Self Credit Builder Plans

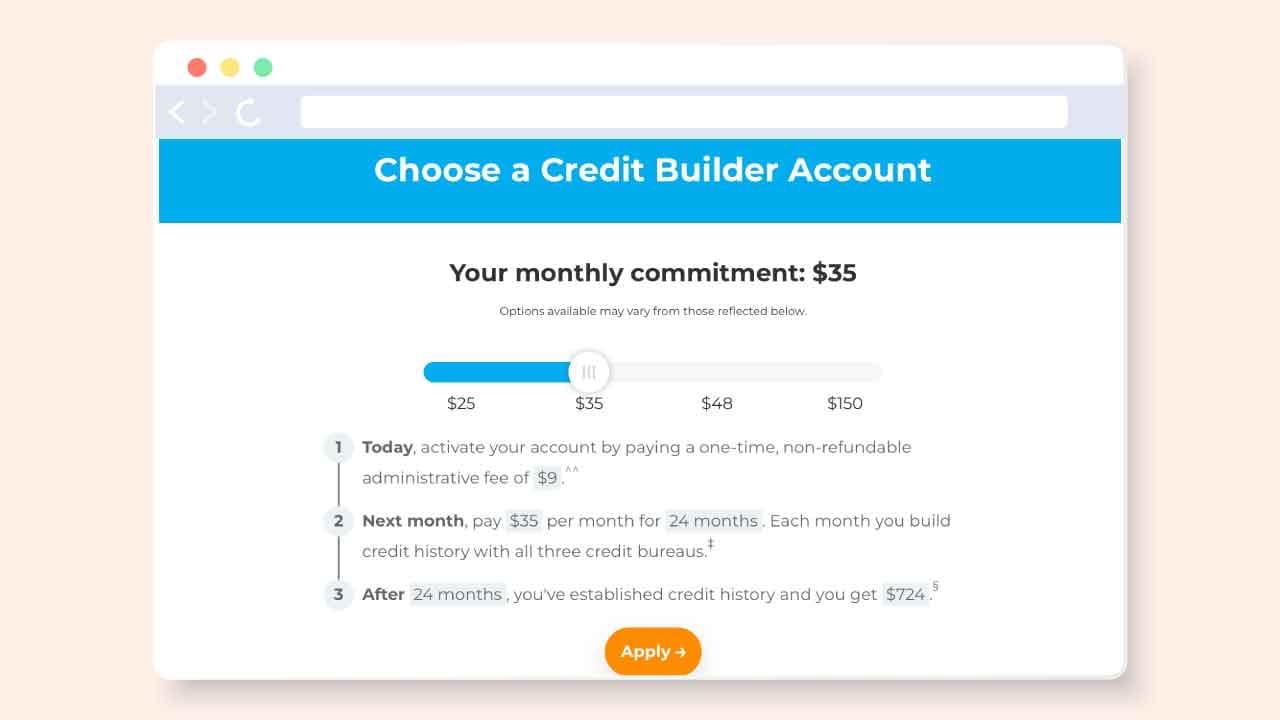

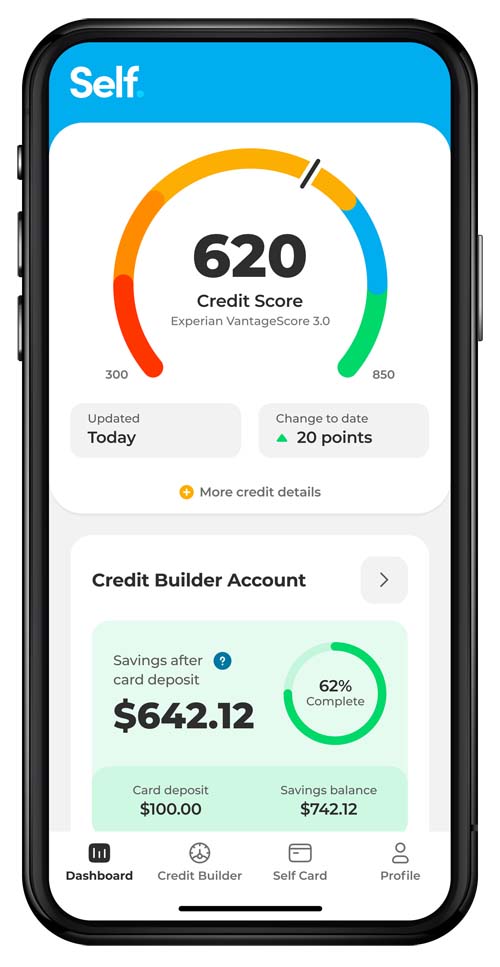

Self Credit Builder Plans - Rent reporting and credit builder account. Small, medium, large, and extra large. Choose from 4 plans to fit your budget and savings goals; Build your credit with self's credit builder account & secured self visa® credit card. Self, formally known as self lender, offers products that help people establish credit or build their credit. To start with self’s credit builder loan, complete the online form, pay a $9 administration fee, and choose a plan with monthly payments from $25 to $150. Ideal for credit building, no hard check, & reports to all three bureaus. Each monthly payment gets reported to all three credit bureaus. The self credit builder account is designed with you in mind, offering an accessible way to build credit and savings, regardless of your past financial history. But instead of receiving the loan amount within a few. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Build your credit with self's credit builder account & secured self visa® credit card. To start with self’s credit builder loan, complete the online form, pay a $9 administration fee, and choose a plan with monthly payments from $25 to $150. Choose from 4 plans to fit your budget and savings goals; No hard credit checks or hard inquiries on your credit But instead of receiving the loan amount within a few. The self credit builder account is designed with you in mind, offering an accessible way to build credit and savings, regardless of your past financial history. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. The app earns 4.5 stars. Build credit and savings all at once with self; The flexibility in monthly payments, ranging from $25 to $150, allows you to select a plan that. Small, medium, large, and extra large. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. Self offers four credit builder plans: How does self build credit? Each monthly payment gets reported to all three credit bureaus. A credit builder plan from self lender is an affordable tool that could help boost your credit score, while helping you build savings too. The money basics guides are a series of learning. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit!. The self credit builder account builds credit by opening a loan and reporting monthly payments to the three credit bureaus—experian™, transunion®, and equifax®—until the scheduled. Self offers four credit builder plans: The self credit builder account is designed with you in mind, offering an accessible way to build credit and savings, regardless of your past financial history. The flexibility in. The monthly payment amount and total interest you pay depend on the loan plan you choose, with. Self, formally known as self lender, offers products that help people establish credit or build their credit. To start with self’s credit builder loan, complete the online form, pay a $9 administration fee, and choose a plan with monthly payments from $25 to. But instead of receiving the loan amount within a few. No hard credit checks or hard inquiries on your credit Build your credit with self's credit builder account & secured self visa® credit card. Choose from 4 plans to fit your budget and savings goals; Each monthly payment gets reported to all three credit bureaus. The monthly payment amount and total interest you pay depend on the loan plan you choose, with. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. Build your credit with self's credit builder account & secured self visa® credit card. To start with self’s credit builder loan, complete the online form, pay a. To start with self’s credit builder loan, complete the online form, pay a $9 administration fee, and choose a plan with monthly payments from $25 to $150. No hard credit checks or hard inquiries on your credit A credit builder plan from self lender is an affordable tool that could help boost your credit score, while helping you build savings. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. But instead of receiving the loan amount within a few. No hard credit checks or hard inquiries on your credit How does self build credit? Ideal for credit building, no hard check, & reports to all three bureaus. No hard credit checks or hard inquiries on your credit Choose from 4 plans to fit your budget and savings goals; About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Each monthly payment gets reported to all three credit bureaus. The app earns 4.5 stars. The flexibility in monthly payments, ranging from $25 to $150, allows you to select a plan that. The app earns 4.5 stars. A credit builder plan from self lender is an affordable tool that could help boost your credit score, while helping you build savings too. The money basics guides are a series of learning. Ideal for credit building, no. A credit builder plan from self lender is an affordable tool that could help boost your credit score, while helping you build savings too. How does self build credit? Get your rent payments reported to all three credit bureaus for free, or pay a monthly. But instead of receiving the loan amount within a few. The monthly payment amount and total interest you pay depend on the loan plan you choose, with. Build your credit with self's credit builder account & secured self visa® credit card. The self credit builder account is designed with you in mind, offering an accessible way to build credit and savings, regardless of your past financial history. No hard credit checks or hard inquiries on your credit See detailed information about the cost to build your credit with self (formerly self lender), including fees, apr, loan term and monthly payment options. Each monthly payment gets reported to all three credit bureaus. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Ideal for credit building, no hard check, & reports to all three bureaus. The money basics guides are a series of learning. Small, medium, large, and extra large. Choose from 4 plans to fit your budget and savings goals; Self offers four credit builder plans:What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

Self Credit Builder Review What Is it and How Does It Work?

Self Builder Credit Card Self Financial Review Build Credit and Save

How to Build Credit Self. Credit Builder. (2024)

What is Self and How does it work? CREDIT BUILDER account & secured

Self Credit Builder Build Credit. Build Savings. Build Dreams.

Self credit builder build credit build savings build dreams Artofit

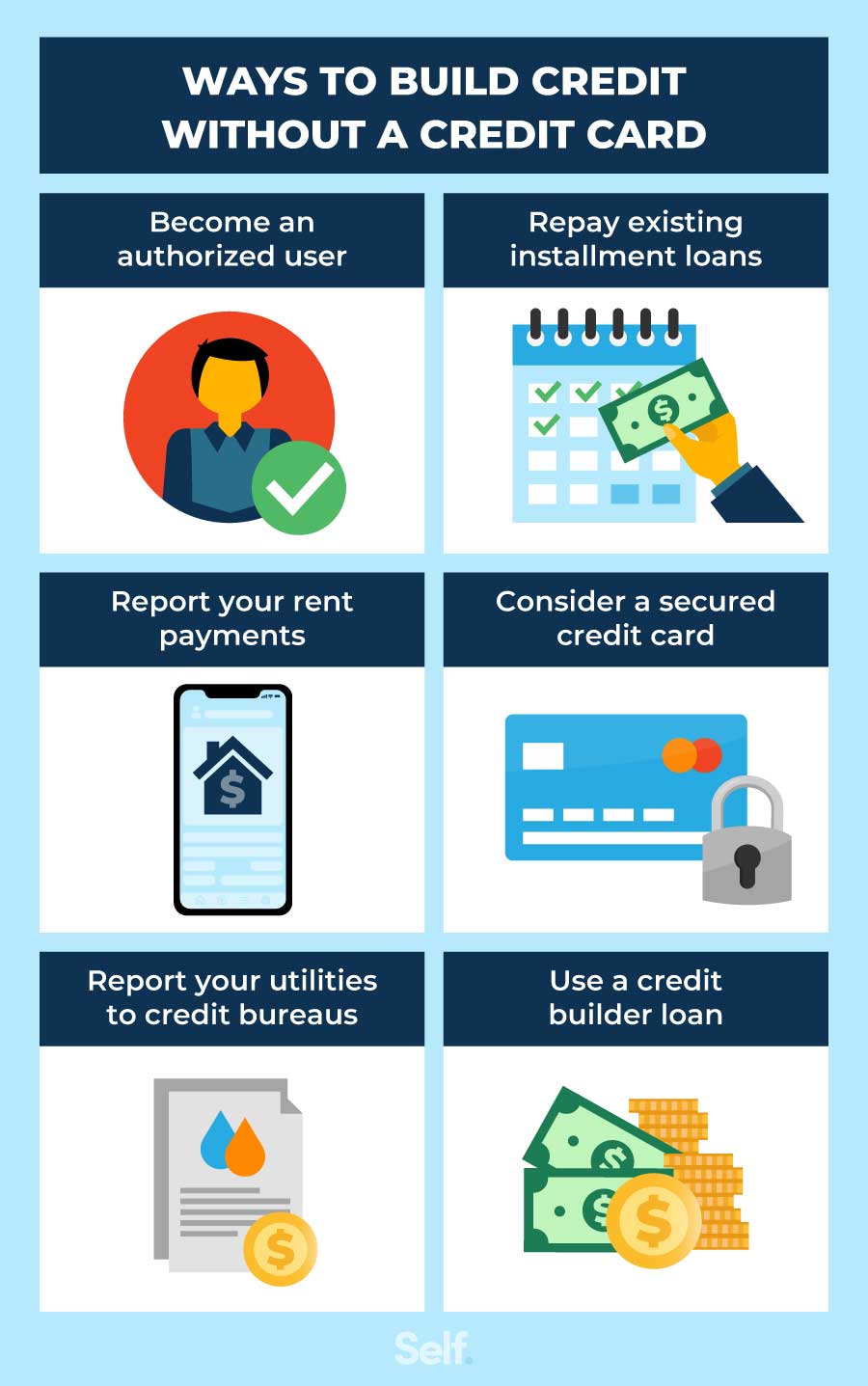

How To Build Credit Without a Credit Card Self. Credit Builder.

To Start With Self’s Credit Builder Loan, Complete The Online Form, Pay A $9 Administration Fee, And Choose A Plan With Monthly Payments From $25 To $150.

The Flexibility In Monthly Payments, Ranging From $25 To $150, Allows You To Select A Plan That.

The Self Credit Builder Account Builds Credit By Opening A Loan And Reporting Monthly Payments To The Three Credit Bureaus—Experian™, Transunion®, And Equifax®—Until The Scheduled.

Self, Formally Known As Self Lender, Offers Products That Help People Establish Credit Or Build Their Credit.

Related Post: