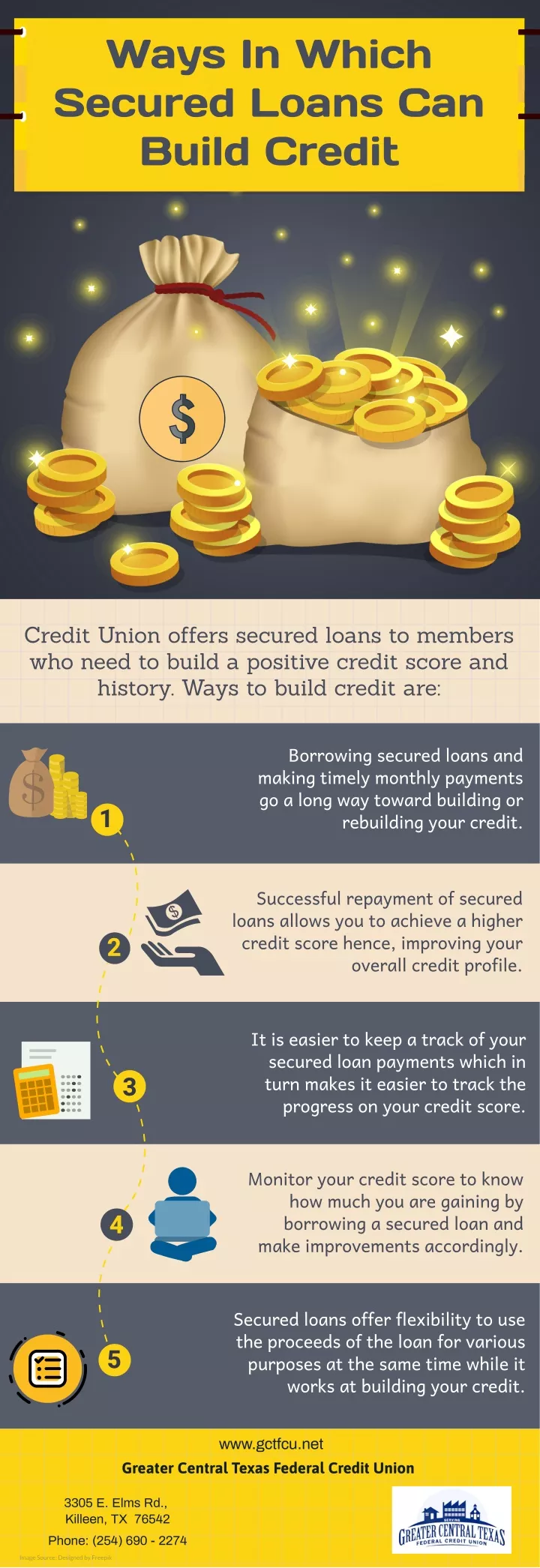

PPT Ways In Which Secured Loans Can Build Credit PowerPoint

Secured Loans vs. Unsecured Loans The Key Differences Self. Credit

10000 Secured Loans Guaranteed Best 3 Secured Loan Credit Builders

GCTFCU Blog Ways In Which Secured Loans Can Build Credit

What Is a Secured Loan?

3 ways to build credit using your own money as collateral. Build

44+ which credit report do mortgage lenders use SeyyedSimbiat

Complete Challenges Designed To Help You Build Credit And Earn.

Regions Bank Offers Secured Personal Loans As Small As $250, Which Should Help You Not Have To Borrow More Than You Need.

Start Rebuilding Your Credit After Financial Hardship With Our Secured Loan Option, Ranging From $250 To $1,000.

These Loans Are Collateralized By Assets Like The Borrower’s Home Or Vehicle, And May Make It Easier For Less.

Related Post:

/secured-loans-2386169_final-cbd3a613da25474fa240c59185879183.jpg)