Step Bank And Build Credit

Step Bank And Build Credit - The step card is a secured spending card that builds credit just like a credit card. For starters, these professionals can help individuals and families secure financing for a new home purchase or refinance an existing mortgage. Step is a teen banking app and debit card that charges no fees and can help teens begin to build a positive credit history. Shared accounts remain the responsibility of both parties unless refinanced or closed.; Complete the loan application and get approved for up to $4,000*. Gocredit.me makes it easy to get. Step guarantees insured deposits, secured bank information, fraud prevention, and a card lock or freeze feature. Step offers a free fdic insured bank account and visa card designed for the next generation. Protect your finances—sign up for your step account today! Take the first big step toward financial stability with a credit builder loan from gocredit.me. Complete the loan application and get approved for up to $4,000*. Unlike a credit card, there are no monthly payments or. Step guarantees insured deposits, secured bank information, fraud prevention, and a card lock or freeze feature. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Step empowers you to build credit, save, invest, and reach financial independence with no fees. Shared accounts remain the responsibility of both parties unless refinanced or closed.; It’s important to establish positive credit early in your financial journey. Teen banking accounts allow teens to have their own spending cards and receive deposits from friends or employers. Take the first big step toward financial stability with a credit builder loan from gocredit.me. Sail loans makes it possible to get funded for a credit builder loan, build credit history, and build savings in just 3 easy steps. The money basics guides are a series of learning. How does my step card help me build credit? Step helps you build a positive credit history just by using your step. Building or repairing credit takes time, but our credit builder loan can help you get started while also boosting your savings. Complete the loan application and get approved for. It’s important to establish positive credit early in your financial journey. Take the first big step toward financial stability with a credit builder loan from gocredit.me. Step is the safe and easy way to build credit history, even before you turn 18. The step card is a secured spending card that builds credit just like a credit card. Complete the. It’s important to establish positive credit early in your financial journey. Shared accounts remain the responsibility of both parties unless refinanced or closed.; Take the first big step toward financial stability with a credit builder loan from gocredit.me. How does my step card help me build credit? About the money basics guide serieswelcome to the ncua’s money basics guide to. Step helps you build a positive credit history just by using your step. Learn how to build your credit for free—no credit score required. Join today and take control of your money! Does the step card build credit? Complete the loan application and get approved for up to $4,000*. For starters, these professionals can help individuals and families secure financing for a new home purchase or refinance an existing mortgage. The money basics guides are a series of learning. Learn how to build your credit for free—no credit score required. Step is a teen banking app and debit card that charges no fees and can help teens begin to. Does the step card build credit? Step helps you build a positive credit history just by using your step. Establish savings that will be there for you when you need it. Gocredit.me makes it easy to get. Sail loans makes it possible to get funded for a credit builder loan, build credit history, and build savings in just 3 easy. Step offers a free fdic insured bank account and visa card designed for the next generation. Unlike a credit card, there are no monthly payments or. Gocredit.me makes it easy to get. Teen banking accounts allow teens to have their own spending cards and receive deposits from friends or employers. Step is the safe and easy way to build credit. How does my step card help me build credit? Gocredit.me makes it easy to get. Take the first big step toward financial stability with a credit builder loan from gocredit.me. Does the step card build credit? Protect your finances—sign up for your step account today! For starters, these professionals can help individuals and families secure financing for a new home purchase or refinance an existing mortgage. Step guarantees insured deposits, secured bank information, fraud prevention, and a card lock or freeze feature. Unlike a credit card, there are no monthly payments or. About the money basics guide serieswelcome to the ncua’s money basics guide to. Step helps you build a positive credit history just by using your step. Building or repairing credit takes time, but our credit builder loan can help you get started while also boosting your savings. Step offers a free fdic insured bank account and visa card designed for the next generation. Shared accounts remain the responsibility of both parties unless refinanced. Step helps you build a positive credit history just by using your step. Learn how to build your credit for free—no credit score required. Protect your finances—sign up for your step account today! Step empowers you to build credit, save, invest, and reach financial independence with no fees. Get a free fdic insured bank account & step visa card with no subscription fees. Building or repairing credit takes time, but our credit builder loan can help you get started while also boosting your savings. Shared accounts remain the responsibility of both parties unless refinanced or closed.; Step offers a free fdic insured bank account and visa card designed for the next generation. Step guarantees insured deposits, secured bank information, fraud prevention, and a card lock or freeze feature. How does my step card help me build credit? Complete the loan application and get approved for up to $4,000*. For starters, these professionals can help individuals and families secure financing for a new home purchase or refinance an existing mortgage. They also make it easy for parents to transfer funds to. The money basics guides are a series of learning. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Sail loans makes it possible to get funded for a credit builder loan, build credit history, and build savings in just 3 easy steps.Does Step Card Build Credit

Step Banking & Debit Card Review My Experience Kids' Money

How To Build Credit In 3 Easy Steps in 2020 Build credit, Credit

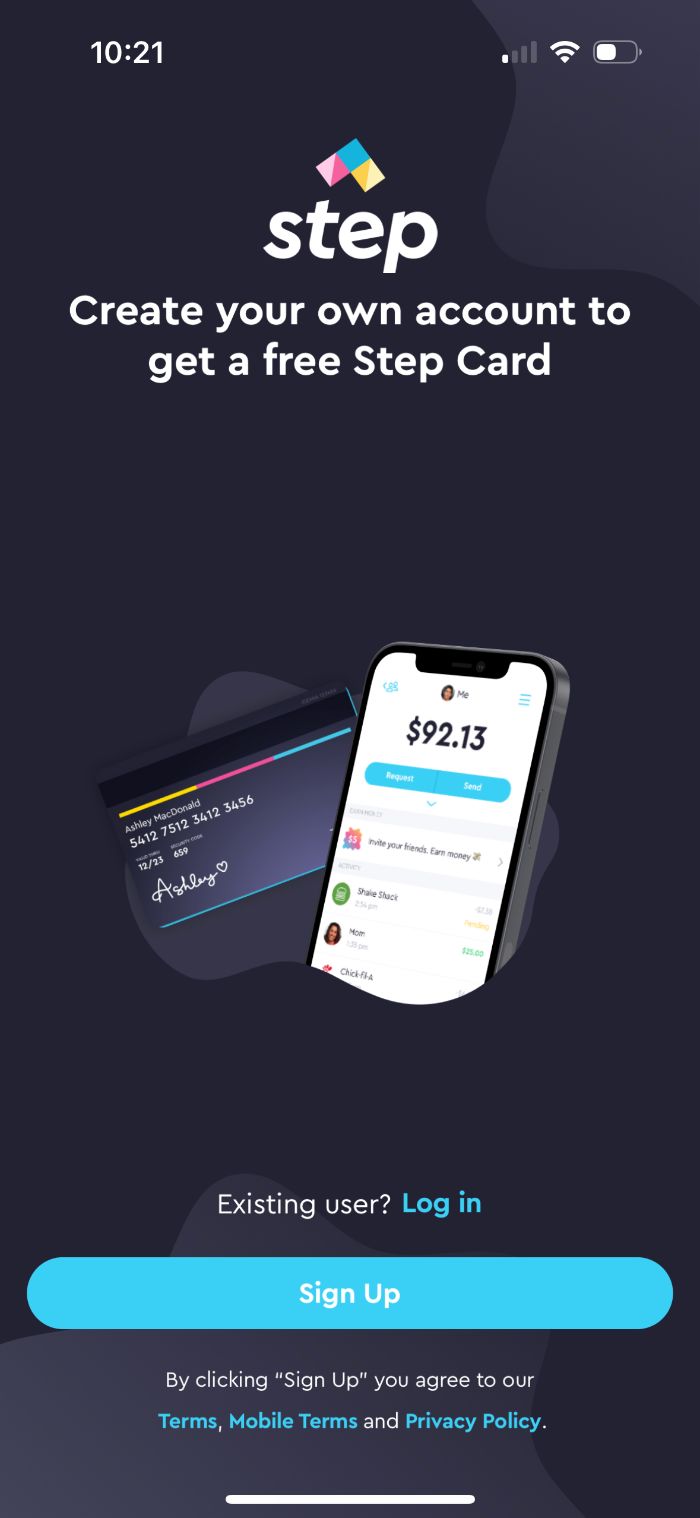

Elizabeth S invited you to join Step Banking for the next generation

How to Build Credit The 7Step Guide for 2024 (2024)

Step Bank & Build Credit Apps on Google Play

5 Powerful Steps to Conquer Building Credit From Scratch Life Of

Building Credit Worksheets

5 Best Credit Cards for Teens [Build Credit in 2024]

Step Bank & Build Credit on the App Store

Teen Banking Accounts Allow Teens To Have Their Own Spending Cards And Receive Deposits From Friends Or Employers.

Take The First Big Step Toward Financial Stability With A Credit Builder Loan From Gocredit.me.

Establish Savings That Will Be There For You When You Need It.

Step Is The Safe And Easy Way To Build Credit History, Even Before You Turn 18.

Related Post:

![5 Best Credit Cards for Teens [Build Credit in 2024]](https://youngandtheinvested.com/wp-content/uploads/step-signup-new-nocode.jpg)