Self Credit Builder Card

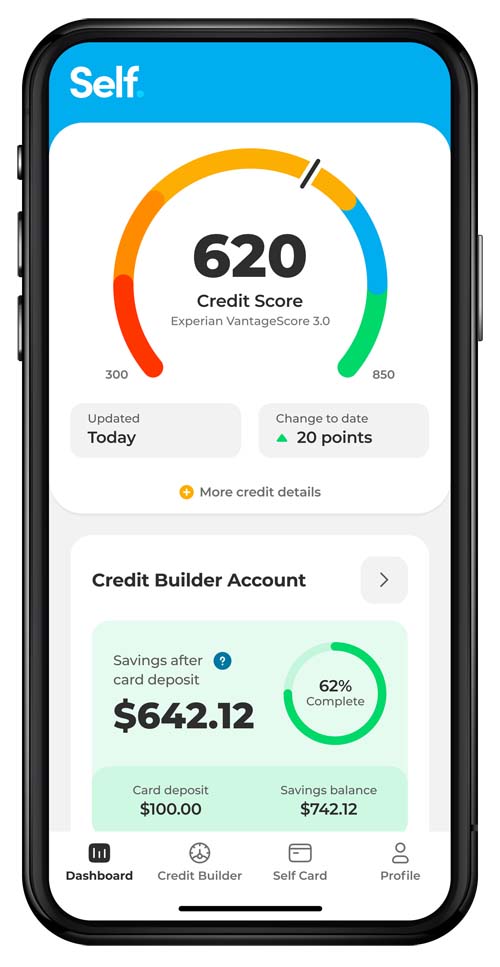

Self Credit Builder Card - It can result in a series of foibles and missteps,. Ideal for credit building, no hard check, & reports to all three bureaus. Whether rebuilding or trying to establish credit when you have none, falling for a myth can hurt one's effort to build credit. There’s no credit check or credit required. With no credit check or prior credit required, anyone can. The secured self visa® credit card is easy to qualify for, provided you have the cash to make the security deposit or required payments to your credit builder account. Build your credit with self's credit builder account & secured self visa® credit card. But obtaining a first credit card can be a challenge for young adults. Application is straightforward — and the approval rate is high. Self helps cardholders build credit by giving them a good credit mix — the credit builder account plus the credit card — and encouraging responsible credit building habits. The secured self visa® credit card is easy to qualify for, provided you have the cash to make the security deposit or required payments to your credit builder account. From personalized tips to helpful. The secured self visa credit card allows anyone with limited or damaged credit to build their payment history on two different credit lines: There’s no credit check or credit required. Ideal for credit building, no hard check, & reports to all three bureaus. The secured self visa® credit card¹ is crafted for the credit builder in mind. It can result in a series of foibles and missteps,. It’s a secured card which doesn't require a. These tools can help you build credit over time, but you'll pay some fees for the service. Self financial is a fintech company that offers rent reporting, a credit builder account and a secured credit card that are all geared toward helping you build your credit. With the self visa credit card, you can build your security deposit over several months, choose your own credit limit and then raise your limit over time as you make. Self helps cardholders build credit by giving them a good credit mix — the credit builder account plus the credit card — and encouraging responsible credit building habits. It’s a. With no credit check and a high approval rate, the secured self visa® credit card* is made for building credit. But obtaining a first credit card can be a challenge for young adults. It can result in a series of foibles and missteps,. It’s a fact—you need credit to get credit. You can use it to access credit and build. The secured self card is designed for gradual, responsible use, helping you build credit in a way that benefits you over time. It can result in a series of foibles and missteps,. Self helps cardholders build credit by giving them a good credit mix — the credit builder account plus the credit card — and encouraging responsible credit building habits.. The self visa® credit card has no credit check and it lets you build your security deposit in installments. A loan and a credit card. These tools can help you build credit over time, but you'll pay some fees for the service. With no credit check or prior credit required, anyone can. From personalized tips to helpful. Self offers a credit builder account and a secured visa® credit card. Credit karma credit builder (mcburberod financial, inc.) nmls id# 2057952 | licenses | nmls consumer access california loans arranged pursuant to dep't of business oversight finance. From personalized tips to helpful. To qualify for the secured self visa credit card, you’ll first need to open a credit builder. But obtaining a first credit card can be a challenge for young adults. Anyone can build credit with the secured self visa ® credit card. Build your credit with self's credit builder account & secured self visa® credit card. You would then need to make at least three monthly payments on time, save a minimum of $100,. To qualify for. To qualify for the secured self visa credit card, you’ll first need to open a credit builder account with self. The secured self visa credit card allows anyone with limited or damaged credit to build their payment history on two different credit lines: Build your credit with self's credit builder account & secured self visa® credit card. Self helps cardholders. Support every step of the way: The self visa® credit card has no credit check and it lets you build your security deposit in installments. Whether rebuilding or trying to establish credit when you have none, falling for a myth can hurt one's effort to build credit. It’s a secured card which doesn't require a. The secured self visa® credit. Ideal for credit building, no hard check, & reports to all three bureaus. But obtaining a first credit card can be a challenge for young adults. Self offers a credit builder account and a secured visa® credit card. Self helps cardholders build credit by giving them a good credit mix — the credit builder account plus the credit card —. Self helps cardholders build credit by giving them a good credit mix — the credit builder account plus the credit card — and encouraging responsible credit building habits. It can result in a series of foibles and missteps,. Anyone can build credit with the secured self visa ® credit card. From personalized tips to helpful. To qualify for the secured. With no credit check and a high approval rate, the secured self visa® credit card* is made for building credit. It’s a secured card which doesn't require a. Self offers a credit builder account and a secured visa® credit card. Self helps cardholders build credit by giving them a good credit mix — the credit builder account plus the credit card — and encouraging responsible credit building habits. Most credit cards aren’t available to applicants who lack credit. With the self visa credit card, you can build your security deposit over several months, choose your own credit limit and then raise your limit over time as you make. A loan and a credit card. The self visa® credit card can be a good option for customers who need support while using a credit card to create or build credit. The secured self visa® credit card is easy to qualify for, provided you have the cash to make the security deposit or required payments to your credit builder account. It can result in a series of foibles and missteps,. The secured self card is designed for gradual, responsible use, helping you build credit in a way that benefits you over time. From personalized tips to helpful. Looking to build or rebuild credit without a credit check? The self visa® credit card has no credit check and it lets you build your security deposit in installments. The secured self visa credit card allows anyone with limited or damaged credit to build their payment history on two different credit lines: Ideal for credit building, no hard check, & reports to all three bureaus.Self Builder Credit Card Self Financial Review Build Credit and Save

Self Credit Builder Build Credit. Build Savings. Build Dreams.

Self's New Secured Card No Credit Check or Upfront Deposit NerdWallet

Learn How to Apply for a Self Credit Builder Secured Visa Credit Card

Self Credit Builder Secured Visa

Self Credit Builder Secured Visa Credit Card A Good Option to Recover

SELF LENDER CREDIT BUILDER LOAN + SELF VISA CREDIT CARD REVIEW! Boost

Self Offers Credit Builder Accounts and Secured Cards that Help Users

What is Self and How does it work? CREDIT BUILDER account & secured

🔥 Self Credit Builder Card Review Pros and Cons of this Credit

Anyone Can Build Credit With The Secured Self Visa ® Credit Card.

Support Every Step Of The Way:

You Can Use It To Access Credit And Build A Positive Credit History.

It’s A Fact—You Need Credit To Get Credit.

Related Post: