The Key Input Required To Build A Cash Budget Is

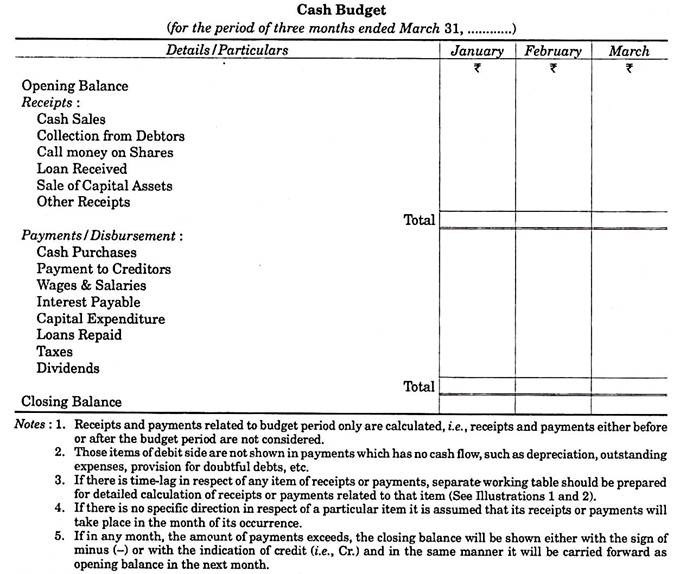

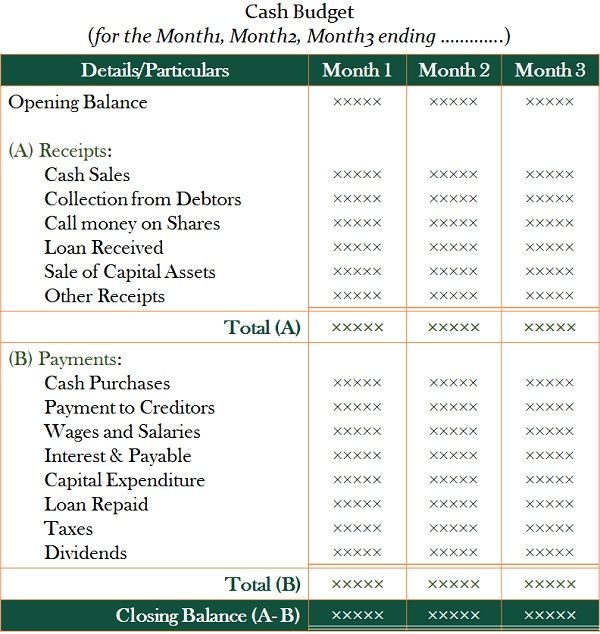

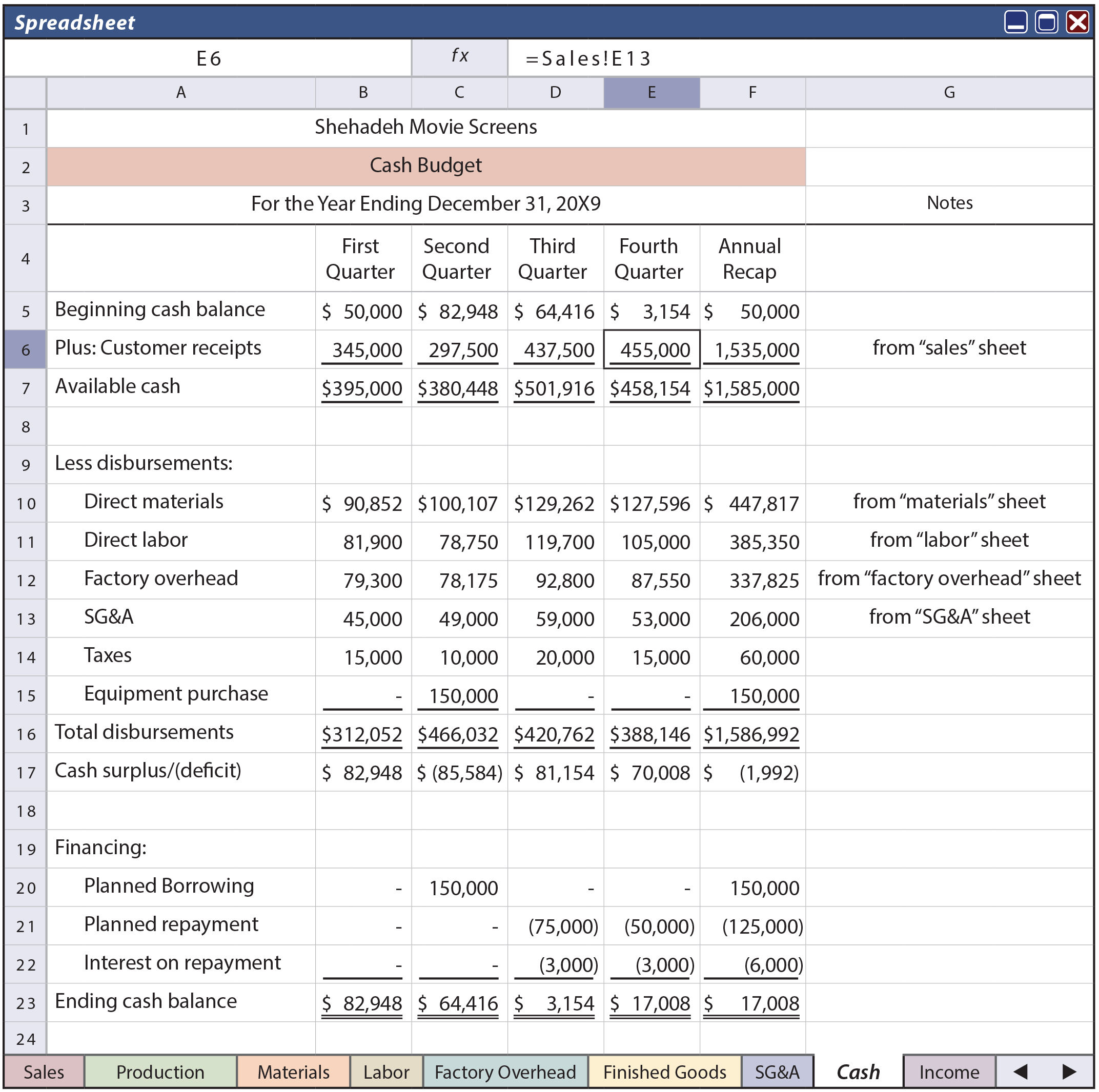

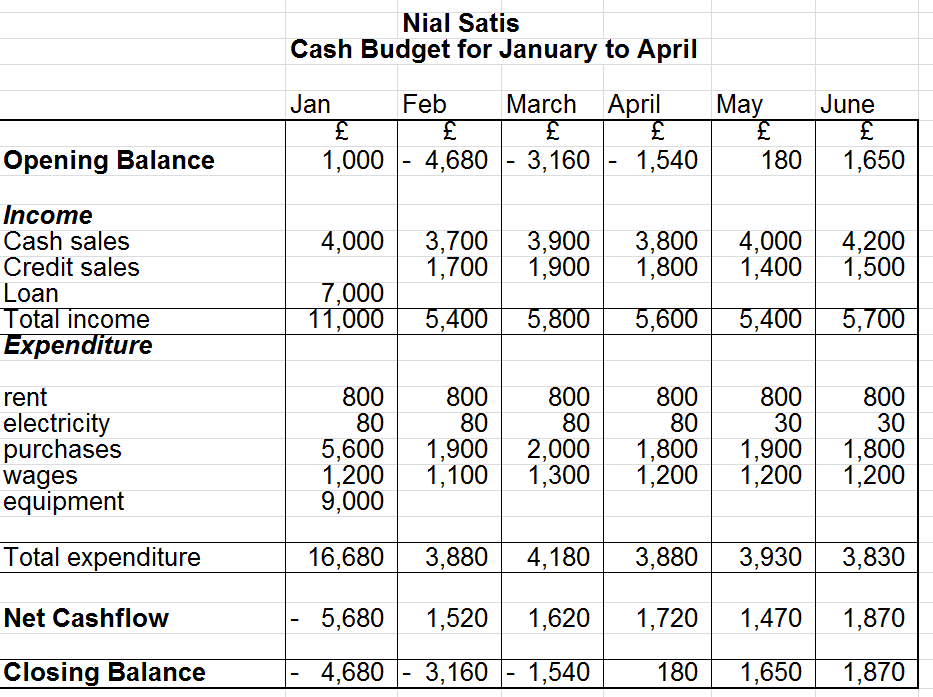

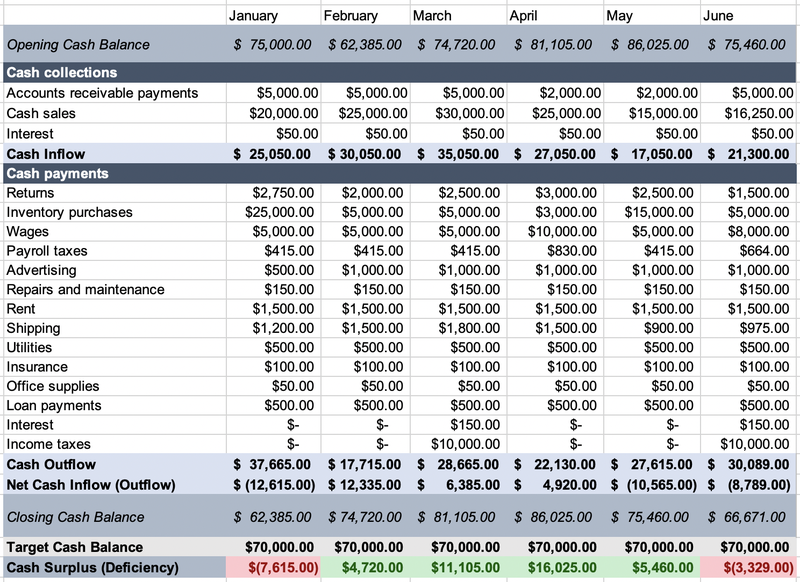

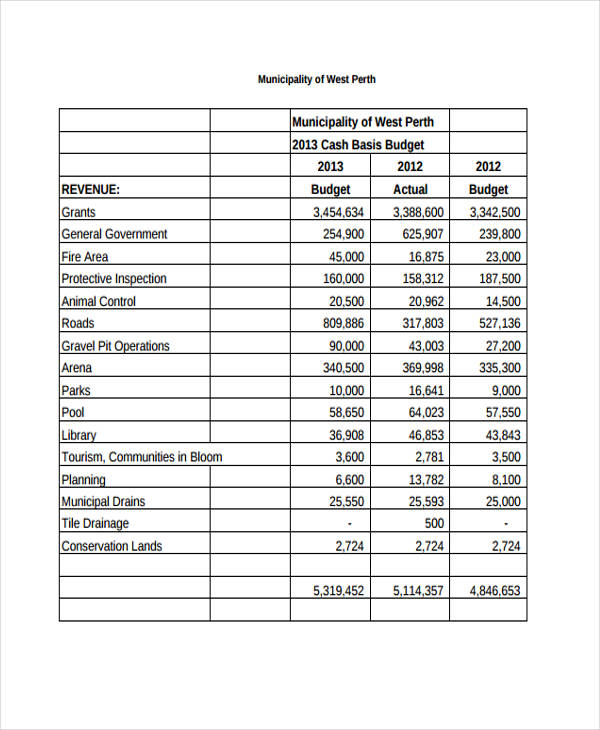

The Key Input Required To Build A Cash Budget Is - Key components of a cash budget. As a result, the most important input required to create a cash budget is the firm's sales prediction (option c), which has a direct impact on cash inflows and consequently overall cash flow. Which of the following would be the least likely to utilize pro forma financial statements or a cash budget? Implementing a cash budget offers numerous benefits for financial management. The correct answer is (b) sales forecast. Which of the following is not a cash disbursement? The accuracy of the sales forecast. The basic format of a cash budget includes four sections: Here are some key advantages: Which of the following is an inflow of cash to a corporation? Study with quizlet and memorize flashcards containing terms like the bottom up method for forecasting sales, the sustainable growth model gives managers a kind of shorthand. The key input required to build a cash budget is blank________. Creating a cash budget involves tracking income and expenses while anticipating changes. The correct answer is (b) sales forecast. Identify the underlying pattern between the components of a cash budget and the options provided to pinpoint the correct input. It's a financial plan that estimates a business' cash inflows and outflows for a specific period, helping it manage liquidity. The accuracy of the estimated. Which of the following is an inflow of cash to a corporation? Simply input your inflows and outflows,. Here are some key advantages: Which of the following is an inflow of cash to a corporation? The basic format of a cash budget includes four sections: By projecting cash movements, a cash budget empowers businesses to make informed financial decisions, ensuring they have sufficient funds to meet their obligations while capitalizing on. A strong cash budget starts with organizing cash inflows and outflows. It's. The correct answer is (b) sales forecast. Cash inflows comprise all the cash that a company or. Key components of a cash budget. As a result, the most important input required to create a cash budget is the firm's sales prediction (option c), which has a direct impact on cash inflows and consequently overall cash flow. Not the question you’re. The basic format of a cash budget includes four sections: Identify the underlying pattern between the components of a cash budget and the options provided to pinpoint the correct input. Implementing a cash budget offers numerous benefits for financial management. Which of the following is an inflow of cash to a corporation? The key input required to build a cash. The correct answer is (b) sales forecast. Which of the following is an inflow of cash to a corporation? Up to $9 cash back a key to estimating an accurate amount of cash to be collected from sales is: Operations and payroll with a budget. Creating a cash budget involves tracking income and expenses while anticipating changes. Cash inflows comprise all the cash that a company or. Simply input your inflows and outflows,. By projecting cash movements, a cash budget empowers businesses to make informed financial decisions, ensuring they have sufficient funds to meet their obligations while capitalizing on. Which of the following would be the least likely to utilize pro forma financial statements or a cash. Up to $9 cash back a key to estimating an accurate amount of cash to be collected from sales is: This blog explores key components, benefits, and. Study with quizlet and memorize flashcards containing terms like the bottom up method for forecasting sales, the sustainable growth model gives managers a kind of shorthand. The key input required to build a. Implementing a cash budget offers numerous benefits for financial management. Here are some key advantages: Identify the underlying pattern between the components of a cash budget and the options provided to pinpoint the correct input. The correct answer is (b) sales forecast. Key components of a cash budget. Key components of a cash budget. This blog explores key components, benefits, and. Which of the following is not a cash disbursement? By projecting cash movements, a cash budget empowers businesses to make informed financial decisions, ensuring they have sufficient funds to meet their obligations while capitalizing on. The accuracy of the sales forecast. A cash budget is a financial management tool that helps individuals and businesses track and plan their cash inflows and outflows. Here’s the best way to solve it. A strong cash budget starts with organizing cash inflows and outflows. Cash inflows comprise all the cash that a company or. It's a financial plan that estimates a business' cash inflows and. Up to $9 cash back a key to estimating an accurate amount of cash to be collected from sales is: A cash budget is a financial management tool that helps individuals and businesses track and plan their cash inflows and outflows. The key input required to build a cash budget is blank________. Operations and payroll with a budget. Not the. The accuracy of the estimated. Which of the following is an inflow of cash to a corporation? Here are some key advantages: Implementing a cash budget offers numerous benefits for financial management. Here’s the best way to solve it. The key components of a cash budget typically include cash inflows, cash outflows, and the ending cash balance. The basic format of a cash budget includes four sections: Key components of a cash budget. Which of the following would be the least likely to utilize pro forma financial statements or a cash budget? Which of the following is not a cash disbursement? A cash budget is a financial management tool that helps individuals and businesses track and plan their cash inflows and outflows. Study with quizlet and memorize flashcards containing terms like the bottom up method for forecasting sales, the sustainable growth model gives managers a kind of shorthand. Simply input your inflows and outflows,. Up to $9 cash back a key to estimating an accurate amount of cash to be collected from sales is: The key input required to build a cash. Identify the underlying pattern between the components of a cash budget and the options provided to pinpoint the correct input.Cash Budget Methods 3 Methods of Preparing A Cash Budget

Basic Instructions for a Cash Budget Statement Expense Dividend

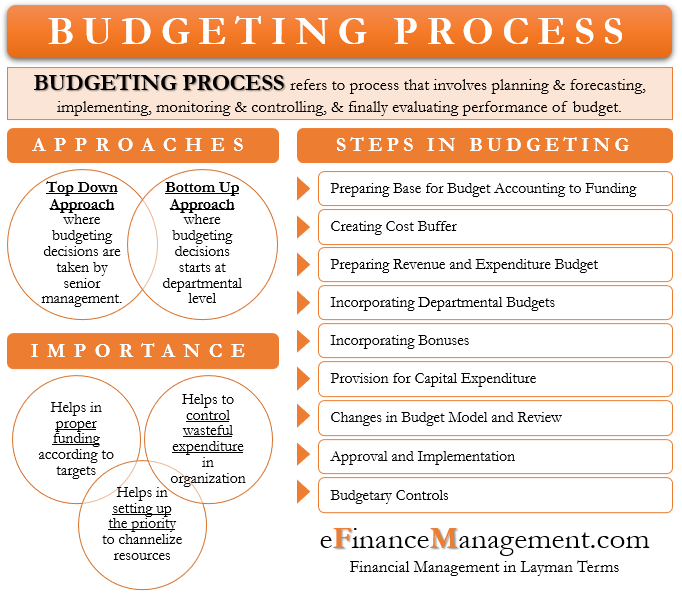

Budgeting Process Meaning, Approaches, Steps eFM

Cash Budget Example Accounting Education

What is a Cash Budget? Format, Methods and Example The Investors Book

Components Of The Budget

Accounting made easy Cash Budgets / Cash Flow Forecasts

Introduction to Financial Budgets Managerial Accounting

How to Prepare a Cash Budget for Your Business The Blueprint

11+ Cash Budget Templates Free Sample,Example Format Download Free

As A Result, The Most Important Input Required To Create A Cash Budget Is The Firm's Sales Prediction (Option C), Which Has A Direct Impact On Cash Inflows And Consequently Overall Cash Flow.

By Projecting Cash Movements, A Cash Budget Empowers Businesses To Make Informed Financial Decisions, Ensuring They Have Sufficient Funds To Meet Their Obligations While Capitalizing On.

Creating A Cash Budget Involves Tracking Income And Expenses While Anticipating Changes.

The Accuracy Of The Sales Forecast.

Related Post: