Starter Loans To Build Credit

Starter Loans To Build Credit - Use a secured credit card: Apply for a business line of credit or loan. Apply for the credit starter loan. Once approved, we’ll provide you with a $500 secure credit. Starter loans are small, manageable loans tailored for people who are just beginning to establish credit or are looking to improve their credit score. Credit refers to any loan or credit card that you may take out. Most loans are $300 to $1,000 with a term of. This helps you establish and build credit. Most credit cards aren’t available to applicants who lack credit. Starter loans contribute to your credit profile in several ways: Before you can start building good credit, you need to understand the basics of credit and how it works. It’s a suitable option for anyone who a poor or no credit history who the. You don’t need an established credit history, but you must not have negative credit history. Business owners receive smaller, more manageable loans governed by more flexible criteria. Apply for a business line of credit or loan. Once approved, we’ll provide you with a $500 secure credit. Starter loans are designed to help people establish credit and build a good credit history. Build users with a starting vantagescore under 600 see their credit scores increase by an average of 30 points in as few as 60 days.¹. Let's break down how it works and why it might be a. Make small purchases on your business credit card and pay them off in full every month to build a solid credit history. You don’t need an established credit history, but you must not have negative credit history. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. Credit builder loans have an annual. Most loans are $300 to $1,000 with a term of. It’s an excellent way to get started on. Apply for a business line of credit or loan. Most loans are $300 to $1,000 with a term of. Build users with a starting vantagescore under 600 see their credit scores increase by an average of 30 points in as few as 60 days.¹. Most credit cards aren’t available to applicants who lack credit. A credit builder loan with 1st. One great tool to consider is a starter loan—a small loan designed specifically to help you establish or improve your credit. Unlike traditional loans that rely heavily on. Apply for a business line of credit or loan. It’s a fact—you need credit to get credit. Let's break down how it works and why it might be a. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. They work under the concept of lending small loan amounts to the borrower, with the. Build users with a starting vantagescore under 600 see their credit scores increase by an average of 30 points in as few as 60 days.¹. Credit refers to. It’s an excellent way to get started on the road toward better financial security. One great tool to consider is a starter loan—a small loan designed specifically to help you establish or improve your credit. Credit builder loans have an annual. What is a credit builder loan? Credit refers to any loan or credit card that you may take out. Let's break down how it works and why it might be a. What is a credit builder loan? Apply for a business line of credit or loan. Starter loans contribute to your credit profile in several ways: Most credit cards aren’t available to applicants who lack credit. It’s an excellent way to get started on the road toward better financial security. Instead of using an unsecured credit card, start using a secured one to avoid interest and overspending. Apply for the credit starter loan. America's next generation of farmers and ranchers are supported through fsa's beginning farmer direct and guaranteed loan programs. Apply for a business line. Let's break down how it works and why it might be a. They work under the concept of lending small loan amounts to the borrower, with the. Once approved, we’ll provide you with a $500 secure credit. Starter loans are small, manageable loans tailored for people who are just beginning to establish credit or are looking to improve their credit. Apply for the credit starter loan. Unlike traditional loans that rely heavily on. Credit builder loans have an annual. A credit builder loan with 1st source bank can help you establish credit and save money at the same time. Credit refers to any loan or credit card that you may take out. Apply for a business line of credit or loan. Starter loans contribute to your credit profile in several ways: Business owners receive smaller, more manageable loans governed by more flexible criteria. You don’t need an established credit history, but you must not have negative credit history. Once approved, we’ll provide you with a $500 secure credit. You don’t need an established credit history, but you must not have negative credit history. Most credit cards aren’t available to applicants who lack credit. It’s a suitable option for anyone who a poor or no credit history who the. Use a secured credit card: Credit builder loans have an annual. Starter loans contribute to your credit profile in several ways: Make small purchases on your business credit card and pay them off in full every month to build a solid credit history. It’s a fact—you need credit to get credit. Starter loans are small, manageable loans tailored for people who are just beginning to establish credit or are looking to improve their credit score. Business owners receive smaller, more manageable loans governed by more flexible criteria. It’s an excellent way to get started on the road toward better financial security. Let's break down how it works and why it might be a. America's next generation of farmers and ranchers are supported through fsa's beginning farmer direct and guaranteed loan programs. Credit starter loans are personal installment loans created for borrowers with limited or no credit history that have low credit score requirements, average aprs of 11%, and low average. Before you can start building good credit, you need to understand the basics of credit and how it works. How starter loans help build credit.Golden1 Credit Union Credit Starter Loan Review! Borrow up to 1,500

What Is a Starter Loan? Top Financial Plan

Best Starter Credit Cards for (Re)Building Your Credit, 2023

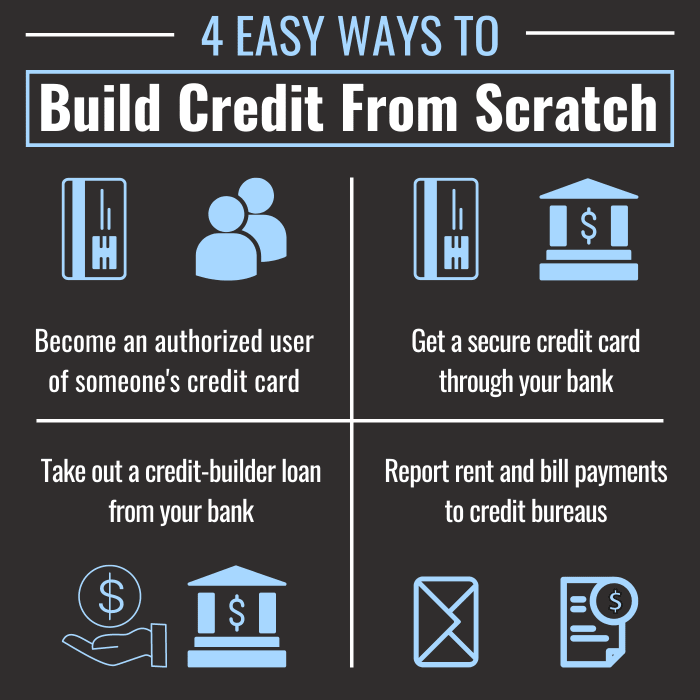

How to Build Your Credit Starting From Scratch

How to Build Credit Self. Credit Builder.

7 Strategies to Build Credit with No Credit History

4 Ways to Safely Build Credit When You Have None TheStreet

Great Ways to Build Your Credit — Nonprofit Financial Services

How to Use Starter Loans to Build Credit Bell Finance

How to Build Credit The 7Step Guide for 2024 (2024)

Most Loans Are $300 To $1,000 With A Term Of.

This Financial Product Is Designed To Help People With Limited Or Poor Credit Histories Access A Modest Loan Amount And Increase.

Build Users With A Starting Vantagescore Under 600 See Their Credit Scores Increase By An Average Of 30 Points In As Few As 60 Days.¹.

What Is A Credit Builder Loan?

Related Post: