Tax Credits For Building A New Home

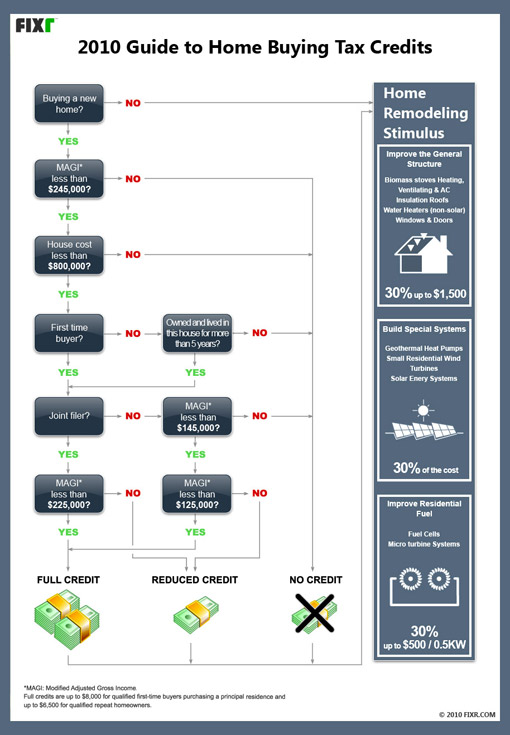

Tax Credits For Building A New Home - The section § 45l new energy efficient home credit has been updated and extended through 2032. Builders of energy star certified or doe zero energy ready new homes may qualify for federal tax incentives. You can also get 30% back on electric. In august 2022, the inflation reduction act amended two credits available for energy efficient home improvements and residential clean energy equipment, so that they last. These faqs supersede earlier faqs. Learn how to claim a tax credit up to $5,000 for building or reconstructing a qualified new energy efficient home. Find out the eligibility requirements, credit amounts and how to file form 8908. Sips can help you qualify for incentives & rebates for efficiency upgrades to new and existing commercial buildings, homes, multifamily and public buildings through sections. There are some financial benefits to. Bush signed the energy policy act of 2005, introducing the residential energy. Unlike tax deductions, which reduce your taxable income and are based on your tax rate, tax credits directly reduce the taxes you owe and don’t depend on your income. You can claim the credit for improvements made through. 1, 2023, you may qualify for a tax credit up to $3,200. You can also get 30% back on electric. As part of the inflation reduction act, passed in august 2022, modifying internal revenue code sec. Bush signed the energy policy act of 2005, introducing the residential energy. 45l, contractors will benefit from the increased tax credit for building. These credits can significantly impact. For homes and apartments acquired on or after january 1, 2023, earning the § 45l tax. Click “learn more” below, to visit the energy star landing page for. These credits can significantly impact. Bush signed the energy policy act of 2005, introducing the residential energy. Sips can help you qualify for incentives & rebates for efficiency upgrades to new and existing commercial buildings, homes, multifamily and public buildings through sections. Click “learn more” below, to visit the energy star landing page for. Learn how to claim a tax. If you’ve recently built your new home and were able to itemize your deductions, you can deduct the interest you. Here’s how you can navigate the process of claiming energy tax credits for your new home. $13 billon of those goods were imported from. Find out the eligibility requirements, credit amounts and how to file form 8908. Builders of energy. Learn how to claim a tax credit up to $5,000 for building or reconstructing a qualified new energy efficient home. 1, 2023, you may qualify for a tax credit up to $3,200. You can also get 30% back on electric. $13 billon of those goods were imported from. Click “learn more” below, to visit the energy star landing page for. In an effort to reduce reliance on foreign oil and stabilize american energy security, president george w. Unlike tax deductions, which reduce your taxable income and are based on your tax rate, tax credits directly reduce the taxes you owe and don’t depend on your income. The section § 45l new energy efficient home credit has been updated and extended. $13 billon of those goods were imported from. 45l, contractors will benefit from the increased tax credit for building. Here’s how you can navigate the process of claiming energy tax credits for your new home. Bush signed the energy policy act of 2005, introducing the residential energy. 1, 2023, you may qualify for a tax credit up to $3,200. In an effort to reduce reliance on foreign oil and stabilize american energy security, president george w. You can claim the credit for improvements made through. Learn how to claim a tax credit up to $5,000 for building or reconstructing a qualified new energy efficient home. These faqs supersede earlier faqs. Find out the eligibility requirements, credit amounts and how. These faqs supersede earlier faqs. You can also get 30% back on electric. As part of the inflation reduction act, passed in august 2022, modifying internal revenue code sec. Builders of energy star certified or doe zero energy ready new homes may qualify for federal tax incentives. Find out the eligibility requirements, credit amounts and how to file form 8908. $13 billon of those goods were imported from. Find out the eligibility requirements, credit amounts and how to file form 8908. If you’ve recently built your new home and were able to itemize your deductions, you can deduct the interest you. Bush signed the energy policy act of 2005, introducing the residential energy. There are some financial benefits to. Renovating your home can be an expensive endeavor, especially since you can't claim a federal tax deduction to defray the costs. Here are a few things you may be able to write off on your taxes! $13 billon of those goods were imported from. Bush signed the energy policy act of 2005, introducing the residential energy. There are some financial. 1, 2023, you may qualify for a tax credit up to $3,200. You can also get 30% back on electric. For homes and apartments acquired on or after january 1, 2023, earning the § 45l tax. Click “learn more” below, to visit the energy star landing page for. Builders of energy star certified or doe zero energy ready new homes. There are some financial benefits to. 1, 2023, you may qualify for a tax credit up to $3,200. In an effort to reduce reliance on foreign oil and stabilize american energy security, president george w. Here’s how you can navigate the process of claiming energy tax credits for your new home. You can also get 30% back on electric. For homes and apartments acquired on or after january 1, 2023, earning the § 45l tax. $13 billon of those goods were imported from. In august 2022, the inflation reduction act amended two credits available for energy efficient home improvements and residential clean energy equipment, so that they last. These credits can significantly impact. Learn how to claim a tax credit up to $5,000 for building or reconstructing a qualified new energy efficient home. Click “learn more” below, to visit the energy star landing page for. The section § 45l new energy efficient home credit has been updated and extended through 2032. Find out the eligibility requirements, credit amounts and how to file form 8908. 45l, contractors will benefit from the increased tax credit for building. Here are a few things you may be able to write off on your taxes! Energy tax credits are incentives provided by the federal government, and.First Time Home Buyer Credit Flow Chart

Several tax benefits are available to you, if you are building a new

PPT New Homes Tax Credit PowerPoint Presentation, free download ID

Maximizing LIHTC Twinning 9 and 4 Tax Credits SVA

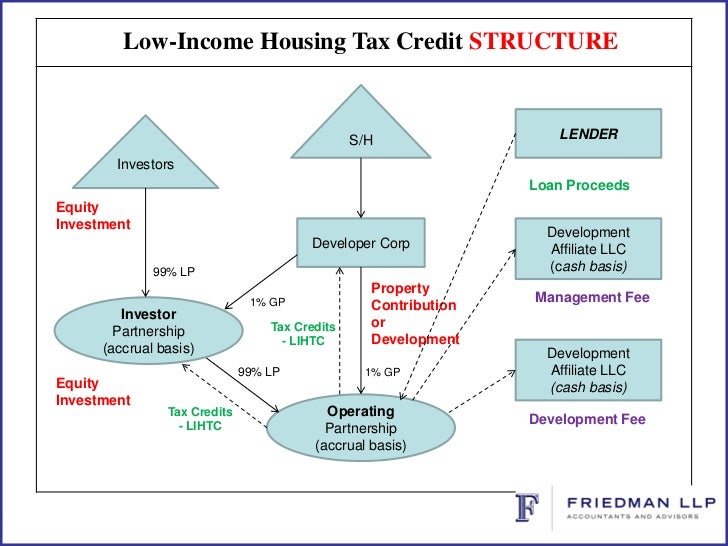

Affordable Housing Tax Credits Barranca

Getting the Inflation Reduction Act Efficient Home Improvement Tax

2024 Tax Credits For Home Improvements Dael Mickie

2024 Tax Credits For Home Improvements Dael Mickie

2024 Federal Tax Credits For Energy Efficient Home Improvements Jodi

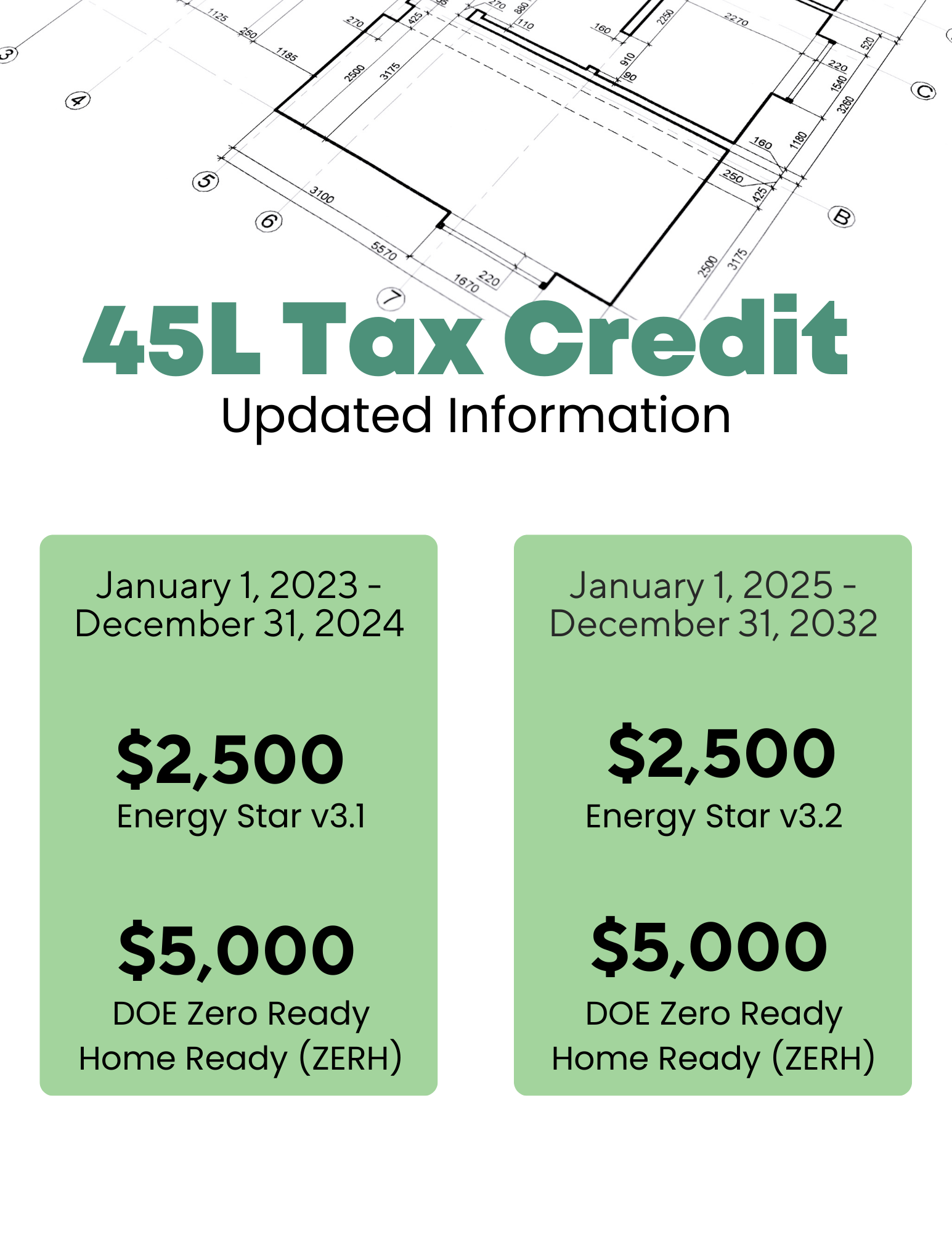

45L Tax Credit Energy Diagnostics

As Part Of The Inflation Reduction Act, Passed In August 2022, Modifying Internal Revenue Code Sec.

You Can Claim The Credit For Improvements Made Through.

Tax Credits Are Often More Valuable Than Deductions.

Renovating Your Home Can Be An Expensive Endeavor, Especially Since You Can't Claim A Federal Tax Deduction To Defray The Costs.

Related Post: